The ongoing US federal government shutdown, now in its third week, is projected to cost the economy up to $15 billion per week in lost output, according to a Treasury official. This clarification came after Treasury Secretary Scott Bessent initially overstated the impact, suggesting a daily loss of $15 billion. Bessent later corrected his statement, emphasizing the significant economic strain caused by the shutdown. The revised estimate is based on a report by the White House Council of Economic Advisers. Bessent warned that the shutdown is beginning to ‘cut into the muscle’ of the US economy, despite the sustained investment boom in sectors like artificial intelligence (AI). He attributed the economic momentum to President Donald Trump’s policies, including tax incentives and tariffs, which he compared to transformative periods in US history, such as the railroad expansion in the late 1800s and the internet boom of the 1990s. However, the shutdown has created a major obstacle to continued growth. The political deadlock in Congress over spending has intensified, with Trump threatening mass layoffs of federal workers. On Wednesday, a federal judge in California issued a temporary restraining order to halt the planned layoffs of 10,000 workers, following a lawsuit by labor unions. The judge ruled that the layoffs were ‘not ordinary’ and potentially illegal, especially as many employees were unaware of their termination due to inaccessible government email accounts during the shutdown.

分类: business

-

After winning Trump’s $20 billion, President Milei must win votes as Argentine industry reels

The once-bustling textile mill of the Galfione Group in southern Buenos Aires now stands eerily quiet. Luciano Galfione, the owner, walks through the factory, reminiscing about the days when 200 employees operated state-of-the-art machinery to produce fabrics for Argentina’s middle class. Today, only a handful of workers remain, spooling yarn and dyeing cloth. The factory’s operations have been slashed by 80%, and half the staff has been laid off or suspended. Galfione is now dipping into his personal savings to keep the 78-year-old family business afloat. This grim scenario is emblematic of Argentina’s broader economic crisis, exacerbated by President Javier Milei’s austerity measures and free-market reforms. Since Milei took office nearly two years ago, over 17,600 businesses, including 1,800 manufacturers and 380 textile companies, have shut down, according to Fundación Pro Tejer, a nonprofit representing textile manufacturers. The crisis has been fueled by falling domestic orders, surging competition from cheap imports, and reduced consumer spending due to higher unemployment and lower wages. As Argentina approaches midterm elections on October 26, widely seen as a referendum on Milei’s policies, the textile industry’s collapse highlights the broader challenges facing the nation. The economy has stagnated, manufacturing has been gutted, and consumer confidence has plummeted. Milei’s initial success in curbing inflation has been overshadowed by rising unemployment, stagnant wages, and increased costs for essentials like transportation and healthcare. The president’s reliance on high interest rates and central bank interventions to stabilize the peso has further eroded the competitiveness of Argentine industries. Meanwhile, the removal of trade barriers has flooded the market with cheaper foreign products, leaving local manufacturers struggling to compete. As Milei seeks financial support from the U.S., many Argentines remain skeptical about the potential benefits of foreign aid, emphasizing the need for domestic economic revival. The crisis has left thousands of workers unemployed, with families struggling to make ends meet. The future of Argentina’s economy remains uncertain, as the government grapples with the dual challenges of stabilizing inflation and fostering growth.

-

Wall Street steadies after its slide as banks recover some of their losses

The U.S. stock market showed signs of stabilization on Friday, with bank stocks recovering from significant losses earlier in the week. Despite this, Wall Street remains volatile, experiencing frequent fluctuations. The S&P 500 saw a slight decline of 0.1% in early trading, while the Dow Jones Industrial Average rose by 91 points (0.2%), and the Nasdaq composite dropped by 0.3%. Big Tech stocks, including Nvidia, faced downward pressure, dropping 0.6% amid concerns over inflated valuations driven by the artificial intelligence boom, despite strong profit growth. Meanwhile, bank stocks rebounded after several institutions, such as Fifth Third Bancorp, Huntington Bancshares, and Truist Financial, reported better-than-expected quarterly earnings. This recovery followed a sharp decline in the sector triggered by fears of bad loans affecting smaller and midsized banks. Zions Bancorp and Western Alliance Bancorp, both central to Thursday’s concerns, also saw gains, rising 3.4% and 2.9%, respectively. The market remains cautious as scrutiny intensifies over loan quality following the bankruptcy of First Brands Group, an auto parts supplier. Jefferies Financial Group, potentially impacted by the bankruptcy, rose 4.8% after a significant drop since mid-September. JPMorgan CEO Jamie Dimon warned of potential risks in the banking sector, likening them to ‘cockroaches,’ but analysts suggest the situation is not yet critical. Trading volatility persists amid geopolitical tensions, including President Trump’s tariff threats on China, though he later indicated a possible meeting with Chinese President Xi Jinping. Overseas, European and Asian markets saw declines, with Germany’s DAX dropping 1.8% and Hong Kong’s Hang Seng falling 2.5%. Treasury yields remained steady after Thursday’s sharp declines.

