The UAE has unveiled the BRIDGE Alliance, a groundbreaking initiative aimed at fostering inclusivity, diversity, and innovation in the global media, content, and entertainment sectors. Headquartered in Abu Dhabi, the Alliance brings together an influential board of former heads of state, global leaders, policymakers, and CEOs from diverse industries, united by a shared vision to create a collaborative and future-ready content ecosystem. The announcement was made during the inaugural meeting of the BRIDGE Alliance Board of Directors, presided over by Abdulla bin Mohammed bin Butti Al Hamed, marking the formal establishment of the organization’s leadership and strategic direction. Rooted in the UAE’s legacy as a cultural and economic crossroads, the BRIDGE Alliance is designed to build a connected, resilient, and ethical global media framework. The Board of Directors, comprising distinguished figures such as Princess Lamia bint Majed Al Saud, Macky Sall, and Jessica Sibley, will provide strategic oversight and policy direction. The Alliance’s first major initiative, the BRIDGE Summit 2025, will take place from December 8 to 10 at the Abu Dhabi National Exhibition Centre (ADNEC). The event will feature 400 global speakers, 300 exhibitors, and over 60,000 participants across seven content tracks, aiming to turn dialogue into action and shape new partnerships, policies, and investments. Maryam bin Fahad, Managing Director of BRIDGE Alliance, emphasized that every aspect of the Summit has been strategically designed to advance collaboration, innovation, and sustainable growth. From its UAE headquarters, the BRIDGE Alliance aspires to become a global hub for driving innovation, informing policy, and accelerating collaboration across media, content, and entertainment sectors, setting the agenda for responsible media growth worldwide.

分类: business

-

Over 10,000 US flights delayed on Sunday: Worst day for aviation since shutdown began

The ongoing federal shutdown, now in its 40th day, has plunged the US aviation industry into chaos, with over 10,000 flights delayed and more than 2,700 cancellations on Sunday alone. This marks the worst day for air travel since the shutdown began on October 1. Transportation Secretary Sean Duffy has warned that air travel could dwindle to a ‘trickle’ in the lead-up to Thanksgiving, one of the busiest travel periods in the US, due to severe shortages of air traffic controllers. Many of these essential workers, along with other federal employees, have not been paid for weeks, leading to a surge in retirements and staffing crises. The Federal Aviation Administration (FAA) has mandated flight reductions at 40 major airports, with cuts escalating to 10% by November 14. Airlines like United have already announced significant cancellations, while industry officials express growing concerns about the system’s ability to function under worsening conditions. The economic impact is also alarming, with estimates suggesting daily losses of $285 million to $580 million. The shutdown has forced 13,000 air traffic controllers and 50,000 security screeners to work without pay, raising safety concerns as fatigue-related errors increase.

-

Tariff-troubled US fears not-so-happy holidays

As the holiday season approaches, Americans are grappling with the economic fallout of escalating tariffs, which are driving up the cost of essential goods. The ongoing trade disputes between the United States and key partners, including China, have created a ripple effect that is now hitting consumers hard. With Thanksgiving and Christmas on the horizon, many are calling for swift resolution to these trade tensions to alleviate the financial strain. Kegan Bordeaux, a concessions worker in New York City, voiced concerns over the rising prices, stating, ‘New York is already expensive, but even basic items like rice are becoming unaffordable.’ According to Gary C. Hufbauer, a senior fellow at the Peterson Institute for International Economics, US businesses have absorbed 75% of the tariff costs so far, but consumers are bearing the remaining 25%. However, this balance is unsustainable, and by 2026, most of the burden is expected to shift to consumers. A Goldman Sachs report corroborates this, estimating that US consumers are already paying 55% of the tariff costs, a figure projected to rise to 70% by the end of 2026. The tariff landscape remains volatile, with rates varying widely across countries. For instance, India and Brazil face a 50% tariff, while the European Union is subject to a 15% levy. In a recent meeting between President Xi Jinping and US President Donald Trump, agreements were made to reduce tariffs on Chinese imports from 57% to 47%, offering a glimmer of hope for resolution. Nevertheless, the immediate impact on American households remains a pressing concern as the holiday season looms.

