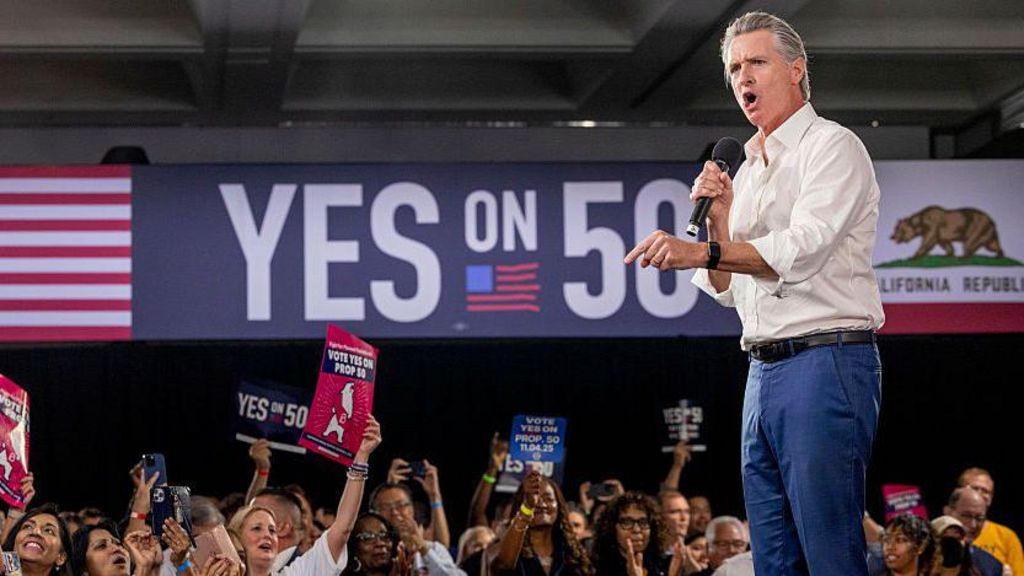

California voters have approved Proposition 50, a redistricting measure designed to favor Democrats in the upcoming 2026 midterm elections. The initiative aims to reconfigure voting districts to potentially secure five House seats currently held by Republicans. This move is seen as a counterattack against similar efforts by Republican-led states, intensifying the nationwide battle for control of the U.S. House of Representatives.

作者: admin

-

At least 10 killed in Bosnia nursing home fire

A devastating fire erupted at a nursing home in Tuzla, northeastern Bosnia-Herzegovina, on Tuesday night, resulting in the deaths of 10 residents and injuring 20 others, according to local police. The blaze began at approximately 20:45 local time (19:45 GMT) on the seventh floor of the retirement facility. Emergency responders, including firefighters, police officers, medical personnel, and staff, rushed to the scene, with around 20 individuals transported to a nearby medical center for treatment. Among the injured were several patients suffering from carbon monoxide poisoning, three of whom required intensive care. The cause of the fire remains undetermined, prompting Prime Minister Nermin Nikšić to describe the incident as “a disaster of enormous proportions.” Authorities have pledged a thorough investigation once conditions permit. Željko Komšić, Chairman of Bosnia-Herzegovina’s tripartite presidency, extended condolences to the families of the victims and those injured. Eyewitness accounts, including that of resident Ruza Kajic, who lived on the third floor, described chaotic scenes as flames engulfed the upper floors, where many bed-ridden individuals resided. Footage from the scene captured the intensity of the blaze, with flames visible from the building’s windows. The tragedy has cast a somber shadow over the community, raising questions about safety protocols in such facilities.

