The protracted Israel-Hamas conflict reached a significant milestone on Monday as the last 20 living Israeli captives were released by Hamas in exchange for 1,968 Palestinian prisoners and detainees. This exchange concludes a harrowing chapter that began on October 7, 2023, when 251 Israelis and foreign nationals were abducted during a Hamas-led attack on Israel, which also claimed nearly 1,200 lives. The same day, Israel launched a military campaign in Gaza, resulting in over 67,000 Palestinian deaths over two years. While Israel declared the return of captives a top priority, senior officials later admitted that it was not a central aim of the military operation. Gadi Eisenkot, former head of the Israeli military, criticized the government for sidelining the hostages in its war objectives. The conflict saw 168 captives returned alive, while 87 died under contested circumstances. The release of the Bibas family’s bodies in February 2025, along with other captives, underscored the tragic human cost of the war. Both sides continue to trade blame for the deaths of hostages, with Israel accusing Hamas of killings during captivity and Hamas attributing many deaths to Israeli military actions. The conflict has left deep scars on both societies, with thousands of Palestinian prisoners still in Israeli jails and widespread devastation in Gaza. The recent exchange, facilitated by international diplomacy, signals a potential end to the war but leaves unresolved questions about accountability and justice.

标签: Asia

亚洲

-

‘Sorry I couldn’t save you’: Israel buries hostage returned from Gaza

In a somber ceremony on Wednesday, Israel laid to rest Guy Iluz, a 26-year-old hostage whose remains were returned from Gaza as part of a US-backed ceasefire agreement. The funeral procession began in Rishon Lezion and concluded in Raanana, where Iluz had resided before being abducted during the Hamas-led attack on October 7, 2023. The attack, which targeted the Nova music festival in southern Israel, resulted in the deaths of at least 370 people and the abduction of 251 others, both living and deceased. Iluz, a guitarist and sound engineer, was among those taken captive. Reports indicate he attempted to flee the festival site and later hid in a tree, where he made his final contact with his parents before being captured. He died in captivity due to untreated injuries sustained during his abduction. The ceasefire deal, which took effect last Friday, mandated the release of all hostages within 72 hours. In exchange, Israel released nearly 2,000 Palestinian detainees. The return of Iluz’s body, along with three others on Monday and four more on Tuesday, marked a bittersweet moment for mourners. Amira, a woman in her sixties, expressed her grief, stating, ‘I’m sorry, sorry, sorry I could not save you!’ She emphasized the importance of having a grave for the family to mourn. Viki Lavi, another attendee, noted the duality of emotions, saying, ‘This is our life, crying and being happy.’ The ceremony underscored the ongoing trauma and resilience of those affected by the conflict.

