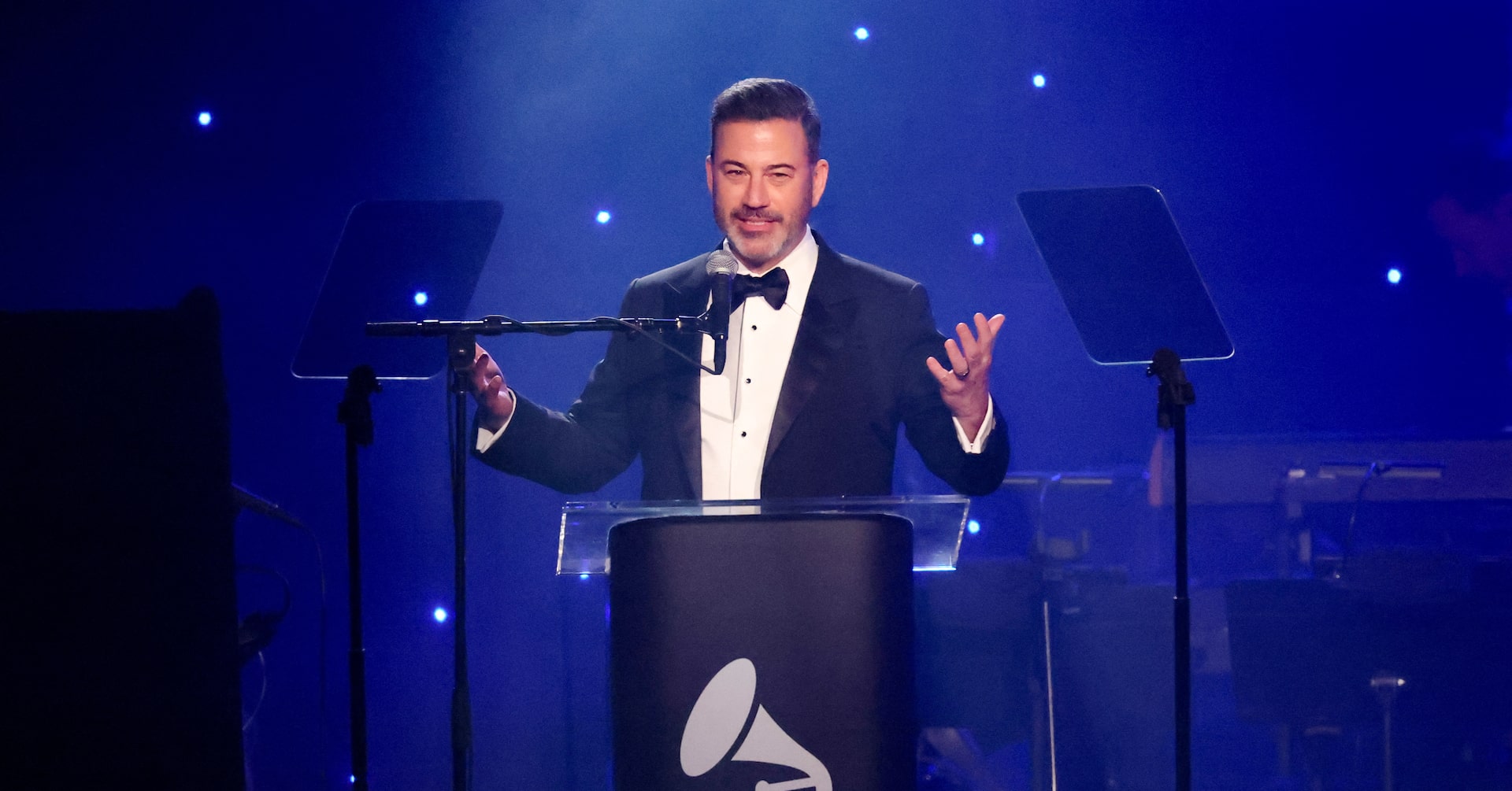

In a dramatic turn of events, ABC has indefinitely suspended ‘Jimmy Kimmel Live’ following intense regulatory threats from the Trump administration. The decision came after Jimmy Kimmel, a vocal critic of former President Donald Trump, made controversial remarks about the assassination of conservative activist Charlie Kirk during his September 10 monologue. Kimmel suggested that Kirk’s allies were exploiting his death for political gain, a statement that sparked widespread backlash from conservative circles. The Walt Disney-owned broadcaster faced pressure from Nexstar Media Group, which owns 32 ABC affiliates, and the Federal Communications Commission (FCC), which threatened investigations and potential fines. FCC Chair Brendan Carr urged local broadcasters to cease airing the show, praising Nexstar for its stance. Unions representing writers, actors, and musicians have condemned the suspension, labeling it an attack on free speech and a form of state censorship. The Writers Guild of America West and East issued a joint statement, emphasizing the importance of protecting constitutional rights. Meanwhile, actor Ben Stiller and SAG-AFTRA voiced their support for Kimmel, criticizing the decision as a dangerous precedent. The incident has reignited debates about media freedom and government interference in the entertainment industry.

博客

-

In Congo, army and rebels dig in for war Trump says is over

In the eastern Democratic Republic of Congo (DRC), the fragile peace process is unraveling as both the Congolese army and the Rwandan-backed M23 rebel group reinforce their military positions. This escalation comes amid missed deadlines for peace agreements brokered by the U.S. and Qatar, raising fears of a renewed regional conflict. The M23, which seized two major cities earlier this year, demands prisoner releases and power-sharing in the territories they control, while the Congolese government refuses to cede authority or release detainees.

-

Hong Kong central bank cuts interest rate, tracking Fed; banks follow

