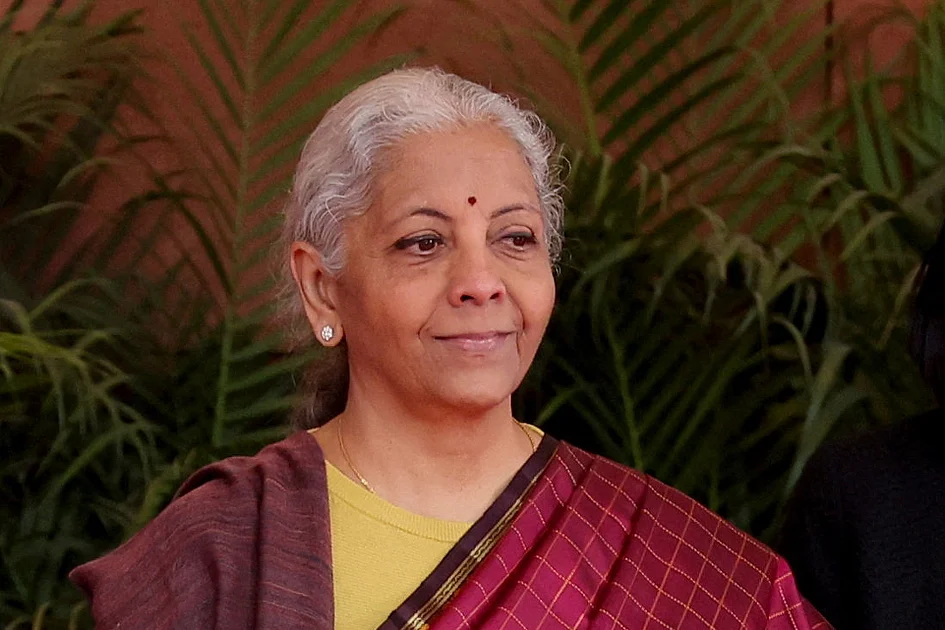

Finance Minister Nirmala Sitharaman presented a transformative budget on February 1, 2026, outlining India’s roadmap to achieve developed nation status by its 100th independence anniversary in 2047. The comprehensive fiscal plan combines massive infrastructure development with strategic tax reforms designed to position India as a global technology and healthcare hub.

The centerpiece of the infrastructure initiative involves seven new high-speed rail corridors connecting major metropolitan centers including Delhi, Mumbai, Pune, Hyderabad, Chennai, Varanasi, and Siliguri. These corridors aim to revolutionize domestic transportation and facilitate efficient movement for millions of daily commuters across the nation.

In a bold move to attract foreign investment, the government proposed an unprecedented tax holiday extending until 2047 for international companies providing global cloud services through Indian data centers. This incentive requires foreign entities to serve Indian customers via local reseller partnerships, creating a symbiotic relationship between international technology firms and domestic businesses.

The budget introduced significant support measures for the technology sector, particularly benefiting mid-sized IT companies by raising the safe harbour threshold from ₹3 billion to ₹20 billion. This regulatory easing comes as Indian IT firms face challenges in their primary American market.

Financial sector reforms include establishing a high-level banking committee dedicated to the ‘Viksit Bharat’ (Developed India) vision, targeting economic transformation into a $10 trillion economy through focused development in education, healthcare, employment, technology, and sustainability.

Healthcare initiatives feature five planned regional medical hubs developed through public-private partnerships, designed to establish India as a premier medical tourism destination. These integrated complexes will combine medical facilities, educational institutions, and research centers while incorporating traditional Ayurvedic medicine centers and rehabilitation infrastructure.

The budget also provides a one-time, six-month voluntary disclosure window for eligible taxpayers including students, young professionals, and returning NRIs to regularize limited undisclosed foreign income or assets with immunity from penalties and prosecution.

Despite these ambitious measures, stock markets reacted negatively primarily due to increased Securities Transaction Tax (STT) for Futures and Options trading, highlighting the challenge of balancing growth initiatives with market confidence.