Yum! Brands, the parent company of Pizza Hut, is reportedly evaluating the potential sale of its iconic pizza chain as it grapples with declining sales and fierce competition in the fast-food industry. Pizza Hut has faced multiple quarters of falling same-store sales in the United States, a critical market that accounts for 42% of its global revenue. This downturn has overshadowed growth in other regions, prompting Yum! Brands to explore strategic alternatives. In a recent statement, CEO Chris Turner emphasized the need for decisive action to unlock Pizza Hut’s full potential, suggesting that the brand might thrive better under new ownership. The pizza division’s struggles contrast sharply with the performance of Yum!’s other major brands, KFC and Taco Bell, which have both demonstrated resilience. Taco Bell, known for its affordable offerings, saw a 7% increase in same-store sales last quarter, while KFC posted a 3% rise despite economic headwinds. Pizza Hut, however, reported a 1% decline in sales at existing outlets. The chain operates approximately 20,000 stores worldwide, with 6,500 in the U.S., but has lost ground to competitors like Domino’s and Papa Johns. Domino’s recently reported a 6% surge in quarterly sales, partly driven by promotional strategies. Yum! Brands, which derives about 11% of its operating profits from Pizza Hut, has not set a timeline for a decision on the brand’s future. The broader fast-food industry is also feeling the pinch of cautious consumer spending, exacerbated by inflation and labor market challenges. In the U.K., Pizza Hut is closing half of its restaurants as consumers increasingly favor more agile competitors. Despite these challenges, Turner described U.S. consumers as ‘cautious but incredibly resilient,’ noting that Taco Bell’s sales have remained stable amid macroeconomic pressures.

分类: business

-

European Union welcomes suspension of China’s rare earth controls

In a significant move to secure the global supply chain of critical materials, the European Union (EU) and China have reached an agreement to stabilize the trade of rare earth materials and products. These elements are indispensable for high-tech and military applications, making their steady flow crucial for both economies. The agreement follows a series of discussions between EU Trade Commissioner Maroš Šefčovič and Chinese Commerce Minister Wang Wentao in Brussels last Friday. The talks centered on China’s export controls on rare earths, implemented in April and October, and the EU’s regulations on semiconductor sales. Olof Gill, a spokesperson for the European Commission, highlighted the EU’s reliance on China for rare earth materials, which are essential for manufacturing magnets used in automobiles and household appliances. The EU welcomed China’s recent 12-month suspension of rare earth export controls and emphasized the need for a stable trade system. Both parties are collaborating on an export licensing mechanism to ensure a consistent supply of these critical minerals. Šefčovič noted that Brussels and Beijing are committed to further discussions on trade measures, aiming to enhance the implementation of export control policies. With China being the EU’s second-largest trading partner, bilateral trade remains a cornerstone of the global economy, valued at approximately 2.3 billion euros ($2.7 billion) daily. The agreement underscores the shared interest of both regions in maintaining stable trade relations and advancing mutual climate goals.

-

UAE strengthens renewable energy drive ahead of Adipec 2025

As the world prepares for Adipec 2025 in Abu Dhabi, the United Arab Emirates (UAE) is intensifying its renewable energy initiatives, transforming its national ambitions into actionable strategies. The UAE’s Energy Strategy 2050, launched in 2017, aims to triple the contribution of renewables to its energy mix by 2030, a critical step in reducing carbon emissions and diversifying energy sources in a fossil fuel-dependent global economy. This strategy is underpinned by significant investments, international collaborations, and cutting-edge digital innovations. Key projects like the Mohammed Bin Rashid Al Maktoum Solar Park in Dubai and Masdar’s global renewable energy investments highlight the UAE’s commitment to clean energy. These initiatives not only address climate concerns but also position the UAE as a competitive player in the sustainable energy market. Adipec 2025 will serve as a platform to explore the intersection of artificial intelligence (AI) and energy, with AI-powered systems projected to unlock $1.3 trillion in global economic value by 2030. The conference will also focus on hydrogen energy, policy frameworks, and infrastructure investments, showcasing the UAE’s integrated approach to energy transition. As the UAE progresses toward its Net Zero by 2050 target, Adipec 2025 will evaluate the nation’s advancements and the global readiness to embrace a renewable-driven future.

