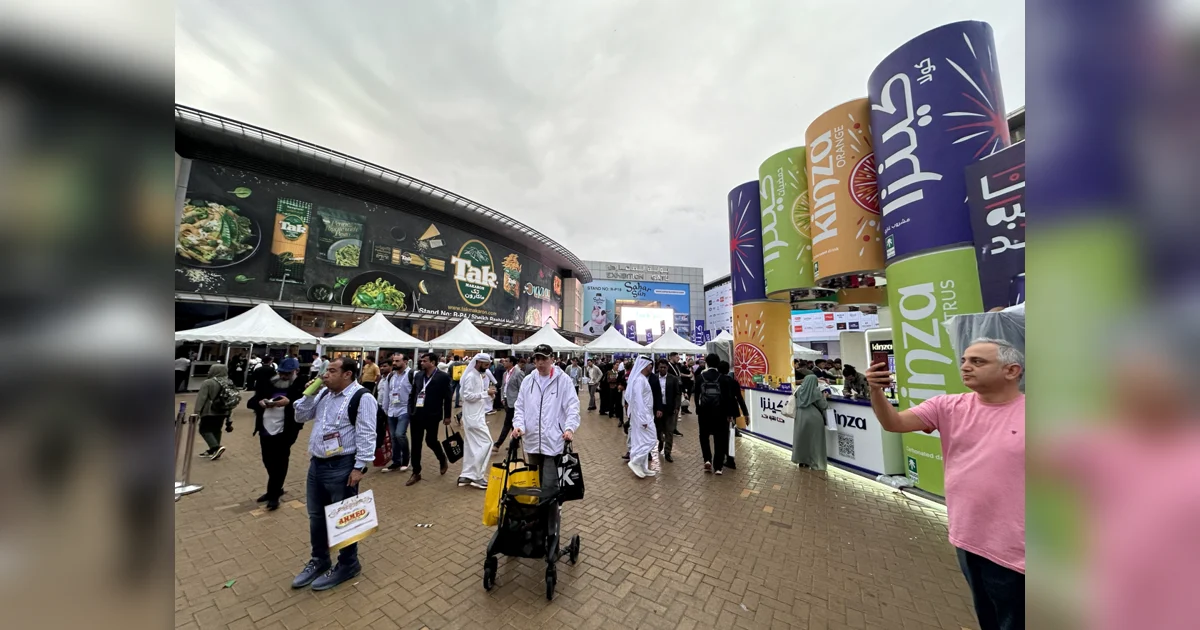

Dubai has reaffirmed its status as a global leader in the exhibitions and events sector during a landmark industry gathering that brought together key stakeholders from around the world. The event, attended by global organizers, government representatives, and industry innovators, showcased Dubai’s vision for the future of international exhibitions and its role in shaping the next decade of global trade, business networking, and sustainable growth.

分类: business

-

UAE: 2-year licence fee exemption for businesses amid infrastructure works in some RAK areas

In a significant move to bolster the private sector and mitigate the challenges posed by ongoing infrastructure developments, Sheikh Saud bin Saqr Al Qasimi, Supreme Council Member and Ruler of Ras Al Khaimah, has announced a two-year exemption from commercial licence fees for businesses in the Al Riffa and Al Jazeera Al Hamra areas. This initiative underscores the government’s commitment to fostering a resilient and competitive economic environment while ensuring the continuity of local enterprises. The Ras Al Khaimah Department of Economic Development emphasized that this decision aligns with the leadership’s vision to empower businesses, enhance economic confidence, and stimulate growth across the Emirate. By alleviating financial burdens on businesses affected by construction works, the government aims to strengthen Ras Al Khaimah’s position as a regional business hub and promote sustainable development. This strategic measure reflects the UAE’s broader efforts to support the private sector and create a conducive environment for economic prosperity.

