The UAE Ministry of Defence and Abu Dhabi Police have finalized a series of high-value contracts totaling Dh25.4 billion during the 19th Dubai Airshow 2025. These agreements, facilitated by the Tawazun Council for Defence Enablement, encompass 36 contracts aimed at bolstering the nation’s defense and security infrastructure. The deals include the procurement of advanced aircraft, drones, and other critical defense technologies. On the final day of the event, nine new contracts worth Dh1.012 billion were announced, bringing the total value of agreements signed over the five-day exhibition to Dh25.455 billion. Key local contracts included a Dh161.634 million deal with M4 Trading for aircraft procurement and a Dh76 million agreement with Abu Dhabi Autonomous Systems Investments (ADASI) for drone acquisition. International contracts featured partnerships with American firms Lockheed Martin and Raytheon, valued at Dh467.913 million, focusing on technical support and advanced identification systems. The Tawazun Council, the national authority responsible for enabling and regulating the UAE’s defense ecosystem, emphasized the strategic importance of these agreements in enhancing the country’s defense capabilities and fostering sustainable growth in the sector. Majed Ahmed Al Jaberi, a spokesperson for the Council, highlighted the success of the event in advancing the UAE’s defense and security objectives through collaboration with both public and private entities.

分类: business

-

Dubai Airshow incident: What could have caused the crash of India’s fighter jet Tejas?

The Dubai Airshow 2025 concluded on a tragic note as India’s indigenous fighter jet, Tejas, crashed during a stunt performance, resulting in the pilot’s death. The incident occurred at approximately 2:10 PM on the final day of the event, marking the first major accident in the airshow’s history since its inception in 1986. Aviation analyst Saj Ahmad of StrategicAero Research suggested that the crash was likely caused by the stunt being performed too close to the ground, leaving insufficient space for the pilot to recover. The incident, captured on multiple cameras, is under investigation, with experts calling for a reevaluation of high-risk airshow displays. Tejas, developed by India’s Aeronautical Development Agency (ADA) and manufactured by Hindustan Aeronautics Limited (HAL), is a single-engine, multirole light combat aircraft designed to replace the ageing MiG-21 fleet. Its development began in the 1980s, with its first flight taking place in 2001. The Indian Air Force has been a regular participant at the Dubai Airshow, showcasing its latest innovations and technologies. This tragic event has raised concerns about the safety of such high-profile airshow performances and may lead to stricter regulations in the future.

-

What is the Tejas? Inside India’s fighter jet that crashed at Dubai Airshow

The Tejas, India’s indigenously developed single-engine, delta-wing combat aircraft, has been a symbol of the nation’s growing defense manufacturing capabilities. However, the aircraft made headlines for tragic reasons during the Dubai Airshow 2025 when one of the jets crashed shortly after take-off, resulting in the death of its pilot, Namansh Syal. The incident occurred around 2:10 pm on Friday, leading to a suspension of the flying display for over two hours. The Tejas, designed by the Aeronautical Development Agency (ADA) and manufactured by Hindustan Aeronautics Limited (HAL), has been operational since 2016 and was a centerpiece of India’s participation at the airshow. The jet, known for its compact design, agility, and high-performance maneuvers, had been showcasing its capabilities throughout the event, including high-G turns, rapid climbs, and signature orange smoke trails. The crash has raised questions about the aircraft’s safety and the circumstances leading to the accident. Despite the tragedy, India’s presence at the airshow remained significant, with the Indian Minister of State for Defence, Sanjay Seth, leading the official delegation and inaugurating the Indian pavilion. The event also saw key industry announcements, including a technology transfer agreement between HAL and German conglomerate Hensoldt AG for advanced sensors and guidance systems. This deal aligns with India’s Aatmanirbhar Bharat initiative, aimed at strengthening domestic manufacturing and technological independence. The Tejas crash has cast a shadow over what was otherwise a successful showcase of India’s aerospace innovations, but it also underscores the challenges and risks inherent in defense aviation.