On September 18, 2023, the Hong Kong Monetary Authority (HKMA) announced a reduction in its base interest rate by 25 basis points to 4.50%, aligning with the U.S. Federal Reserve’s recent decision. This marks the first rate cut by the HKMA since December 2022, when it last lowered rates by a similar margin. The adjustment, implemented through the overnight discount window, aims to maintain economic stability in Hong Kong, whose currency is pegged to the U.S. dollar within a narrow range of 7.75-7.85 per dollar. Major banks in Hong Kong, including HSBC and Bank of China (Hong Kong), partially followed suit, reducing their prime lending rates to 5.125% effective September 19. HSBC’s Hong Kong CEO, Luanne Lim, emphasized that the decision reflects both the U.S. rate cut and local market conditions, while HKMA Chief Executive Eddie Yue highlighted the potential positive impact on the city’s property market and broader economy. The Federal Reserve’s recent quarter-point rate cut and its indication of further reductions this year have influenced Hong Kong’s monetary policy, though Yue cautioned that the pace and extent of future U.S. rate cuts remain uncertain.

-

Fed’s rate cut comes with caveats, leaving investors lukewarm

The Federal Reserve’s recent decision to cut interest rates by 25 basis points has left investors navigating a complex landscape of economic uncertainty. On September 17, 2025, Fed Chair Jerome Powell announced the first rate cut since December, lowering the policy rate to a range of 4%-4.25%. While the move signaled a dovish shift, Powell tempered expectations by highlighting persistent inflation risks and a weakening labor market, leaving markets cautious about the pace of future easing. The Fed’s updated economic projections, including its ‘dot plot,’ indicated a potential 50 basis points in cuts by year-end, but inflation is still forecasted to remain above the 2% target at 3%. This nuanced messaging has dampened optimism, with the Nasdaq and S&P 500 closing lower in choppy trading. Treasury yields rose, reflecting market unease. Analysts warn of stagflation risks, a mix of sluggish growth and high inflation, complicating the Fed’s ability to support the economy. Internal disagreements within the Fed, including a lone dissent advocating for a larger rate cut, have added to the volatility. Investors now face a challenging environment as they digest conflicting signals and brace for heightened market fluctuations.