-

GFS Developments marks a new milestone with grand groundbreaking ceremony

GFS Developments, a leading global real estate developer, celebrated a significant milestone with a grand groundbreaking ceremony, underscoring its commitment to innovation, sustainability, and lifestyle-driven communities. The event, held on October 17, 2025, was attended by renowned actress and GFS brand ambassador Tamannaah Bhatia, whose presence highlighted the company’s vision of luxury and cosmopolitan living. With over 25 years of industry expertise, GFS Developments has delivered more than 2 million units across 10+ countries, setting new standards in modern residential and mixed-use developments. Michael Collings, General Manager of GFS Developments, reiterated the company’s mission to create world-class communities that inspire confidence and pride. The company’s flexible payment structures and tailored financial solutions cater to both end-users and investors, ensuring convenience and long-term value. Bhatia praised GFS for its future-ready approach, blending innovation and trust to redefine urban living. As GFS continues to expand globally, it remains dedicated to delivering projects that embody sustainability, modern luxury, and excellence.

-

Tanishq brings the magic of ‘India Wali Diwali’ to the heart of the UAE and GCC

Tanishq, India’s renowned jewellery brand under the Tata Group, is bringing the essence of ‘India Wali Diwali’ to the UAE and GCC regions this festive season. The brand has unveiled a vibrant campaign that encapsulates the traditions, emotions, and togetherness of Diwali, making it a celebration of love, laughter, and legacy. The campaign aims to recreate the sights, sounds, and soul of an Indian Diwali, ensuring that the festive spirit resonates with people, no matter where they are. From the glow of diyas to the shimmer of gold, Tanishq’s initiative is a heartfelt tribute to the cherished moments that make Diwali special. To enhance the festive experience, Tanishq has introduced exclusive offers, including savings on gold and diamond jewellery, zero deductions on gold exchange, and advance booking benefits to safeguard against rising gold prices. These limited-time promotions are designed to make festive shopping more rewarding, encouraging customers to invest in meaningful pieces that carry lasting value. Aditya Kejriwal, head of marketing for Titan Company Limited’s international business, emphasized that Diwali is more than a festival—it’s an emotion that connects people to their roots and to each other. The ‘India Wali Diwali’ campaign reflects this sentiment, celebrating the idea that the spirit of Diwali transcends geographical boundaries. The campaign is supported by a festive film that captures moments of joy, belonging, and shared celebration, reinforcing Tanishq’s belief that jewellery is not just adornment but a symbol of love and connection. The brand’s festive collection features designs that embody Diwali’s optimism and elegance, crafted with timeless artistry and intricate detailing. Each piece is designed to evoke the beauty of connection, whether as a gift for a loved one or a celebration of one’s personal journey.

-

Political deadlock and spending on dual crises leaves French finances in disarray

France, the world’s seventh-largest economy and a cornerstone of the European Union, is grappling with a severe fiscal crisis. Despite its industrial prowess, the nation faces mounting debt, political gridlock, and rising borrowing costs, raising concerns about its financial stability and broader implications for Europe and the global economy.

**The Roots of the Crisis**

France’s fiscal woes stem from a combination of long-standing structural issues and recent external shocks. The country last balanced its budget in 1973, relying on robust economic growth to sustain its generous welfare state and worker protections. However, accumulated debt has soared, exceeding 90% of GDP since 2008. The COVID-19 pandemic and the subsequent energy crisis triggered by Russia’s invasion of Ukraine exacerbated the situation. The government’s heavy spending on subsidies to support businesses and households during these crises pushed debt to 114% of GDP in 2023, with the annual deficit ballooning to 5.8%, far above the EU’s 3% limit.**Political Paralysis and Economic Uncertainty**

President Emmanuel Macron’s government is hamstrung by a deeply divided parliament, resulting from snap elections called in 2022. With no political faction holding a majority, consensus on deficit reduction measures—whether through tax hikes or spending cuts—remains elusive. This political deadlock has led to four government changes in just over a year, creating unprecedented instability in France’s Fifth Republic. The uncertainty has unsettled businesses, while rising bond yields have increased borrowing costs for both the government and private sector.**Broader Implications for Europe and Beyond**

