Taiwanese Premier Cho Jung-tai has characterized the newly established US-Taiwan trade agreement as the most favorable tariff arrangement available to nations maintaining trade surpluses with Washington. This assessment emerged alongside strong condemnation from Chinese officials in Beijing regarding the bilateral pact.

The groundbreaking agreement, negotiated following former President Donald Trump’s proposed sweeping tariffs on multiple US trading partners, reduces US tariffs on Taiwanese goods to 15% in exchange for substantial investments totaling $250 billion within the American technology sector. This tariff rate aligns with those previously extended to the European Union, Japan, and South Korea, representing a significant reduction from the initially proposed 32% rate that was later adjusted to 20%.

Premier Cho emphasized the strategic importance of this development, stating: “This demonstrates that the US views Taiwan as an important strategic partner. Our objective has been to lower mutual tariffs, and according to negotiation outcomes, Taiwan has successfully secured 15% tariffs without additional fees.”

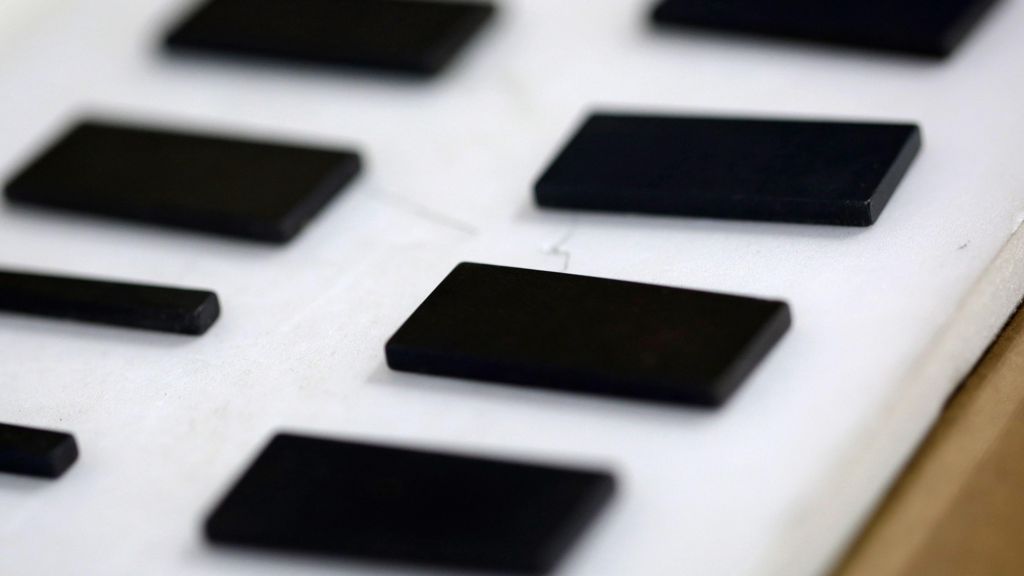

The arrangement includes specific provisions benefiting multiple industries: automotive and wood furniture sectors receive the 15% tariff rate without supplementary charges, while certain aerospace components gain complete tariff exemption. Semiconductor producers investing in the United States will qualify for preferential tariff treatment, including exemptions.

The agreement establishes an economic partnership framework that will facilitate the creation of world-class industrial parks across the United States, aimed at bolstering domestic manufacturing capabilities. The US Department of Commerce described the pact as “a historic trade deal that will drive a massive reshoring of America’s semiconductor sector.”

China’s Foreign Ministry spokesperson Guo Jiakun expressed firm opposition to the agreement, reiterating Beijing’s position against any sovereign-implicating agreements between countries maintaining diplomatic relations with China and Taiwan, which China claims as its territory.

The timing of the agreement coincides with Taiwan Semiconductor Manufacturing Company’s (TSMC) announcement of plans to increase capital spending by nearly 40% this year, following a 35% surge in quarterly net profit driven by artificial intelligence demand. TSMC has committed approximately $165 billion to US investments and is accelerating construction of new fabrication plants in Arizona.

The agreement requires ratification by Taiwan’s parliament, where opposition lawmakers have raised concerns about potential impacts on the island’s domestic semiconductor industry. Despite these concerns and ongoing geopolitical tensions with China, Taiwan prioritized strengthening economic relations with the United States, according to trade expert Ryan Majerus, a former official in both Trump and Biden administrations.