-

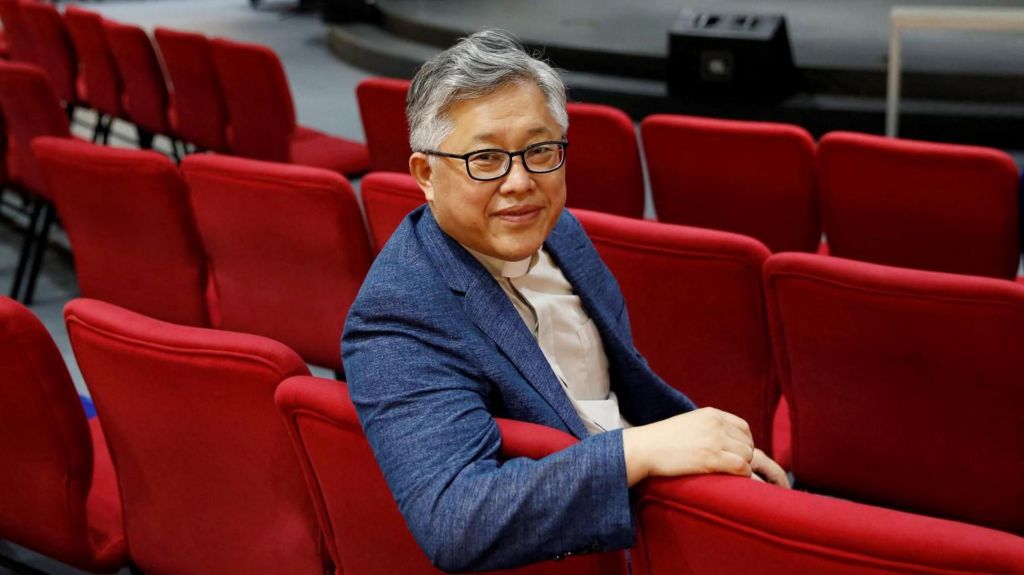

China arrested 30 Christians. Some fear it’s the start of a bigger crackdown

In what activists are calling China’s largest arrest of Christians in decades, 30 members of the Zion Church network, including its founder Pastor Jin Mingri, were detained last weekend. The arrests, spanning at least 10 cities, have raised concerns of a broader crackdown on underground churches. Jin Mingri, a prominent figure in China’s Christian community, was taken from his base in Beihai city, Guangxi province, and is currently held in Beihai Number Two prison on suspicion of “illegal use of information networks.” His daughter, Grace Jin Drexel, who resides in the US, recounted the moment she learned of her father’s detention, describing it as a sudden and shocking event. The arrests come amid increasing pressure from Chinese authorities on unregistered religious groups, with new laws and regulations aimed at curbing their activities. Despite official figures stating there are 38 million Protestants and six million Catholics in China, rights activists estimate that tens of millions more attend underground churches, which do not align with state-sanctioned ideologies. The Chinese government has long sought to control religious practices, with recent measures including the banning of Christian apps, demolition of church buildings, and the imposition of strict online codes of conduct for religious personnel. The Zion Church, which began as a small house church in Beijing, has grown to over 10,000 followers across 40 cities, making it a significant target for authorities. While some arrested members have been released, the majority remain in detention, with fears that this crackdown may be just the beginning. Christian advocacy groups warn that the Chinese government’s policy of acting against house churches will continue, with accusations of fraud and economic crimes likely to be used as intimidation tactics. Despite the challenges, church leaders remain hopeful, citing historical examples where repression led to revival.

-

Sri Lankan PM highly praises China’s initiatives at Global Leaders’ Meeting on Women

During her visit to China for the Global Leaders’ Meeting on Women, Sri Lankan Prime Minister Harini Amarasuriya highlighted the concerning global decline in women’s rights, gender equality, and reproductive rights. In an exclusive interview with China Daily on Tuesday, she praised China’s steadfast support for gender equality and its proactive initiatives, which she described as a testament to the nation’s strong sense of international responsibility. Amarasuriya emphasized that China’s efforts stand out in a world where many countries are experiencing setbacks in these critical areas. Her remarks underscored the importance of global cooperation and leadership in advancing gender equality, particularly in the face of growing challenges. The Prime Minister’s comments also reflected the broader significance of the meeting, which brought together leaders from around the world to address pressing issues related to women’s rights and empowerment.

-

Halsey to headline 2025–2026 Dubai Shopping Festival with first UAE concert

Global music sensation Halsey is set to make her highly anticipated debut in the United Arab Emirates with a headline performance at the Coca-Cola Arena in Dubai on December 6, 2025. This exclusive concert will mark the grand opening of the 2025–2026 Dubai Shopping Festival (DSF), the world’s longest-running retail festival. Presented as part of Dubai Calendar’s winter lineup, the event promises an electrifying night of chart-topping hits, powerful vocals, and the raw storytelling that has defined Halsey’s illustrious career. Tickets, starting at Dh295, are now available at www.coca-cola-arena.com, with the first 500 Fan Pit ticket buyers receiving a Dh50 merchandise voucher to commemorate this historic occasion. Halsey, a three-time GRAMMY-nominated artist, has cemented her status as a cultural icon with over 50 billion streams, 75 RIAA-certified singles, and four RIAA-certified albums. Her latest release, *The Great Impersonator* (2024), debuted at No. 1 on *Billboard’s* Top Rock & Alternative and Top Alternative Albums charts, continuing her streak of chart-topping successes. Beyond music, Halsey has expanded her influence through her beauty line, bestselling poetry collection, and inclusion in *TIME’s* 100 Most Influential People list. This concert follows her critically acclaimed For My Last Trick Tour and coincides with the release of *BADLANDS: Decade Edition Anthology*, celebrating 10 years of her groundbreaking debut album.

