In a landmark move for Africa-UAE economic relations, Tanzania’s CRDB Bank has inaugurated its Dubai Representative Office at the Dubai International Financial Centre (DIFC), marking the first Tanzanian financial institution to establish a presence within this globally influential financial hub. This strategic expansion positions Tanzania and the broader East and Central Africa region directly within the global capital ecosystem, utilizing an African-born financial institution as the crucial conduit between regional opportunities and international finance.

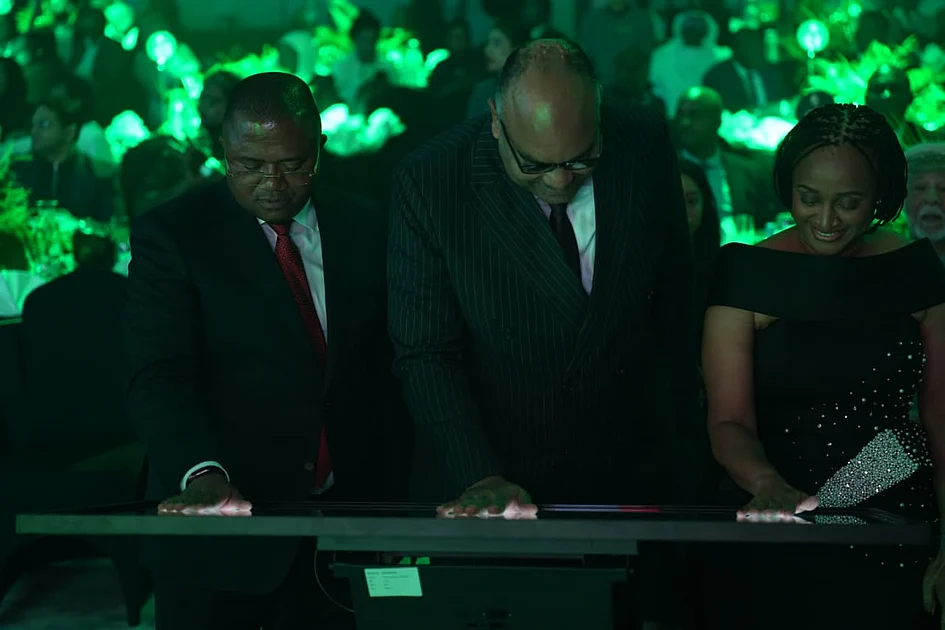

The official launch ceremony gathered senior leaders from international financial institutions, global investors, multinational corporations, and development finance partners, signaling increasing global interest in Africa as the world’s next major growth frontier. Ambassador Mahmoud Thabit Kombo, Minister for Foreign Affairs and East African Cooperation, delivered a keynote address on behalf of Tanzanian President Samia Suluhu Hassan, commending CRDB Bank for advancing Tanzania’s national economic vision through a domestically-grown institution operating at global standards.

Minister Kombo emphasized the strategic selection of Dubai, citing its status as a premier global capital hub and the robust regulatory framework of DIFC. “The presence of a Tanzanian bank in Dubai will significantly deepen economic, trade, and investment relations between Tanzania and the United Arab Emirates,” he stated, referencing existing bilateral trade that has already reached approximately $2.5 billion annually.

Tanzania’s economic stability provides a strong foundation for this expansion. With over 60 million people, the country has maintained average GDP growth of 6-7% for more than two decades, preserved single-digit inflation, and demonstrated macroeconomic resilience even during global disruptions. This stability has transformed Tanzania into a natural gateway economy, connecting the Indian Ocean to landlocked markets across East and Central Africa.

CRDB Bank, founded three decades ago, has evolved alongside Tanzania’s economy and regional integration agenda. The Group now serves over six million customers across the region with a balance sheet exceeding $9 billion, maintaining footprints in Tanzania, Burundi, and the Democratic Republic of Congo that mirror the region’s most vital trade, logistics, and investment corridors.

Abdulmajid Nsekela, Group CEO of CRDB Bank, characterized the Dubai expansion as the logical progression in a regional strategy rooted in Tanzania’s economic geography and Africa’s integration agenda. “CRDB Bank was built to finance Tanzania’s growth. As Tanzania became a gateway, the Bank became regional,” he explained. “Dubai now enables us to complete the triangle—connecting global capital, Tanzania, and East and Central Africa through one trusted African institution.

The targeted region represents a nearly 400 million-person market characterized by rising intra-African trade, expanding infrastructure networks, vast mineral and energy resources, and one of the world’s youngest labor forces. Africa collectively hosts 1.4 billion people, generates over $3.4 trillion in GDP, and is projected to account for a quarter of the global population by 2050.

Despite this enormous potential, access to long-term, structured capital remains a persistent challenge. The CRDB Bank Dubai Representative Office specifically addresses this gap by originating deals, structuring financing, and mobilizing global capital for African projects requiring both local understanding and international standards. “Africa does not lack opportunity,” Mr. Nsekela noted. “What it often lacks is a bridge between capital and execution. This office is that bridge.”

Through its DIFC presence, CRDB Bank is expected to enhance trade finance, cross-border investment structuring, and syndicated financing between the Gulf and Africa, utilizing Tanzania as the anchor and East and Central Africa as the growth hinterland. The office additionally strengthens Africa’s engagement with Islamic finance, a global market exceeding $4 trillion in assets.

Neema Mori, Chairperson of the CRDB Bank Board of Directors, stated that this milestone reflects growing confidence in African institutions operating at the highest global level. “This is a statement about governance, capability, and trust,” she affirmed. “CRDB Bank’s presence in Dubai demonstrates that African banks can anchor global partnerships while remaining firmly aligned with Africa’s development priorities.”

Leadership from the Dubai Financial Services Authority welcomed CRDB Bank into the DIFC ecosystem, recognizing that an African bank with profound regional roots strengthens the Africa-Middle East financial corridor and enhances the flow of long-term capital into emerging markets.