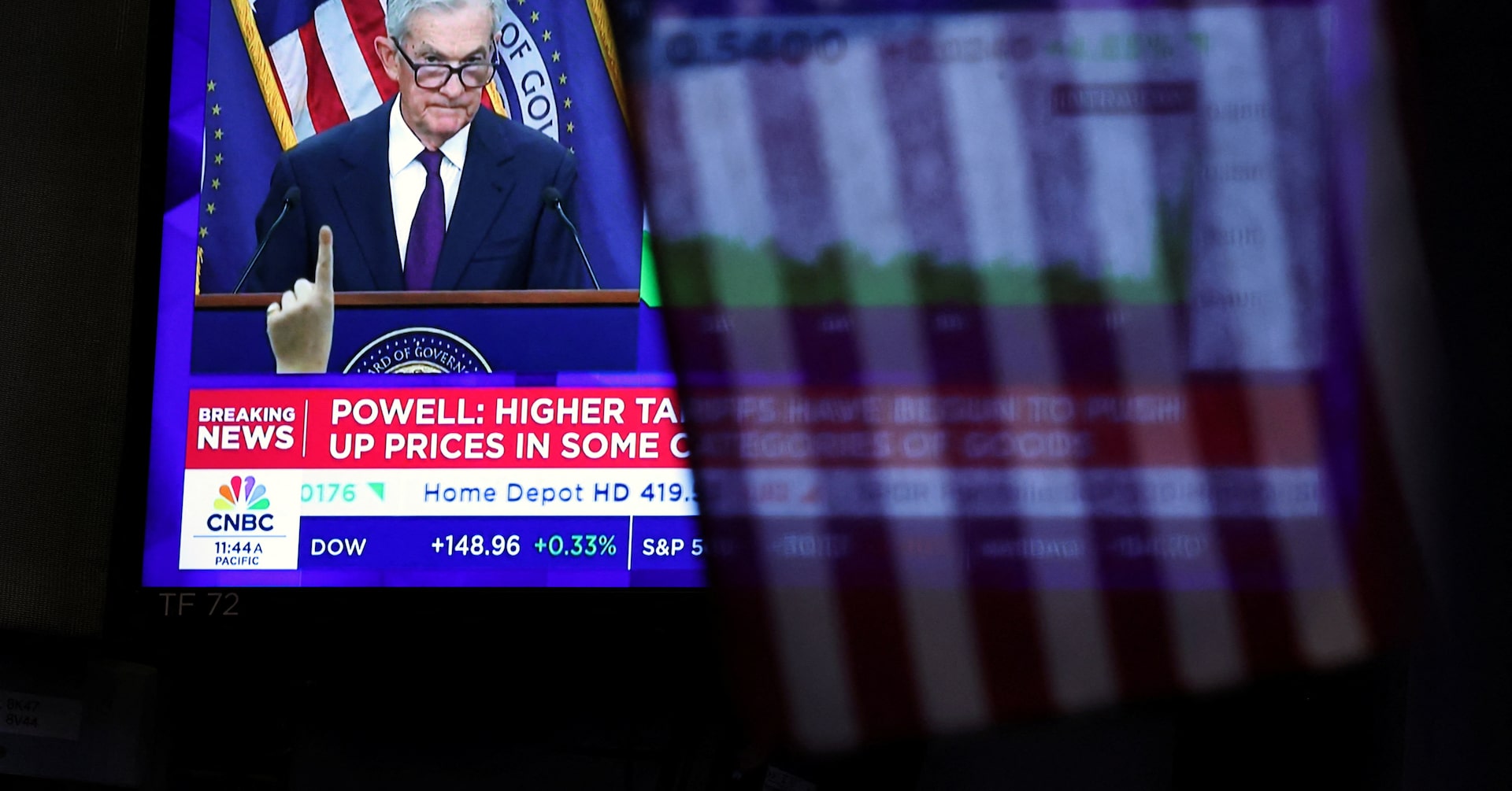

The U.S. Federal Reserve’s decision to implement its first interest rate cut of 2025 sent ripples through global markets, sparking a mix of reactions across financial sectors. While the initial announcement led to a stumble in U.S. markets, stock futures rebounded sharply ahead of Thursday’s trading session as Fed Chair Jerome Powell signaled a cautious approach to further easing. The dollar and Treasury yields experienced significant fluctuations, with the greenback hitting a multi-year low before recovering. Powell emphasized a risk-management strategy, noting that while the median projection among Fed policymakers suggests two additional cuts this year and one in 2026, a third of officials oppose further easing in 2025, and nearly half anticipate only one more cut or none at all. This divergence has left markets uncertain, with Fed futures pricing in an 85% chance of a 25-basis-point cut in October and only 44 basis points of easing for the remainder of the year. The Nasdaq and S&P 500 both dipped on Wednesday, partly due to Nvidia’s 3% decline following reports of Chinese regulators urging domestic tech firms to halt purchases of Nvidia’s AI chips. However, optimism returned as Chinese officials expressed willingness to engage in dialogue, and tech stocks like Oracle and Lyft surged on positive news. Meanwhile, global central banks are also in focus, with the Bank of Canada cutting rates as expected and the Bank of England’s decision on quantitative tightening drawing attention. The Bank of Japan is expected to hold rates but hint at future hikes, adding to the complexity of global monetary policy. As markets brace for further volatility, the Fed’s rate-cutting cycle stands in contrast to other central banks winding down their easing measures, signaling potential turbulence ahead.

