Japan’s parliament is preparing to elect ultraconservative Sanae Takaichi as the nation’s first female prime minister on Tuesday, marking a historic moment in Japanese politics. This development follows a coalition agreement between her struggling Liberal Democratic Party (LDP) and the right-wing Japan Innovation Party (JIP), a move that signals a further shift to the right for the governing bloc. Takaichi will succeed Prime Minister Shigeru Ishiba, whose resignation earlier Tuesday ended a three-month political vacuum triggered by the LDP’s devastating election loss in July. The alliance with JIP ensures Takaichi’s election, as the opposition remains fragmented. However, the coalition lacks a majority in both houses of parliament, raising concerns about the stability and longevity of her government. Takaichi emphasized the importance of political stability during Monday’s signing ceremony with JIP leader Hirofumi Yoshimura, stating that it is crucial for advancing economic and diplomatic measures. The coalition agreement reflects Takaichi’s hawkish and nationalistic views, which have drawn criticism from centrist and dovish factions. The LDP’s recent split with its longtime partner, the Buddhist-backed Komeito, has further complicated the political landscape. Once elected, Takaichi, a protégé of the late Prime Minister Shinzo Abe, is expected to pursue policies focused on strengthening Japan’s military and economy, as well as revising the country’s pacifist constitution. However, her government’s weak parliamentary position and her controversial stances on issues like gender equality, same-sex marriage, and Japan’s wartime history could hinder her ability to implement significant reforms. Takaichi’s premiership comes at a critical juncture, with pressing challenges such as rising prices and public frustration demanding immediate attention.

博客

-

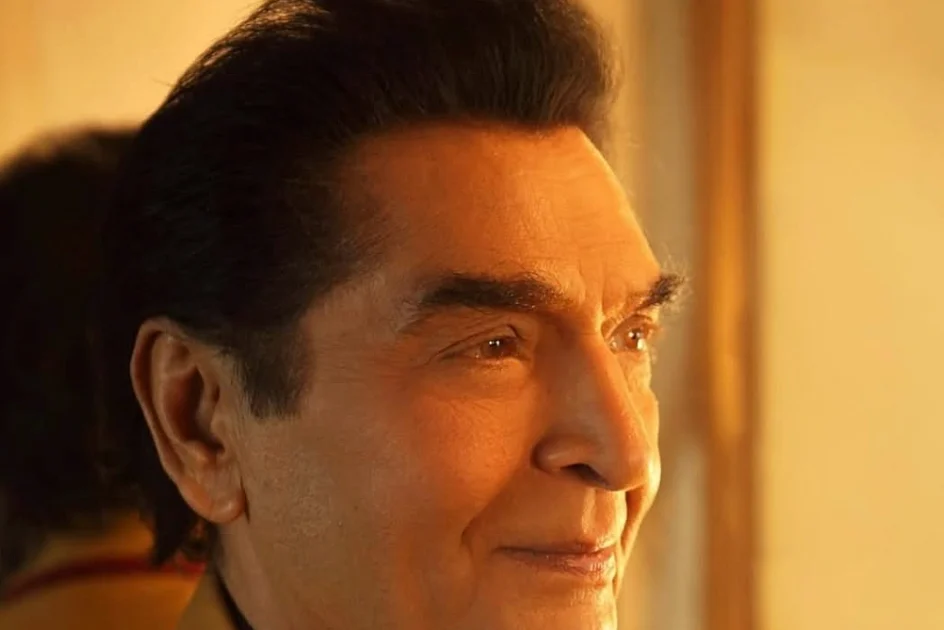

Veteran Indian actor, comedian Asrani passes away at 84

The Indian entertainment industry mourns the loss of veteran actor and comedian Govardhan Asrani, who passed away at the age of 84 on Monday, October 20, 2025. According to reports from NDTV, Asrani had been hospitalized for five days battling a prolonged illness before his demise. His manager, Babu Bhai Theeba, confirmed the news to ANI, stating that the actor breathed his last at Arogya Nidhi Hospital in Juhu. His cremation was held the same evening at the Santacruz crematorium. Asrani, celebrated for his iconic role as the jailer in the legendary film *Sholay*, leaves behind a rich legacy of memorable performances that have left an indelible mark on Indian cinema. His contributions to the industry spanned decades, earning him a place in the hearts of millions of fans worldwide.

