Recent geopolitical tensions between the United States and Venezuela have intensified following statements from former President Donald Trump regarding Venezuela’s oil industry. Trump asserted that Venezuela’s socialist regime had effectively “stolen” American oil assets through forceful nationalization, characterizing it as one of the most significant property thefts in American history. He further indicated that Washington would oversee Venezuela’s governance until what he termed a “safe, proper and judicious transition” could be implemented, with US oil companies poised to rehabilitate the country’s deteriorated infrastructure.

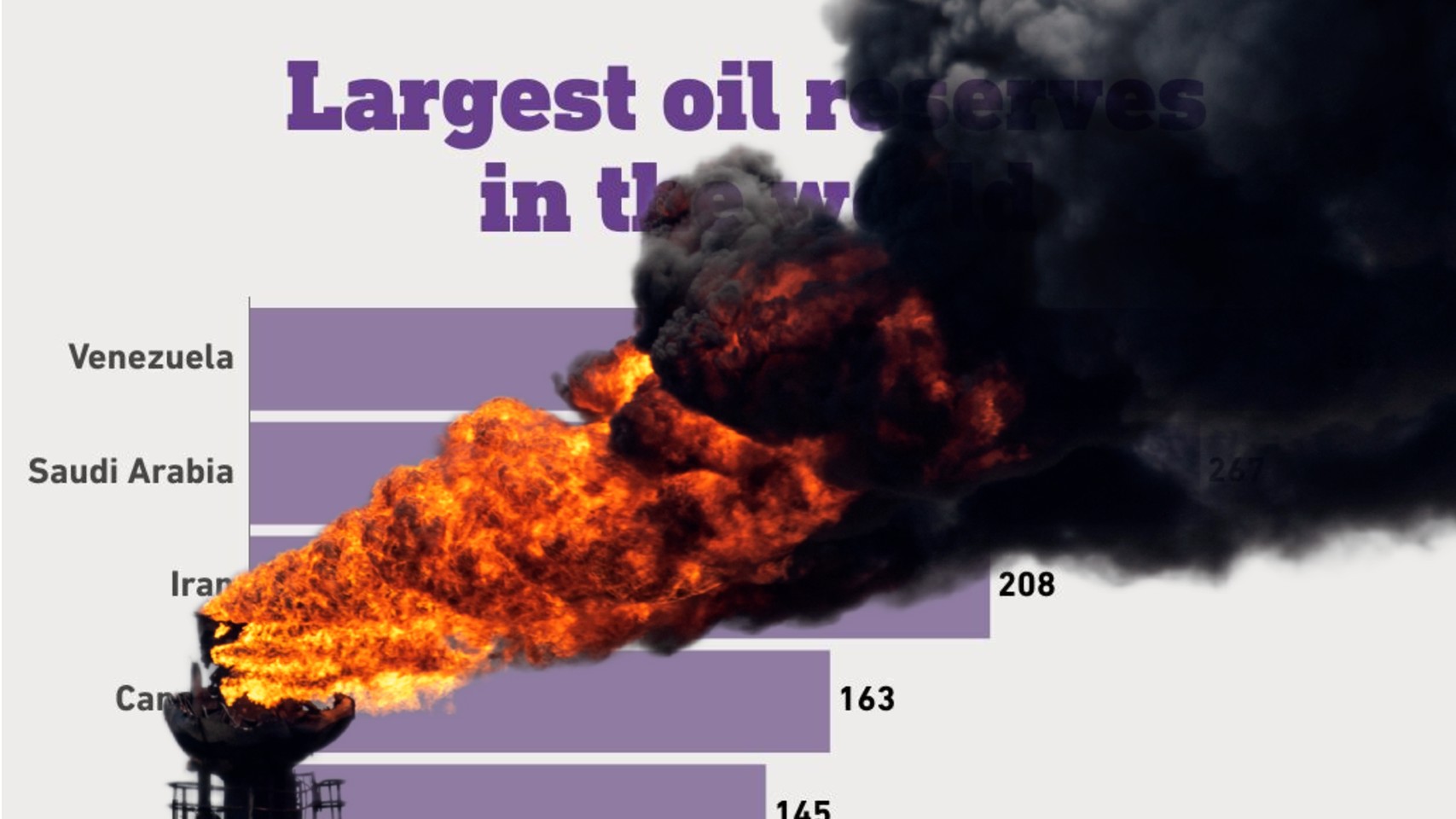

The underlying motivation for this heightened interest becomes clear upon examining Venezuela’s energy portfolio. The nation possesses the world’s largest proven oil reserves, estimated at 303 billion barrels—representing approximately 17% of global reserves and exceeding US reserves by more than fivefold. The majority of these deposits are concentrated in the Orinoco Belt, characterized by dense, sulfur-rich crude that requires sophisticated and costly extraction methods.

Despite its vast reserves, Venezuela’s current production has plummeted to about 1 million barrels per day, a mere fraction of its potential capacity. This decline is attributed to years of economic mismanagement, insufficient investment, and crippling international sanctions. Consequently, while the US remains the world’s top oil producer at 22.7 million barrels daily, its refining infrastructure—particularly along the Gulf Coast—is specifically calibrated to process heavier crude varieties. This creates a strategic imperative for importing dense oil, with over 60% of US crude imports currently sourced from Canada and Mexico.

Historical context reveals that Venezuela nationalized its oil industry in the 1970s, establishing state-owned PDVSA. The early 2000s saw increased state control under Hugo Chávez, resulting in the appropriation of assets from international corporations like Exxon and Conoco. Subsequent political instability and sanctions have dramatically reduced production and redirected exports from traditional Western markets toward China, which now receives approximately 80% of Venezuelan oil.

Analysts caution that any potential recovery of Venezuela’s oil sector would require substantial investment and years of development. Furthermore, historical precedents in Iraq and Libya demonstrate that regime change does not automatically guarantee stable oil production. The situation remains a complex interplay of energy economics, geopolitical strategy, and regional power dynamics, with significant implications for global oil markets and international relations.