-

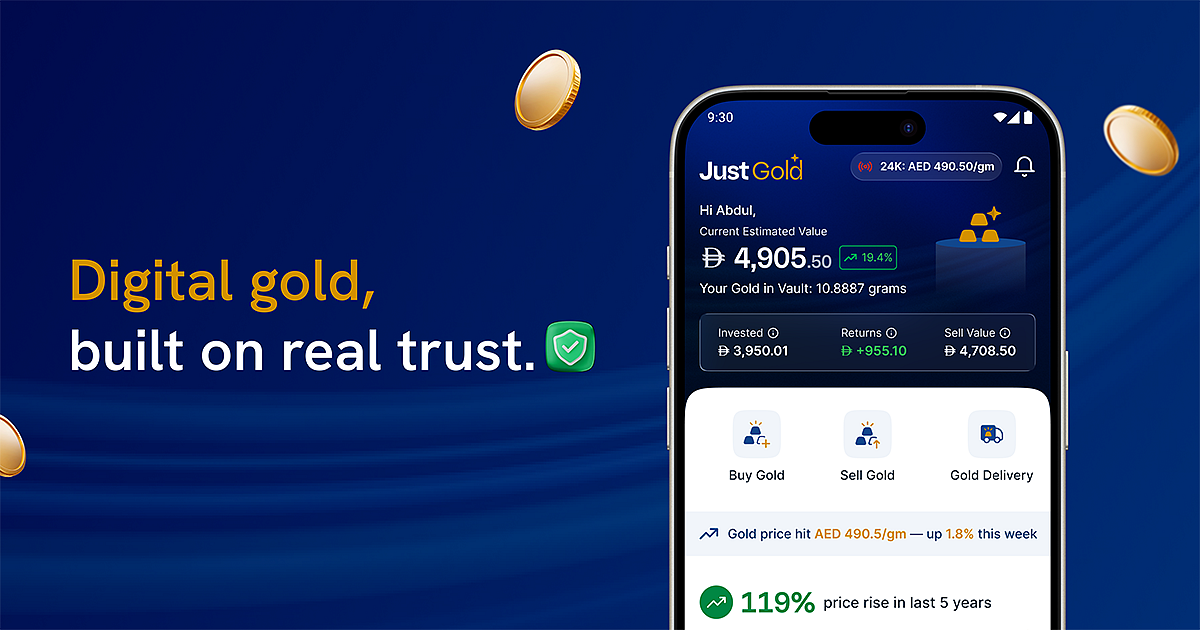

The calm after the digital gold rush: Why trust matters more than technology

In the UAE, a transformative shift is reshaping the gold investment landscape. Once confined to traditional gold souks and large upfront purchases, gold ownership has now entered the digital age. With platforms like the Just Gold App, investors can start with as little as AED 10, marking a significant departure from conventional methods. Dubai’s $3 billion retail bullion market is transitioning from physical displays to digital wallets, driven by technology and a growing demand for transparency and trust.

Digital platforms have democratized gold ownership, enabling users to purchase small quantities of 24-karat gold stored securely in insured vaults. This innovation eliminates concerns about physical storage while allowing investors to build real assets gradually. The Just Gold App exemplifies this new era of responsible investing, blending technology, ethics, and transparency to foster confidence among users.

According to the World Gold Council (WGC), investment demand for gold in the Middle East surged by over 30% in the first half of 2025, fueled by digital accessibility and younger investors. Globally, gold investment remains above its five-year average as consumers seek stability amid economic uncertainty.

Trust has emerged as the cornerstone of digital gold investing. Investors prioritize knowing where their gold is stored, how it is insured, and who oversees the process. JustGold addresses these concerns by linking every purchase to the official UAE gold rate and storing gold in Loomis International’s insured vaults in Dubai. The platform is ISO 27001:2022 certified for information security and adheres to Islamic finance principles, ensuring Shariah compliance and real ownership without speculation.

