Tanzania has decided to cancel its upcoming independence celebrations, redirecting funds to rebuild infrastructure damaged during recent election-related unrest. Prime Minister Mwigulu Nchemba announced the decision amidst growing calls from opposition groups for mass demonstrations on December 9, the country’s independence day, to protest alleged killings following last month’s disputed election. The opposition claims hundreds died in a government crackdown, though no official death toll has been released. A commission of inquiry has been established to investigate the incidents. President Samia Suluhu Hassan secured a landslide victory with 98% of the vote, a result the opposition has labeled a ‘mockery of democracy.’ Key opposition leaders, Tundu Lissu and Luhaga Mpina, were barred from contesting the election—Lissu remains detained on treason charges, while Mpina’s candidacy was rejected on technical grounds. Election observers have raised concerns about vote manipulation and the election’s failure to meet democratic standards. The government imposed a five-day internet blackout starting on election day, October 29, and warned against sharing protest-related images. Despite this, graphic footage of the unrest has circulated widely online, with international media verifying its authenticity. The government has dismissed these portrayals as attempts to tarnish Tanzania’s image, maintaining that the country remains safe. Government spokesman Gerson Msigwa stated that the inquiry commission would clarify the events, though concerns about its independence persist. Over 240 individuals were charged with treason following the protests, but President Samia later urged prosecutors to show leniency, leading to some releases. In his announcement, Nchemba appealed for unity and dialogue, urging Tanzanians to avoid violence. President Samia, Tanzania’s first female president, initially gained praise for easing political repression, but critics argue that the political environment has since tightened.

标签: Africa

非洲

-

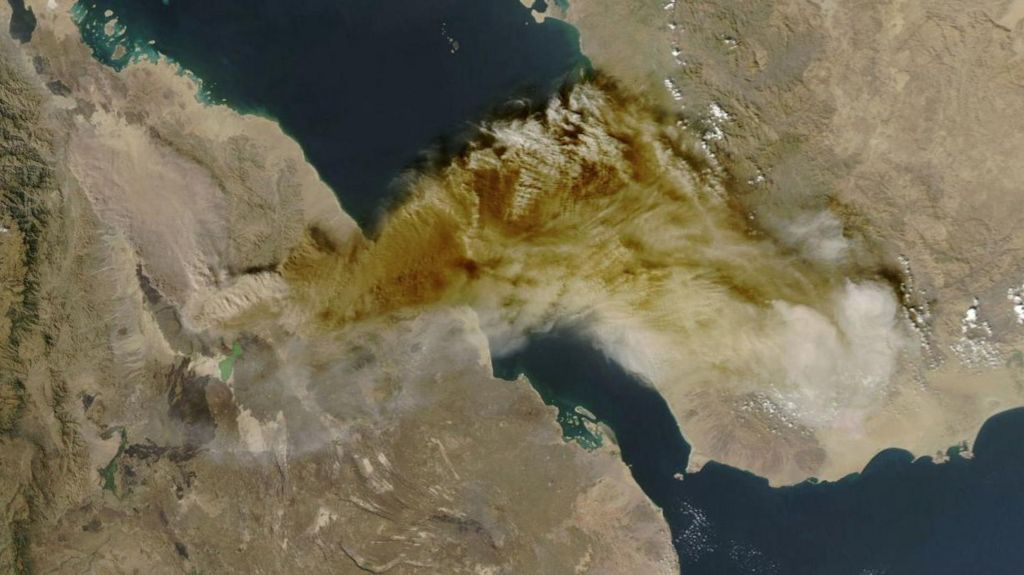

Ethiopian volcano eruption sends ash to Delhi, hitting flight operations

The Hayli Gubbi volcano in Ethiopia, dormant for thousands of years, erupted on Sunday morning, sending a massive ash column thousands of feet into the atmosphere. The volcanic ash plume has traveled across the Red Sea, affecting Oman, Yemen, and reaching as far as Delhi, India. This unprecedented event has caused significant disruptions to air travel, with numerous international and domestic flights being canceled, delayed, or rerouted. India’s aviation regulator has issued advisories urging airlines to avoid affected areas. The ash cloud, which reached altitudes between 8.5km and 15km, poses a risk to aircraft engines, airfields, and visibility, though experts believe it is unlikely to impact Delhi’s already poor air quality. The India Meteorological Department (IMD) predicts that the ash cloud will continue moving towards China, with Delhi’s skies expected to clear by Tuesday evening. The eruption has drawn comparisons to the 2010 Eyjafjallajökull eruption in Iceland, which caused widespread air travel chaos across Europe. Authorities are closely monitoring the situation, with airlines and airports advising passengers to check flight statuses before traveling.