-

What we know about deadly Kentucky cargo plane crash

A catastrophic cargo plane crash at Louisville International Airport on Tuesday evening has resulted in at least seven fatalities, with fears that the death toll may rise. The UPS-operated flight 2976, an MD-11F aircraft, veered off the runway during takeoff at approximately 17:15 local time, igniting a massive fire that engulfed nearby buildings. The incident has triggered a large-scale emergency response to contain the blaze and mitigate further risks. Kentucky Governor Andy Beshear confirmed that two businesses, Kentucky Petroleum Recycling and Grade A Auto Parts, were directly impacted by the crash. Unverified footage shows the plane already ablaze as it skidded off the runway. The fire spread rapidly, prompting authorities to issue shelter-in-place orders for residents within a one-mile radius due to concerns over air pollution and potential explosions. All airport operations have been suspended indefinitely. Officials have reported eleven injuries so far, with the number expected to increase. The cause of the crash remains under investigation, though the substantial fuel load on the aircraft, which was en route to Hawaii, likely exacerbated the fire. Louisville Fire Department Chief Brian O’Neal described the scene as “very dangerous” due to the spilled fuel. Searches are ongoing to locate two missing workers from the auto parts business, and it remains unclear how many customers were present at the time of the crash. The MD-11F, a triple-engine cargo plane, has been in service for 34 years. Authorities have assured the public that the aircraft was not carrying hazardous materials.

-

World shares retreat after losses for Big Tech pull US stocks lower

Global financial markets experienced significant turbulence on Wednesday, triggered by a sharp decline in Big Tech shares on Wall Street. The ripple effects were felt across Europe and Asia, with major indices initially plunging before partially recovering. Tokyo’s Nikkei 225 index, which had plummeted nearly 5% during the day, managed to pare losses to close 2.5% lower at 50,212.27. Similarly, European markets saw declines, with Germany’s DAX dropping 0.7% and France’s CAC 40 shedding 0.4%. The UK’s FTSE 100 edged 0.1% lower. In the U.S., futures for the S&P 500 slipped 0.1%, while the Dow Jones Industrial Average futures inched 0.1% higher. The tech-driven sell-off was particularly pronounced in Asia, where SoftBank Group’s shares tumbled 10% amid concerns over its artificial intelligence investments. Other tech giants, including Tokyo Electron and Advantest Corp., also saw significant declines. Toyota Motor Corp. reported a 7% drop in profits for the April-September period but raised its annual earnings forecast despite U.S. tariff pressures. South Korea’s Kospi fell 2.9%, driven by losses in Samsung Electronics and SK Hynix. Chinese markets showed mixed performance, with the Shanghai Composite edging 0.2% higher while Hong Kong’s Hang Seng dipped 0.1%. The tech sector’s volatility has been a key driver of market movements this year, with companies like Nvidia and Microsoft exerting outsized influence. Gold prices, often seen as a safe haven, rose 0.8% to $3,990.90 per ounce amid the uncertainty. Analysts described the sell-off as a ‘reality check’ for markets that had been riding a prolonged rally. Wall Street remains focused on corporate earnings, with most S&P 500 companies surpassing expectations. However, the U.S. government shutdown has added to the uncertainty, leaving investors without crucial economic data. Tesla shares fell 5.1% after Norway’s sovereign wealth fund opposed a controversial compensation package for CEO Elon Musk. In commodities, U.S. benchmark crude oil and Brent crude both declined by 14 cents per barrel.

-

‘He’s just on it’: New Yorkers laud Mamdani’s energy and progressive politics on election day

The New York City mayoral election witnessed a significant voter turnout, with over 1.2 million ballots cast, surpassing the previous election’s total. The race, marked by high stakes, pits Democratic nominee Zohran Mamdani against former New York Governor Andrew Cuomo, representing a clash between progressive ideals and established political power. Mamdani, a 34-year-old Muslim Democratic Socialist, has garnered attention for his vision of a more inclusive and affordable city, resonating particularly in neighborhoods like Brooklyn’s Bedford-Stuyvesant (BedStuy), which has been heavily impacted by gentrification. Residents such as Nesby and Memeshwarie Hardy expressed their support for Mamdani, citing his focus on addressing the cost-of-living crisis and his commitment to representing all New Yorkers. Mamdani’s campaign has been notable for its outreach to diverse communities, often in their native languages, and his promises to freeze rent prices, provide free and fast buses, and implement universal childcare. Supporters like Sarah Jaffe and Elton Garcia Sosa highlighted Mamdani’s authenticity and his opposition to Israel’s policies as key reasons for their backing. Despite the enthusiasm, some voters remained skeptical of political promises, while others, like Christian Jay Smith, felt detached from the election’s outcome. The election’s energy was palpable in BedStuy, where residents like Jasmine and Donna Cleary praised Mamdani’s advocacy and outspokenness. The campaign’s extensive canvassing efforts, including knocking on three million doors, underscored its grassroots approach. As New Yorkers await the results, the election represents a pivotal moment for the city’s future, with Mamdani’s progressive agenda challenging the status quo.