-

World shares advance as tech shares rebound and the Senate takes steps to end the shutdown

Global stock markets experienced a significant uptick on Monday, driven by optimism surrounding potential progress in ending the U.S. federal government shutdown and a resurgence in technology shares. The U.S. Senate’s procedural vote on Sunday to advance compromise legislation aimed at funding the government fueled hopes for a resolution, although final approval may still face delays due to potential Democratic objections. This development pushed U.S. futures higher, with the S&P 500 futures rising 0.7% and Dow Jones Industrial Average futures gaining 0.1%. European markets also saw robust gains, with Germany’s DAX climbing 1.4%, France’s CAC 40 jumping 0.9%, and Britain’s FTSE 100 rising 0.5%. In Asia, South Korea’s Kospi led the charge with a 3% surge, driven by strong performances from tech giants like SK Hynix and Samsung Electronics. Tokyo’s Nikkei 225 added 1.3%, while Hong Kong’s Hang Seng and China’s Shanghai Composite also posted gains. The rebound in technology stocks, particularly those tied to artificial intelligence, helped calm investor concerns over recent market volatility. Meanwhile, Wall Street remains focused on corporate earnings and the Federal Reserve’s cautious stance on interest rate cuts, with traders awaiting key economic data delayed by the shutdown. Oil prices and the U.S. dollar also saw modest increases early Monday.

-

How the US overtook China as Africa’s biggest foreign investor

The global competition for critical minerals and metals, essential for powering modern technology, has intensified between the United States and China, with Africa emerging as a strategic battleground. The continent, rich in resources like lithium, cobalt, and rare earths, plays a pivotal role in the supply chains for electric vehicles, AI data centers, and advanced weapon systems. China has long dominated this market, leveraging its domestic reserves and extensive investments in African mining operations. However, the US has recently surpassed China as the largest foreign direct investor in Africa, marking a significant shift in the geopolitical landscape. According to the China Africa Research Initiative at Johns Hopkins University, the US invested $7.8 billion in Africa in 2023, compared to China’s $4 billion. This marks the first time since 2012 that the US has reclaimed the lead. The US International Development Finance Corporation (DFC), established in 2019, has been instrumental in this effort, explicitly aiming to counter China’s influence in strategic regions. One beneficiary of this investment is Rwandan mining company Trinity Metals, which secured a $3.9 million grant from the DFC to develop its tin, tantalum, and tungsten mines. The company now exports tungsten to a processing plant in Pennsylvania, reflecting a growing trend of US-focused supply chains. However, economists like Sepo Haimambo of FNB Namibia caution African nations to assert their interests in negotiations with US entities. She advocates for diversified frameworks, such as joint ventures and local equity participation, to ensure long-term economic benefits. Meanwhile, US companies like ReElement Africa are building refineries in Africa to process minerals locally, aiming to capture more value and foster industrial development. Despite these efforts, some experts argue that US trade tariffs on African nations have dampened enthusiasm for American investments, potentially hindering the US from capitalizing on African discontent with Chinese projects. As the competition heats up, other nations like Brazil, India, and Japan are also increasing their presence in Africa, signaling a broader scramble for the continent’s mineral wealth.

-

US air travel could ‘slow to a trickle’ as shutdown bites, says top official

The United States is bracing for significant disruptions in air travel as the federal government shutdown continues to impact critical services. Transportation Secretary Sean Duffy issued a stark warning on Sunday, predicting that air travel could ‘slow to a trickle’ in the coming weeks, particularly as the Thanksgiving holiday approaches. Speaking to Fox News, Duffy emphasized the potential for widespread chaos, with thousands of flights already canceled or delayed. He highlighted the critical role of air traffic controllers, many of whom are expected to stay home due to the shutdown, leading to severe operational challenges. ‘We’re going to see very few air traffic controllers coming to work, which means only a limited number of flights will be able to take off and land,’ Duffy explained. This situation is likely to result in massive disruptions and leave countless Americans frustrated during one of the busiest travel periods of the year. The shutdown has already caused significant strain on various sectors, and the aviation industry is now feeling the brunt of its impact. As families prepare to reunite for Thanksgiving, the prospect of travel chaos looms large, raising concerns about the broader economic and social consequences of the ongoing government impasse.