As one of the EU’s largest economies, France’s fiscal troubles pose significant challenges for the bloc. The Franco-German partnership, traditionally the driving force behind EU policy, is under strain. Europe faces pressing issues, including supporting Ukraine, countering Russian aggression, and boosting productivity to compete with the U.S. and China. France’s inability to address its debt crisis complicates these efforts.Globally, France’s situation serves as a cautionary tale for other heavily indebted nations, including the U.S., China, and Brazil. While France is not at immediate risk of default, the potential for a debt spiral—where rising borrowing costs undermine fiscal sustainability—looms large. The EU’s bailout mechanisms and the European Central Bank’s financial backstop offer some reassurance, but these measures are contingent on political action, which remains absent in France.

**A Call for Urgent Reforms**

Market analysts emphasize that France must avoid the fate of Greece and Italy during the 2010-2015 eurozone debt crisis. Long-term solutions require structural reforms to boost economic growth and restore fiscal discipline. However, the current political impasse makes such reforms unlikely in the near term. As France’s fiscal crisis deepens, the stakes for Europe and the global economy continue to rise. -

UGREEN to host ‘Activate Your Connection’ summit in Dubai

UGREEN, a leading consumer technology brand, recently held its Middle East Partner Summit 2025 at the Shangri-La Hotel in Dubai. Themed ‘Activate Your Connection,’ the event gathered over 150 prominent distributors, resellers, retailers, and media representatives from the GCC region. The summit highlighted UGREEN’s commitment to fostering collaboration, exploring new opportunities, and showcasing its latest technological innovations. Central to the event was UGREEN’s philosophy that long-term success in the Middle East is rooted in strong partnerships. Attendees were treated to an immersive product showcase, featuring cutting-edge technologies such as the UGREEN Nexode Series, which utilizes Advanced GaN II Technology for enhanced safety and efficiency, and the UGREEN MagFlow Series, a new generation of Qi-based magnetic wireless chargers. The choice of Dubai as the summit’s location underscores UGREEN’s strategic focus on the Middle East, aligning with its participation in GITEX Global 2025 to maximize visibility among key stakeholders. Jessie Fu, UGREEN’s senior sales manager, emphasized the brand’s dedication to integrating into the local ecosystem and collaborating with partners to drive future growth. The summit not only showcased innovative products but also symbolized UGREEN’s vision of building stronger business relationships and empowering its partners.

-

Egypt to freeze domestic fuel prices for a year after latest hike

In a significant move to stabilize its economy, Egypt has announced a one-year freeze on domestic fuel prices following a recent increase. The decision, confirmed by the petroleum ministry, comes after the government raised prices on a wide range of fuel products by 10.5% to 12.9%, marking the second hike this year. This aligns with Egypt’s broader strategy to reduce subsidies and address its budget deficit. Diesel, a widely used fuel in the country, saw a price increase of 2 Egyptian pounds ($0.0421) to 17.50 pounds per litre. The government remains committed to aligning domestic fuel prices with actual costs by December, as part of its agreement with the International Monetary Fund (IMF) under an $8 billion loan. The IMF has urged Egypt to cut subsidies on fuel, electricity, and food while expanding social safety nets. Despite these measures, Egypt’s current account deficit stood at $2.2 billion in the second quarter, with oil product imports rising to $500 million from $400 million a year earlier. The freeze aims to provide economic stability amid global market uncertainties.