-

France investigates Shein and Temu after sex doll scandal

Online retail giants Shein, Temu, AliExpress, and Wish are under investigation in France for allegedly enabling minors to access pornographic content on their platforms, the Paris prosecutor announced on Tuesday. The probe follows a report by the country’s consumer watchdog, which raised concerns over the sale of childlike sex dolls on Shein’s platform. The watchdog referred the matter to the prosecution service on Sunday. The Paris prosecutor’s office confirmed that the platforms are being scrutinized for hosting violent, pornographic, or ‘undignified messages’ accessible to minors. AliExpress responded by stating it takes the issue seriously and has removed the offending listings, while Shein announced a global ban on the sale of all sex dolls and stricter platform controls. The French consumer watchdog highlighted that the descriptions and categorizations of the sex dolls left ‘little doubt as to the child pornography nature’ of the products. The investigation coincides with Shein’s launch of its first permanent physical outlet in Paris on Wednesday, amidst protests. The company, founded in China, also plans to expand its presence in other French cities, including Dijon, Reims, and Angers.

-

Australia announces 15-member squad for first Ashes Test in Perth

Australia has unveiled its 15-member squad for the opening Ashes Test against England in Perth, with Steve Smith stepping in as captain following Pat Cummins’ injury. Travis Head has been appointed as vice-captain. The squad, announced by chairman of selectors George Bailey, aims for a balanced composition, with 14 players participating in the upcoming Sheffield Shield matches to fine-tune their form. Three newcomers—batsman Jake Weatherald and bowlers Brendan Doggett and Sean Abbott—are set to make their Test debuts, with Weatherald vying for an opening spot alongside Marnus Labuschagne and Usman Khawaja. All-rounders Cameron Green and Beau Webster, along with wicketkeeper Alex Carey and reserve Josh Inglis, complete the lineup. The bowling attack features Josh Hazlewood, Nathan Lyon, Mitchell Starc, and Scott Boland. Bailey expressed optimism about Cummins’ potential return later in the series. Weatherald’s consistent performance over the past 18 months earned him a spot, with Bailey praising his complementary style. The final XI remains undecided, with Bailey emphasizing that the selection will be finalized closer to the match. Sam Konstas, who opened in the West Indies series, was omitted due to lackluster domestic form. The first Test will be held at Optus Stadium in Perth from November 21 to 25, followed by matches in Brisbane, Adelaide, Melbourne, and Sydney. England, led by Ben Stokes, announced their 16-man squad in September, featuring Ben Duckett and Zak Crawley as openers.

-

Vietnam rethinks its flood strategy as climate change drives storms and devastation

Vietnam is undergoing a transformative approach to managing floods as relentless storms and record rainfall wreak havoc across the country. With climate change intensifying, the government has committed over $6 billion under a national master plan through 2030 to build early-warning systems, relocate vulnerable communities, and redesign urban areas to better handle extreme weather. Central to this strategy is the concept of ‘sponge cities,’ which absorb and release water naturally, reducing flood risks. Cities like Vinh are already implementing these ideas, expanding drainage networks, creating flood basins, and transforming riverbanks into green spaces. However, the urgency of this work has been underscored by a series of devastating storms in 2025, including Ragasa, Bualoi, and Matmo, which caused widespread destruction and economic losses. Scientists warn that warmer seas are fueling more intense and prolonged storms, disproportionately affecting Vietnam’s poorest communities. The economic toll has been severe, with extreme weather costing the country $1.4 billion in 2025 alone. Vietnam estimates it will need $55 billion to $92 billion this decade to manage climate impacts. Major cities like Hanoi and Ho Chi Minh City, home to nearly 18 million people, are particularly vulnerable due to rapid urbanization that has replaced natural flood buffers with concrete. Flooding in Hanoi in October 2025 lasted nearly a week, overwhelming the city’s outdated infrastructure. Experts emphasize that traditional flood control methods are insufficient and advocate for nature-based solutions, such as restoring wetlands and green spaces. Globally, cities like Bengaluru and Johannesburg are adopting similar strategies, and Vietnam’s real estate developers are beginning to follow suit. For instance, the Sun Group is building a ‘sponge city’ in Nha Trang, featuring 60 hectares of wetlands designed to store and reuse rainwater. As climate risks escalate, Vietnam’s efforts to adapt offer valuable lessons for other nations grappling with similar challenges.