-

Dubai powers ahead as global startup hub: Over 580 digital firms backed in 2025

Dubai is solidifying its position as a leading global hub for digital innovation, with the Dubai Chamber of Digital Economy supporting the establishment and expansion of 582 digital startups in the first nine months of 2025. This remarkable growth underscores the emirate’s rising influence in technology entrepreneurship and its strategic efforts to attract the next generation of global digital pioneers. Notably, 70% of these startups are international companies, reflecting Dubai’s growing appeal as a gateway to Middle Eastern, African, and Asian markets. Artificial intelligence (AI) leads the charge, accounting for 21% of supported firms, while HealthTech, Software-as-a-Service (SaaS), and FinTech collectively represent another 17%. This momentum aligns with Dubai’s D33 Economic Agenda, which aims to double the emirate’s economy by 2033 and position it among the world’s top three cities for business and innovation. Omar Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy, and Remote Work Applications, emphasized Dubai’s commitment to fostering a dynamic business environment that enables digital companies to scale globally. Nearly half of the supported firms benefited from establishment assistance, accelerator programs, and incubator services, while 32% utilized the chamber’s “Business in Dubai” platform, a one-stop service model connecting startups with investors and regulatory support. Beyond direct assistance, the chamber has invested in knowledge creation and global outreach, releasing four research reports and organizing 15 sector-specific events and 16 international roadshows across 17 cities in 10 countries. These efforts have positioned Dubai as a “launchpad city” for global startups, bridging East and West with its policy support, funding access, and fast-moving regulatory environment. The UAE’s progressive visa reforms and digital infrastructure have further attracted record levels of talent, with digital startups now contributing over 11% of the UAE’s non-oil GDP. As 2025 progresses, Dubai’s innovation engine shows no signs of slowing, redefining what it means to build, scale, and succeed on a global stage.

-

Adnoc sets sights on global trading dominance with expansion drive

Abu Dhabi National Oil Company (Adnoc) is embarking on a transformative journey to solidify its position as a global leader in energy trading. The company’s trading division is set to increase its handling of oil and refined products by nearly two-thirds in the coming years, marking a pivotal phase in its growth trajectory. This ambitious expansion is part of a broader strategy to enhance the UAE’s role in global energy markets and maximize value creation across the energy supply chain. Since its inception in 2018, Adnoc Global Trading has rapidly expanded its footprint, establishing offices in Singapore and Geneva, with plans to open a new hub in Houston by 2027. This global presence enables Adnoc to capture greater value from its production and respond effectively to shifting market dynamics. Adnoc’s trading operations are divided into two complementary arms: Adnoc Trading, focused on crude oil, and Adnoc Global Trading (AGT), a joint venture with Eni and OMV, specializing in refined products like diesel, jet fuel, and gasoline. This dual structure allows the company to operate across the entire value chain, from upstream production to downstream sales, enhancing profitability and flexibility. Market analysts highlight the strategic timing of this expansion, as global energy markets undergo significant transformation due to volatile prices, evolving trade flows, and the energy transition. By scaling its trading operations, Adnoc aims to hedge against price fluctuations and capture downstream value traditionally earned by intermediaries. The planned 60–70% increase in trading volumes will position Adnoc among the elite national oil company traders, such as Saudi Aramco Trading, Equinor, and Shell. The addition of a Houston office is particularly strategic, given the US Gulf Coast’s prominence as a global energy trading and refining hub. This move will provide Adnoc with access to critical market intelligence and trading opportunities in North and Latin America. Adnoc’s expansion aligns with its broader efforts to diversify its energy portfolio, invest in low-carbon solutions, and strengthen partnerships with global energy majors. The company is also transforming its Ruwais Industrial Complex into a world-class refining and chemicals hub, while listing subsidiaries on the Abu Dhabi Securities Exchange to attract foreign investment. Industry experts view Adnoc’s trading expansion as a logical step in its evolution, enabling the UAE to reinforce its status as a global energy hub. As Adnoc scales its operations and embeds itself in key global markets, it is redefining the role of a 21st-century oil producer — agile, globally connected, and commercially driven.

