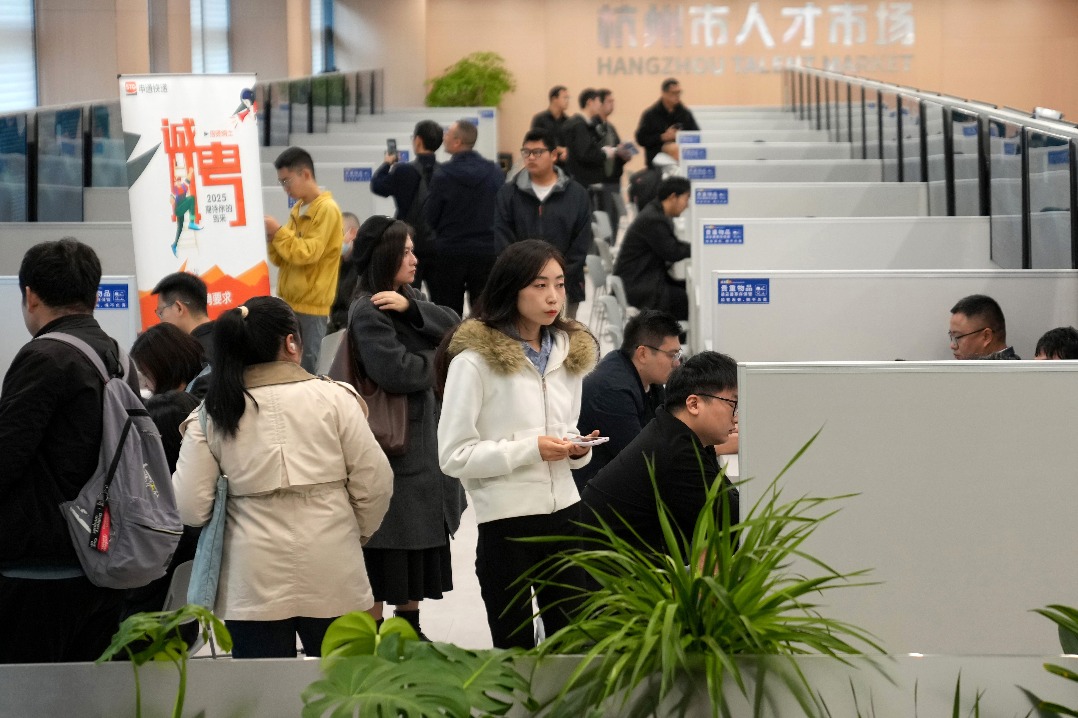

China has strategically developed an extensive national infrastructure of talent markets and human resource service centers to enhance labor allocation across key economic sectors. Official data released Thursday reveals the establishment of 36 national talent markets alongside 29 specialized human resource industrial parks, creating a comprehensive framework aimed at addressing employment challenges and workforce distribution.

The announcement came during a press briefing preceding the third National Human Resource Services Industry Development Conference in Wuhan, Hubei Province. This network of national facilities, complemented by regional specialized parks, constitutes an integrated service system specifically designed to optimize employment services and industrial talent allocation nationwide.

Since the commencement of the 14th Five-Year Plan period (2021-2025), China’s employment services sector has experienced substantial growth, now providing essential services to approximately 300 million workers and over 50 million employers annually. This expansion reflects the government’s concerted effort to modernize labor market mechanisms and improve workforce mobility.

Authorities are particularly focused on aligning human capital with critical economic drivers, including advanced manufacturing capabilities, digital economy initiatives, and modern service industries. This strategic approach aims to bridge persistent gaps between talent availability and sector-specific requirements, thereby mitigating labor shortages in vital industries.

The upcoming Wuhan conference (November 28-29) will demonstrate these initiatives through practical application, featuring a large-scale recruitment drive offering more than 40,000 positions targeting university graduates and overseas students. Opportunities will concentrate on emerging fields such as artificial intelligence development and the burgeoning low-altitude economy sector, highlighting China’s commitment to future-oriented workforce development.