-

Dubai: Gold prices rise slightly; analysts say global costs could jump over $4,100

Gold prices experienced a modest increase in Dubai on Tuesday, with 24K gold rising to Dh480.25 per gram, while 22K, 21K, and 18K gold stood at Dh444.75, Dh426.50, and Dh365.25 per gram, respectively. This slight uptick comes after a dip in global spot prices, which fell to $3,971.26 per ounce at 10am UAE time, with silver priced at $47.56. The decline in gold prices on Monday was attributed to fading hopes of another interest rate cut by the US Federal Reserve in December, causing prices to drop below $4,000 at the start of Tuesday’s trading session. However, analysts are now predicting a potential surge in gold prices, driven by a weak ISM Manufacturing PMI report. The PMI stood at 48.7, significantly lower than the expected 49.4, signaling a slowdown in the US economy. Nadir Belbarka, an analyst at XMArabia, described the weak PMI as a ‘gut punch’ for the Federal Reserve, suggesting that a rate cut in December could ‘supercharge’ gold’s appeal as a safe-haven asset. Belbarka also noted that the US dollar is under pressure, down nearly 0.6%, with further declines likely if risk-off sentiment intensifies. He anticipates gold could reach $4,100 this week as inflation fears subside and real yields decline. Last month, gold prices rallied to record highs before sharply falling towards the end of the month. Analysts expect no major movements in gold prices for the remainder of the year.

-

US tech stocks soar: Will Wall Street’s AI bubble last?

As the US stock market soared to record highs in October 2025, fueled by the artificial intelligence (AI) boom, investors are questioning whether this surge represents a sustainable trend or an impending bubble. While comparisons to the dot-com bubble of the late 1990s are inevitable, experts argue that the current AI-driven rally is fundamentally different, supported by robust earnings growth and long-term technological advancements.

-

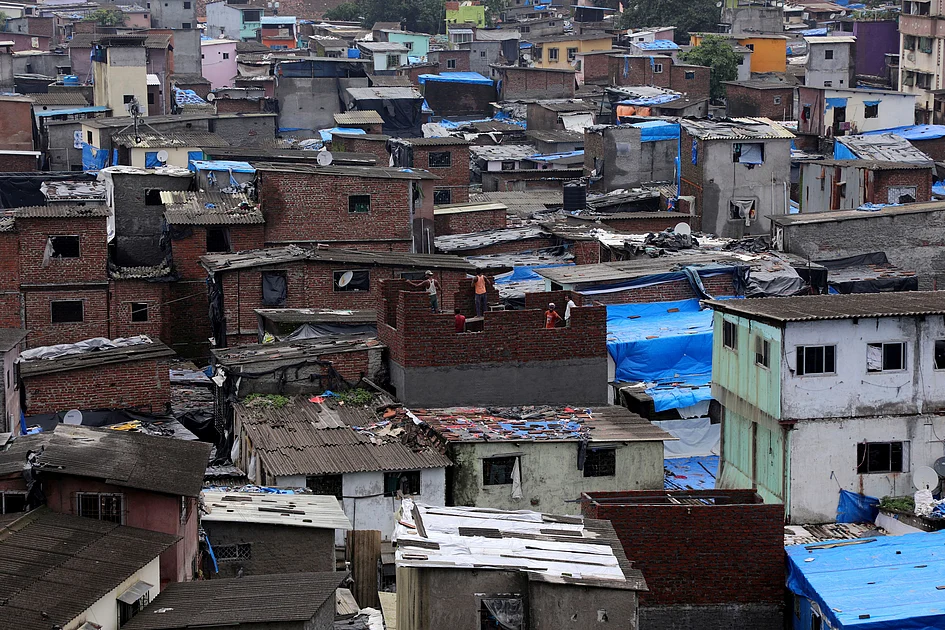

Dubai firm reaches India’s top court over cancelled Dharavi slum redevelopment bid

A Dubai-based consortium, SecLink Technologies Corporation, has escalated its legal battle to India’s Supreme Court after its bid for the redevelopment of Mumbai’s Dharavi slum was controversially cancelled. The project, one of Asia’s most ambitious urban transformation initiatives, aims to revitalize one of the world’s largest slum settlements, home to over one million residents. The redevelopment is estimated to generate over Dh125 billion in long-term commercial value. SecLink emerged as the highest bidder in 2019 with an offer of Dh3 billion, but the process was abruptly cancelled, and revised criteria introduced in 2022 excluded the consortium from participating again. The contract was subsequently awarded to the Adani Group. SecLink alleges that the rule changes undermined fair competition and has offered a revised bid of Dh3.6 billion, committing to meet all new obligations. The Supreme Court has ordered the state government to produce all relevant documents for scrutiny and has placed project payments under judicial supervision. The next hearing is scheduled for November 13, 2025.

-

Britain’s Treasury chief prepares the ground for a tax-hiking budget

In a significant pre-budget announcement, UK Treasury Chief Rachel Reeves has indicated that tax increases are likely in the forthcoming budget, scheduled for November 26. Reeves, in an unusual move, addressed the public and financial markets three weeks ahead of the budget, preparing them for potential hikes in income and sales taxes. This decision marks a departure from her earlier election pledge to avoid such increases. Reeves emphasized the necessity of collective contribution to secure the nation’s future, hinting at broad tax adjustments. She attributed the need for these measures to several factors, including the UK’s substantial £2.6 trillion national debt, lower-than-expected productivity, and global economic challenges such as U.S. President Donald Trump’s tariffs, volatile supply chains, and rising government borrowing costs. Reeves also pointed to the economic mismanagement by the previous Conservative government, which has left the UK particularly vulnerable. Despite these challenges, Reeves aims to deliver a budget focused on growth, fairness, and strengthening public services, while reducing national debt and controlling inflation. However, her approach has faced criticism for being overly pessimistic and for increasing business taxes in the previous budget. Additionally, Reeves has been under scrutiny for allegedly renting out her London house without a proper license, a mistake for which she has apologized.