-

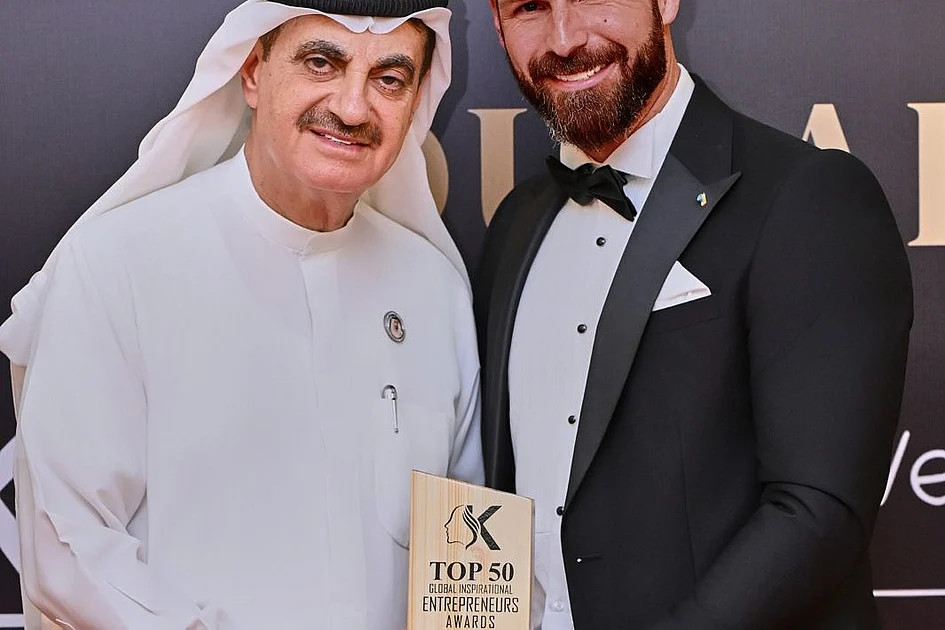

Romain Gerardin-Fresse receives the “Top 50 UAE Personality” distinction

The Khatoon Entrepreneurs Summit & Awards 2025, held in the UAE, celebrated visionary leaders who are reshaping innovation and leadership across the Emirates. Among the notable honorees was Romain Gerardin-Fresse, an internationally acclaimed lawyer and strategic advisor, who was awarded the prestigious ‘Top 50 UAE Personality’ distinction. He also received the Lawyer of Influence & Corporate Legal Visionary Award, presented by Sheikha Aisha Humaid Al Mulla. The event, themed ‘Innovation, Leadership, and Legacy,’ highlighted the UAE’s commitment to fostering excellence and entrepreneurship. Attendees included prominent figures such as Sheikh Zayed Bin Jamal Al Qassimi, Sheikha Aysha Bint Saud Al Qasimi, and Aarefa Al Fahali, among other royal dignitaries and business leaders. Gerardin-Fresse’s recognition underscores his unique blend of legal expertise and strategic entrepreneurship, which has significantly contributed to global partnerships and cross-border corporate transformations. His work exemplifies the values of integrity, foresight, and excellence that drive the UAE’s entrepreneurial spirit. The award not only honors his professional achievements but also acknowledges his holistic approach to leadership, where legal acumen serves as a catalyst for innovation and sustainable growth.

-

Meta is earning a fortune on a deluge of fraudulent ads, internal documents show

Internal documents from Meta, reviewed by Reuters, reveal that the tech giant projected 10% of its 2024 revenue—approximately $16 billion—would come from advertisements promoting scams and banned goods. These documents, spanning from 2021 to 2025, highlight Meta’s struggle to curb a flood of fraudulent ads on its platforms, including Facebook, Instagram, and WhatsApp. Despite internal warnings, Meta’s automated systems only banned advertisers if they were 95% likely to be fraudulent, while charging higher rates for those deemed suspicious but not conclusively fraudulent. This approach has allowed Meta to profit significantly from scam ads, with users exposed to an estimated 15 billion high-risk advertisements daily, generating $7 billion annually. The company’s ad-personalization system further exacerbates the issue by showing users more scam ads based on their interests. Meta’s internal assessment acknowledges the scale of abuse on its platforms but reveals a reluctance to implement stricter measures that could harm its revenue. Regulatory bodies worldwide, including the U.S. Securities and Exchange Commission and UK authorities, are pressuring Meta to address the issue. Meta has pledged to reduce scam ads by 50% in certain markets by 2025 and has already removed over 134 million pieces of scam content in 2025. However, internal documents suggest that Meta’s leadership has prioritized business interests over aggressive enforcement, with concerns that abrupt reductions in scam ad revenue could impact financial projections. The company anticipates regulatory fines of up to $1 billion but continues to earn billions from scam ads, far exceeding potential penalties. Meta’s strategy includes charging suspected fraudsters higher ad rates to deter them, though this approach has had mixed financial results. Critics argue that Meta’s efforts remain insufficient, with user reports of scams often ignored or dismissed. The revelations come as Meta invests heavily in artificial intelligence and other technologies, raising questions about its commitment to user safety and regulatory compliance.