-

US soliciting new bids for Moon mission amid SpaceX delays: NASA chief

NASA is intensifying its efforts to return humans to the Moon by soliciting new bids for its Artemis program, as SpaceX, Elon Musk’s aerospace company, faces delays. NASA Administrator Sean Duffy announced the move on Monday, emphasizing the urgency to compete against China’s advancing lunar ambitions. ‘We’re going to have a space race among American companies to see who can get us back to the Moon first,’ Duffy stated during an interview on Fox News. He revealed plans to open the contract to other competitors, including Jeff Bezos’ Blue Origin, to accelerate progress. SpaceX currently holds the contract for the fifth Artemis mission, but delays have prompted NASA to seek alternatives. Duffy, who also serves as the US Transportation Secretary, stressed the importance of innovation and competition in maintaining US dominance in space exploration. The Artemis program, initiated during President Donald Trump’s first term, aims to return astronauts to the Moon and eventually voyage to Mars. Despite setbacks, NASA remains committed to its timeline, with the Artemis 2 mission, featuring a crew of three US astronauts and one Canadian, scheduled for April 2026. This mission will mark the first crewed lunar flyby in over 50 years. NASA officials, including Lakiesha Hawkins, have reaffirmed their dedication to meeting these ambitious goals, even as they navigate challenges and rising global competition.

-

Dubai strengthens global financial standing as DIFC surpasses 8,000 registered companies

Dubai has further cemented its position as the premier financial hub for the Middle East, Africa, and South Asia (MEASA) region, with the Dubai International Financial Centre (DIFC) surpassing 8,000 active registered companies. This milestone includes over 1,000 entities regulated by the Dubai Financial Services Authority (DFSA), showcasing the Centre’s robust growth and influence. The DIFC’s banking assets have also surged to approximately $240 billion, marking a 200% increase since 2015. This achievement aligns with Dubai’s rise to 11th place in the Global Financial Centre Index, reinforcing its reputation as a top global FinTech hub and the region’s most credible financial centre. Essa Kazim, Governor of DIFC, emphasized the Centre’s pivotal role in advancing Dubai’s Economic Agenda (D33), stating, ‘DIFC’s success sets the benchmark for emerging financial centres, offering a business environment rooted in innovation, integrity, and global standards.’ Since its inception in 2004, the DIFC has attracted global financial institutions, innovators, and professional services firms, supported by its unique ecosystem of legal and regulatory certainty. Arif Amiri, CEO of DIFC Authority, highlighted the Centre’s diversity and scale, noting, ‘Exceeding 8,000 registered companies underscores DIFC’s unmatched position in the region, enabling us to shape the global financial services landscape and drive Dubai’s emergence as a technology innovation hub.’ The DFSA’s evolving regulatory framework, grounded in common law and benchmarked against global standards, continues to draw financial institutions seeking growth and connectivity. Mark Steward, Chief Executive of DFSA, remarked, ‘With over 1,000 regulated entities, DIFC is the region’s premier financial centre, connecting firms with global capital and growth opportunities.’ The DIFC Courts also reported significant activity, with over AED 17.5 billion in total claim values filed this year, reflecting growing trust in its legal framework. As Dubai expands its global influence, the DIFC remains central to its vision for the future of finance, combining scale, innovation, and regulatory excellence to support sustainable economic growth across the region and beyond.

