In a significant move to bolster industrial development in Xinjiang’s border regions, a 10-billion-yuan ($1.4 billion) industrial fund was officially launched in Beijing on Sunday. The initiative, unveiled during the Conference on Financial Support for High-Quality Industrial Development in Xinjiang’s Border Areas, aims to accelerate the modernization of industries in Tacheng prefecture, a strategically important area in northwest China. The Tacheng High-Quality Industrial Investment Fund, with an initial commitment of one billion yuan, is a collaborative effort between Beijing Hangke Junfu Private Fund Management Center (LLP) and New China Asset Management Co., Ltd. The fund will operate under a parent-subsidiary structure, with seven sub-funds designed to support enterprises at various stages of growth, from startups to established companies. This financial injection is expected to enhance Tacheng’s economic resilience, attract investment, and foster innovation in key sectors such as manufacturing, technology, and agriculture. The initiative underscores China’s broader strategy to promote balanced regional development and strengthen the economic foundations of its border areas.

分类: business

-

Chinese vice-premier urges trust and cooperation as trade talks conclude

Chinese Vice-Premier He Lifeng, a key member of the Political Bureau of the Communist Party of China Central Committee, concluded the fifth round of China-US trade talks in Kuala Lumpur on October 26, 2025, by emphasizing the importance of mutual trust, managing differences, and expanding mutually beneficial cooperation. The two-day discussions, attended by US Treasury Secretary Scott Bessent, aimed to elevate bilateral economic and trade relations to new heights. He Lifeng highlighted that the essence of China-US economic and trade relations lies in mutual benefit and win-win cooperation, stressing that confrontation harms both nations. He urged both sides to safeguard the ‘hard-won outcomes’ achieved through months of consultations, noting that stable development of these relations serves the fundamental interests of both countries and aligns with international expectations. Key issues discussed included the US Section 301 probe into Chinese shipping and shipbuilding industries, the extension of the tariff truce set to expire on November 10, fentanyl-related tariffs, counternarcotics law enforcement cooperation, agricultural trade, and export controls. The talks were described as ‘candid, in-depth, and constructive,’ with both sides reaching a basic consensus on addressing each other’s concerns and agreeing to finalize specific details and complete domestic approval procedures.

-

China, US reach basic consensuses on arrangements to address respective trade concerns

In a significant development for global trade relations, China and the United States have reached foundational agreements to address mutual trade concerns following intensive discussions in Kuala Lumpur, Malaysia. The talks, held over two days, were led by Chinese Vice-Premier He Lifeng and US Treasury Secretary Scott Bessent, alongside US Trade Representative Jamieson Greer. The negotiations were guided by the strategic consensus established by the leaders of both nations during their recent communications. The discussions covered a range of critical issues, including the US Section 301 measures targeting China’s maritime, logistics, and shipbuilding sectors, the extension of tariff suspensions, fentanyl-related tariffs, agricultural trade, and export controls. Both parties have committed to detailing these agreements and navigating their respective domestic approval processes. Vice-Premier He emphasized the mutual benefits of stable Sino-American trade relations, advocating for dialogue based on mutual respect and win-win cooperation. He also highlighted the importance of implementing the agreements reached during the leaders’ discussions and the outcomes of this year’s trade talks to foster trust and expand cooperation. The US delegation acknowledged the pivotal nature of the US-China economic relationship and expressed a readiness to collaborate with China to resolve differences and enhance mutual development. Both sides agreed to utilize the established economic and trade consultation mechanisms to ensure the sustainable and beneficial growth of their economic relations, aiming to contribute positively to global prosperity.

-

Stable China-US relations paramount to global economy, Chinese official says

A high-ranking Chinese official has underscored the critical importance of maintaining stable economic and trade relations between China and the United States, asserting that such stability is vital not only for the two nations but also for the global economy. Li Chenggang, China’s international trade representative at the Ministry of Commerce, made these remarks following the conclusion of the latest round of China-US economic and trade talks held in Kuala Lumpur, Malaysia, on October 25, 2025. Li emphasized that the recent turbulence in bilateral relations is not in line with Beijing’s objectives, and both countries are committed to fostering a constructive and stable partnership. He highlighted that China has diligently adhered to the consensus reached in numerous high-level discussions between the two nations’ leaders, working to implement the outcomes of economic and trade consultations and preserving the ‘hard-won relative stability’ in their relationship. The Kuala Lumpur talks were described as in-depth, candid, and constructive, with the outcomes awaiting domestic approval from both sides. Moving forward, Li stated that China and the US will enhance communication and collaboration to ensure the steady and healthy development of their economic and trade ties.

