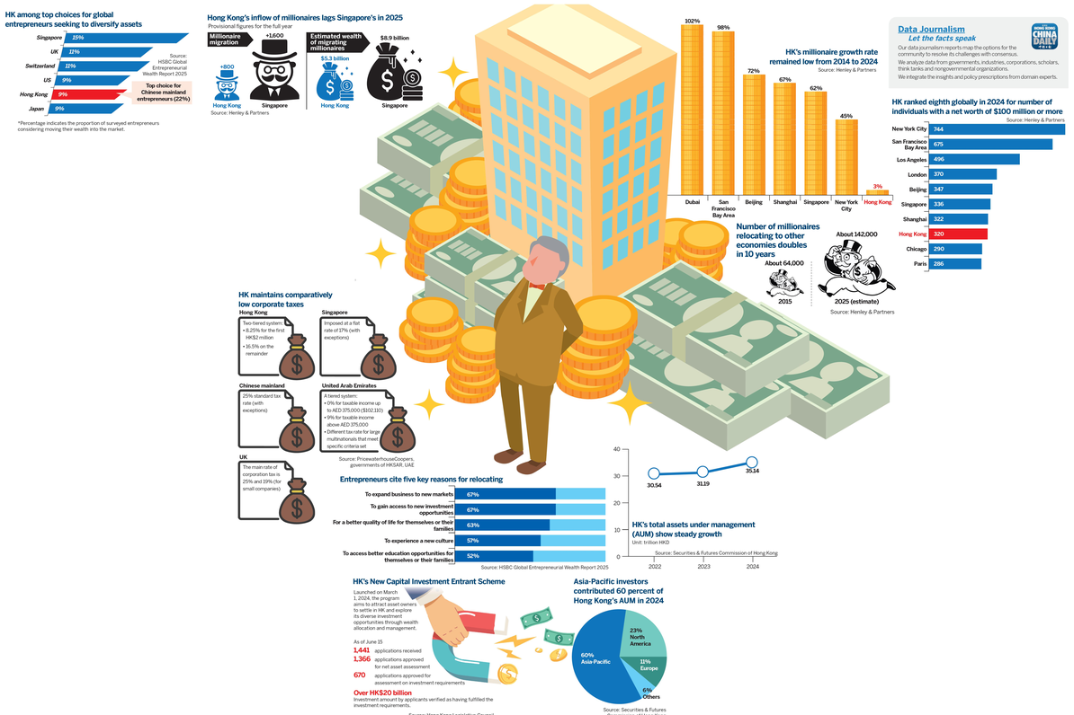

In the intensifying global competition for high-net-worth individuals and entrepreneurial talent, Hong Kong occupies a uniquely nuanced position. While numerically trailing destinations like the UAE (9,800 millionaires) and Singapore (1,600) in sheer volume, the Special Administrative Region is experiencing a fundamental recalibration rather than decline in its wealth migration patterns, according to the Henley & Partners Private Wealth Migration Report 2025.

Global jurisdictions have escalated policy competition through attractive residency-by-investment programs, creating what experts describe as a ‘gold-mining zero-sum game.’ Among Asia’s six prominent investment migration destinations—Hong Kong, Singapore, Malaysia, Thailand, Japan, and Kazakhstan—Hong Kong distinguishes itself through superior tax structures, processing efficiency, and established financial systems. The city anticipates a net inflow exceeding 800 high-net-worth individuals this year, ranking 11th globally.

The narrative of Hong Kong’s perceived shortfall requires contextual examination. Parag Khanna, CEO of AlphaGeo and migration authority, emphasizes that current metrics reflect ‘relative shifts’ rather than absolute decline. ‘Hong Kong has been at the top and remains in the top tier. That’s what matters,’ Khanna asserts, noting that ultra-rich density rankings show negligible practical differences between top-tier wealth hubs.

Critical to understanding Hong Kong’s evolution is its deepening integration with mainland China’s economy and the Greater Bay Area initiative. This connection generates substantial new wealth streams, with studies indicating significant migration from top-earning executives of Shenzhen’s high-tech corporations. A Deloitte study commissioned by InvestHK revealed over 2,700 single-family offices in Hong Kong by late 2023, predominantly backed by mainland families.

Immigration specialists Magdalene Tennant and Kitty Lo of Fragomen note Hong Kong’s enduring appeal lies in its strategic positioning: ‘The SAR’s position within the Greater Bay Area gives direct access to one of the region’s most dynamic economic clusters.’ The city maintains competitive advantages through its robust legal system, transparent regulations, simple tax structure, and status as China’s primary offshore capital-raising hub.

While Singapore leads in pathways to citizenship and quality-of-life metrics, Hong Kong’s unique value proposition remains its unparalleled connectivity to mainland markets. The city’s evolution reflects what Khanna terms the ‘Asianization’ of its financial identity, increasingly integrating with regional networks including Tokyo, Singapore, Sydney, and New Delhi.

Looking forward, experts identify areas for enhancement including policy flexibility expansion, entrepreneur immigration pathway diversification, and reinforced investor confidence through transparent regulations. These developments will determine Hong Kong’s continued position as a premier destination for global wealth and talent in an increasingly competitive landscape.