-

China’s biggest shopping event starts five weeks early to revive spending

China’s annual online shopping extravaganza, Singles’ Day, traditionally held on November 11, has seen an early launch this year as retailers strive to stimulate spending in a sluggish market. The event, originally created by Alibaba, has grown into a global shopping phenomenon, comparable to Amazon’s Prime Day or Black Friday. However, this year’s extended sales period, beginning in mid-October, reflects the broader economic challenges facing Chinese consumers. Issues such as rising youth unemployment, a prolonged property crisis, escalating government debt, and ongoing trade tensions with the US have led to a more cautious approach to spending. Despite government efforts to boost consumption through subsidies, wage increases, and discounts, retail sales growth continues to fall short of expectations. E-commerce giants like Taobao, JD.com, and Douyin are aggressively promoting the event, offering deep discounts and vouchers to entice shoppers. Alibaba has also integrated artificial intelligence into its platforms to enhance the shopping experience, making it easier for consumers to find relevant products. The cautious spending trend, which began during the Covid-19 pandemic, has persisted as China grapples with deflation. High-end retailers, including luxury brands like Louis Vuitton and Burberry, have been particularly affected, with sales declining in recent months. However, there are signs of optimism in the market, as shares of luxury brands such as LVMH and Moncler have risen, buoyed by indications of improved demand in the region.

-

Gold smuggling surges in India as price spikes before festivals

Gold smuggling in India has seen a significant uptick as the nation approaches the festive seasons of Dhanteras and Diwali, occasions traditionally marked by auspicious gold purchases. Government and industry officials report that the surge is driven by record-high gold prices and a supply crunch. Despite a reduction in import taxes from 15% to 6% last year, which initially curbed smuggling, recent weeks have witnessed a resurgence in illegal activities. Customs and Directorate of Revenue Intelligence (DRI) officials have foiled several smuggling attempts at various Indian airports. A Chennai-based bullion dealer noted that the process of bringing gold into India and liquidating it has become quicker and less risky due to strong festival demand and limited supply. Gold prices in India hit a record 128,395 rupees per 10 grams, a 67% increase this year, making smuggling highly lucrative. Grey market operators can earn margins exceeding 1.15 million rupees per kilogram by evading import duties and local sales taxes. A Mumbai-based bullion dealer highlighted the increasing profitability for smugglers as gold prices continue to rise. The situation is exacerbated by banks’ inability to meet full demand, leading to high premiums on available stock. Indian dealers are quoting premiums of up to $25 per ounce over official domestic prices, the highest in over a decade. In the 2024/25 fiscal year, government agencies registered 3,005 cases of gold smuggling and seized 2.6 metric tons of the metal.

-

The Wealth Circle to make Middle East debut at IgKnightED’25

The Wealth Circle (TWC), a global investment and learning platform, is set to make its Middle East debut at IgKnightED’25, an innovation ecosystem developed in collaboration with Khaleej Times. The event, which integrates media, mentorship, and market access, aims to connect founders, investors, and policymakers through curated events, summits, and digital communities. This partnership will introduce investor education, live deal showcases, and masterclasses to the event experience. TWC’s participation is part of the BIT Summit by Khaleej Times Events, now in its fourth edition, focusing on capital readiness and credible investment pipelines for startups. Following its soft launch at IgKnightED’25, TWC plans to roll out a full platform and native mobile app. The expansion into the Middle East and India aligns with the rapid growth of regional startup ecosystems, supported by initiatives like Dubai’s Future District Fund, Abu Dhabi’s Hub71+ Digital Assets Hub, Saudi Arabia’s National Technology Development Program, and India’s Startup India mission. TWC aims to bridge the gap in access to capital, mentorship, and trusted networks by offering curated deal flow, investor-led masterclasses, and private networking forums. The platform also provides quarterly-updated frameworks and databases to help ventures scale responsibly. Leading TWC is Nick Ayala, a U.S.-based entrepreneur and licensed investment adviser with over 15 years of experience in fintech, private markets, and financial services. Ayala has founded five companies, successfully exiting four, and has raised and advised on over USD 1 billion in private equity, venture, and real estate deals through his firm, Align Equity Group.