Since mid-2025, JustGold has experienced consistent growth, with transaction values increasing significantly. The average buy transaction value rose from AED 192 in July to AED 1,032 in October, a 440% increase. Similarly, the average sell transaction value nearly doubled, reflecting growing investor confidence. User behavior indicates habit formation, with nearly two-thirds of customers making multiple transactions and over 20% completing three or more trades.

To further enhance investor protection, JustGold is appointing an independent trustee to safeguard customer assets and maintain verified records of vault holdings. This measure aligns with the Islamic concept of Amānah, emphasizing trust and responsibility. In the unlikely event of operational disruption, the trustee ensures customers receive their gold or its equivalent value directly.

Dubai’s status as a global gold trading hub, handling 20-30% of global gold trade annually, provides a secure foundation for digital gold custody. The future of digital gold lies in platforms that prioritize accountability, physical backing, and compliance. For investors valuing security and opportunity, digital gold offers a transparent and trustworthy path to ownership.

JustGold’s success underscores the UAE’s evolving investment culture, where technology and ethics converge to redefine gold ownership. By combining real assets with independent oversight and secure digital access, the platform empowers investors to hold something timeless in a modern way.

-

China and UAE complete first cross-border digital currency payment

In a landmark development for global finance, China and the United Arab Emirates have successfully executed their inaugural cross-border payment utilizing central bank digital currency (CBDC). This pioneering transaction was conducted through the newly established JISR network, representing a significant advancement in both financial technology and international monetary cooperation.

The breakthrough occurred during an official visit by People’s Bank of China Governor Pan Gongsheng to Abu Dhabi. Sheikh Mansour bin Zayed Al Nahyan, Vice-President and Deputy Prime Minister of the UAE who also chairs the Central Bank’s board of directors, personally conducted the inaugural transaction. The event was documented by the UAE’s official news agency WAM, which characterized the development as reflecting “the depth of the strategic partnership between the UAE and the People’s Republic of China.”

The JISR platform, developed with participation from financial institutions in both nations, is specifically engineered to streamline cross-border payments while dramatically reducing associated transaction costs and enabling instantaneous settlement. Banking sector expansion is anticipated throughout 2026 as additional financial institutions join the network.

Concurrently, officials from both countries witnessed the technical integration of the UAE’s Instant Payment Platform with China’s Internet Banking Payment System. This interoperability will facilitate secure, real-time financial transfers between the two nations regardless of time zones, enabling diverse applications including educational scholarship transfers for Emirati students in China, remittance services for Chinese expatriates in the UAE, and seamless commercial transactions between enterprises.

The bilateral cooperation extended further with the introduction of the ‘Jaywan–UnionPay’ multi-scheme prepaid card. Developed in collaboration with Lari Exchange, this financial instrument merges both payment ecosystems to provide extensive global accessibility through UnionPay’s international network spanning more than 180 countries while maintaining local transaction efficiency within the UAE.

Complementing these achievements, central bank governors from both nations formalized their commitment through a Memorandum of Understanding aimed at enhancing cooperation in cross-border payment systems, advancing financial infrastructure development, and supporting joint strategic initiatives to deepen the comprehensive bilateral partnership.

-

Beijing’s Chaoyang aims for trillion-yuan GDP by 2026

Chaoyang District, a pivotal economic hub in Beijing, is on track to achieve a GDP exceeding 1 trillion yuan ($140.6 billion) by 2026, as announced by Zhao Haidong, Deputy Secretary and Executive Deputy District Head of Chaoyang. This ambitious target was revealed during the Linjia No 7 Salon, an investment-promotion event hosted by the Chinese Public Diplomacy Association. Zhao highlighted Chaoyang’s robust economic foundation, noting that the district is home to over 1,800 licensed financial institutions, including nearly 400 foreign-invested entities, accounting for approximately 65% of Beijing’s total. Additionally, Chaoyang serves as a central hub for international resources, hosting 90% of foreign media outlets with Beijing offices, 80% of international organizations and chambers of commerce, and 70% of multinational regional headquarters in the capital. During the 14th Five-Year Plan period (2021–25), the district saw the establishment of 2,481 new foreign enterprises, the highest number citywide. Chaoyang also hosts more than half of Beijing’s international conferences and over one-third of its international exhibitions annually. Looking ahead to the 15th Five-Year Plan period (2026–30), Zhao emphasized the district’s commitment to developing a modern industrial system and providing a high-quality business environment for global companies. Chaoyang’s GDP grew by 5.3% in the first three quarters of this year, underscoring its dynamic economic momentum.