-

EO Charging completes £25 million recapitalisation to accelerate next phase of growth

EO Charging, a prominent player in fleet electrification solutions, has successfully completed a £25 million recapitalisation, marking a significant milestone in its growth trajectory. The funding round, led by existing investors Zouk Capital and Vortex Energy, combines an expanded debt facility with HSBC and a fresh equity injection. This strategic move underscores the unwavering confidence of its investors and provides a robust foundation for the company’s next phase of expansion.

The recapitalisation follows a series of strategic decisions, including EO Charging’s planned exit from the US market and the sale of its domestic EV charger hardware and manufacturing business to Cogent Technologies, a subsidiary of the Heathpatch Group. These measures aim to streamline operations, enhance efficiency, and transition towards a scalable platform-led business model.

With a renewed focus on software, services, and infrastructure-as-a-service (IaaS) for commercial fleets and heavy goods vehicles, EO Charging is poised to deliver scalable and dependable fleet-charging solutions across the UK and Europe. The investment will accelerate the deployment of its commercial-grade charging infrastructure and its flagship software offering, Charge Assurance™, which provides fleet operators with comprehensive visibility, management, and energy optimisation tools.

Richard Staveley, CEO of EO Charging, emphasised the significance of the investment, stating, ‘This funding reflects our shareholders’ confidence in our evolved strategy and long-term vision. We are committed to delivering reliable, commercial-grade charging infrastructure and intelligent software that empowers fleets to electrify and perform at scale.’

Massimo Resta, Partner and Head of Infrastructure at Zouk Capital, echoed this sentiment, highlighting EO’s alignment with the growing demand for scalable, software-enabled infrastructure solutions in the fleet electrification market. Bakr Abdel-Wahab, Chief Investment Officer at Vortex Energy, added that the transition to electric mobility is becoming foundational, and EO’s software- and service-first model positions it for sustained growth.

EO Charging continues to serve major global fleet operators, including Amazon, DHL, UPS, Tesco, and FedEx, leveraging over a decade of expertise in EV charging infrastructure and management solutions.

-

Dollar extends gains on rate cut doubts and safety play; pound slips

The U.S. dollar surged to a four-month high against the euro on Tuesday, driven by growing doubts about another Federal Reserve rate cut this year and heightened demand for safe-haven assets amid a risk-off market sentiment. The euro declined for the fifth consecutive session, falling 0.3% to $1.148, its lowest level since August 1. Meanwhile, the British pound tumbled after UK Finance Minister Rachel Reeves highlighted the challenging economic conditions ahead of her upcoming budget, emphasizing high debt, low productivity, and persistent inflation. Market sentiment remained subdued, with stocks declining and government bonds attracting investors. Safe-haven currencies like the Japanese yen and Swiss franc held steady. The dollar index, which measures the U.S. currency against a basket of six others, surpassed 100 for the first time since early August, reaching 100.17. Traders now estimate a 65% chance of a December rate cut, down from 94% a week earlier, according to CME FedWatch. The Australian dollar fell 0.7% to $0.6496 after the Reserve Bank of Australia maintained its cash rate at 3.60%, signaling caution about further easing. Cryptocurrency Bitcoin dropped 2% to $107,486, its weakest since June. The yen, nearing levels that prompted Japanese intervention in 2022 and 2024, remained under pressure, with Finance Minister Satsuki Katayama reiterating the government’s vigilance over currency movements. Analysts noted that U.S. President Donald Trump’s recent criticism of countries allowing their currencies to weaken could influence Japan’s approach.