-

UAE poised to power GCC’s 2026 boom with 5.6% growth

The Gulf Cooperation Council (GCC) is set for a significant economic upswing in 2026, with the UAE and Saudi Arabia leading the charge. According to the ICAEW’s Q4 2025 Economic Insight report, the GCC’s GDP is projected to grow by 4.4%, driven by surging non-oil activities in the UAE and Saudi Arabia. The UAE, in particular, is expected to achieve a 5.6% GDP growth, cementing its status as one of the Gulf’s fastest-growing economies. Key sectors such as tourism, trade, logistics, real estate, and financial services are anticipated to fuel this expansion, supported by strong population growth, a vibrant labor market, and sustained domestic demand. The UAE’s strategic initiatives, including the “We the UAE 2031” plan, are further bolstering long-term economic momentum. Dubai has already showcased the resilience of the UAE’s non-oil economy, with a 4.4% growth in the first half of 2025, driven by trade, transport, hospitality, and financial services. Abu Dhabi’s non-oil foreign trade surged by 34.7% to AED 195.4 billion in the same period, highlighting the emirate’s growing role as a global trade and logistics hub. The Central Bank of the UAE (CBUAE) forecasts real GDP growth of 4.9% in 2025 and 5.3% in 2026, with non-hydrocarbon GDP expected to grow by 4.5% and 4.8%, respectively. Hydrocarbon output is projected to rise by 5.8% and 6.5%, while inflation remains contained at 1.5–1.9%. Across the GCC, non-energy activity is expected to expand by 4.1% in 2026, supported by strong labor markets, improved credit conditions, and increased investment in technology and AI infrastructure. Saudi Arabia is also poised for robust growth, with a projected GDP increase of 4.3% in 2026, driven by non-oil sectors and policy reforms. Despite fiscal challenges, Riyadh remains committed to Vision 2030, prioritizing long-term diversification. Analysts emphasize that the UAE’s strategic location, economic reforms, and innovation-led investments are not only accelerating its own growth but also uplifting the entire GCC region, marking a pivotal shift towards sustainable and diversified economic expansion.

-

HSBC’s tokenised deposit move set to transform banking for UAE clients by 2026

HSBC Holdings is set to introduce tokenized deposits to its corporate clients in the UAE and the US by the first half of 2026, marking a transformative step in the bank’s adoption of blockchain-based financial technologies. This initiative follows the successful rollout of similar services in Hong Kong, Singapore, the UK, and Luxembourg, underscoring HSBC’s commitment to positioning the UAE as a hub for next-generation financial infrastructure. Tokenized deposits convert traditional fiat balances into secure digital tokens using HSBC’s proprietary Distributed Ledger Technology (DLT). Unlike volatile cryptocurrencies, these tokens represent direct claims on funds held in regulated bank accounts and can accrue interest like standard deposits. Financial experts highlight the system’s ability to enable real-time, 24/7 transactions, eliminating delays tied to cut-off times, batch cycles, or multi-day international processes. For UAE-based companies, this translates to faster cross-border payments and improved liquidity management. Manish Kohli, HSBC’s global head of payment solutions, emphasized that tokenized deposits are becoming a cornerstone of corporate liquidity management. By automating key processes and removing time-based constraints, the system allows treasurers to keep funds active around the clock—a critical capability for firms operating across regions or handling high-volume transactions. The UAE’s fast-growing sectors, including logistics, energy, aviation, and digital commerce, stand to benefit significantly from smoother operations and reduced financing costs. Additionally, the technology offers enhanced risk management, providing companies with real-time visibility into their cash positions and enabling automated, error-free payments. HSBC is also integrating artificial intelligence to assist with liquidity forecasting, automate complex payment chains, and balance accounts without manual intervention. These features are expected to appeal to UAE corporations with regional or global footprints. Unlike stablecoins, which are issued by private entities and often circulate on public blockchains, HSBC’s tokenized deposits operate entirely within a regulated framework, ensuring compliance, transparency, and risk management. While the bank is in discussions with stablecoin issuers to provide settlement and reserve-management services, it has clarified that any decision to launch its own stablecoin would depend on clearer regulatory guidance. HSBC’s move aligns with the UAE’s growing prominence as a global wealth hub and financial innovation center. The bank recently opened its first Middle East wealth center in Dubai, catering to affluent and high-net-worth clients. With projections indicating nearly 10,000 new millionaires relocating to the UAE in 2025, the country’s supportive regulatory environment for digital finance makes it an ideal launchpad for HSBC’s blockchain-enabled banking services. As tokenized deposits go live in 2026, UAE businesses are poised to be among the earliest beneficiaries of a shift toward faster, more efficient, and highly automated financial infrastructure.

