Japan is deliberating whether to permit North Korean athletes to compete in the 2025 Asian Games in Nagoya, following North Korea’s expressed interest in participating. This decision comes despite the absence of diplomatic relations between the two nations and North Korea’s non-participation when Japan last hosted the Games in 1994. Since 2016, Japan has enforced a ban on North Korean citizens entering the country due to concerns over its nuclear and ballistic missile programs. However, exceptions have been made for North Korean athletes to participate in international sports events. According to Kyodo News, North Korea has indicated plans to send approximately 150 athletes to compete in 17 events during the Games, scheduled from September 19 to October 4, 2025. Japan’s Chief Cabinet Secretary, Yoshimasa Hayashi, confirmed that the Asian Games’ organizing committee has consulted the Japanese sports ministry regarding this matter. The government is currently evaluating the request through inter-ministerial consultations. Notably, North Korea participated in the 2023 Asian Games in Hangzhou, China, securing 11 gold medals and a total of 39 medals. The decision on North Korea’s participation in the Nagoya Games remains pending, reflecting the complex interplay between sports and diplomacy.

作者: admin

-

Exclusive: U.S. diplomats on Syria abruptly let go amid pro-Damascus policy push, sources say

In a surprising turn of events, several senior U.S. diplomats stationed at the Syria Regional Platform (SRP) in Istanbul have been abruptly dismissed, according to sources familiar with the matter. The SRP, which functions as the de facto U.S. mission to Syria, has been a key player in Washington’s efforts to integrate Syrian Kurdish allies with the central administration in Damascus. The dismissals, which occurred suddenly and involuntarily, are part of a broader reorganization of the team, though they are not expected to impact U.S. policy in Syria. The diplomats reported to Tom Barrack, the U.S. special envoy for Syria and a close confidant of former President Donald Trump. Barrack, who was appointed in May, has been advocating for a unified Syrian state under President Ahmed al-Sharaa, who rose to power in a swift advance last year. The move to integrate the Kurdish-led Syrian Democratic Forces (SDF) into national security forces has been met with resistance from some SDF leaders, who have fought alongside the U.S. against Islamic State during former President Bashar al-Assad’s rule. The SDF continues to push for a less centralized government, aiming to retain the autonomy they gained during Syria’s civil war. Barrack, who also serves as the U.S. ambassador to NATO member Turkey, has been actively involved in addressing regional issues, including a recent plan to resolve a standoff with the Druze minority in southern Syria. The State Department has declined to comment on the dismissals, emphasizing that core staff working on Syrian issues remain operational from various locations. The SRP, headquartered at the U.S. consulate in Istanbul, has been the primary U.S. diplomatic presence in Syria since the closure of the embassy in Damascus in 2012.

-

Foreigners snap up Asian bonds in August after two-month hiatus

In August, Asian bonds experienced their first monthly foreign inflow in three months, driven by expectations of U.S. Federal Reserve rate cuts aimed at supporting a cooling labor market. This development has heightened demand for higher-yielding emerging markets. According to data from regulatory authorities and bond market associations in India, Indonesia, Thailand, Malaysia, and South Korea, non-native investors purchased Asian bonds worth a net $311 million last month, marking the first monthly net purchase since May. The Fed reduced interest rates for the first time since December, citing increasing risks to the labor market and signaling further rate reductions as unemployment rises, work hours shrink, and other signs of economic weakness emerge. Khoon Goh, head of Asia research at ANZ, anticipates a cumulative rate cut of 125 basis points, bringing the Fed funds rate to 3.25% by March 2026. Goh also noted that a more accommodative U.S. monetary policy stance should bolster currencies and asset markets in Asia, excluding China. Last month, investors bought Indian bonds worth $773 million and Malaysian debt instruments worth $721 million, ending a two-month selling trend in both markets. However, South Korean, Indonesian, and Thai bonds saw foreign outflows of $447 million, $400 million, and $337 million, respectively.