-

Shein bans all sex dolls after outrage over childlike products

Global online retail giant Shein has announced a worldwide ban on the sale of sex dolls, particularly those with ‘a childlike appearance,’ following accusations of hosting such products on its platform. The decision comes after France’s Directorate General for Competition, Consumer Affairs and Fraud Control flagged concerns over the weekend, describing the listings as having ‘little doubt as to the child pornography nature of the content.’ Shein responded swiftly, permanently banning all seller accounts linked to such products and temporarily removing its adult products category as a precaution. The company has also initiated a thorough review of its platform, vowing to implement stricter controls on sellers and enhance its keyword blacklist to prevent circumvention of restrictions. Executive Chairman Donald Tang emphasized Shein’s unwavering stance against child exploitation, stating, ‘The fight against child exploitation is non-negotiable for Shein. We are tracing the source and will take swift, decisive action against those responsible.’ The controversy erupted just days before Shein’s planned opening of its first permanent outlet in Paris, where protesters gathered outside the BHV department store. France’s finance minister threatened to ban the Singapore-based retailer from the country if it continued to sell the offending products. This incident adds to Shein’s existing scrutiny over its fast-fashion environmental impact and labor practices.

-

Starbucks to sell majority stake in China business

Starbucks has announced a groundbreaking $4 billion deal with investment firm Boyu Capital, selling a 60% stake in its China operations. Under the agreement, Starbucks will retain a 40% stake in its Chinese retail business and maintain ownership of its brand in the region. The coffee giant, which entered China in 1999, has faced increasing competition from local brands like Luckin Coffee, despite being the country’s second-largest market outside the U.S. The partnership with Boyu Capital, described as a ‘significant milestone,’ underscores Starbucks’ commitment to long-term growth in China. The company plans to expand its footprint from 8,000 to 20,000 outlets and introduce new beverages and digital platforms. Boyu Capital, known for its investments in retail, financial services, and technology, brings deep consumer insights to the collaboration. The deal, set to finalize by mid-2025, follows months of uncertainty after former CEO Laxman Narasimhan hinted at strategic partnerships to bolster competitiveness. This move mirrors similar strategies by global brands like KFC and Pizza Hut, which spun off their Chinese operations in 2016. Starbucks has faced declining sales in China due to the pandemic, reduced consumer spending, and fierce competition. Luckin Coffee, with its lower prices and aggressive expansion, now operates more stores than Starbucks in China. Despite price cuts to compete, Starbucks has seen profit margins shrink. Under CEO Brian Niccol, the company is revamping its menu, hiring more baristas, and scaling back automation efforts as part of a broader turnaround strategy. With over 40,000 outlets worldwide, Starbucks continues to navigate challenges in one of its most critical markets.

-

For small states, air links can be the first step in welcoming international investment

In the early 1980s, the Maldives was among the world’s poorest nations, with a fragile economy and minimal global presence. Today, it stands as a testament to transformation, with a tripled population, per capita income exceeding $18,000, and significant improvements in health, education, and life expectancy. A key driver of this success? Air connectivity. In 1987, Emirates launched biweekly flights to Malé, a bold move that unlocked the Maldives’ potential as a global tourism hub. Today, Emirates operates multiple daily flights, supporting a tourism sector that contributes nearly a third of the nation’s GDP. This story underscores the pivotal role of air links in economic development, particularly for small states. Airlines not only facilitate tourism but also attract investment, foster innovation, and reduce operational friction for international businesses. They enable students to study abroad, entrepreneurs to access new markets, and nations to integrate into the global economy. Antigua and Barbuda, a small island nation, recognizes this potential. Recent discussions with Emirates on potential air routes aim to deepen connectivity and economic opportunities. The nation has also signed bilateral air service agreements with Qatar and visa waiver agreements with several African countries, positioning itself as a hub between the Caribbean, the Middle East, and Africa. These efforts are part of a broader strategy to attract visitors, investment, and partnerships. However, as small states expand their air networks, they must balance growth with environmental responsibility. Emirates’ commitment to sustainable aviation fuel and cleaner technologies aligns with this vision, offering a model for sustainable development. Air connectivity is more than a logistical tool; it is a catalyst for transformation, unlocking potential and fostering resilience in small states.