Dubai’s property sector represents one of the world’s most dynamic and rapidly evolving markets, continuously transformed by visionary policies, technological innovation, and strategic national planning. Manuel Gallo, Associate Director at AQUA Properties, has built his career on interpreting these changes since his first encounter with the emirate in 2005.

Gallo’s entrepreneurial journey began when he witnessed Dubai’s extraordinary transformation, recognizing that iconic projects like the Burj Khalifa symbolized much more than architectural achievements—they represented the nation’s future trajectory. This perspective has shaped his business philosophy: anticipating trends, adapting swiftly, and aligning with the UAE’s long-term vision.

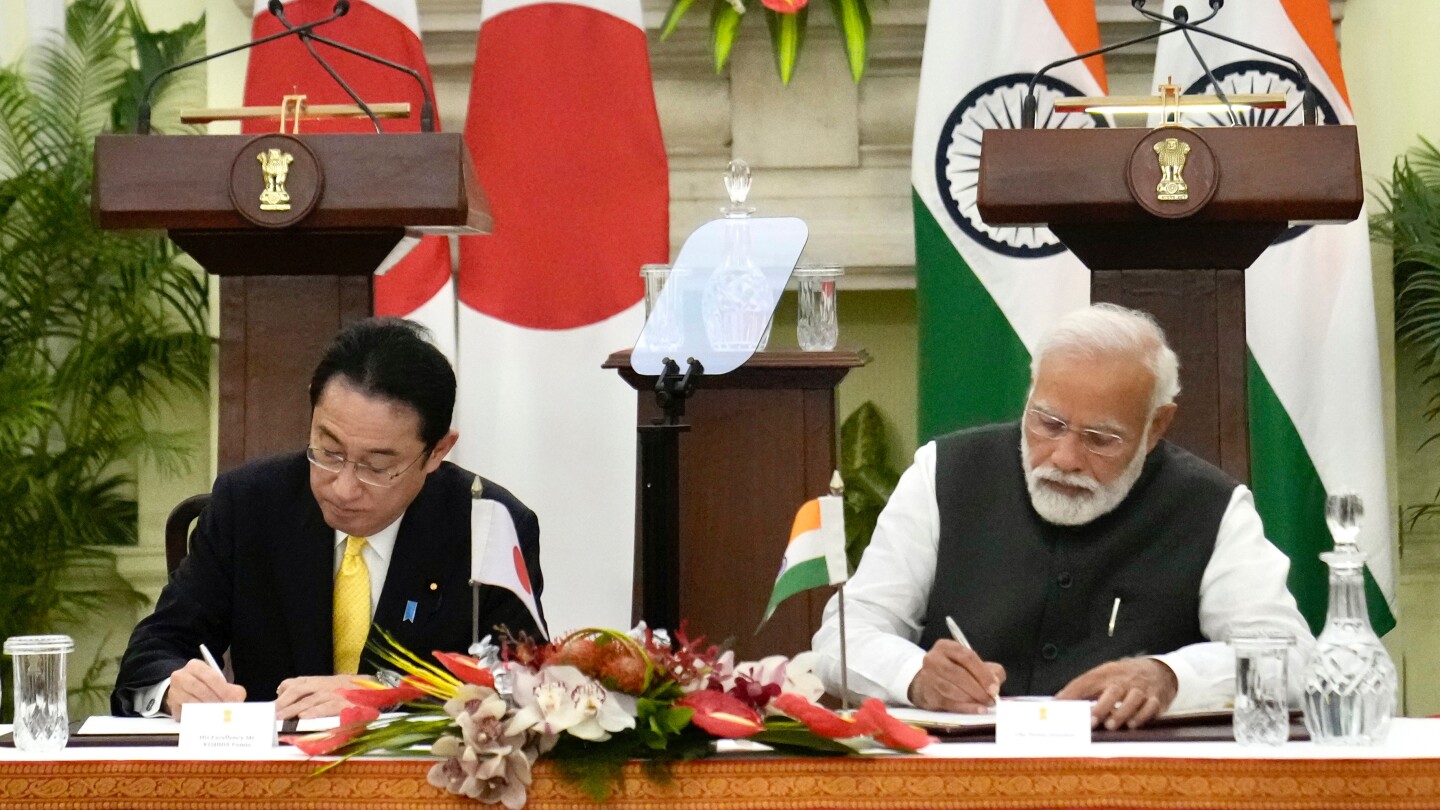

The UAE’s business environment, characterized by transformative policies such as freehold ownership and 100% foreign business ownership, has fundamentally influenced Gallo’s approach. He describes these measures not merely as regulatory changes but as intentional signals of the nation’s direction. This has cultivated an operational style that is decisive, globally connected, and deeply attuned to the underlying narratives behind governmental decisions.

Addressing market challenges, Gallo emphasizes the necessity of synchronization with Dubai’s rapid evolution. He references Marshall McLuhan’s ‘extension effect’ concept, explaining how his business grows in harmony with the city rather than resisting change. Early recognition of transformations, he notes, often proves more valuable than perfect execution in response.

Sustainability and social responsibility form integral components of Gallo’s business model, reflecting Dubai’s regulatory framework where environmental consciousness is embedded in infrastructure and national strategy. His company prioritizes transparency, responsible growth, and solutions that actively contribute to the UAE’s ecological and social objectives.

Technology represents another critical dimension of Gallo’s strategy. He observes that technological integration has moved beyond accessory status to fundamentally reshape urban functionality. Emerging trends include AI-driven irrigation systems, climate-adaptive vegetation, smart shading solutions, and bio-engineered green corridors—all designed to create healthier, human-centric communities.

Gallo also identifies a significant shift toward ‘Made in Dubai’ and ‘Made in the UAE’ initiatives, indicating reduced import reliance and growing capabilities in manufacturing, sustainable materials, and advanced production. These developments are positioning Emirati products to compete with, and potentially surpass, traditional global standards.

Networking and partnerships have played architectural roles in Gallo’s journey, connecting diverse people, capital, and ideas within the UAE’s multicultural ecosystem. For emerging entrepreneurs, he offers decisive advice: build with intentionality, interpret the signals embedded in Dubai’s development, and align business strategies with the nation’s visionary trajectory for sustainable success.