-

China, US reach initial consensus on key trade issues

In a significant development, China and the United States have achieved preliminary agreements on several pivotal trade issues, as announced by a senior Chinese official on Sunday. The discussions, held in Kuala Lumpur, Malaysia, addressed key areas such as export controls, the extension of the 90-day tariff truce, fentanyl-related tariffs, the expansion of bilateral trade, and US port fees. Li Chenggang, China’s international trade representative at the Ministry of Commerce, described the talks as ‘constructive’ following the conclusion of the fifth round of China–US economic and trade negotiations since May. The negotiations took place at Merdeka 118, the world’s second-tallest building, and commenced on Saturday. This round of talks was particularly crucial as the already-extended 90-day tariff truce is nearing its expiration on November 10. The agreements mark a positive step towards resolving longstanding trade disputes between the two economic giants, potentially paving the way for more stable and cooperative economic relations in the future.

-

China, US teams have in-depth, candid discussion, says China int’l trade representative

In a significant development for global trade relations, Chinese and US trade teams recently held in-depth and candid discussions, as reported by China’s international trade representative. The talks, which took place against a backdrop of ongoing economic tensions, aimed to address key issues affecting bilateral trade and explore avenues for mutual cooperation. The Chinese representative emphasized the importance of open dialogue in fostering a stable and predictable trade environment. While specific details of the discussions were not disclosed, the meeting is seen as a positive step toward resolving longstanding disputes and enhancing economic ties between the two nations. This engagement comes at a critical juncture, as both countries navigate the complexities of global supply chains, technological competition, and geopolitical dynamics. The outcome of these talks could have far-reaching implications for international trade policies and market stability.

-

Dubai’s transport projects lift property prices by up to 16%

Dubai’s property market has witnessed a significant surge, with prices increasing by up to 16% due to the emirate’s extensive transport and infrastructure projects, according to a recent study by McKinsey & Company commissioned by the Roads and Transport Authority (RTA). The report highlights that proximity to metro stations and major highways has been a critical factor in driving real estate appreciation. Areas such as Downtown Dubai, Dubai Marina, and Business Bay, which are well-connected to the transport network, have experienced gains surpassing the overall market average, underscoring the importance of improved accessibility and reduced travel times in boosting property demand. The study, released on the RTA’s 20th anniversary, emphasizes the transformative role of the Dubai Metro, the first of its kind in the Gulf region. Over the past 16 years, the Metro has reduced travel distances by nearly 29.8 billion kilometers, alleviating congestion and enhancing mobility between business and residential districts. The Metro and Tram networks span over 100 kilometers across the emirate. Additionally, Dubai’s road network has made the city more accessible than comparable global cities, contributing to a reduction of 9.5 million tonnes of carbon dioxide emissions over 15 years. This reduction, equivalent to several billion dirhams in global carbon credit trading, has also positively impacted public health by decreasing respiratory and cardiovascular illnesses. The upcoming Dubai Metro Blue Line, a 30-kilometer extension with 14 stations, is expected to serve six key districts with a projected population of one million by 2040. The study links Dubai’s growth to two decades of sustained investment in mobility infrastructure, with Dh175 billion invested since 2005, generating Dh150 billion in revenues and saving Dh319 billion in fuel and time costs. RTA’s projects have contributed Dh156 billion to Dubai’s GDP, while property values have risen by Dh158 billion due to enhanced connectivity. The internal rate of return on RTA’s investments is estimated at 5%, with total cash returns projected to exceed Dh254 billion by 2050. Over the past decade, RTA’s initiatives have attracted Dh32.4 billion in foreign direct investment, particularly in logistics, distribution, and transport services. The study also highlights Dubai’s cost efficiency in infrastructure delivery, with the average annual length of road lanes built by RTA reaching 829 kilometers, double the global average. Mattar Al Tayer, Director General of the RTA, stated that transport investments have been a catalyst for Dubai’s long-term growth and that the emirate is preparing for a new era of sustainable mobility in 2026 with the introduction of autonomous taxis and aerial taxi services. Dubai has already commenced trial flights for its air taxis, with a network of vertical take-off and landing stations set to be established across the city by next year. The RTA has also launched a program to test autonomous taxis, aiming for 25% of total mobility in Dubai to be autonomous by 2030.

-

New ‘retail sukuk’ initiative: UAE residents can buy govt bonds from just Dh4,000

The UAE has introduced a groundbreaking ‘Retail Sukuk’ initiative, enabling citizens and residents to invest in sovereign-backed Islamic financial instruments with a minimum investment of just Dh4,000. Announced by Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister, and Minister of Finance, this initiative aims to democratize access to public-sector financing while fostering a culture of saving and financial inclusion. The retail version of the government’s T-Sukuk programme allows individual investors to lend money to the federal government through Shariah-compliant instruments, receiving periodic profit payments and the face value at maturity. Previously reserved for institutional investors, this rollout marks a significant shift in the UAE’s financial-market architecture. The initiative aligns with the leadership’s vision of empowering individuals, promoting economic participation, and strengthening the domestic debt capital market. For residents, this offers a secure, government-guaranteed investment channel, diversifying savings beyond conventional deposits or real estate. The first participating bank is set to be announced on November 3, 2025. The broader public policy implications include enhancing financial inclusion, reducing reliance on foreign-currency debt, and reinforcing the UAE’s capital-market infrastructure. This initiative represents a strategic move to deepen the financial-market architecture while providing accessible investment opportunities for everyday residents.