-

UAE growth forecast leapfrogs global trend, IMF report says

The International Monetary Fund (IMF) has significantly revised its growth projections for the United Arab Emirates (UAE), highlighting the nation’s economic resilience amidst global uncertainties. In its latest World Economic Outlook, the IMF now anticipates the UAE’s real GDP to grow by 4.8% in 2025, up from its April estimate, with a further acceleration to 5.0% in 2026. This optimistic outlook contrasts with a global economic slowdown, where growth is expected to decline from 3.3% in 2024 to 3.1% in 2026. Advanced economies are projected to grow at a modest 1.5%, while emerging markets hover just above 4%. The Middle East and Central Asia are set to see growth rise from 2.6% in 2024 to 3.8% in 2026, with the UAE leading the charge. The IMF attributes the UAE’s robust performance to its diversified economy, strong financial buffers, and strategic reforms. Key drivers include a widening current account surplus, bolstered by non-hydrocarbon exports, and deepening trade agreements with nations like India, Indonesia, Türkiye, and South Korea. The UAE’s financial sector remains stable, with well-capitalized banks, declining non-performing loans, and innovative measures such as the Digital Dirham and stablecoin regulation. The real estate market continues to thrive, supported by population growth and foreign investment, though the IMF cautions against potential shifts in capital flows. Structural reforms in infrastructure, sustainability, and AI further cement the UAE’s position as a forward-looking economic hub. Looking ahead, the UAE’s growth trajectory remains promising, underpinned by sound fiscal policies, regulatory advancements, and a commitment to long-term reforms.

-

Trump claims India will stop buying Russian oil, escalating pressure on Moscow over Ukraine war

In a significant development, former U.S. President Donald Trump announced on Wednesday that Indian Prime Minister Narendra Modi had personally guaranteed India would cease purchasing Russian oil. This claim, yet to be verified by the Indian government, aligns with Trump’s broader strategy to exert pressure on Moscow to negotiate an end to the ongoing conflict in Ukraine. ‘There will be no oil. He’s not buying oil,’ Trump stated, adding that the transition would not be immediate but would occur ‘within a short period of time.’ The Indian embassy in Washington has not yet commented on the matter. Trump has been vocal about his frustrations over the prolonged war in Ukraine, which began with Russia’s invasion nearly four years ago. He has increasingly criticized Russian President Vladimir Putin, labeling him as the main impediment to peace. Trump is scheduled to meet with Ukrainian President Volodymyr Zelenskyy on Friday. India, the second-largest buyer of Russian oil after China, faced U.S. tariffs in August as part of Trump’s efforts to curb its economic ties with Russia.

