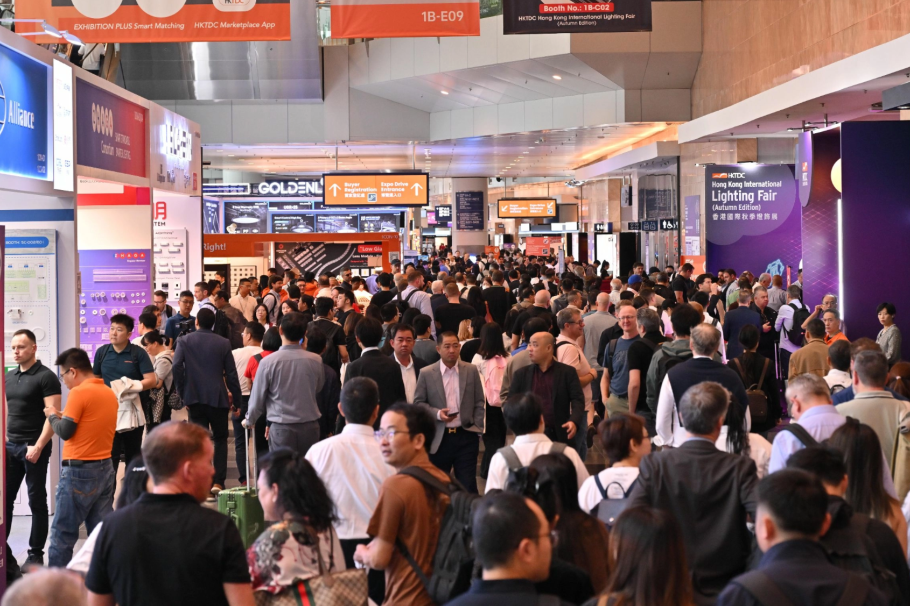

The Hong Kong International Lighting Fair (Autumn Edition) and the 10th Hong Kong International Outdoor and Tech Light Expo commenced on Monday, drawing approximately 3,000 businesses from around the globe. Organized by the Hong Kong Trade Development Council (HKTDC), the event underscores innovation and smart design in the lighting industry. A highlight of the fair is the ‘Connected Lighting Pavilion,’ which features award-winning designs and products from renowned brands in Finland, Germany, the Netherlands, Japan, and other countries. These exhibits demonstrate cutting-edge lighting solutions that have been implemented in major global projects. The expo, running from Tuesday to Friday, will display a diverse array of outdoor, commercial, and industrial lighting products and technologies, all aimed at advancing smart city initiatives. This gathering not only serves as a platform for industry leaders to showcase their latest innovations but also fosters international collaboration in the lighting sector.

分类: business

-

Amazon confirms 14,000 job losses in corporate division

Amazon has unveiled plans to significantly reduce its global corporate workforce, cutting approximately 14,000 jobs as part of a strategic shift to streamline operations and capitalize on the transformative potential of artificial intelligence (AI). The announcement, made on Tuesday, underscores the tech giant’s commitment to reallocating resources toward its most promising initiatives and customer-centric innovations. Beth Galetti, Amazon’s Senior Vice President, emphasized in a company-wide memo that the restructuring would position Amazon ‘even stronger’ by focusing on ‘what matters most to our customers’ current and future needs.’ Galetti acknowledged the move might raise questions, particularly given Amazon’s robust performance, but she highlighted AI as ‘the most transformative technology since the Internet,’ enabling unprecedented innovation. The company has pledged to support affected employees by assisting them in finding new roles within Amazon or providing transition support, including severance packages. This decision follows Amazon’s aggressive hiring during the COVID-19 pandemic, which saw a surge in demand for online services. CEO Andy Jassy has since prioritized cost-cutting measures, investing heavily in AI tools to enhance efficiency. In June, Jassy predicted that AI advancements would lead to job cuts as machines increasingly handle routine tasks, necessitating a shift in workforce roles. Amazon, which employs over 1.5 million people globally, including 350,000 corporate staff, remains a dominant force in the tech industry as it navigates this pivotal transition.