作者: admin

-

Kennedy’s hand-picked CDC committee to vote on hepatitis B and COVID shots

In a pivotal moment for U.S. public health policy, the Centers for Disease Control and Prevention (CDC) is poised to redefine its vaccination guidelines under the leadership of Health Secretary Robert F. Kennedy Jr. A newly appointed advisory committee, handpicked by Kennedy, is set to convene on September 18 and 19, 2025, to deliberate on critical vaccine recommendations, including those for hepatitis B, measles-mumps-rubella-varicella (MMRV), and COVID-19. This meeting follows Kennedy’s controversial decision earlier this year to dismiss all 17 members of the CDC’s Advisory Committee on Immunization Practices (ACIP) and replace them with a smaller, 12-member panel. The new committee, chaired by Martin Kulldorff, a biostatistician and epidemiologist known for his opposition to COVID-19 lockdowns, has already stirred debate. Among the key issues on the agenda is the potential delay of the hepatitis B vaccine for newborns, a move that has drawn criticism from medical experts who argue that the birth dose has been instrumental in reducing hepatitis B infections. The committee will also review the use of a combined MMRV vaccine, which has been linked to a higher risk of seizures in young children compared to separate MMR and varicella vaccines. The reshuffling of the CDC’s leadership and advisory panels has raised concerns among public health officials, with some accusing Kennedy of prioritizing ideology over science. The meeting comes amid broader turmoil at the CDC, including the resignation of several senior officials who cited fears that policy decisions were being predetermined without adequate scientific review. As the nation watches, the outcome of these deliberations could mark a significant shift in U.S. vaccination policy, with far-reaching implications for public health.

-

Taiwan central bank raises growth forecast, warns of tariff risks

In a significant move, Taiwan’s central bank has decided to maintain its benchmark discount rate at 2% during its quarterly meeting, aligning with market expectations. The decision, made unanimously, reflects the bank’s cautious optimism about the island’s economic trajectory. Governor Yang Chin-long highlighted the unique nature of this year’s economic growth, driven largely by booming exports, particularly in the semiconductor sector, which has been pivotal in powering the global AI boom. Companies like Nvidia have benefited immensely from Taiwan’s advanced chip production, bolstering the local economy. However, Yang expressed concerns over the potential adverse effects of U.S. tariffs, which could necessitate adjustments in monetary policy. The central bank has revised its 2025 economic growth forecast upward to 4.55%, up from 3.05% in June, but anticipates a slowdown to 2.68% in the following year. Additionally, the bank has trimmed its consumer price index forecast for this year to 1.75%, with inflation expected to ease further to 1.66% next year. The bank remains vigilant, closely monitoring developments in U.S. tariffs and geopolitical risks, which could significantly impact Taiwan’s competitive edge. This rate decision follows the U.S. Federal Reserve’s recent rate cut, the first since December, amid concerns over rising unemployment.

-

EU set to miss UN climate deadline amid internal divisions

In a significant development, European Union climate ministers are poised to confirm on Thursday that the bloc will fail to meet a global deadline for setting new emissions reduction targets. This delay stems from internal disagreements among EU governments, casting a shadow over the EU’s leadership in global climate action. The missed deadline could undermine the bloc’s credibility as it prepares to join other major powers at the United Nations General Assembly next week, where updated climate plans are expected to be presented ahead of the COP30 climate talks in November. While major emitters like China are anticipated to meet the deadline, and Australia has already announced its target, the EU’s internal discord highlights the challenges of aligning ambitious climate goals with economic and geopolitical realities. EU Climate Commissioner Wopke Hoekstra defended the bloc’s efforts, stating, “If you zoom out, you can find that we continue to be amongst the absolutely most ambitious on the global stage.” However, the EU’s inability to agree on new targets for 2035 and 2040 has sparked criticism. Germany, France, and Poland have called for further discussions on the 2040 goal at an October summit, delaying progress on both targets. As a temporary measure, EU ministers will attempt to draft a “statement of intent” outlining their climate ambitions. A draft of this statement, previously reported by Reuters, suggests the EU aims to reduce emissions by 66.3% to 72.5% by 2035. Despite the setback, the bloc remains committed to finalizing its 2035 target before COP30. Finnish Climate Minister Sari Multala emphasized, “It is hard for us to require the others, our international partners, to do the same if we don’t deliver ourselves.” The EU’s traditional role as a climate leader is under strain due to rising concerns over the costs of climate measures and competing priorities such as defense and industrial spending. Divisions among member states are further exacerbated by differing views on the European Commission’s proposal to cut net greenhouse gas emissions by 90% by 2040. While countries like Spain and Denmark advocate for stronger climate action, citing extreme weather events and energy security, others like the Czech Republic and Italy oppose the ambitious targets, citing potential harm to industries. This internal conflict underscores the complexities of balancing environmental goals with economic and political pressures in a rapidly changing world.