-

Barca’s Lopez showing summer suitors Chelsea what they missed

Barcelona’s financial challenges have forced the club to rely heavily on its famed La Masia academy, and one of its brightest graduates, Fermin Lopez, is making waves. While Lamine Yamal, often compared to Lionel Messi, garners much of the attention, Lopez has emerged as a crucial figure in Hansi Flick’s squad. The 22-year-old midfielder, who joined Barcelona at 13, has become a regular starter and a key goal threat. Chelsea, who had a €40 million bid rejected last summer, are well aware of his talent. As Barcelona prepares to face Chelsea at Stamford Bridge in the Champions League, Lopez’s performance could reignite interest from the London club. Lopez’s journey to prominence began under Xavi Hernandez, who integrated him into the first team during the 2023 pre-season. His standout moment came in a friendly against Real Madrid, where he scored and secured his place in the squad. Last season, Lopez made 46 appearances, contributing to Barcelona’s domestic treble, often as a substitute. This season, he has taken a significant leap forward, outperforming Dani Olmo in the number 10 role and becoming Flick’s preferred option in midfield, especially with Gavi sidelined due to injury. Lopez’s dynamic playing style, characterized by relentless energy, pressing, and goal-scoring ability, has earned him praise from Flick, who described him as “complete” and “dynamic.” With seven goals and four assists in 12 appearances this season, including a hat-trick against Olympiakos, Lopez has proven his worth. His recent performance in Barcelona’s 4-0 victory over Athletic Bilbao, where he scored on his 100th appearance, further solidified his importance. As Barcelona faces Chelsea, Lopez’s ability to shine on the big stage could not only boost his team’s chances but also increase his market value, potentially tempting Chelsea to make another move for the rising star.

-

UAE slams Sudan’s General Burhan’s repeated ceasefire refusal

The United Arab Emirates (UAE) has strongly criticized Sudan’s General Abdel Fattah al-Burhan for his persistent refusal to agree to a ceasefire, labeling his actions as ‘consistently obstructive behavior.’ Reem bint Ebrahim Al Hashimy, UAE’s Minister of State for International Cooperation, emphasized that the Sudanese people are paying the highest price for this ongoing conflict. ‘The Sudanese people bear the heaviest cost as General Burhan refuses peace overtures once more,’ she stated. The UAE has called for an ‘unconditional and immediate ceasefire’ to halt the civil war, expressing grave concern over the escalating military actions and the obstruction of humanitarian aid by both warring factions. Al Hashimy warned that these actions are pushing Sudan closer to collapse. The UAE also commended US President Donald Trump’s initiatives to prevent Sudan from descending further into extremism and humanitarian disaster. The minister urged for a unified regional and international effort to establish a credible path toward a united Sudan, emphasizing the need to end atrocities against civilians. The United Nations has described the situation in Sudan as ‘one of the worst humanitarian tragedies in modern history,’ with aid access being weaponized and civilians deliberately starved.

-

Jansen takes six as South Africa close in on historic Test series win

South Africa’s towering pace spearhead Marco Jansen delivered a stellar performance, claiming six wickets to edge his team closer to a historic Test series victory in India. On day three of the second Test in Guwahati, Jansen’s figures of 6-48 dismantled India’s first innings, restricting them to 201 in response to South Africa’s commanding 489. Despite a 288-run deficit, the tourists opted not to enforce the follow-on, choosing instead to bat again and extend their lead. At stumps, South Africa were 26-0, with Ryan Rickelton (13) and Aiden Markram (12) at the crease, pushing their overall lead to 314. Jansen’s brilliance, coupled with disciplined bowling from the spinners, left India reeling. Yashasvi Jaiswal’s 58 and a resilient 72-run partnership between Washington Sundar (48) and Kuldeep Yadav (19) offered brief resistance, but India’s batting crumbled under pressure. South Africa, having won the first Test in Kolkata, are now on the verge of their first Test series win in India since 2000. The hosts, meanwhile, face mounting scrutiny after their fourth defeat in six home Tests.

-

New shared bank account lets UAE families track spending, save together

Wio Bank has unveiled Wio Family, the UAE’s first fully shared banking platform, designed to help households manage finances collectively. Launched ahead of the UAE’s Year of the Family, the service allows two primary account holders, termed ‘Family Leads,’ to open a shared account and invite family members, including children, teenagers, and relatives, to join. The platform offers tools for shared spending, saving, and budgeting, providing families with greater financial clarity and control. Virtual cards and permission settings enable Family Leads to set spending limits, track transactions, and manage access for each member through a single dashboard. For children aged 8 to 17, dedicated ‘Pockets’ with spending caps and saving features are available to teach money management. Families maintaining a minimum balance of Dh35,000 can access all benefits free of charge; otherwise, a monthly fee of Dh49 applies. Jayesh Patel, CEO of Wio Bank, emphasized the platform’s focus on treating money as a shared resource, offering families ‘clarity, flexibility, and control.’ CMO Amina Taher highlighted the platform’s role in helping families save for joint goals such as homes, education, or weddings, bringing everyone together for shared financial success.