-

Russian oil company Lukoil to sell international assets in response to Trump sanctions

In a significant move driven by escalating geopolitical tensions, Russian oil giant Lukoil has announced the sale of its international assets. This decision comes in response to stringent sanctions imposed by the U.S. government, aimed at compelling Russia to agree to a ceasefire in its ongoing conflict with Ukraine. The sanctions, announced by President Donald Trump on October 22, target Lukoil and Rosneft, Russia’s two largest oil companies, which collectively account for approximately half of the nation’s oil exports. Oil and gas revenues are a critical pillar of the Russian economy, making these sanctions particularly impactful.

-

China, ASEAN sign Free Trade Area 3.0 Upgrade Protocol

In a significant move to bolster economic cooperation, China and the Association of Southeast Asian Nations (ASEAN) have officially signed the Free Trade Area 3.0 Upgrade Protocol. The signing ceremony took place in Kuala Lumpur on Tuesday, marking a new chapter in the long-standing partnership between the two regions. This upgraded protocol aims to further reduce trade barriers, enhance market access, and foster deeper economic integration. The agreement is expected to stimulate trade and investment flows, benefiting businesses and consumers across both China and ASEAN member states. The signing of this protocol underscores the commitment of both parties to maintaining open and mutually beneficial trade relations, especially in an era of global economic uncertainty. This development is seen as a strategic step towards strengthening regional economic resilience and promoting sustainable growth.

-

Trump is signing rare earths deals ahead of talks with China’s Xi- will they help?

During his recent Asia tour, US President Donald Trump signed a series of agreements with Japan, Malaysia, Thailand, Vietnam, and Cambodia to secure access to rare earth minerals, a sector long dominated by China. These deals, varying in scope and detail, aim to diversify the US supply chain for these critical materials, essential for advanced manufacturing in industries ranging from electric vehicles to smartphones. While the tangible impact of these agreements remains uncertain, they represent a strategic move to reduce reliance on China ahead of Trump’s high-stakes meeting with Chinese President Xi Jinping.

-

Ford’s enormous F-150 becomes unlikely part of Japan’s efforts to woo Trump

In a symbolic move to strengthen economic ties with the United States, Japanese Prime Minister Sanae Takaichi showcased an American Ford F-150 truck during her meeting with U.S. President Donald Trump at the Akasaka Palace in Tokyo. The gesture was aimed at fostering goodwill, as Trump has long criticized Japan’s stringent vehicle safety standards and the scarcity of American cars in the country. The Ford F-150, a favorite of Trump, was prominently displayed as part of Takaichi’s efforts to align with U.S. trade interests. However, the practicality of large American vehicles in Japan remains questionable due to the country’s narrow roads, limited parking, and consumer preferences for compact or European models. Despite Trump’s enthusiasm for the idea, Japanese consumers and experts highlight challenges such as left-hand steering, lower fuel efficiency, and insufficient maintenance networks as barriers to the success of American car brands in Japan. This diplomatic maneuver comes amid ongoing trade negotiations, where Trump has pushed for increased purchases of American goods and investments in U.S. infrastructure. While Japan has committed to significant investments, it seeks to prioritize its own vendors and contractors in these deals.

-

Wall Street makes modest gains ahead of Fed rate announcement, Trump-Xi meeting

Wall Street showed signs of modest gains early Tuesday as investors awaited a series of corporate earnings reports and a highly anticipated meeting between President Donald Trump and China’s top leader later this week. Futures for the S&P 500 edged up by less than 0.1%, while the Dow Jones Industrial Average futures rose 0.3%. Nasdaq futures also saw a slight increase of 0.1% before the market opened.