-

US import dependence on EU on the rise, outpacing China, study finds

A recent study by Germany’s IW economic institute reveals a significant shift in the United States’ import dependency, with the European Union now surpassing China in both the total value and variety of goods imported. Over the past 15 years, the U.S. reliance on EU imports has grown substantially, with the number of product categories where at least 50% of imports originate from the EU increasing from over 2,600 in 2010 to more than 3,100 in 2023. The total import value of these goods, including chemical products, electrical machinery, and equipment, reached $287 billion last year, nearly 2.5 times higher than in 2010. In contrast, China accounted for 2,925 product categories with a total value of $247 billion in the same period. The study suggests that this growing dependence could provide the EU with strategic leverage in future tariff negotiations. EU Commission President Ursula von der Leyen may have had a stronger position in recent talks, which resulted in a baseline tariff rate of 15% on most EU goods. The report also highlights that many EU products are difficult to replace in the short term, a factor that could be pivotal if trade tensions escalate. As a last resort, the EU could consider export restrictions on goods critical to the U.S. economy. Co-author Samina Sultan emphasized that while trade data alone cannot fully capture the importance of these goods, the study underscores the potential risks for the U.S. if it continues to raise tariffs, effectively ‘shooting itself in the foot.’

-

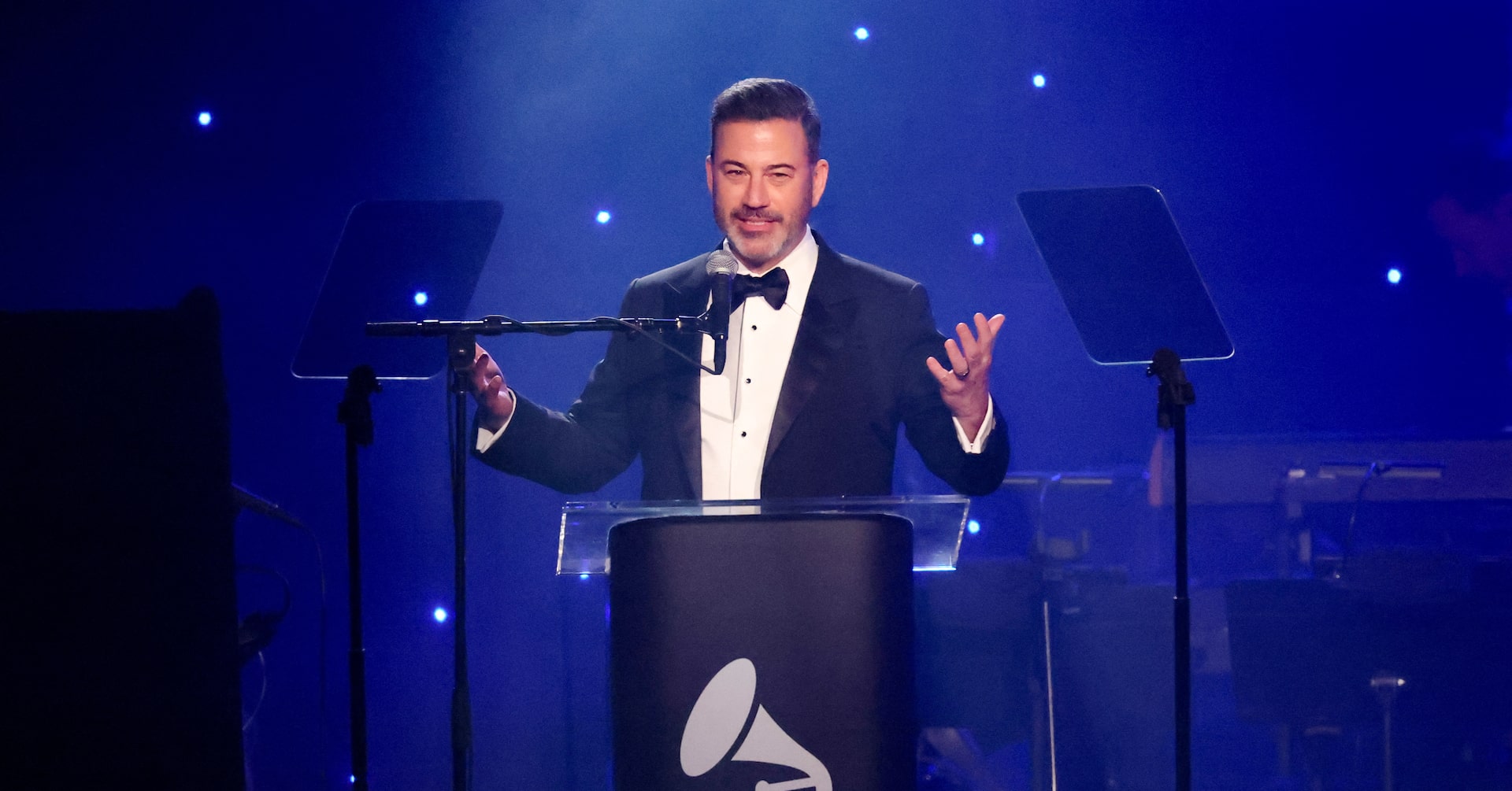

Hollywood comes to Kimmel’s defense after ABC pulls late-night show

In a dramatic turn of events, ABC has indefinitely suspended ‘Jimmy Kimmel Live’ following intense regulatory threats from the Trump administration. The decision came after Jimmy Kimmel, a vocal critic of former President Donald Trump, made controversial remarks about the assassination of conservative activist Charlie Kirk during his September 10 monologue. Kimmel suggested that Kirk’s allies were exploiting his death for political gain, a statement that sparked widespread backlash from conservative circles. The Walt Disney-owned broadcaster faced pressure from Nexstar Media Group, which owns 32 ABC affiliates, and the Federal Communications Commission (FCC), which threatened investigations and potential fines. FCC Chair Brendan Carr urged