Venezuela’s National Assembly has enacted landmark legislation to privatize its oil industry, marking a historic reversal of the socialist policies that defined the nation’s energy sector for over two decades. The sweeping reform, approved Thursday, comes less than a month after the dramatic capture of former President Nicolás Maduro during a U.S. military operation in Caracas.

The new energy framework, now awaiting signature from Acting President Delcy Rodríguez, fundamentally restructures Venezuela’s approach to oil production and investment. The legislation grants private corporations unprecedented control over petroleum extraction and sales while introducing independent arbitration mechanisms for dispute resolution—a crucial safeguard demanded by international investors.

The Rodríguez administration designed these changes to reassure major U.S. energy companies that have remained hesitant about re-entering Venezuela’s volatile market. Many firms suffered substantial losses when the government nationalized oil assets under former leader Hugo Chávez in 2006.

Key provisions include a revised taxation structure that caps royalty rates at 30%, with flexibility for the executive branch to adjust percentages based on project-specific factors including capital requirements and market competitiveness. The legislation additionally removes the previous mandate requiring all legal disputes to be settled exclusively in Venezuelan courts, which foreign investors viewed as susceptible to political influence.

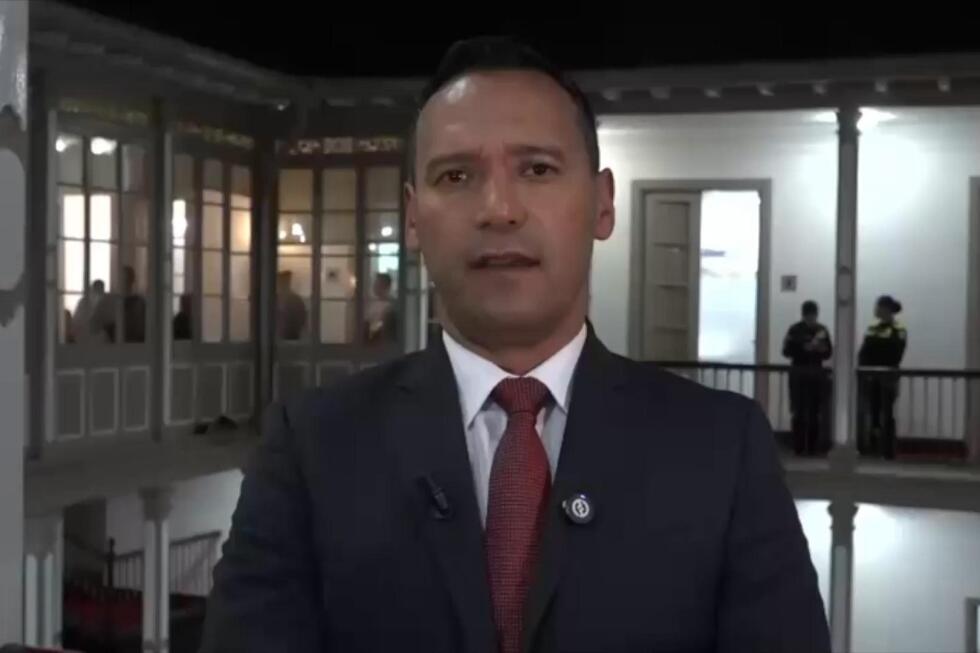

Orlando Camacho, head of the assembly’s oil committee, hailed the reform as an economic game-changer that “will change the country’s economy.” Meanwhile, opposition lawmaker Antonio Ecarri advocated for enhanced transparency measures, including public disclosure platforms to combat systemic corruption. “Let the light shine on in the oil industry,” Ecarri urged during legislative debates.

This policy shift represents a stark departure from the Chávez-era doctrine that established state-owned PDVSA as the mandatory majority stakeholder in all major petroleum projects. That previous model, funded by record-high global oil prices in the early 2000s, eventually collapsed due to price volatility, governmental mismanagement, and crippling international sanctions. The subsequent economic crisis prompted over 7 million Venezuelans to flee the country since 2014.

The current reforms aim to attract foreign capital and technical expertise to revitalize an industry holding the world’s largest proven crude reserves—a strategic priority for the interim government as it seeks to stabilize Venezuela’s devastated economy.