In a significant move for the biotechnology sector, UAE-based CE Ventures has announced its participation in a $55 million Series A funding round for Colorado-based Think Bioscience. The investment round, notably oversubscribed, was spearheaded by Regeneron Ventures, Innovation Endeavors, and Janus Henderson Investors.

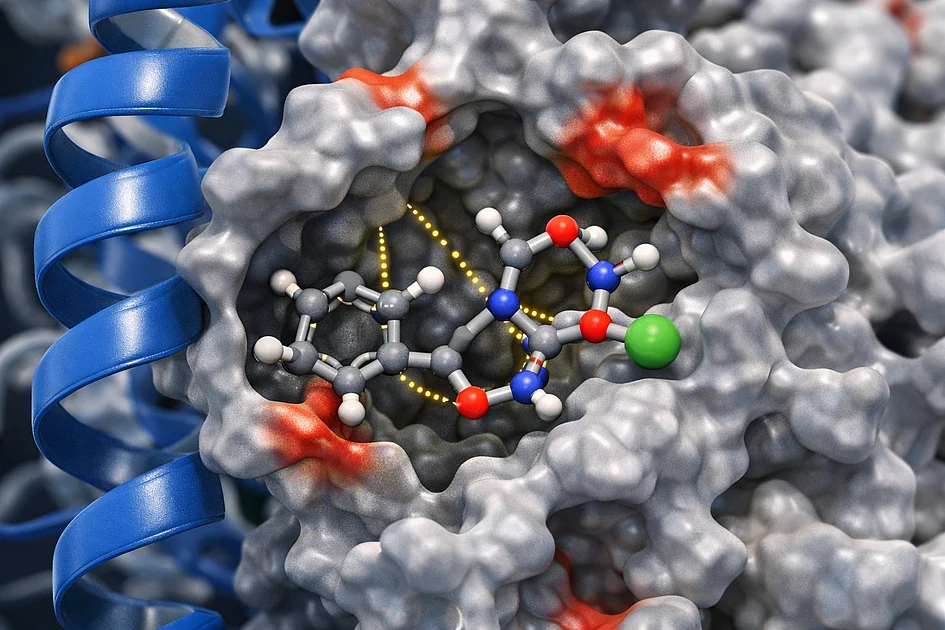

Think Bioscience is pioneering a revolutionary synthetic biology platform designed to tackle one of medicine’s most persistent challenges: so-called ‘undruggable’ protein targets. The company’s innovative approach identifies previously hidden binding sites on proteins, enabling the development of small-molecule therapeutics for conditions that have long eluded conventional treatment modalities.

The company’s lead program addresses Noonan syndrome, a genetic disorder affecting approximately 1 in 2,500 births worldwide. This condition presents serious cardiac and lymphatic complications, cognitive impairment, chronic pain, and short stature. Currently, no approved therapies target the underlying biology of this syndrome, representing a significant unmet medical need.

Tushar Singhvi, Deputy CEO and Head of Investments at Crescent Enterprises, expressed strong conviction in the investment: ‘Think Bioscience is building a differentiated platform at the frontier of synthetic biology and drug discovery, with the potential to expand what is pharmaceutically possible for patients with high unmet need.’

Dr. Jerome Fox, co-founder and CEO of Think Bioscience, emphasized the transformative potential of their work: ‘Our lead programme has the potential to give a broad set of Noonan patients a normal life. We are grateful to our investors for supporting our vision to develop life-changing therapies.’

The funding will accelerate the advancement of Think Bio’s internal pipeline of first-in-class small molecule programs while further developing their proprietary discovery platform. This investment aligns with CE-Ventures’ strategy of backing R&D-intensive, asset-light business models in deep-tech and biotech sectors with global competitive potential.

Dr. Damir Illich, Manager of Life Sciences at CE-Ventures, who will join Think Bio’s board as an observer, noted: ‘Think Bioscience is addressing one of drug discovery’s most critical bottlenecks by enabling small-molecule drugs against historically undruggable targets.’

The announcement comes as CE-Ventures prepares to host ‘The Microbiome Revolution’ on February 5, 2026, in Dubai, bringing together global experts to explore the growing human microbiome market, projected to exceed $4 billion by 2030.