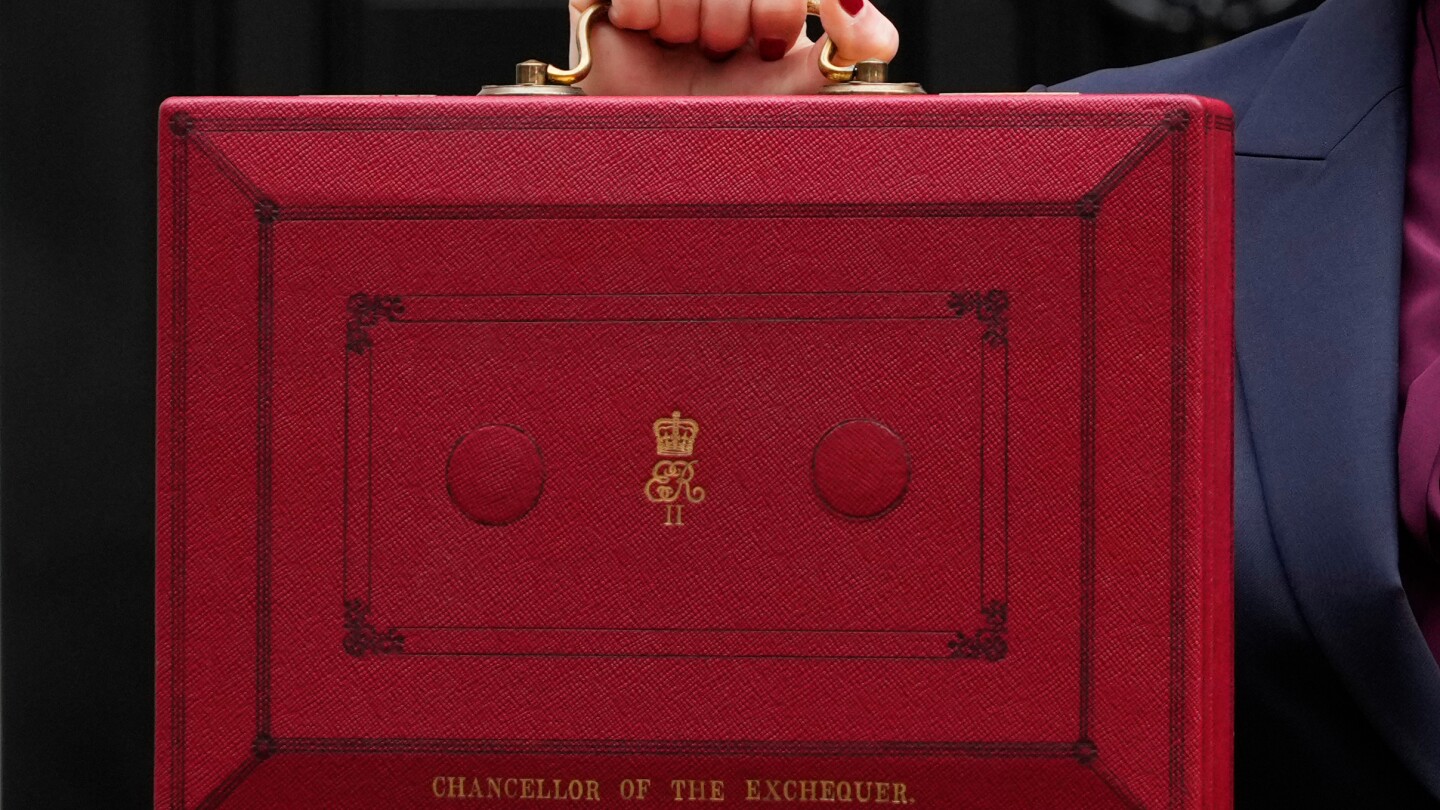

LONDON — Amid mounting economic pressures, Britain’s Labour government, led by Chancellor of the Exchequer Rachel Reeves, is poised to unveil its second budget since its landslide election victory in July 2024. The announcement, scheduled for Wednesday, comes as the government grapples with a strained public finances and a faltering economy. Reeves, the first woman to hold the prestigious Treasury role, is expected to introduce additional tax-raising measures to address a significant fiscal shortfall. This marks a departure from her earlier assurance that her first budget would be the sole major tax-raising effort of the current parliamentary term, which extends to 2029. The British economy, the world’s sixth-largest, has struggled to meet expectations, with critics attributing the downturn to last year’s business tax hikes. Despite a brief recovery in the first half of 2024, when the UK led the Group of Seven in growth, the economy has since stumbled. Peter Arnold, chief economist at EY U.K., noted that Reeves must navigate a ‘delicate balancing act’ between ensuring fiscal stability and fostering economic growth. The UK’s financial woes are compounded by long-term challenges stemming from the 2008 global financial crisis, the COVID-19 pandemic, the Russia-Ukraine war, and the lingering effects of Brexit. These factors have collectively eroded the nation’s economic resilience and tax revenue. Reeves also faces substantial spending commitments, including reversing planned welfare cuts and addressing the cost-of-living crisis amid persistent inflation. Economists estimate she will need to secure £20-30 billion ($26-39 billion) to meet these demands. While a straightforward income tax hike has been ruled out, Reeves is likely to implement smaller, more complex tax measures. Key expectations include freezing tax thresholds, which would push more earners into higher brackets as wages rise, and introducing a mansion tax on high-value properties. Changes to capital gains tax and private pension provisions are also under consideration.