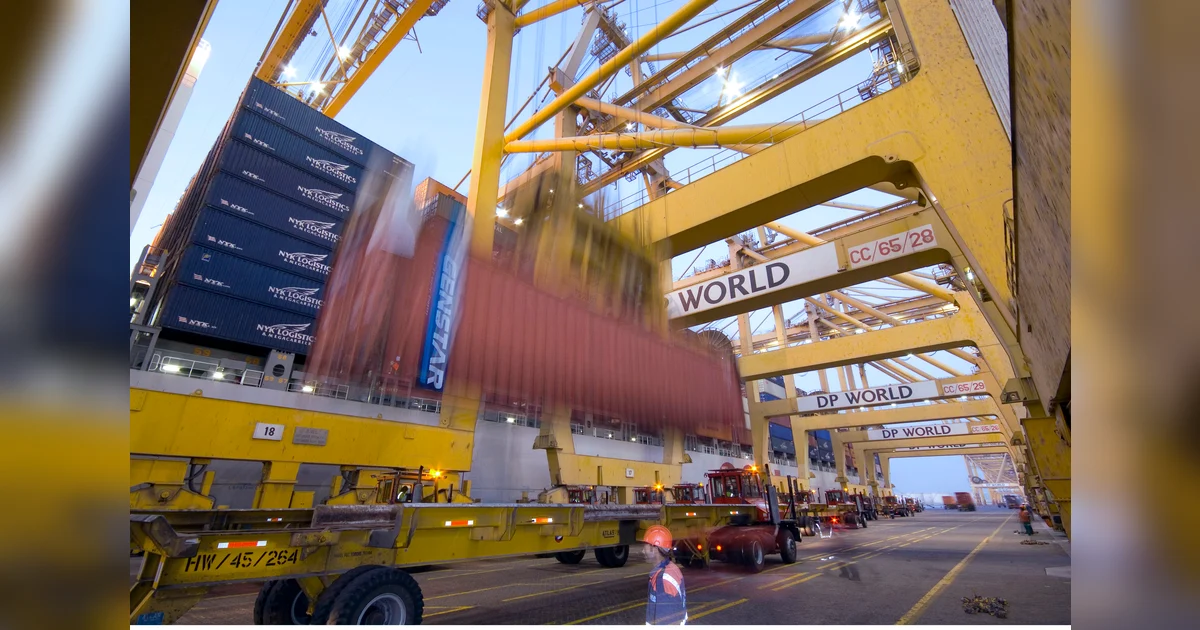

Despite mounting geopolitical tensions and policy uncertainties, global trade leaders are demonstrating remarkable optimism for 2026, with 94% of senior supply chain executives anticipating growth rates that will match or surpass 2025 levels. This confident outlook emerges from DP World’s comprehensive Global Trade Observatory Annual Outlook, presented during the World Economic Forum in Davos, which surveyed 3,500 executives across 19 countries and eight industries.

The research reveals a striking divergence between corporate sentiment and institutional projections. While the International Monetary Fund forecasts a decline in global merchandise trade growth from 3.6% in 2025 to 2.3% in 2026, more than half (54%) of business leaders actually expect accelerated expansion. This optimism persists despite widespread recognition of challenges: 90% anticipate rising or sustained trade barriers, and 53% predict high policy uncertainty throughout 2026.

Sultan Ahmed bin Sulayem, Group Chairman and CEO of DP World, characterized the trading environment as structurally complex rather than cyclical. He emphasized the company’s commitment to maintaining trade flow through strategic infrastructure investments and partnership development that enhance operational efficiency and reliability for customers.

Regional analysis identifies Europe as the most promising growth area (22% of respondents), followed closely by China (17%), with Asia Pacific (14%) and North America (13%) also generating significant confidence. This regional optimism stems from anticipated European demand stabilization, China’s export resurgence in electric vehicles and renewable energy equipment, and expanding intra-Asian supply chains.

The United Arab Emirates is emerging as a primary beneficiary of global trade realignment, with WTO projections indicating Middle Eastern outperformance in merchandise trade growth. UAE government data shows non-oil foreign trade exceeding Dh4.3 trillion in 2024, representing 14% year-on-year growth, fueled by comprehensive economic partnership agreements with over 20 nations and deepening integration with Asian and African markets.

Corporate adaptation strategies are accelerating dramatically, with 51% of firms planning supplier diversification, 44% increasing inventory buffers, and 36% adopting friend-shoring approaches that prioritize politically aligned markets. UNCTAD estimates indicate more than $1.3 trillion in manufacturing investment announced globally since 2022 under supply chain reconfiguration programs.

Route flexibility has become central to trade strategy, with 26% of executives planning new shipping routes in 2026 and another 23% actively evaluating alternatives. This shift is driven by cost reduction objectives, enhanced inland connectivity, and faster customs processing. The expansion of Asia-Europe overland corridors, Middle Eastern logistics hubs, and Africa-linked maritime routes reflects a strategic reduction in dependency on traditional maritime chokepoints.

Border friction remains a critical constraint, with 60% of executives citing customs clearance as a primary cause of delays. Investments in warehousing, logistics hubs, road networks, and border processing infrastructure are prioritized as essential efficiency drivers. World Bank research indicates that reducing border processing time by just one day can increase trade volumes by up to 1%, strengthening the economic rationale for digital customs platforms and integrated clearance systems.