-

US, UK ramp up pressure on India, China to cut Russian oil imports

Amid escalating tensions in the Ukraine conflict, the United States and the United Kingdom have intensified their efforts to persuade India and China to reduce their reliance on Russian oil. US President Donald Trump announced that Indian Prime Minister Narendra Modi had pledged to cease Russian oil imports, a claim swiftly refuted by India’s foreign ministry, which stated it was unaware of any such conversation between the leaders. Indian officials, currently engaged in trade negotiations in Washington, face mounting pressure to curb Russian oil purchases as a condition for finalizing a trade deal. Meanwhile, British authorities imposed sanctions on major Russian oil firms, including Lukoil and Rosneft, as well as Chinese refiner Shandong Yulong Petrochemical and several port operators. Despite these measures, Russia remains confident, with Deputy Prime Minister Alexander Novak affirming continued cooperation with India. China has condemned the sanctions, labeling them as unilateral and unjustified. As geopolitical tensions rise, the global energy market braces for potential disruptions, with oil prices remaining stable for now.

-

Cheap oil, high stakes: Can India do without Russia?

In a complex geopolitical and economic landscape, India finds itself at a crossroads, navigating the delicate balance between its energy needs and international relations. The recent imposition of 50% tariffs on Indian goods by the United States, framed as a punitive measure for India’s continued purchase of Russian oil, has escalated tensions. US President Donald Trump’s assertion that Indian Prime Minister Narendra Modi privately agreed to cease these purchases ‘within a short period of time’ has further complicated matters. However, both Russia and India have distanced themselves from these claims, with Russia emphasizing the economic benefits of its oil for India, and India reaffirming its import policy as consumer-centric in a volatile energy market. India, the world’s third-largest oil importer, has significantly increased its reliance on Russian crude, which now constitutes 37% of its oil imports, driven by substantial discounts post-Western sanctions. This shift has come at the expense of imports from other traditional suppliers like Iraq, Saudi Arabia, and the UAE, as well as from the US, Brazil, and others. The economic rationale for India’s pivot to Russian oil is clear: it has saved the country approximately $5 billion annually, or 3–4% of its crude import bill. However, the strategic implications are profound. India’s refineries are optimized for heavier crude grades like Russia’s Urals blend, making a switch to lighter US shale oil costly and inefficient. The ongoing geopolitical tensions and the delayed India-US trade deal underscore the high-stakes nature of India’s energy policy decisions. As Washington tightens its grip, India must weigh the short-term economic benefits of discounted Russian oil against the potential long-term costs of strained bilateral relations with the US. The outcome of this balancing act will not only shape India’s energy strategy but also define the future trajectory of its international partnerships.

-

China has found Trump’s pain point – rare earths

China’s Ministry of Commerce recently issued ‘Announcement No. 62 of 2025,’ a seemingly innocuous document that has significantly disrupted the fragile tariff truce between China and the United States. The announcement introduces stringent new restrictions on rare earth exports, tightening Beijing’s control over these critical minerals essential for technologies ranging from smartphones to fighter jets. Under the new regulations, foreign companies must obtain Chinese government approval to export products containing even minimal amounts of rare earths and declare their intended use. This move underscores China’s near-monopoly in rare earth processing, which accounts for approximately 70% of global supply. In response, US President Donald Trump threatened to impose an additional 100% tariff on Chinese goods and implement export controls on key software. US Treasury Secretary Scott Bessent criticized the measures, stating, ‘This is China versus the world. They have pointed a bazooka at the supply chains and the industrial base of the entire free world.’ A Chinese Commerce Ministry spokesperson countered, accusing the US of introducing 20 measures to suppress China shortly after September’s economic talks in Madrid. The escalation has also seen both nations impose new port fees on each other’s ships, marking the end of months of relative calm since a May truce. Experts predict that China’s rare earth restrictions will give it the upper hand in upcoming negotiations between Trump and Chinese President Xi Jinping. Analysts note that while rare earths constitute a small fraction of China’s $18.7 trillion economy, their strategic value is immense, providing Beijing with significant leverage. Despite the tensions, both sides have left the door open for negotiations, with Bessent expressing optimism about de-escalation. However, China’s recent actions are seen as a strategic move to strengthen its position ahead of trade talks, leveraging its dominance in rare earths to pressure Washington for a favorable deal.