-

China stocks putting AI froth over fragile economic reality

As global markets ride the wave of irrational AI exuberance, China’s soaring stock valuations appear increasingly disconnected from economic fundamentals. The world’s second-largest economy is slowing, with deflationary pressures persisting. Despite this, Chinese equities are rallying to decade highs, creating a critical challenge for President Xi Jinping to bridge the gap between investor optimism and the $19 trillion economy’s financial realities. Xi’s administration must act decisively to implement the 15th Five-Year Plan, unveiled in October, which emphasizes technological self-reliance, efficient manufacturing, and a green transformation. Key priorities include boosting domestic consumption, leveling industry playing fields, and advancing the ‘Made in China 2025’ initiative, which targets dominance in AI, semiconductors, electric vehicles, and other future technologies. However, the plan’s execution remains a significant hurdle. Since 2013, Xi has championed market-driven reforms, yet the gap between rhetoric and action persists. As deflation deepens and US tariffs impact global demand, Beijing faces the temptation to prioritize short-term stimulus over long-term structural reforms. Premier Li Qiang’s ability to balance these competing demands in 2026 will be crucial. Meanwhile, global investors are increasingly drawn to Chinese tech stocks, driven by successes like BYD, DeepSeek, and Alibaba. Despite concerns over deflation and property sector woes, China’s stock market rally shows resilience, with analysts noting that valuations remain below their 2015-2021 peak. However, economists warn that prolonged deflation could erode profits, weaken consumer confidence, and entrench weak domestic demand. The success of Xi’s economic strategy hinges on effectively implementing the 15th Five-Year Plan, fostering domestic consumption, and addressing structural vulnerabilities. As the global AI frenzy continues, China’s ability to navigate these challenges will determine its economic trajectory in the years ahead.

-

Taxation Society UAE hosts conference in Dubai

The Taxation Society UAE, in partnership with the Indian Business and Professional Council (IBPC) Dubai, recently organized a pivotal conference titled ‘Preserving Wealth in a Borderless World: Asset Protection, Tax Strategy, and Intergenerational Legacy Planning.’ Held at the India Club in Dubai, the event attracted a distinguished gathering of experts, family-office advisors, and finance professionals to discuss strategies for wealth preservation and legacy building across jurisdictions. The conference opened with remarks from Bhawna Chopra, Secretary of the Taxation Society UAE, who emphasized the organization’s dedication to fostering professional collaboration and knowledge exchange. Naveen Sharma, Chairman of the Taxation Society UAE, provided insights into the critical role of wealth preservation, compliance, and intergenerational planning in today’s rapidly evolving global economy. Dr. Sahitya Chaturvedi, Secretary-General of IBPC Dubai and Head of Internal Audit at Ajmal Perfumes, delivered the keynote address, stressing the importance of holistic financial governance for sustainable legacy continuity. Renowned speakers, including Advocate Harsh Patel, Nirav Shah, and Julie Rouas, shared expertise on estate planning, tax complexities, and foundation-based structuring. A dynamic panel discussion, moderated by Nimish Makvana, President of the Taxation Society UAE, explored real-world case studies in asset protection and cross-border taxation. The event concluded with a networking lunch, reinforcing the society’s mission to enhance tax knowledge and promote professional excellence in the UAE.

