The United States has announced the termination of South Sudan’s Temporary Protected Status (TPS), a program that has allowed South Sudanese nationals to legally reside in the U.S. and escape ongoing armed conflict in their homeland. The decision, effective January 5, was confirmed by the Department of Homeland Security (DHS) in a recent statement. Secretary of Homeland Security Kristi Noem concluded that South Sudan no longer meets the statutory requirements for TPS after consultations with interagency partners. South Sudanese nationals who voluntarily depart the U.S. using the Customs and Border Protection mobile app may receive a complimentary plane ticket, a $1,000 exit bonus, and potential future legal immigration opportunities. This policy shift is a significant setback for South Sudanese refugees, as the country remains politically unstable and continues to produce a large number of displaced individuals seeking safety abroad. Edmund Yakani, a prominent South Sudanese civic leader, suggested that the decision reflects deteriorating U.S.-South Sudan relations, particularly regarding the deportation of foreign nationals. South Sudan has resisted accepting a second phase of U.S. deportees, which reportedly angered the Trump administration. The TPS designation, initially granted in 2011 following South Sudan’s independence from Sudan, has been renewed in 18-month increments. However, the Trump administration has consistently sought to withdraw protections for immigrants, including ending TPS for hundreds of thousands of Venezuelans and Haitians. South Sudan’s government, already struggling to provide basic services, faces additional challenges due to U.S. cuts in foreign aid. The country’s fragile peace deal, signed in 2018 to end conflict between President Salva Kiir and former deputy Riek Machar, is under strain following Machar’s arrest on criminal charges earlier this year.

标签: Africa

非洲

-

Why food-water-energy nexus must be at heart of tomorrow’s communities

As the world grapples with mounting pressures on water resources, escalating energy demands, and the increasing need for local food production due to global supply chain vulnerabilities, the UAE has positioned itself at the forefront of addressing these challenges. The concept of the food-water-energy nexus has emerged as a critical framework for building resilient and sustainable communities, particularly in the face of rapid urbanization and resource constraints. This approach, endorsed by the United Nations, underscores the interconnectedness of water, energy, and food security, which are central to achieving 14 out of the 17 Sustainable Development Goals. In the UAE, this interconnectedness is not merely theoretical but is actively integrated into strategic initiatives such as the UAE Food Security Strategy 2051, which aims to enhance domestic food production while mitigating the impacts of climate change-induced water scarcity. Sharjah, in particular, has become a hub for sustainable innovation, with projects like Sharjah Sustainable City exemplifying this commitment. Spanning 7.2 million square feet, this master-planned community features 1,250 villas powered by rooftop solar panels, treats 100% of its wastewater for irrigation, and incorporates urban farming and biodomes to promote local food production. The project also emphasizes behavioral change, engaging residents through workshops on urban farming, composting, energy conservation, and sustainable art. Sharjah’s broader sustainability vision, including initiatives like electrifying its public bus fleet with low-emission vehicles, further cements its leadership in regenerative urbanism. Moving forward, the challenge for real estate developers and policymakers lies in embedding the food-water-energy nexus into the core of new developments, ensuring that sustainable living becomes the default rather than the exception. As global milestones for food, energy, and sustainability are observed, the integration of these systems will be pivotal in shaping communities that are not only resilient but also economically, socially, and environmentally sustainable.

-

GFH Partners announces acquisition of Riyadh logistics asset

GFH Partners Ltd, a prominent institutional fund manager based in Dubai International Financial Centre and regulated by the DFSA, has announced a significant acquisition in the logistics sector. One of its advised real estate funds has secured a large-scale logistics property in Riyadh for approximately 200 million Saudi riyals. This strategic move underscores GFH Partners’ commitment to expanding its industrial and logistics investment platform in the GCC region, which now boasts assets worth around 1.5 billion riyals. The firm’s global assets under management (AUM) currently stand at an impressive 26 billion riyals. The newly acquired property, situated in Riyadh’s industrial and logistics zone, spans over 40,000 square meters and features state-of-the-art infrastructure, including 12-meter clear heights, truck docks, high power capacity, and direct access to Riyadh’s Eastern and Southern Ring Roads. Fully leased, the asset caters to leading logistics operators seeking scalable, high-quality infrastructure in one of the region’s most sought-after distribution hubs. This acquisition marks the fourth asset secured by GFH Partners in Saudi Arabia and the 34th property within its broader platform. The platform’s properties are leased to over 120 tenants across strategic industrial and logistics zones in Saudi Arabia and the UAE, benefiting from prime access to multi-modal transport corridors linking key regional markets, including JAFZA, Dubai South, and industrial cities in Dammam and Riyadh. Mohamed Ali, Head of GCC at GFH Partners, emphasized the firm’s optimistic outlook on the industrial and logistics sector in the GCC, citing strong growth driven by national initiatives to diversify economies and enhance supply chain infrastructure. Since launching its GCC platform in 2023, GFH Partners and its affiliates have managed three dedicated funds focused on industrial and logistics assets in Saudi Arabia and the UAE. The firm continues to expand its portfolio, with several built-to-suit and infrastructure-related development transactions underway in the logistics sector, alongside plans for additional acquisitions in the near future.