-

Civil aviation sector shows growth with release of upcoming flight season

China’s civil aviation industry has unveiled its 2025/26 winter-spring flight season, marking a significant step in the sector’s recovery and growth. The Civil Aviation Administration of China (CAAC) announced the new schedule on Sunday, which will run from October 26, 2025, to March 28, 2026. This season will see 210 domestic and international airlines operating approximately 119,500 passenger and cargo flights weekly, reflecting a 1.3 percent increase from the previous year. International routes are set to experience substantial growth, with 191 airlines planning to operate 21,427 international flights per week—a 10.8 percent year-on-year increase. These flights will connect China with 83 countries, including the resumption of passenger services between China and India after a five-year hiatus. New routes will also link China with Oman and Argentina for passenger travel, and with Panama, Chile, and Switzerland for cargo services. Major hubs such as Beijing, Shanghai, and Guangzhou will handle 52.1 percent of international passenger flights, up 8.6 percentage points from last year. Beijing Capital International Airport will average 1,243 daily flights, including 166 international services, while Beijing Daxing International Airport will operate about 979 flights daily, with 82 international and regional services. Airlines like China Southern, China Eastern, and Air China are expanding their networks, introducing new routes and increasing frequencies on existing ones, signaling a robust recovery and growth trajectory for China’s aviation sector.

-

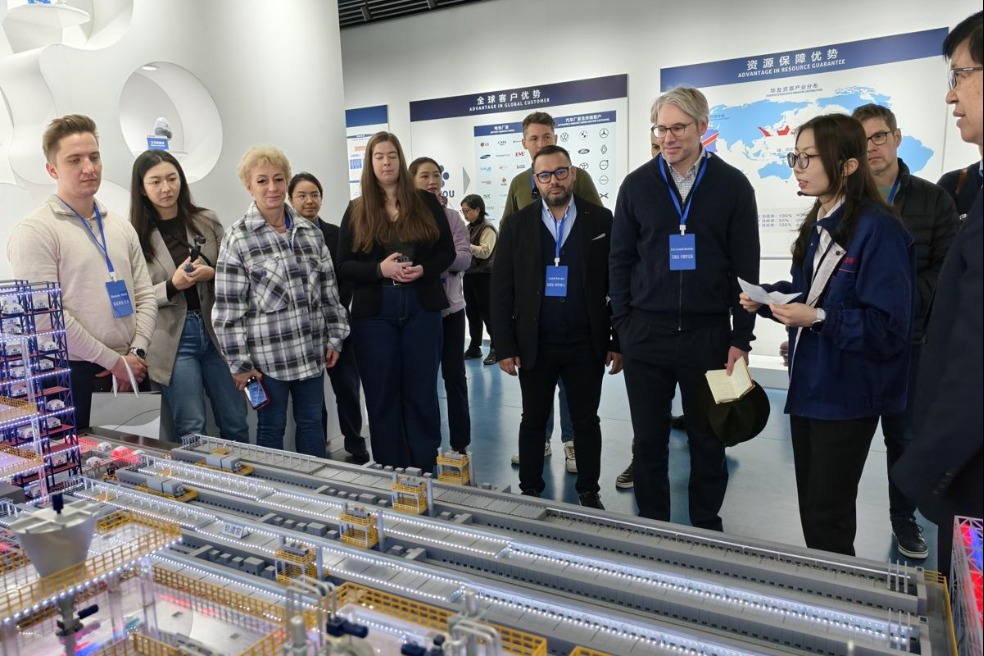

China’s industrial development driving economic growth in Europe, scholars say

China’s relentless pursuit of a modernized industrial system is not only bolstering its own economy but also significantly contributing to the economic growth of Hungary and broader Europe. This development is also playing a pivotal role in global climate change mitigation efforts, according to European scholars. These insights were shared during a recent research tour by a Hungarian think tank delegation in Sichuan province, China. The delegation, which included Eric Cornelis Hendriks, a Dutch sociologist and visiting fellow at the Danube Institute, visited several industrial projects in Chengdu, the capital of Sichuan province, from October 25 to 26, 2025. Hendriks expressed particular admiration for China’s advanced industrial capabilities during a visit to Chengdu B&M Science and Technology Co Ltd, a subsidiary of Huayou Cobalt. He highlighted a high-nickel ternary cathode material green manufacturing project in Hungary, which is currently under construction and slated for operation next year. This project exemplifies the growing industrial collaboration between China and Europe, underscoring the mutual benefits of such partnerships.