-

Kabul must rein in militants for ceasefire to hold, says Pakistan

The success of a recent ceasefire agreement between Pakistan and Afghanistan hinges on the Afghan Taliban’s ability to curb militant activities along their shared border, Pakistan’s Defence Minister Khawaja Muhammad Asif stated on Monday. The agreement, brokered in Doha over the weekend, followed intense border clashes that resulted in numerous casualties, marking the worst violence since the Taliban’s rise to power in 2021. Asif emphasized that any breach of the accord, particularly incursions from Afghanistan, would render the ceasefire void. The minister accused the Pakistani Taliban, operating from Afghan soil, of collaborating with the ruling Afghan Taliban to launch attacks on Pakistan. Kabul, however, denies harboring militants and accuses Pakistan of sheltering Islamic State-linked groups to destabilize Afghanistan. Taliban spokesperson Zabihullah Mujahid reiterated Afghanistan’s commitment to preventing its territory from being used against other nations. The next round of talks, scheduled for October 25 in Istanbul, aims to establish mechanisms for enforcing the agreement. Qatar and Turkey, who mediated the initial talks, stressed the importance of follow-up meetings to ensure the ceasefire’s sustainability.

-

UAE President, Sheikh Mohammed congratulate Morocco King on U-20 World Cup

In a historic moment for Arab sports, Morocco has become the first Arab nation to clinch the FIFA Under-20 World Cup, sparking widespread celebration and pride across the region. The Moroccan team, affectionately known as the Atlas Cubs, triumphed over Argentina with a decisive 2-0 victory in the final held in Santiago on Sunday. This win marks a significant milestone, as Argentina, the most successful team in the tournament’s history with six titles, suffered their second-ever final defeat, the first being in 1983 against Brazil.

UAE President Sheikh Mohamed bin Zayed Al Nahyan and Dubai Ruler Sheikh Mohammed bin Rashid Al Maktoum extended their heartfelt congratulations to Morocco’s King Mohammed VI and the nation. In a tweet, Sheikh Mohamed hailed the victory as “a remarkable sporting achievement that brings pride to Morocco and the entire Arab world.” Similarly, Sheikh Mohammed bin Rashid expressed optimism, stating, “It is a well-deserved win, an Arab joy, and a renewed hope that the FIFA World Cup title itself will one day be claimed by an Arab nation, God willing.”

The Moroccan U-20 team’s success has not only elevated the country’s standing in global football but also inspired hope for the future of Arab sports. The senior Moroccan national team has already secured a spot in the 2026 FIFA World Cup, which will be hosted by the United States, Canada, and Mexico. This dual achievement underscores Morocco’s growing influence in international football and sets a precedent for other Arab nations to aspire to similar heights.

-

DGCX primed to lead new era of global precious metals trading

The Dubai Gold and Commodities Exchange (DGCX) is set to redefine the global precious metals trading landscape, leveraging a combination of robust market demand, regulatory support, and cutting-edge digital technologies. Established two decades ago as the region’s first derivatives exchange, DGCX has evolved into a cornerstone of the Middle East’s financial ecosystem, offering a diverse range of products, including currencies, commodities, and Sharia-compliant contracts. With gold prices surpassing $4,000 per ounce amid geopolitical uncertainty, the exchange is strategically positioned to capitalize on the precious metal’s resurgence as a safe-haven asset. The UAE Central Bank’s mandate requiring gold bullion to be stored in DMCC-approved vaults has further solidified the foundation of physical trade in the region. DGCX’s integration of AI-driven technologies enhances operational efficiency and scalability, enabling deeper liquidity, broader market access, and unparalleled physical integrity. The exchange is also introducing a dirham-denominated gold contract, designed to mitigate geopolitical risks and promote the UAE’s national currency in global trade settlements. Additionally, DGCX plans to launch a daily benchmark gold price, aligned with international standards, to provide market participants with precise pricing and hedging opportunities. The exchange’s commitment to operational excellence includes same-day or real-time settlement processes, reducing counterparty risk and improving capital efficiency. To ensure global connectivity, DGCX is exploring extended operating hours to align with key international markets, offering continuous trading opportunities across time zones. Furthermore, the exchange is democratizing gold investment through fractionalized tokenized gold and silver, allowing retail investors to participate with smaller denominations backed by physical assets. These initiatives underscore DGCX’s ambition to become a globally recognized hub for commodities and derivatives trading, driven by transparency, innovation, and stakeholder-centric strategies.