-

It’s official: Rajinikanth to act in movie produced by Kamal Haasan

In a groundbreaking announcement, Indian cinema legends Rajinikanth and Kamal Haasan are set to collaborate for the first time in over four decades. The project, tentatively titled ‘#Thalaivar173’, will be directed by Sundar C, renowned for his work in Tamil cinema. Kamal Haasan, who also serves as the producer, revealed the news via social media, confirming a release date of January 14, 2027, coinciding with the Pongal festival. While it remains unclear if the two icons will share screen space, the collaboration has already sparked immense excitement among fans. The film is produced under Haasan’s banner, Raaj Kamal Films International, marking 44 years of the production house. This project not only reunites the duo but also celebrates their enduring friendship and contributions to Indian cinema. Rajinikanth and Haasan last appeared together in full-fledged roles in the 1979 film ‘Allaudinaum Arputha Vilakkum’. Since then, they have made cameo appearances in each other’s films, including Rajinikanth’s ‘Thillu Mullu’ (1981). The announcement follows Rajinikanth’s earlier hint about a potential collaboration with Haasan. Director Sundar C, known for hits like ‘Aranmanai’ and ‘Anbe Sivam’, brings his expertise to this highly anticipated project, further elevating expectations.

-

Are Christians being persecuted in Nigeria as Trump claims?

The recent claims of widespread Christian persecution in Nigeria, amplified by U.S. political figures and media personalities, have sparked intense debate. President Donald Trump’s threat to intervene in Nigeria “guns-a-blazing” to halt the alleged killings of Christians has drawn attention to the issue, but the accuracy of the data fueling these assertions remains questionable. Campaigners and politicians, including Senator Ted Cruz and comedian Bill Maher, have cited figures suggesting that over 100,000 Christians have been killed since 2009, with thousands of churches destroyed. However, the Nigerian government and independent analysts dispute these claims, labeling them as a “gross misrepresentation of reality.”

Much of the data cited by U.S. figures originates from the International Society for Civil Liberties and Rule of Law (InterSociety), a Nigerian NGO. InterSociety’s reports claim that jihadist groups, including Boko Haram and Fulani herders, have systematically targeted Christians. Yet, the organization’s methodology has been criticized for its lack of transparency and reliance on unverified sources. For instance, while InterSociety cites media reports as evidence, many of these reports do not specify the religious identity of victims. The BBC’s analysis of InterSociety’s data found significant discrepancies, with the total number of deaths reported by the NGO far exceeding verifiable figures.

Nigerian officials argue that the violence is not religiously motivated but rather part of a broader security crisis involving jihadist groups, criminal networks, and ethnic tensions. Security analyst Christian Ani emphasized that while Christians have been victims of attacks, there is no evidence to support claims of deliberate targeting. Similarly, other monitoring groups, such as Acled, report that the majority of victims in Nigeria’s political violence are Muslims, not Christians.

The controversy has significant political implications, with U.S. politicians using the issue to criticize Nigeria’s government and advocate for intervention. However, Nigerian authorities have welcomed international support, provided it is not unilateral. The debate also highlights the complexities of Nigeria’s security challenges, which include jihadist insurgencies, ethnic conflicts, and criminal activities. As the discourse continues, the need for accurate, verifiable data remains critical to understanding and addressing the situation.