-

Hub71 and UAE–India Cepa Council forge strategic partnership

In a landmark move to bolster innovation and economic collaboration, Hub71, Abu Dhabi’s premier global tech ecosystem, has entered into a strategic partnership with the UAE–India Cepa Council. This alliance, forged under the UAE–India Comprehensive Economic Partnership Agreement (Cepa), aims to accelerate trade, investment, and innovation between the two nations. The agreement was formalized during the Abu Dhabi Investment Forum (ADIF) in Mumbai, marking a significant step in operationalizing the innovation agenda of the Cepa.

The partnership will facilitate a seamless pathway for high-potential Indian start-ups to enter, validate, and scale their operations in Abu Dhabi. As part of this initiative, Hub71 will support the UAE–India Cepa Council’s flagship Start-Up Series by offering structured market-entry assistance. Five winning start-ups from the Series, which culminates in New Delhi on November 25, 2025, will join Hub71’s Immersion Programme in 2026. This newly launched programme is designed to expedite market entry through a combination of virtual onboarding and in-person sessions in Abu Dhabi, complemented by curated knowledge sessions, mentorship, and access to Abu Dhabi’s tech ecosystem.

Among the five start-ups, one will be selected to join Hub71’s Access programme, which provides tailored soft-landing support, enabling founders to explore market opportunities, engage with key stakeholders, and identify sustainable growth pathways across the region. The partnership underscores the shared ambition of the UAE and India to build a dynamic, interconnected start-up corridor that drives investment, technology exchange, and economic growth.

Abdulnasser Alshaali, UAE Ambassador to India, emphasized the transformative potential of the Cepa, stating, ‘Innovation lies at the heart of this partnership, and the Start-Up Series showcases the depth of talent emerging from India. This collaboration with Hub71 strengthens our commitment to providing world-class platforms for founders to scale globally.’

Ahmad Ali Alwan, CEO of Hub71, highlighted the initiative’s role in bridging innovation hubs and high-growth markets, while Ahmed Aljneibi, Director of the UAE-India Cepa Council, emphasized the tangible benefits for Indian founders and the broader economic impact of this collaboration.

Since its inception in June 2025, the UAE-India Start-Up Series has attracted over 10,000 applications, reflecting strong demand for UAE expansion. The alignment of applicants with Hub71’s priority sectors—FinTech, HealthTech, AgriTech, mobility, and advanced technologies—demonstrates the strategic synergy between India’s innovation strengths and Abu Dhabi’s sector-focused agenda. This partnership not only streamlines market entry but also unlocks new investment flows, fostering a robust innovation corridor between the two economies.

The agreement also establishes a framework for cross-referring high-impact start-ups, enabling soft landings in both Abu Dhabi and India. Referred founders will receive comprehensive support, including company setup, regulatory facilitation, mentorship, and access to investors and partners. Eligible start-ups may also benefit from grants, incentive programmes, and scaling opportunities, further enhancing the UAE-India innovation ecosystem.

This collaboration is part of Hub71’s broader mission to position Abu Dhabi as a global launchpad for start-ups, fostering cross-border initiatives that translate bilateral cooperation into measurable technological and economic outcomes.

-

Gueye sent off for striking team-mate – but Moyes ‘quite likes’ it

In a dramatic Premier League encounter, 10-man Everton secured a surprising 1-0 victory against Manchester United at Old Trafford, despite Idrissa Gueye’s controversial red card for striking teammate Michael Keane. The incident occurred in the 13th minute when Gueye and Keane engaged in a heated argument, culminating in Gueye slapping Keane in the face. Referee Tony Harrington immediately showed Gueye a straight red card for violent conduct, a decision upheld by VAR. Everton manager David Moyes expressed a peculiar approval of the altercation, stating he ‘quite likes’ when his players show such intensity, attributing it to the team’s resilience. Gueye later apologized on social media, taking full responsibility for his actions and vowing to ensure such behavior never recurs. Despite being a man down, Everton clinched the win with Kiernan Dewsbury-Hall’s 29th-minute goal, marking Moyes’ first victory at Old Trafford as a visiting manager in 18 attempts. The match also reignited discussions about teammate conflicts in football, with pundits and fans debating the severity of Gueye’s punishment. This rare incident joins the likes of Lee Bowyer and Kieron Dyer’s infamous 2005 clash, highlighting the emotional volatility in high-stakes matches.