-

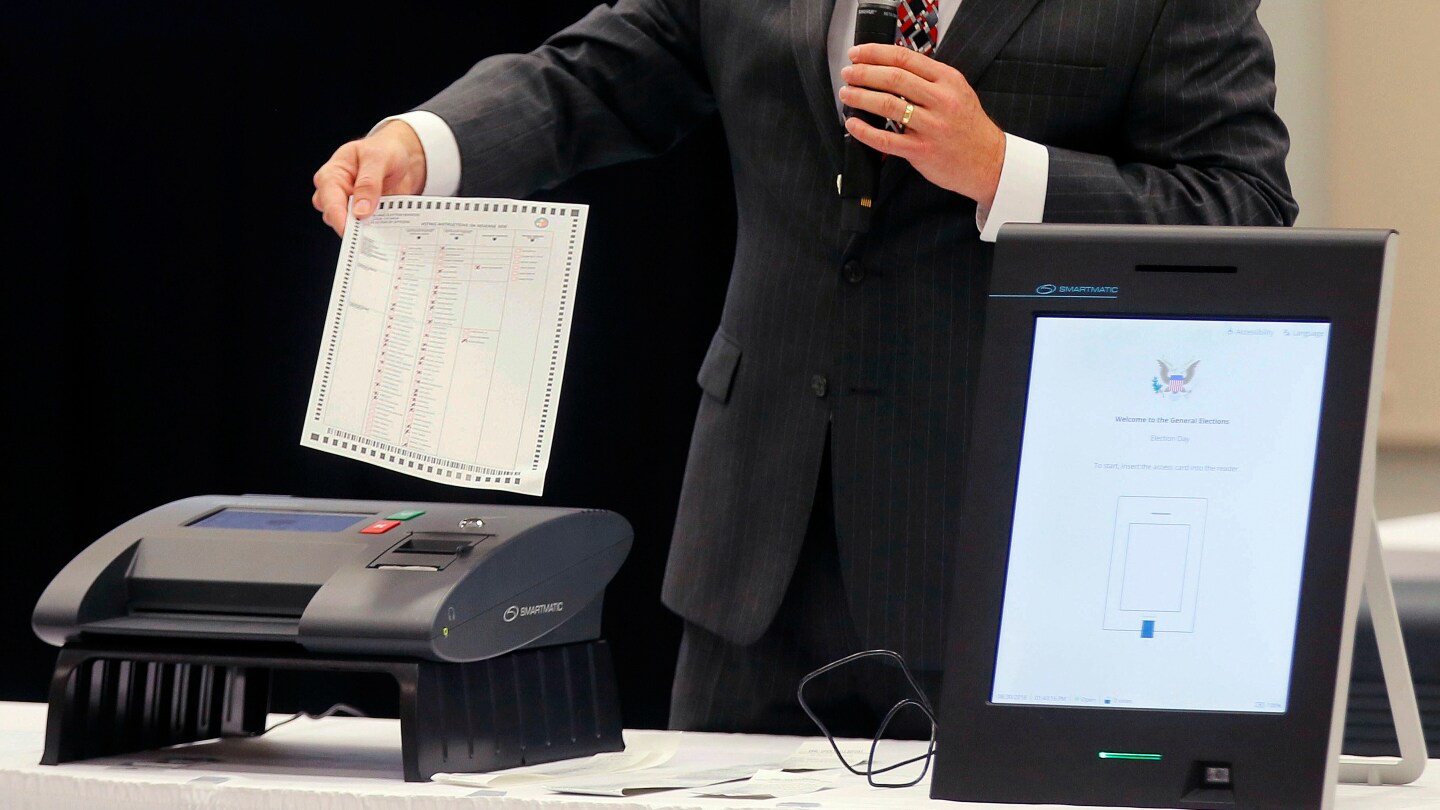

US prosecutors charge Smartmatic in alleged $1M Philippines bribery case

Federal prosecutors in Miami have leveled serious charges against voting technology firm Smartmatic, accusing the company of money laundering and other crimes tied to alleged bribery schemes in the Philippines. According to a superseding indictment filed in a Florida federal court, several Smartmatic executives, including co-founder Roger Pinate, are accused of paying over $1 million in bribes to Philippine election officials between 2015 and 2018. The payments were allegedly made to secure a government contract for managing the 2016 presidential election and ensuring timely payment for services rendered. Pinate, who no longer works for Smartmatic but remains a shareholder, has pleaded not guilty to the charges. This criminal case emerges as Smartmatic is embroiled in a separate $2.7 billion defamation lawsuit against Fox News, alleging the network falsely accused the company of rigging the 2020 U.S. presidential election. Smartmatic has vehemently denied the allegations, claiming the U.S. Attorney’s Office in Miami has been misled and influenced by unnamed powerful interests. The company stated, ‘This is again, targeted, political, and unjust. Smartmatic will continue to stand by its people and principles. We will not be intimidated by those pulling the strings of power.’ Prosecutors have also sought to introduce evidence suggesting that revenue from a $300 million contract with Los Angeles County was diverted into a ‘slush fund’ controlled by Pinate through offshore shell companies and fake invoices. Additionally, Pinate is accused of bribing Venezuela’s former election chief with a luxury home in Caracas, allegedly to mend relations after Smartmatic’s abrupt exit from Venezuela in 2017. A hearing on these allegations is scheduled for next month. Founded over two decades ago in Venezuela, Smartmatic gained prominence under the late President Hugo Chavez and expanded globally, providing election technology in 25 countries. However, the company claims its business suffered significantly following Fox News’ coverage of the 2020 election controversy.