-

UAE leads in financial inclusion as digital push kicks in

The United Arab Emirates (UAE) has solidified its position as a global frontrunner in financial inclusion, driven by a robust digital transformation and strategic policy initiatives. According to the 2025 Global Financial Inclusion Index (GFII), the UAE achieved the most significant global improvement in the ‘financial-system support’ pillar, climbing five places with a 1.9-point score increase. This progress underscores the nation’s commitment to fostering a digitally inclusive financial ecosystem. The UAE also saw a remarkable leap in fintech development, rising seven spots to 14th globally, with over 320 fintech firms collectively valued at more than $3 billion. These advancements are bolstered by the UAE’s Digital Economy Strategy 2022, which has catalyzed innovation and accessibility in financial services. Access to capital surged by 16.6 points, reflecting strong momentum in SME growth and private-sector confidence. Additionally, the UAE ranks 4th globally in consumer protection, up 6.9 points, and 6th in government-provided financial education. The World Bank reports that 84.56% of UAE adults had formal financial accounts in 2021, well above the global average of 66%. The UAE Ministry of Finance and the Central Bank of the UAE (CBUAE) have jointly launched the National Financial Inclusion Strategy and National Financial Literacy Strategy, following a May 2025 policy forum in Abu Dhabi. Kamal Bhatia, President & CEO of Principal Asset Management, emphasized that the UAE’s progress transcends digital access, empowering individuals and businesses to build stronger financial futures. Pushpin Singh, Managing Economist at Cebr, highlighted the UAE’s real economic benefits, with access-to-capital scores jumping 16.6 points. Despite these strides, challenges remain, including ensuring meaningful economic participation among lower-income households and women. The UAE’s financial inclusion journey has evolved from ‘banking the unbanked’ to leveraging digital fintech platforms, regulatory frameworks, and literacy programmes to build a resilient, diversified, and inclusive economy.

-

Trump is going to Asia — what happens next is anyone’s guess

President Donald Trump is set to embark on a pivotal journey to Asia, aiming to address critical global economic issues and ease escalating trade tensions. The trip, which includes stops in Malaysia, Japan, and South Korea, is expected to culminate in a high-stakes meeting with Chinese President Xi Jinping. The outcome of this meeting could significantly influence the future of the global economy, as both leaders grapple with ongoing trade disputes and tariff threats. Trump’s strategy of improvisation has yielded mixed results in his second term, with successes like the return of hostages in the Middle East but ongoing challenges in resolving conflicts in Ukraine and trade tensions with China. The lack of clarity surrounding Trump’s itinerary has added to the uncertainty, with analysts noting the absence of a clear Asia strategy from the administration. Despite this, some experts believe Trump’s approach is gaining traction, particularly in Japan and South Korea, where leaders are eager to solidify partnerships. The trip also offers an opportunity for Trump to showcase his peacemaking efforts, particularly in Southeast Asia, where Malaysia is hosting the Association of Southeast Asian Nations summit. However, concerns remain about the potential for a breakdown in talks with Xi, which could have far-reaching consequences for the international economy. As Trump prepares for his first trip to Asia in his second term, the stakes could not be higher, with the world watching closely to see if he can navigate these complex issues successfully.

-

Iraq bans US gaming platform Roblox over child safety concerns

In a significant move to safeguard children from online exploitation, Iraq has imposed a nationwide ban on the popular US gaming platform Roblox. The decision, announced late Sunday by the Iraqi government, stems from concerns that the platform’s user-generated content and direct communication features expose minors to risks such as cyber-extortion and abuse. The government emphasized that the platform’s content is ‘incompatible with social values and traditions.’ This action aligns Iraq with other Middle Eastern nations, including Turkey, Kuwait, Qatar, and Oman, which have either blocked or heavily regulated the game. Roblox Corp, the developer of the platform, has yet to comment on the ban but has previously stated its commitment to adhering to local laws and protecting children. The Iraqi Communications Ministry cited a comprehensive study and field monitoring as the basis for the ban, highlighting the game’s ‘security, social, and behavioural risks.’ This development underscores a growing regional focus on regulating digital platforms to address child safety and moral concerns.