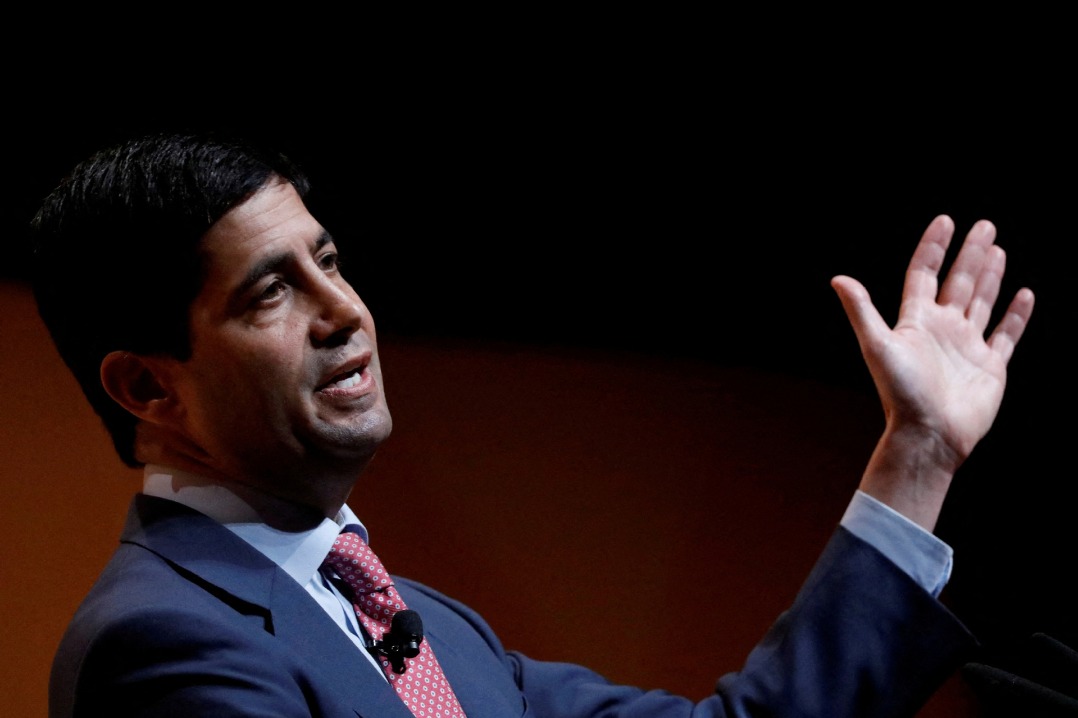

President Donald Trump has nominated Kevin Warsh, a former Federal Reserve official with extensive Wall Street experience, to replace Jerome Powell as Chairman of the U.S. Central Bank. The announcement comes as Powell’s term approaches its conclusion in May, marking a significant shift in leadership at the world’s most influential financial institution.

Warsh, who previously served as a Fed governor during the 2008 financial crisis, brings a traditional conservative economic background with credentials from Harvard, Morgan Stanley, and the Hoover Institution. His selection represents a curious paradox given his historical reputation as an interest rate hawk—a position seemingly at odds with Trump’s frequently expressed preference for accommodative monetary policy.

The nomination has generated mixed reactions across financial and political circles. Supporters highlight Warsh’s institutional knowledge and potential independence, noting his sensitivity to maintaining the Fed’s autonomy from short-term political pressures. Critics question whether his familial connections—Warsh’s father-in-law is a prominent Trump donor—influenced the appointment and point to his controversial opposition to economic stimulus measures during the 2008 crisis.

Financial markets initially responded positively to the news, with gold prices dropping and the dollar strengthening, suggesting traders anticipate a return to more conventional monetary policies. However, analysts note significant uncertainty remains regarding how Warsh would navigate the tension between presidential preferences and economic realities.

Beyond interest rate policy, Warsh has advocated for reducing the Fed’s role in bank regulation and scaling back its involvement in issues like climate change research—positions that align closely with the administration’s priorities. His criticism of the Fed’s expanded balance sheet and market interventions since 2008 suggests potential changes to the central bank’s approach to crisis management.

The nomination now moves to the Senate for confirmation, where Warsh will likely face rigorous questioning about his evolution from inflation hawk to Trump ally and his plans for steering monetary policy through potential economic headwinds.