In response to an unprecedented global recall initiated by Airbus, UAE carriers Etihad Airways and Air Arabia have swiftly implemented mandatory software updates across their A320 family aircraft fleets. The European manufacturer’s directive, affecting approximately 6,000 aircraft worldwide, follows a reported flight control anomaly linked to intense solar radiation exposure.

Air Arabia confirmed immediate compliance with the technical advisory, with a spokesperson stating: “We have begun implementing the required measures across the impacted aircraft in our fleet and expect to complete all updates by the end of today. Our teams have worked diligently to ensure minimal impact on our customers.” The Sharjah-based low-cost carrier operates 67 A320 family aircraft according to Cirium data.

Etihad Airways similarly reported successful completion of the software installation across its 39 A320 family aircraft. The Abu Dhabi-based carrier emphasized that normal operations had resumed despite the challenge occurring during one of the busiest travel periods at Zayed International Airport ahead of the long weekend.

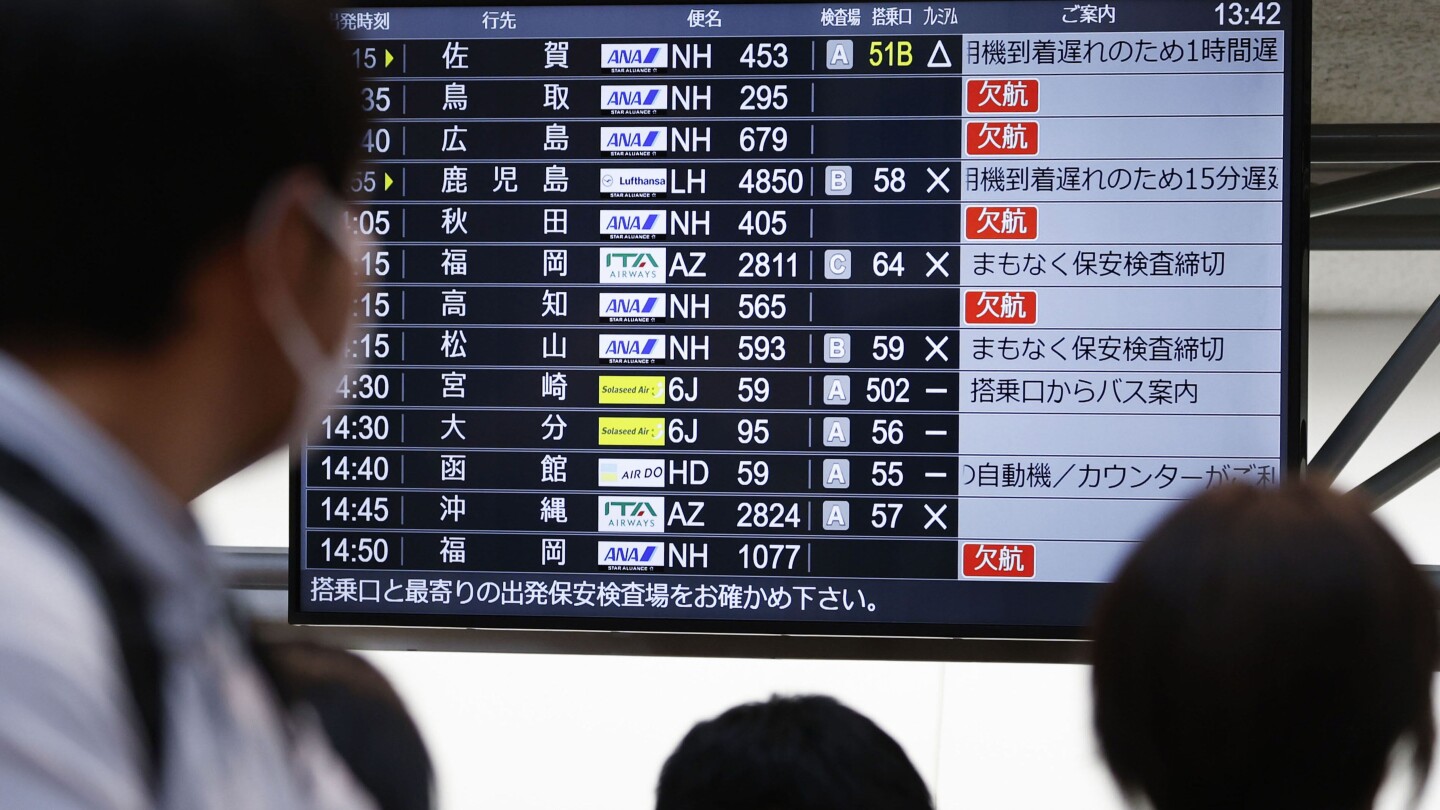

Saj Ahmad, chief analyst at London-based StrategicAero Research, characterized the situation as “rather unprecedented,” noting that the recall stems from a JetBlue A320 incident involving rapid descent and passenger injuries. Ahmad warned that while software updates require few hours, potential hardware modifications could ground aircraft for several days awaiting replacement parts, potentially disrupting flight schedules across the Middle East’s 376 operational A320 family aircraft.

The proactive response from UAE carriers demonstrates the aviation industry’s commitment to safety-first protocols while minimizing traveler inconvenience during critical holiday periods.