-

Gold gains on softer dollar after Fed delivers rate cut

Gold prices experienced a notable uptick on Thursday, driven by a weakening dollar and the U.S. Federal Reserve’s decision to cut interest rates by 25 basis points. The Fed’s move, coupled with its indication of a gradual easing path for the remainder of the year, has significantly bolstered the appeal of the precious metal. Spot gold rose by 0.2% to $3,668.34 per ounce, following a record high of $3,707.40 on Wednesday. U.S. gold futures for December delivery, however, saw a slight decline of 0.4% to $3,703. The dollar, which had recently gained strength, retreated to near a two-month low, making gold more affordable for holders of other currencies. Concurrently, benchmark 10-year Treasury yields also decreased. Market analysts attribute the rise in gold prices to the dollar’s resumed weakness and the Fed’s dovish stance, which suggests two additional rate cuts this year. Fed Chair Jerome Powell described the rate cut as a ‘risk-management measure’ in response to a softening labor market, emphasizing a ‘meeting-by-meeting’ approach to future rate decisions. Gold, a non-yielding asset, is traditionally seen as a safe haven during periods of geopolitical and economic uncertainty, and it tends to thrive in low-interest-rate environments. Analysts, including Ross Norman, an independent market expert, believe that gold’s bull run remains robust, with record highs likely to persist. Traders are currently anticipating a 90% chance of another 25-basis point cut at the Fed’s October meeting, according to the CME Group’s FedWatch tool. ANZ Bank also predicts that gold will outperform early in the easing cycle, citing increased demand for haven assets amid a challenging geopolitical landscape. Meanwhile, other precious metals showed mixed performance, with spot silver rising 0.4% to $41.84 per ounce, platinum gaining 1.5% to $1,383.60, and palladium declining 0.7% to $1,146.55 per ounce.

-

India’s stock benchmarks hit 10-week highs on Fed rate cut, optimism over US trade talks

India’s stock market surged to a 10-week high on Thursday, driven by gains in IT and pharmaceutical sectors. The rally followed the U.S. Federal Reserve’s decision to implement a quarter-point rate cut and indications of easing trade tensions. The Nifty 50 index climbed 0.37% to 25,423.60, while the BSE Sensex rose 0.39% to 83,013.96. IT and pharmaceutical stocks, which derive significant revenue from the U.S., saw notable increases of 0.8% and 1.5%, respectively. Biocon and Natco Pharma further boosted the pharma index with gains of 4% and 3.3%, supported by favorable regulatory developments in the U.S. Twelve out of 16 major sectors recorded gains, with small-cap and mid-cap indices adding 0.3% and 0.4%, respectively. The Fed’s rate cut, its first this year, has sparked optimism among investors, though uncertainty remains about the pace of future monetary easing. Market analyst Om Ghawalkar noted that the decision could attract foreign institutional investments and bolster investor confidence. Additionally, chief economic advisor V. Anantha Nageswaran hinted at potential reductions in U.S. tariffs on certain Indian imports, further supporting market sentiment. The Nifty 50 has closed in positive territory in 11 of the last 12 sessions, now trading just 3.25% below its September 2024 peak. However, Cohance Lifesciences saw a 5.6% decline after a block deal involving an 8.9% stake at a discounted price.

