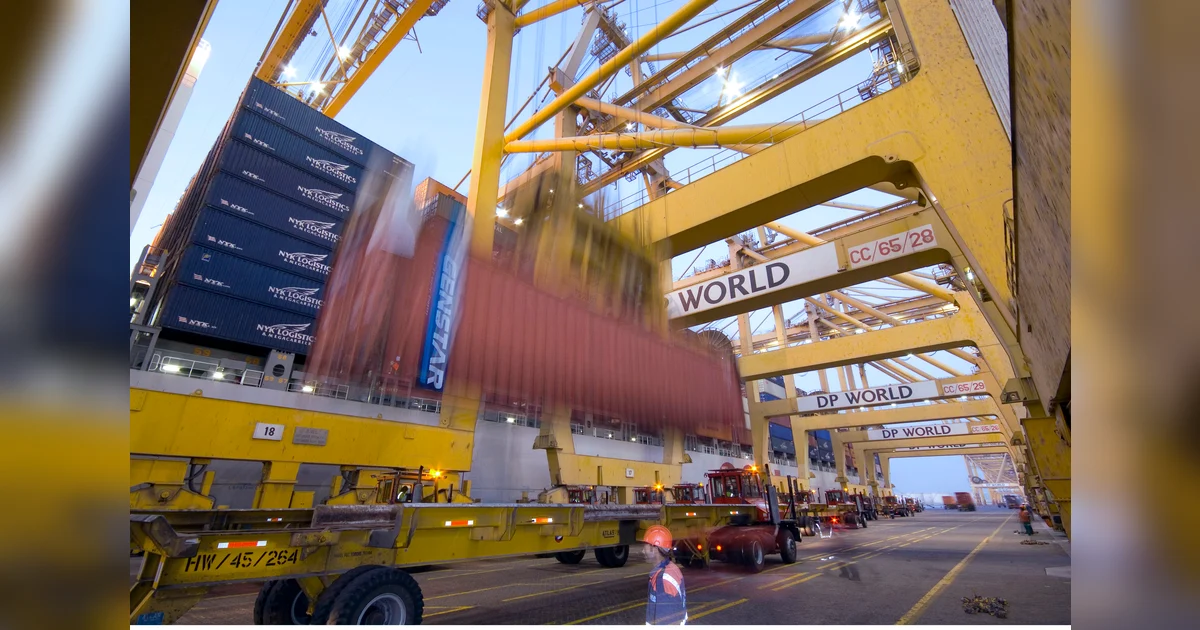

Southeast Asian nations are advancing regional energy integration through a renewed multilateral agreement facilitating hydropower transmission from Laos to Singapore via Thailand and Malaysia. The landmark deal, signed on January 14, represents a strategic step in the Association of Southeast Asian Nations’ (ASEAN) broader initiative to create an interconnected power framework across the region.

While the initial capacity of 100 megawatts may appear modest, energy experts emphasize the arrangement’s significance lies in establishing a replicable commercial model rather than immediate volume. Christina Ng, Managing Director at the Energy Shift Institute, described the capacity as ‘inconsequential’ but highlighted the framework’s importance: ‘It’s what ASEAN needs right now—a repeatable, bankable commercial framework that markets can scale.’

The agreement forms part of the ASEAN Power Grid (APG) initiative, first conceptualized through a 2007 memorandum of understanding and implemented in 2009. The Laos-Thailand-Malaysia-Singapore Power Integration Project, operational since 2018, represents the first multilateral cross-border electricity trade project within ASEAN. The current renewal follows successful pilot operations from 2022 to 2024 where Laos transmitted hydropower to Singapore using existing interconnections, with Thailand and Malaysia serving as transmission intermediaries.

Energy security experts note that cross-border renewable energy trade offers ASEAN nations a strategic tool to diversify energy risks without increasing dependence on volatile fossil fuels. ‘Energy security today is less about ‘owning fuel’,’ Ng explained. ‘It’s more about managing exposure to concentrated risks’—particularly relevant as geopolitical tensions threaten traditional shipping routes and fuel costs.

According to Dinita Setyawati, Senior Analyst at global energy policy think tank Ember, the collaboration demonstrates ASEAN countries prioritizing economic growth and decarbonization goals over political differences. The region’s energy ministers reinforced this commitment in October 2025 by signing an enhanced memorandum understanding to strengthen electricity connectivity through multilateral power trade and renewable integration.

Implementation challenges remain, however. David Broadstock, partner at Singapore-based consultancy The Lantau Group, noted that incomplete power grid infrastructure hinders regional connectivity, while Ng highlighted interoperability issues across eleven nations with differing technical standards. For land-constrained Singapore, which lacks sufficient wind resources, hydropower potential, and space for large-scale solar development, such cross-border arrangements represent essential pathways toward renewable energy adoption and energy security.