local broadcasters to cease airing the show, praising Nexstar for its stance. Unions representing writers, actors, and musicians have condemned the suspension, labeling it an attack on free speech and a form of state censorship. The Writers Guild of America West and East issued a joint statement, emphasizing the importance of protecting constitutional rights. Meanwhile, actor Ben Stiller and SAG-AFTRA voiced their support for Kimmel, criticizing the decision as a dangerous precedent. The incident has reignited debates about media freedom and government interference in the entertainment industry.

-

In Congo, army and rebels dig in for war Trump says is over

In the eastern Democratic Republic of Congo (DRC), the fragile peace process is unraveling as both the Congolese army and the Rwandan-backed M23 rebel group reinforce their military positions. This escalation comes amid missed deadlines for peace agreements brokered by the U.S. and Qatar, raising fears of a renewed regional conflict. The M23, which seized two major cities earlier this year, demands prisoner releases and power-sharing in the territories they control, while the Congolese government refuses to cede authority or release detainees.

-

Hong Kong central bank cuts interest rate, tracking Fed; banks follow

On September 18, 2023, the Hong Kong Monetary Authority (HKMA) announced a reduction in its base interest rate by 25 basis points to 4.50%, aligning with the U.S. Federal Reserve’s recent decision. This marks the first rate cut by the HKMA since December 2022, when it last lowered rates by a similar margin. The adjustment, implemented through the overnight discount window, aims to maintain economic stability in Hong Kong, whose currency is pegged to the U.S. dollar within a narrow range of 7.75-7.85 per dollar. Major banks in Hong Kong, including HSBC and Bank of China (Hong Kong), partially followed suit, reducing their prime lending rates to 5.125% effective September 19. HSBC’s Hong Kong CEO, Luanne Lim, emphasized that the decision reflects both the U.S. rate cut and local market conditions, while HKMA Chief Executive Eddie Yue highlighted the potential positive impact on the city’s property market and broader economy. The Federal Reserve’s recent quarter-point rate cut and its indication of further reductions this year have influenced Hong Kong’s monetary policy, though Yue cautioned that the pace and extent of future U.S. rate cuts remain uncertain.