-

Safer winter: Protecting infants from respiratory syncytial virus

As winter approaches, healthcare institutions across the UAE are gearing up for an anticipated surge in respiratory syncytial virus (RSV) cases, particularly among infants. This seasonal spike highlights the critical need for coordinated efforts among families, communities, and healthcare providers to mitigate the spread of the virus and protect vulnerable populations. RSV, a leading cause of infant hospitalizations globally, demands proactive measures to prevent severe outcomes. Dr. Markus Knuf, Head of the Children’s Hospital in Worms, Germany, and a Paediatric Infectious Disease Consultant at the University of Mainz, emphasized the success of Germany’s strategy, which reduced RSV-related hospitalizations by 80% through public awareness campaigns, preventive measures, and early interventions. This remarkable achievement underscores the importance of education and timely action in safeguarding children’s health. In the UAE, experts like Dr. Walid Abu Hammour, Head of the Infectious Disease Department at Al Jalila Children’s Specialty Hospital, and Dr. Eslam El Baroudy, Professor and Paediatric Consultant at Cairo University and Sheikh Khalifa Medical City, have highlighted the ease of RSV transmission through respiratory droplets and contaminated surfaces. They advocate for consistent preventive practices in households and schools, emphasizing the role of community-wide collaboration in minimizing risks. Sanofi’s General Manager for the Greater Gulf, Baptiste de Clarens, reiterated the company’s partnership with UAE healthcare authorities to promote preventive measures and raise public awareness. These collective efforts aim to ensure a safe and healthy start to the winter season for every child, while also alleviating strain on the healthcare system and fostering a culture of health awareness and shared responsibility.

-

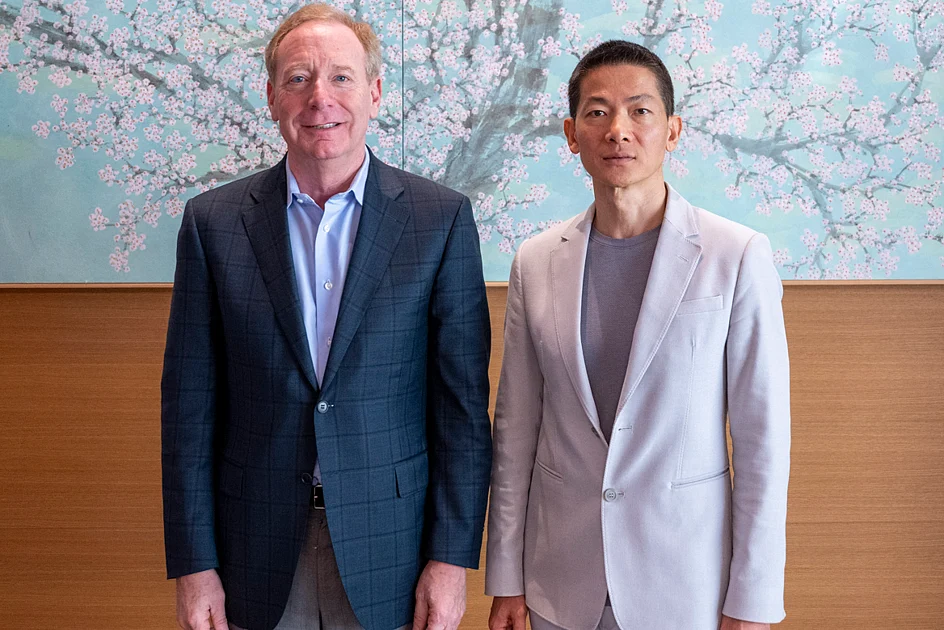

Microsoft and G42 unveil major data centre expansion to power UAE’s digital future

In a landmark initiative to strengthen the UAE’s digital infrastructure, Microsoft and Abu Dhabi-based technology conglomerate G42 have unveiled a significant expansion of data centre capacity in the region. Announced on November 5, 2025, the project is part of Microsoft’s broader $15.2 billion investment in the UAE and will add 200 megawatts (MW) of new capacity through Khazna Data Centres, a subsidiary of G42. The new facilities are slated to become operational by the end of 2026. This expansion underscores the deepening strategic partnership between the two companies, aimed at accelerating the UAE’s digital transformation and doubling the digital economy’s contribution to the nation’s GDP over the next decade. Brad Smith, Vice Chair and President of Microsoft, highlighted the initiative’s broader significance, stating, “This expansion is more than data centres. It’s about powering the UAE’s future.” The enhanced infrastructure will bolster Microsoft Azure’s cloud services, offering advanced AI capabilities and GPU-powered computing to support public sector organisations, regulated industries, and enterprises. The collaboration emphasises trust, cybersecurity, and ethical AI development. Peng Xiao, Group CEO of G42, described the partnership as a step toward building the “Intelligence Grid,” a globally interconnected infrastructure designed to empower industries and individuals in the AI era. The initiative also includes a commitment to developing local talent, with Microsoft pledging to skill one million people in the UAE by 2027. Previous joint efforts, such as the establishment of the Responsible AI Future Foundation, further solidify the UAE’s position as a regional leader in digital innovation.

