A severe capacity shortage is threatening to destabilize one of the world’s most critical aviation corridors as demand between the UAE and India dramatically outpaces available flight capacity. According to new analysis from Tourism Economics, an Oxford Economics company, approximately 27% of forecast passenger demand could go unserved by 2035 if current capacity limits remain unchanged.

The projected deficit translates to a staggering 54.5 million passenger journeys being left unaccommodated between 2026 and 2035, with the Abu Dhabi-India corridor particularly vulnerable. Current load factors already exceed 80% on major routes, leaving minimal spare capacity. Tourism Economics projects that under existing schedules, all available seats will be fully absorbed as early as 2026.

India’s remarkable aviation boom serves as the primary catalyst behind this surge. The country’s ‘travelling class’—households with sufficient income to fly—expanded from 24% of the population in 2010 to 40% in 2024, adding nearly 300 million potential flyers. This demographic shift is fueling annual demand growth of 7.2% through 2035, generating approximately 22 million additional passenger journeys each year.

For airlines, this unprecedented demand underpins substantial revenue growth. For travelers, it translates to constrained supply and escalating airfares, particularly during peak travel periods. Limited capacity has curtailed competition, granting carriers enhanced pricing power on high-demand routes connecting major Indian cities with Dubai and Abu Dhabi.

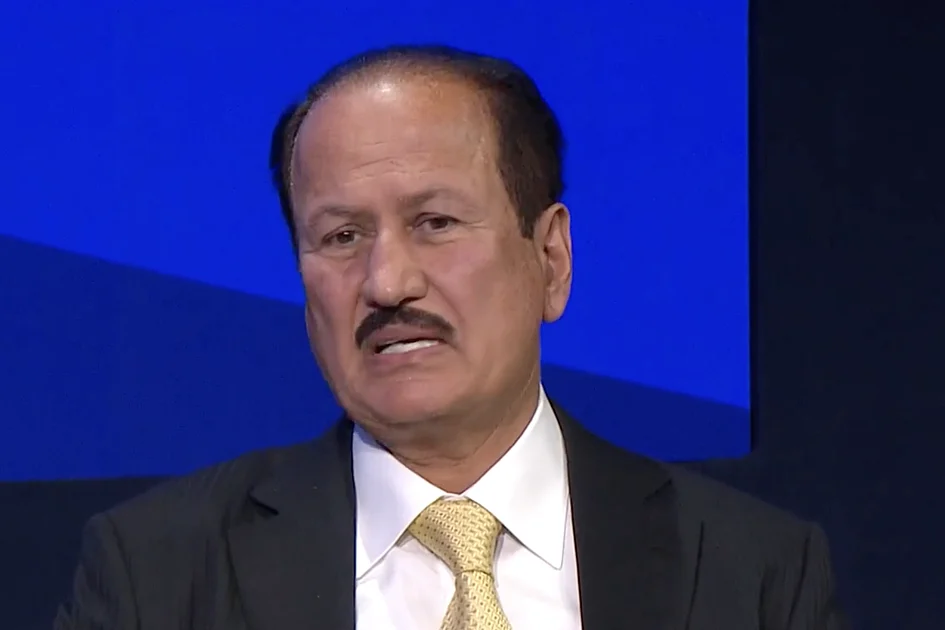

Aviation executives confirm that India routes continue outperforming most international markets. ‘India remains one of the fastest-growing source markets for Gulf carriers, both for point-to-point traffic and onward connections,’ noted Sudheesh TP, General Manager at Deira Travel & Tourist.

The UAE maintains its position as India’s largest international aviation market by a significant margin, accounting for approximately 1.1 million monthly seats and a 27% market share as of November 2025. Thailand, the second-largest market, accounts for merely 9%. While capacity on the India-UAE route increased 3% year-on-year, growth has failed to match accelerating demand.

Dubai International Airport’s 2024 traffic figures highlight the corridor’s strategic importance: 92.3 million passengers transited through the hub, with approximately 12 million traveling between Dubai and India. This means more than one in eight passengers at the world’s busiest international airport is India-related.

Six major carriers currently operate 538 weekly flights between Dubai and 23 Indian destinations. Emirates serves as the market backbone, operating 167 weekly services connecting Dubai to nine Indian cities since launching its first India flights in 1985. Etihad Airways has expanded to 11 Indian destinations but retains limited expansion capacity with approximately 10,000 unutilized seats from its 50,000 weekly bilateral entitlement.

Indian carriers have scaled operations significantly, with IndiGo operating roughly 220 weekly services, Air India maintaining 82 weekly frequencies, and Air India Express emerging as the largest Indian operator with over 240 weekly flights across multiple UAE destinations.

Despite this substantial operational scale, demand continues to exceed supply. Travel industry executives report the imbalance is already reshaping booking patterns, with earlier sell-outs on popular routes and escalating last-minute fares, particularly around school holidays and festival seasons.

The economic implications extend far beyond airline pricing structures. Tourism Economics estimates that maintaining current capacity caps would limit the air corridor’s GDP contribution growth to approximately 3% annually over the next five years. Easing restrictions could accelerate growth to between 5.5% and 7%, while doubling seat capacity on the Abu Dhabi-India route alone could generate an additional $7.2 billion in GDP over five years and support over 170,000 jobs annually.

Policy constraints remain the fundamental bottleneck. The 2014 air service agreement caps weekly seat entitlements at approximately 66,000 for Dubai and 55,000 for Abu Dhabi, with these limits effectively fully utilized. Negotiations to increase capacity remain stalled, with India advocating for a 4:1 ratio favoring Indian carriers for new seats, while the UAE seeks broader access to address rising unmet demand.