-

Fed’s rate cut comes with caveats, leaving investors lukewarm

The Federal Reserve’s recent decision to cut interest rates by 25 basis points has left investors navigating a complex landscape of economic uncertainty. On September 17, 2025, Fed Chair Jerome Powell announced the first rate cut since December, lowering the policy rate to a range of 4%-4.25%. While the move signaled a dovish shift, Powell tempered expectations by highlighting persistent inflation risks and a weakening labor market, leaving markets cautious about the pace of future easing. The Fed’s updated economic projections, including its ‘dot plot,’ indicated a potential 50 basis points in cuts by year-end, but inflation is still forecasted to remain above the 2% target at 3%. This nuanced messaging has dampened optimism, with the Nasdaq and S&P 500 closing lower in choppy trading. Treasury yields rose, reflecting market unease. Analysts warn of stagflation risks, a mix of sluggish growth and high inflation, complicating the Fed’s ability to support the economy. Internal disagreements within the Fed, including a lone dissent advocating for a larger rate cut, have added to the volatility. Investors now face a challenging environment as they digest conflicting signals and brace for heightened market fluctuations.

-

BOJ may raise rates in October even if Takaichi wins leadership race, says ex-c.bank official

The Bank of Japan (BOJ) could proceed with an interest rate hike in October, even if Sanae Takaichi, a prominent advocate of aggressive monetary easing, wins the Liberal Democratic Party’s (LDP) leadership race and becomes Japan’s next prime minister, according to former BOJ executive Tomoyuki Shimoda. Takaichi, a leading candidate in the October 4 leadership race, has been vocal in her opposition to the BOJ’s rate hikes and has called for increased fiscal spending to stimulate the economy. However, Shimoda, who previously served in the BOJ’s monetary affairs department, believes that Takaichi’s potential victory would have a limited impact on monetary policy. He expressed skepticism about her ability to implement policies that could weaken the yen, which has been a concern for policymakers due to its inflationary effects. A weak yen boosts exports but raises import costs, contributing to inflation that has remained above the BOJ’s 2% target. Shimoda noted that a yen fall below 150 to the dollar could also draw complaints from the U.S. administration, which is pursuing a weak-dollar policy to support U.S. exports. The BOJ is likely to raise rates at its October 29-30 meeting if stock prices remain stable and the upcoming ‘tankan’ business sentiment survey, due on October 1, does not show significant deterioration. Shimoda highlighted that solid corporate profits, wage hikes, and persistent rises in food costs are creating a favorable environment for a rate increase. The BOJ is widely expected to maintain its current interest rate of 0.5% at its upcoming meeting, but a Reuters poll indicates that a majority of economists anticipate another 25-basis-point hike by year-end, with bets centered on October and January. Takaichi is known for her support of an ‘Abenomics’-style mix of fiscal and monetary stimulus, while her main rival, Shinjiro Koizumi, has less clear views on BOJ policy. The BOJ exited its decade-long ultra-loose monetary policy last year and raised short-term rates to 0.5% in January, signaling its readiness to continue hiking rates as inflation remains above 2%. The yen’s movements have historically influenced BOJ decisions, and its recent stabilization around 146 per dollar follows a plunge to near two-decade lows last year.

-

US vaccine panel to vote on the use of combined measles shot this week

The U.S. Centers for Disease Control and Prevention (CDC) is set to host a pivotal meeting this week, where vaccine advisers will vote on a proposal to eliminate recommendations for the combined measles, mumps, rubella, and varicella (MMRV) vaccine for children under four. This decision comes amid heightened scrutiny from Health Secretary Robert F. Kennedy Jr., who has long questioned vaccine safety despite overwhelming scientific evidence to the contrary. Kennedy has promoted the unfounded claim that the MMRV vaccine is linked to autism, a theory repeatedly debunked by rigorous scientific studies. The Advisory Committee on Immunization Practices (ACIP) will convene on September 18-19 to deliberate on the proposal, as outlined in a draft agenda on the CDC’s website. The meeting follows Kennedy’s controversial decision in June to dismiss all 17 ACIP members and appoint eight new advisers, some of whom have previously opposed vaccines. Since assuming his role under the Trump administration, Kennedy has initiated a review of vaccine policies, including the measles shot, which remains the most effective method to prevent the highly contagious and potentially deadly virus. Currently, the CDC recommends that children under four receive separate doses of the MMR and varicella vaccines, with the MMRV vaccine preferred for older children. This year, the U.S. has reported 1,454 measles cases, the highest in over three decades, underscoring the urgency of the debate. The MMRV vaccine is marketed in the U.S. by pharmaceutical giants Merck and GSK, with Merck also offering the ProQuad shot, which protects against measles, mumps, rubella, and varicella.