-

Toyota, Honda turn India into car production hub in pivot away from China

In a strategic move to diversify their global supply chains, Japanese automotive giants Toyota, Honda, and Suzuki are channeling billions of dollars into India, transforming the country into a pivotal manufacturing hub. This shift marks a significant pivot away from China, driven by rising costs, intense competition, and geopolitical uncertainties.

-

Bitcoin dips below $100K: Is the crypto rally over or just taking a pause?

The cryptocurrency market has entered a turbulent phase as Bitcoin, the flagship digital asset, plummeted below the psychologically significant $100,000 mark, reaching its lowest level since late June. This sharp decline, which saw Bitcoin lose over 20% from its October 6 peak of $126,000, has sparked intense speculation among analysts: is this a temporary pause in the rally or the onset of a prolonged bear market? The immediate catalysts for the downturn include technical breakdowns, shifting macroeconomic conditions, and internal market dynamics. Technically, Bitcoin’s breach of the 200-day moving average at $109,800 has signaled potential further declines. Katie Stockton of Fairlead Strategies predicts the correction could persist for weeks, with the next support level around $94,200, while maintaining a long-term target of $134,500. Macroeconomic pressures have also intensified, with a stronger US dollar and hawkish Federal Reserve rhetoric dampening investor sentiment. This has led to a net outflow of $360 million from cryptocurrency investment products last week, according to CoinShares’ James Butterfill. Internally, institutional demand has waned, with on-chain data revealing that institutional net buying has dropped below the daily mining supply for the first time in seven months. Glassnode data further confirms a slowdown in institutional accumulation, with Blackrock’s spot Bitcoin ETF seeing weekly net inflows shrink to less than 600 Bitcoins, a stark contrast to the 10,000 Bitcoins per week during previous rallies. Despite these challenges, some analysts remain optimistic. QCP Capital attributes the pullback to profit-taking by long-term holders rather than macroeconomic factors, noting the market’s resilience in absorbing significant selling pressure. Gary O’Shea of Hashdex emphasizes that the long-term investment case for Bitcoin remains intact, citing accelerating institutional adoption as a key driver for future growth. The current downturn is seen as a critical test for the market’s new structure, built around spot ETFs and institutional participation. While this structure may have reduced volatility, the path forward depends on a positive shift in the macro environment and a resurgence of institutional demand. For now, the market watches closely to see if Bitcoin can hold the $100,000 level or if further corrections are imminent.

-

Dubai’s housing sector posts record sales in October

Dubai’s real estate sector has achieved unprecedented milestones in 2025, with residential and office markets reaching record-breaking performance levels. By the end of October, property sales soared to Dh559.4 billion, surpassing the previous full-year record of Dh522.1 billion set in 2024. This remarkable growth is fueled by sustained population expansion, robust investor confidence, and Dubai’s transformation into a permanent residence for global citizens rather than a transient hub. The market’s resilience is further underscored by a strong preference for off-plan properties, which accounted for 70% of total residential sales in Q3 2025. Apartments dominated transaction volumes, while villas and townhouses experienced a 22% average price increase due to limited supply. The Dh5–10 million price segment saw a 60% surge in transactions, reflecting heightened demand for premium properties. The office market mirrored this strength, with Grade A office assets achieving a 95% occupancy rate and citywide rents rising to Dh190 per square foot, a 22% year-on-year increase. Prime districts like DIFC, One Central, and Downtown Dubai continued to command top rental rates. A wave of new office supply, projected at 2.3 million square feet in 2026 and 4.1 million square feet in 2027, is already seeing strong pre-leasing activity. Industry experts attribute this sustained boom to visionary government policies, including long-term residency options like the Golden Visa, and world-class infrastructure. With two months remaining in 2025, analysts predict it will be the most active year ever for Dubai’s real estate market, setting the stage for achieving the Dh1 trillion annual transaction target outlined in the Dubai Real Estate Strategy 2033.