Cambodia’s economic outlook for 2025-2026 shows moderated growth projections amid external pressures, though analysts characterize the disruptions as temporary rather than structural. The Southeast Asian kingdom now anticipates 5.2% GDP growth for 2025, a notable downward revision from the previously projected 6.3%, according to Finance Minister Aun Pornmoniroth.

The economic headwinds stem primarily from two significant challenges: heightened border tensions with neighboring Thailand and substantial tariff impositions by the United States. Cambodia currently faces a 19% tariff on all exports to the American market, creating substantial pressure on the nation’s export-oriented sectors.

Despite these challenges, Cambodia maintains robust economic fundamentals supported by strong domestic consumption and a growing trend of domestic product utilization. The government has responded with strategic fiscal measures, increasing the 2026 national budget to $10 billion—a 7.8% rise from 2025 expenditures—to bolster economic resilience.

International economic institutions have adjusted their forecasts accordingly. The International Monetary Fund projects Cambodia’s growth to moderate to 4.8% in 2025 and further to 4% in 2026, citing export volatility, reduced remittances, tourism sector slowdown, and tempered domestic demand as contributing factors.

Private sector leaders like Arnaud Darc, CEO of Thalias Hospitality, emphasize that current disruptions represent short-term adjustments rather than fundamental weaknesses. The Cambodia-Thailand border closure has particularly impacted regional trade, with bilateral commerce dropping over 90% during the closure period and forcing exporters to absorb 8-12% increased logistics costs through alternative routes.

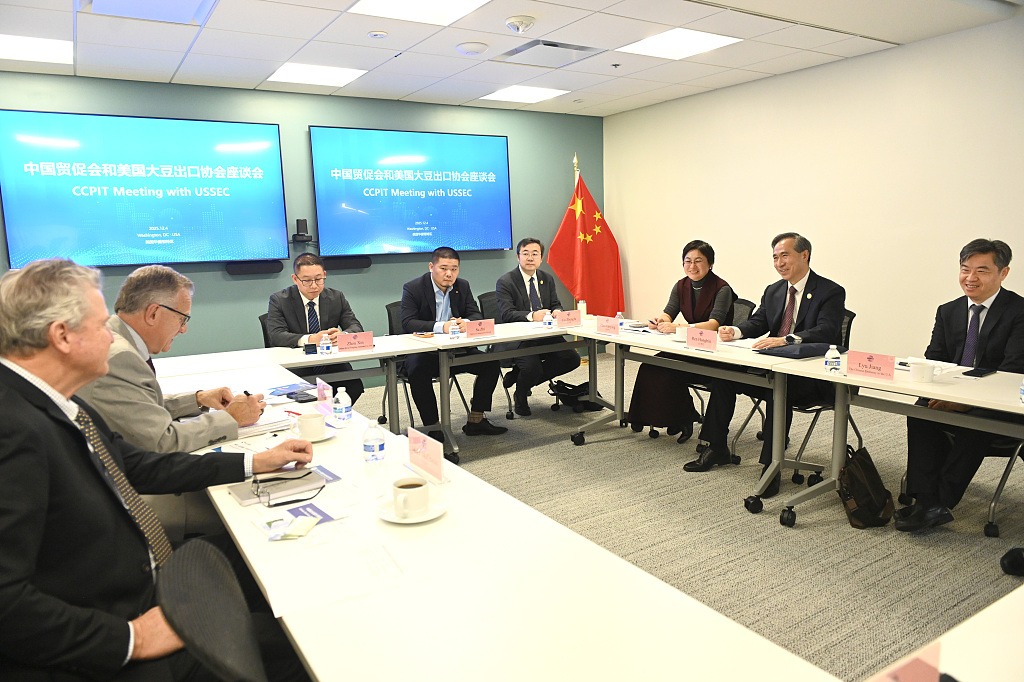

Looking forward, Cambodia is leveraging international partnerships through mechanisms like the Regional Comprehensive Economic Partnership and the Cambodia-China Free Trade Agreement to enhance economic integration. A significant tourism initiative—a visa-free pilot program for Chinese visitors scheduled from June to October 2026—offers potential to revitalize the services sector and provide counterbalance to external pressures.

Academic experts including Thong Mengdavid of the Royal University of Phnom Penh note that while immediate challenges highlight structural vulnerabilities, strategic investments in productivity, infrastructure, human capital, and governance reform position Cambodia for more resilient and diversified long-term growth.