-

Egypt raises fuel prices for the second time this year

Egypt announced a 12% increase in fuel prices on Friday, marking the second such hike this year. The decision, communicated via a government Facebook post, did not specify the rationale behind the move but assured citizens that fuel prices would remain unchanged for at least one year. This adjustment is expected to exacerbate the already high cost of living, as Egyptians continue to face escalating inflation and rising daily expenses. Last year, the country witnessed significant price surges in fuel, subway fares, and a depreciation of the Egyptian pound against foreign currencies. According to the Central Bank of Egypt, annual urban consumer price inflation stood at 11.7% in September, down from 12% in August and 13.9% in July. The latest fuel price adjustments include diesel, which rose from 15.50 pounds ($0.33) to 17.50 pounds ($0.37) per liter, and 92-octane gasoline, which increased from 17.25 pounds ($0.36) to 19.25 pounds ($0.40) per liter. The government emphasized its commitment to maintaining refinery operations at full capacity and incentivizing partners to boost production, reduce import costs, and stabilize prices. Earlier this year, the minimum monthly wage was raised to 7,000 pounds ($138) from 6,000 pounds ($118.58) to alleviate some economic pressures. Egypt’s economy has been severely impacted by years of austerity measures, the COVID-19 pandemic, the Ukraine conflict, and the Israel-Hamas war. Additionally, Houthi attacks on Red Sea shipping routes have significantly reduced Suez Canal revenues, a critical source of foreign currency. In response to these challenges, Egypt secured an $8 billion bailout from the IMF, with fuel price hikes deemed necessary to meet the fund’s conditions for further financial assistance.

-

Experts: Washington’s policy shifts shroud global outlook

Recent shifts in US economic policies, including heightened tariffs and stricter immigration controls, are generating significant uncertainty and volatility in the global economic landscape, experts warn. During a recent webcast, Adam S. Posen, President of the Peterson Institute for International Economics, emphasized that the US economy is currently the primary source of global instability. These policy changes are dampening international trade and investment, with potential ripple effects across both advanced and emerging markets. The Peterson Institute’s semiannual forecast, released on October 9, 2025, highlighted that while optimism around artificial intelligence (AI) has temporarily buoyed the US economy, escalating trade barriers and reduced labor inflows are likely to exacerbate inflation and slow growth. The International Monetary Fund (IMF) echoed these concerns in its World Economic Outlook, projecting a gradual decline in global growth from 3.3% in 2024 to 3.1% in 2026, citing protectionism and policy uncertainty as key headwinds. US tariffs, now at their highest levels in nine decades, have sparked retaliatory measures and temporary trade front-loading, masking underlying economic weaknesses. Immigration restrictions have further strained labor markets, with net inflows reduced by an estimated 2 million in 2025. Despite these challenges, global GDP growth has been revised upward to 3.1% for 2025, driven by temporary factors such as inventory buildup and trade front-loading. However, experts caution that these practices are unsustainable and that inflationary pressures may intensify in the coming years. Emerging markets, particularly China and India, continue to sustain growth despite these headwinds, with China’s exports performing ‘surprisingly well.’ The IMF forecasts emerging market growth above 4%, with China playing a pivotal role in offsetting global economic slack. However, fragmentation in global trade is expected to limit gains, with trade growth projected at just 2.9% in 2025–2026. Posen concluded that US economic volatility remains the dominant force shaping the global outlook, with its policy responses to growth and inflation likely to have far-reaching consequences.

-

Shutdown could cost US economy $15b a week: Treasury

The ongoing US federal government shutdown, now in its third week, is projected to cost the economy up to $15 billion per week in lost output, according to a Treasury official. This clarification came after Treasury Secretary Scott Bessent initially overstated the impact, suggesting a daily loss of $15 billion. Bessent later corrected his statement, emphasizing the significant economic strain caused by the shutdown. The revised estimate is based on a report by the White House Council of Economic Advisers. Bessent warned that the shutdown is beginning to ‘cut into the muscle’ of the US economy, despite the sustained investment boom in sectors like artificial intelligence (AI). He attributed the economic momentum to President Donald Trump’s policies, including tax incentives and tariffs, which he compared to transformative periods in US history, such as the railroad expansion in the late 1800s and the internet boom of the 1990s. However, the shutdown has created a major obstacle to continued growth. The political deadlock in Congress over spending has intensified, with Trump threatening mass layoffs of federal workers. On Wednesday, a federal judge in California issued a temporary restraining order to halt the planned layoffs of 10,000 workers, following a lawsuit by labor unions. The judge ruled that the layoffs were ‘not ordinary’ and potentially illegal, especially as many employees were unaware of their termination due to inaccessible government email accounts during the shutdown.