-

Nasdaq Dubai welcomes CNY1 billion bond listing by Emirates NBD

Nasdaq Dubai has marked a significant milestone with the listing of a CNY1 billion (approximately US$140 million) bond by Emirates NBD Bank. This issuance, part of the bank’s US$20 billion Euro Medium Term Note (EMTN) Programme, features 2.40 percent Notes maturing in 2028. The move signifies Emirates NBD’s re-entry into the Dim Sum market, a platform that facilitates global investors’ access to renminbi-denominated bonds outside mainland China. This strategic issuance not only diversifies the bank’s funding sources but also underscores the robust investor demand for high-quality financial instruments from UAE institutions. With this listing, Emirates NBD’s total debt instruments on Nasdaq Dubai now stand at $5.4 billion across nine issuances, cementing its status as one of the UAE’s most active financial entities on the exchange. The transaction also highlights Dubai’s deepening ties with Asian markets, as renminbi-denominated bonds gain prominence in international capital markets. To commemorate the occasion, Hesham Abdulla Al Qassim, Vice Chairman and Managing Director of Emirates NBD, rang the market-opening bell at Nasdaq Dubai, joined by Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market (DFM). Al Qassim emphasized the bank’s commitment to wealth creation for clients, supported by significant capital inflows and a diverse product portfolio. He praised Nasdaq Dubai’s international reputation and regulatory excellence as key factors in choosing the platform for listings. Ali, in turn, highlighted Dubai’s role as a trusted gateway for UAE issuers to connect with global investors, noting the growing appeal of the market and its ability to facilitate diversified funding across currencies and geographies. The total outstanding value of debt securities listed on Nasdaq Dubai has now reached $140 billion, further solidifying the exchange’s position as a leading hub for fixed income in the region.

-

Japan postpones extraordinary Diet session to elect new PM

The Japanese government has announced the postponement of an extraordinary parliamentary session initially slated for this week to elect a new prime minister. The session is now rescheduled for October 21, though the precise timing of the vote remains undecided. This delay comes amidst a backdrop of political maneuvering and uncertainty within Japan’s ruling and opposition parties. Sanae Takaichi, the newly elected leader of the ruling Liberal Democratic Party (LDP), expressed determination to secure the premiership despite skepticism from some quarters. Takaichi’s path to the top job has been complicated by the withdrawal of the LDP’s junior coalition partner, Komeito, which cited dissatisfaction with the party’s handling of a political funding scandal. Komeito has declared it will not support Takaichi in the upcoming Diet vote. Meanwhile, opposition parties are actively strategizing to unite behind Democratic Party for the People (DPFP) leader Yuichiro Tamaki as their preferred candidate for prime minister. The LDP, which holds 196 seats in the House of Representatives and 100 in the House of Councillors, is navigating a fragmented political landscape. The election process will involve both chambers of parliament, with the lower house’s decision taking precedence in case of a tie. If no candidate secures a majority in the first round, a runoff will be held between the top two contenders.

-

Alec Holdings gains 0.71% on DFM debut in UAE’s largest-ever construction sector IPO

Alec Holdings, a prominent engineering and construction group based in Dubai, marked its debut on the Dubai Financial Market (DFM) with a modest 0.71% gain over its listing price. Opening at Dh1.47, the company’s shares climbed to Dh1.50 before settling, with over 128 million shares traded, amounting to a total value of Dh186.4 million. This listing represents the UAE’s largest-ever initial public offering (IPO) in the construction sector, both in terms of valuation and size, and the first in the sector in over 15 years. The IPO, fully subscribed, raised Dh1.4 billion through the sale of 1 billion existing ordinary shares, representing 20% of the company’s issued share capital. The Investment Corporation of Dubai (ICD), Alec’s sole selling shareholder, retains an 80% stake post-listing. Barry Lewis, CEO of Alec Holdings, highlighted the significance of the listing as a milestone in the company’s journey, emphasizing enhanced governance and transparency. Helal Al Marri, Chairman of the DFM Board of Directors, and Hamed Ali, CEO of DFM and Nasdaq Dubai, also underscored the listing’s role in diversifying Dubai’s capital markets and reinforcing its position as a global financial hub. Alec’s IPO, while modest compared to recent IPOs like Parkin (+31%) and Dubai Taxi (+19%), reflects disciplined pricing and cautious investor sentiment toward private-sector companies. The company plans to distribute dividends, starting with Dh200 million in April 2026, followed by Dh500 million for the 2026 financial year, representing a 7.1% dividend yield at listing. Analysts view Alec’s steady trading range as a sign of healthy consolidation, driven by solid fundamentals rather than speculative gains. The IPO is expected to pave the way for other engineering and infrastructure firms to go public, signaling the UAE’s maturing equity capital markets and positive outlook for future construction-sector floatations.