-

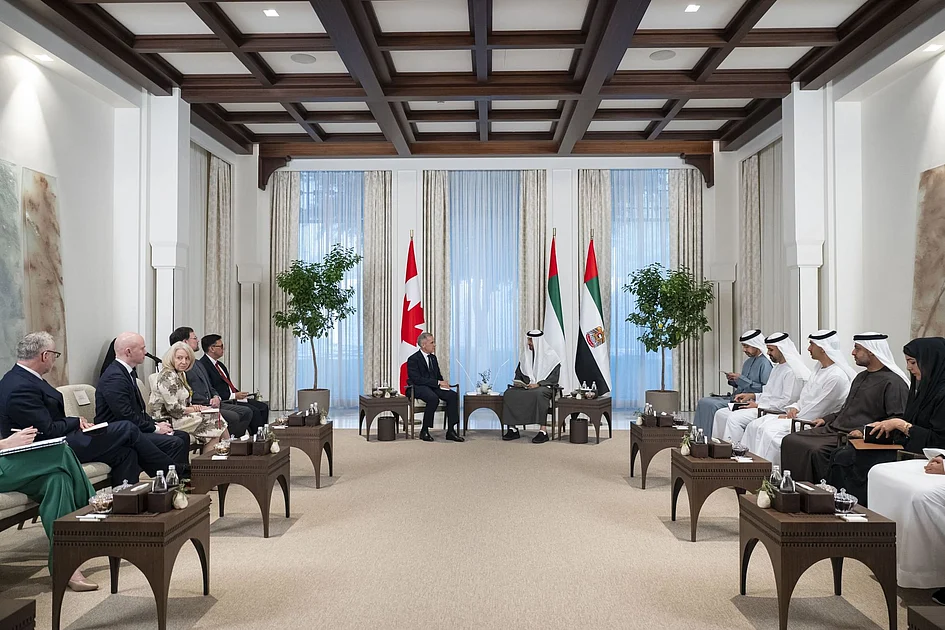

UAE to invest up to $50 billion in Canada in industries such as AI, energy

In a landmark move to bolster economic ties, the United Arab Emirates (UAE) has unveiled plans to invest up to $50 billion in Canada across key sectors, including artificial intelligence (AI), energy, logistics, and mining. This strategic initiative, approved by Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi, underscores the UAE’s commitment to fostering global partnerships and driving mutual prosperity. The announcement came during Canadian Prime Minister Mark Carney’s recent visit to the UAE, where both nations signed an agreement to enhance investment protection and promotion, further solidifying their economic collaboration. The UAE’s foreign direct investment stock in Canada stood at approximately $8.8 billion in 2024, significantly outpacing Canada’s $242 million in direct investments in the UAE during the same period. This new framework reflects the UAE’s position as a leading global investor and its dedication to supporting shared development goals with Canada.

-

UAE to become a major hub for defence research and development

The United Arab Emirates (UAE) is set to become a pivotal center for defence research and development (R&D), as Italian defence and aerospace giant Leonardo strengthens its foothold in the region. Carlo Gualdaroni, Co-General Manager Business at Leonardo, revealed that the company is transitioning its UAE representative office into an industrial entity to foster joint ventures with local partners. This strategic move aims to enhance design and production capabilities within the Emirates, with a long-term vision to manufacture locally and export to markets where the UAE holds significant influence. At the recent Dubai Airshow, Leonardo and EDGE Group announced a joint venture set to launch next year, focusing on the design, development, and production of advanced defence systems, including sensors, platforms, and integration solutions. The collaboration will also encompass testing, industrialisation, and workforce training, contributing to the UAE’s ambition to diversify its economy and bolster its defence sector. Gualdaroni emphasised the UAE’s strategic importance, noting its potential to evolve into a global hub for defence R&D. Leonardo’s broader strategy includes fostering partnerships, transferring technology, and localising production to support the Middle East’s defence and technology ecosystems. The company also plans to recruit and train young Emirati engineers in Italy, integrating them into its UAE operations to drive innovation and production. With a strong presence in helicopters, naval systems, and electronics, Leonardo is well-positioned to support the UAE’s leadership in high-tech and next-generation capabilities, including cybersecurity, space technologies, and artificial intelligence. The Dubai Airshow serves as a critical platform for understanding the region’s evolving priorities and reassessing strategies to align with market demands.