-

Oil India sees restart of Mozambique LNG project by year’s end

India’s state-run Oil India Ltd (OILI.NS) has announced that the $20-billion Mozambique liquefied natural gas (LNG) project, operated by French energy giant TotalEnergies (TTEF.PA), is expected to restart development by the end of 2025. The project, in which Oil India holds a stake, was halted in 2021 due to a deadly attack by Islamic State-linked insurgents, prompting TotalEnergies to declare force majeure. Speaking at the company’s annual shareholder meeting, Oil India Chairman Ranjit Rath expressed optimism about the project’s revival, citing improved security conditions and its strategic importance in meeting India’s growing gas demand. TotalEnergies CEO Patrick Pouyanne had previously indicated in June that development could resume ‘this summer.’ The project is a multinational venture, with TotalEnergies holding a 26.5% stake, Mitsui & Co (8031.T) owning 20%, Mozambique’s state-owned ENH at 15%, and Indian state firms ONGC Videsh, Bharat PetroResources, and Oil India collectively holding 30%. Thailand’s PTTEP (PTTEP.BK) owns the remaining share. Separately, Oil India reported significant dividends from its investments in Russian projects, including Vankorneft and Taas-Yuryakh, with $942 million received, representing 91% of its original investment. Full recovery of the investment is anticipated in the coming year.

-

Exclusive: Turkey’s surprise Air Europa deal came down to one key thing: control

In a surprising move, Turkish Airlines has successfully acquired a significant stake in Spanish carrier Air Europa, outmaneuvering European rivals Lufthansa and Air France-KLM. The deal, valued at 300 million euros for a 25-27% stake, was finalized due to Turkish Airlines’ willingness to share control with Air Europa’s Hidalgo family owners, according to sources familiar with the negotiations. This marks a rare instance of a non-European airline investing in a European carrier, particularly given EU regulations that restrict majority ownership by non-EU entities. The agreement underscores Turkish Airlines’ strategic focus on expanding its presence in Iberia and Latin America, leveraging Air Europa’s established routes. While Lufthansa and Air France-KLM sought a path to majority control, their demands were incompatible with the Hidalgo family’s preference for maintaining influence. Analysts note that the deal is less about financial gain and more about geopolitical and connectivity advantages, positioning Turkish Airlines to strengthen its hub-and-spoke network. The Turkish government’s support further bolsters the airline’s strategic ambitions, with Transport Minister Abdulkadir Uraloglu highlighting the alignment with Turkey’s broader global connectivity strategy. Despite the complexities of minority stakes, Turkish Airlines’ financial stability and political backing mitigate potential risks, ensuring the deal’s viability.

-

US Democratic Senator asks health insurers to commit to covering vaccines

U.S. Senator Adam Schiff (D-CA) has taken a proactive stance in ensuring continued access to routine vaccinations, sending letters to major health insurers ahead of a pivotal meeting of the CDC’s Advisory Committee on Immunization Practices (ACIP). In the letters, Schiff urged companies such as UnitedHealth Group, CVS Health, Elevance Health, Cigna, and Kaiser to publicly commit to covering vaccines for illnesses like measles and COVID-19, regardless of the committee’s recommendations. He emphasized that patients should not face out-of-pocket costs for these essential immunizations. Schiff’s move comes in response to recent changes within the ACIP, which have caused confusion among patients and healthcare providers. In May, Health and Human Services Secretary Robert F. Kennedy Jr., a known vaccine skeptic, announced that the CDC would no longer recommend the COVID-19 vaccine for healthy pregnant women and children. This decision, coupled with Kennedy’s replacement of ACIP members with less experienced or skeptical individuals, has raised concerns about the committee’s credibility. Schiff highlighted that the Affordable Care Act (ACA) mandates private insurers to cover vaccines recommended by the ACIP, but the statute did not anticipate the committee’s overhaul. In response, some states have allowed pharmacies to follow guidance from medical organizations like the American College of Obstetrics and Gynecology. Meanwhile, America’s Health Insurance Plans has assured that coverage for previously recommended vaccines will continue through the end of 2025. The ACIP is set to review recommendations for COVID-19, Hepatitis B, and the measles-mumps-rubella-varicella vaccines on September 18 and 19. Schiff’s initiative underscores the importance of maintaining evidence-based vaccine policies and ensuring public access to critical healthcare services.

-

Kennedy is rewriting US vaccine policy — fast and on his terms

U.S. Health and Human Services Secretary Robert F. Kennedy Jr. is aggressively advancing sweeping changes to the nation’s vaccine policies, despite significant opposition from scientists, lawmakers, and public health experts. Since taking office, Kennedy has restricted eligibility for COVID-19 vaccines, removed the country’s top public health official, expanded federal support for state-level vaccine exemptions, dismantled the vaccine recommendation review process, and reshaped a national vaccine advisory board with like-minded experts. These actions have drawn sharp criticism from medical societies, Democrats in Congress, and even members of Kennedy’s own family, who have called for his removal. Public health leaders warn that his policies could restrict access to critical vaccines for children, potentially reversing decades of progress in immunization. Kennedy’s supporters, however, argue that his efforts aim to restore public trust in health agencies and promote greater scrutiny of vaccine safety. The ongoing debate comes as a Kennedy-appointed advisory board prepares to vote on potential changes to childhood vaccine recommendations, a decision that could have far-reaching implications for public health nationwide.