-

1st US heavy rare earths separation facility planned in Louisiana

Aclara Resources Inc., a Canadian mining company based in Vancouver, has announced a significant $277 million investment to establish the first heavy rare earth separation facility in the United States. Located at the Port of Vinton in Louisiana’s Calcasieu Parish, the facility aims to refine rare earth metals essential for various industries, including consumer electronics, technology, and defense. The company plans to mine rare earth deposits in South America and process them at the Louisiana site using hydrochloric acid to extract and separate the metals from clay mineral deposits. The facility is expected to create 140 direct jobs and will occupy an LED Certified Site, prequalified for industrial development through rigorous environmental and engineering reviews. Louisiana’s robust chemical industry, skilled workforce, and strategic access to key reagents were pivotal factors in Aclara’s decision. The state has also offered a $3 million infrastructure grant and a job-creation grant covering up to 22% of wages, along with eligibility for the Industrial Tax Exemption Program, which provides significant property tax relief. Construction is slated to begin in 2026, with completion expected by 2027. Aclara emphasizes its sustainable mining practices, which include recirculating 95% of water used and replanting trees post-mining. The company plans to commence mining operations in Chile in 2027 and Brazil in 2028.

-

Crescent Enterprises and Majarra partnership expands knowledge access for thousands of Arab youth

Crescent Enterprises, a prominent multinational business based in the UAE, has joined forces with Majarra, the leading Arabic digital knowledge platform, to expand their Renaissance Partners Program. This initiative aims to break down barriers to knowledge by providing free subscriptions to Majarra’s premium content for over 10,000 young individuals across the Arab world. The program offers access to renowned publications such as Harvard Business Review, MIT Technology Review, and Popular Science, all available in Arabic. A notable achievement of the partnership is the increased participation of women, now representing over one-third of beneficiaries, up from one-fifth a year ago, thanks to targeted campaigns promoting gender equity. Ola Al Haj Hussin, Corporate Citizenship Manager at Crescent Enterprises, emphasized the transformative power of knowledge in fostering innovation and progress. Dia Haykal, Director of Brand and Partnerships at Majarra, highlighted the platform’s mission to make global knowledge accessible in Arabic and inspire the next generation of knowledge creators. Mo’men Abou Yousef, a beneficiary from Palestine, shared how the program enriched his educational journey with practical insights delivered through diverse formats. Majarra’s extensive library of over 70,000 content pieces, including articles, videos, and podcasts, solidifies its position as the premier Arabic content provider. The Renaissance Partners Program continues to accept applications, offering free access to resources that support learning, professional growth, and community empowerment.

-

Indian rupee falls most in a month as traders cut long bets, importers buy dollars

The Indian rupee experienced its most significant single-day drop in a month on Monday, October 27, 2025, as it fell below the 88 mark against the U.S. dollar. The currency closed at 88.2450, marking a 0.4% decline—its steepest since September 23. This downturn was driven by traders unwinding long positions on the rupee and persistent dollar demand from importers, particularly local oil companies. While the Reserve Bank of India (RBI) had previously intervened to keep the rupee above the 88 threshold, its defensive measures appeared to ease on Monday, contributing to the currency’s slide. Traders noted that state-run banks were active in offering dollars, though the activity was not concentrated at any specific level. The rupee’s decline was further exacerbated by short covering on the USD/INR pair after it breached the 88 mark. Despite this setback, the rupee has outperformed most regional currencies in October, thanks to earlier heavy interventions by the RBI that prevented it from nearing its all-time low. Analysts at BofA Global Research maintain a neutral outlook on the rupee, citing trade uncertainty and export challenges despite its attractive valuation and a weaker U.S. dollar trend in Q4 2025. The rupee’s 40-currency real effective exchange rate (REER), a measure of its competitiveness, fell to 97.65 in September, its lowest in seven years, indicating undervaluation. Meanwhile, the dollar index remained steady at 98.8, and the offshore Chinese yuan reached a one-month high amid progress in U.S.-China trade talks. On the India-U.S. front, a senior Indian official recently hinted that a bilateral trade deal with Washington is ‘very near.’