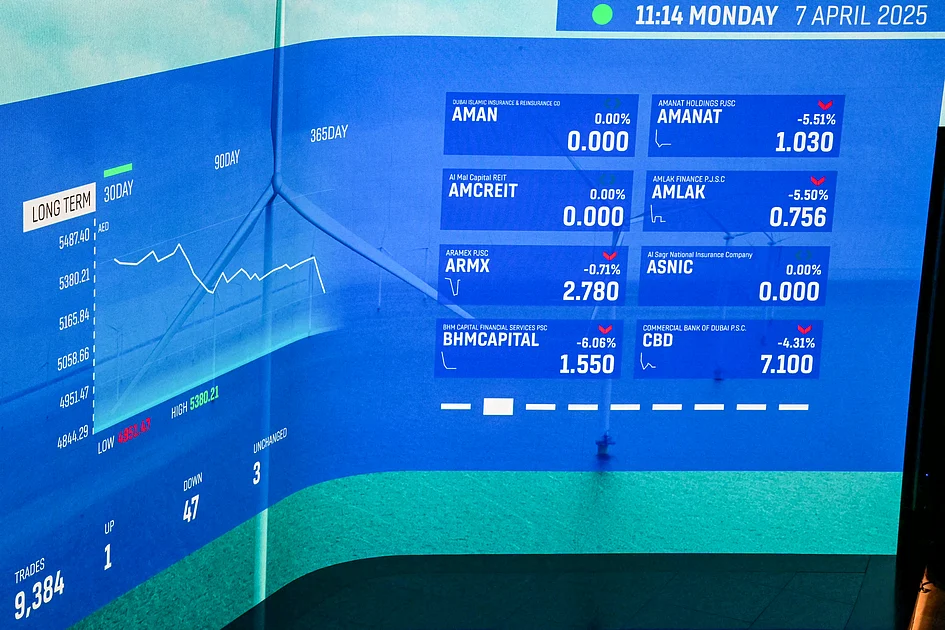

The equity markets in Dubai and Abu Dhabi experienced a downturn last week, influenced by broader global economic challenges. The Dubai Financial Market (DFM) General Index fell by 1.25%, closing at 5,949, while the Abu Dhabi Securities Exchange (ADX) General Index dropped by 1.56% to 9,917.90, slipping below the significant 10,000 mark. This decline was primarily driven by significant losses in key sectors such as technology, financials, and healthcare, despite some gains in materials and real estate sectors. Analysts attribute this trend to the ongoing global risk-off sentiment, which has overshadowed the strong corporate earnings reported by major companies like Dewa and Salik. Vijay Valecha, Chief Investment Officer at Century Financial, highlighted the cautious outlook, suggesting that the markets may continue to face volatility and limited upside potential in the near term. The technical indicators also support this view, with both indices breaching their 50- and 100-day moving averages and the Relative Strength Index (RSI) indicating weakening momentum. Looking ahead, the market is expected to remain range-bound, with potential short-term rallies likely to encounter resistance unless there is a significant improvement in global risk appetite.