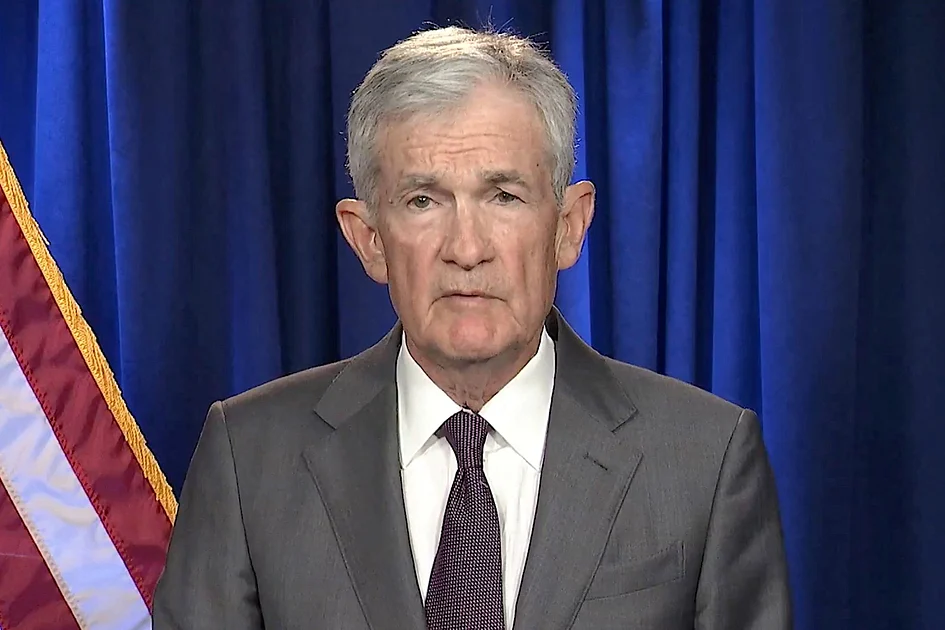

In an extraordinary escalation of political pressure on the Federal Reserve, the Trump administration has threatened criminal indictment against Chair Jerome Powell over congressional testimony regarding a building renovation project—a move Powell characterized as a “pretext” for gaining influence over interest rate policy.

The confrontation represents the most severe test of Federal Reserve independence in decades, triggering immediate reactions across Washington and global financial markets. Republican Senator Thom Tillis, a Banking Committee member, declared he would oppose all Trump Fed nominees “until this legal matter is fully resolved,” questioning the Justice Department’s “independence and credibility.”

Financial markets responded with heightened volatility as investors assessed implications for monetary policy. Longer-term Treasury yields rose amid inflation concerns, gold surged to record highs, and the dollar weakened. Major U.S. stock indexes opened lower, with bank stocks particularly pressured by simultaneous Trump proposals to cap credit card interest rates.

The subpoenas, served Friday by the Justice Department, relate to Powell’s June 2023 testimony about cost overruns in the $2.5 billion renovation of the Fed’s Washington headquarters. Powell maintains the investigation represents broader administration efforts to influence rate-setting decisions, stating: “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

This development occurs two weeks before the Supreme Court hears arguments regarding Trump’s attempt to remove Fed Governor Lisa Cook. Powell’s term as chair concludes in May, though he retains Board membership until 2028. Fed historians describe the situation as “a low point in the history of central banking in America,” highlighting the dangerous precedent of using criminal law against a sitting Fed chair.

Trump denied knowledge of the Justice Department’s actions while criticizing Powell’s performance, telling NBC News: “I don’t know anything about it, but he’s certainly not very good at the Fed, and he’s not very good at building buildings.”