-

BOJ may raise rates in October even if Takaichi wins leadership race, says ex-c.bank official

The Bank of Japan (BOJ) could proceed with an interest rate hike in October, even if Sanae Takaichi, a prominent advocate of aggressive monetary easing, wins the Liberal Democratic Party’s (LDP) leadership race and becomes Japan’s next prime minister, according to former BOJ executive Tomoyuki Shimoda. Takaichi, a leading candidate in the October 4 leadership race, has been vocal in her opposition to the BOJ’s rate hikes and has called for increased fiscal spending to stimulate the economy. However, Shimoda, who previously served in the BOJ’s monetary affairs department, believes that Takaichi’s potential victory would have a limited impact on monetary policy. He expressed skepticism about her ability to implement policies that could weaken the yen, which has been a concern for policymakers due to its inflationary effects. A weak yen boosts exports but raises import costs, contributing to inflation that has remained above the BOJ’s 2% target. Shimoda noted that a yen fall below 150 to the dollar could also draw complaints from the U.S. administration, which is pursuing a weak-dollar policy to support U.S. exports. The BOJ is likely to raise rates at its October 29-30 meeting if stock prices remain stable and the upcoming ‘tankan’ business sentiment survey, due on October 1, does not show significant deterioration. Shimoda highlighted that solid corporate profits, wage hikes, and persistent rises in food costs are creating a favorable environment for a rate increase. The BOJ is widely expected to maintain its current interest rate of 0.5% at its upcoming meeting, but a Reuters poll indicates that a majority of economists anticipate another 25-basis-point hike by year-end, with bets centered on October and January. Takaichi is known for her support of an ‘Abenomics’-style mix of fiscal and monetary stimulus, while her main rival, Shinjiro Koizumi, has less clear views on BOJ policy. The BOJ exited its decade-long ultra-loose monetary policy last year and raised short-term rates to 0.5% in January, signaling its readiness to continue hiking rates as inflation remains above 2%. The yen’s movements have historically influenced BOJ decisions, and its recent stabilization around 146 per dollar follows a plunge to near two-decade lows last year.

-

US vaccine panel to vote on the use of combined measles shot this week

The U.S. Centers for Disease Control and Prevention (CDC) is set to host a pivotal meeting this week, where vaccine advisers will vote on a proposal to eliminate recommendations for the combined measles, mumps, rubella, and varicella (MMRV) vaccine for children under four. This decision comes amid heightened scrutiny from Health Secretary Robert F. Kennedy Jr., who has long questioned vaccine safety despite overwhelming scientific evidence to the contrary. Kennedy has promoted the unfounded claim that the MMRV vaccine is linked to autism, a theory repeatedly debunked by rigorous scientific studies. The Advisory Committee on Immunization Practices (ACIP) will convene on September 18-19 to deliberate on the proposal, as outlined in a draft agenda on the CDC’s website. The meeting follows Kennedy’s controversial decision in June to dismiss all 17 ACIP members and appoint eight new advisers, some of whom have previously opposed vaccines. Since assuming his role under the Trump administration, Kennedy has initiated a review of vaccine policies, including the measles shot, which remains the most effective method to prevent the highly contagious and potentially deadly virus. Currently, the CDC recommends that children under four receive separate doses of the MMR and varicella vaccines, with the MMRV vaccine preferred for older children. This year, the U.S. has reported 1,454 measles cases, the highest in over three decades, underscoring the urgency of the debate. The MMRV vaccine is marketed in the U.S. by pharmaceutical giants Merck and GSK, with Merck also offering the ProQuad shot, which protects against measles, mumps, rubella, and varicella.

-

Trump tariffs could fund bailout for US farmers, agriculture secretary tells FT

The Trump administration is reportedly formulating a plan to utilize tariff revenue to finance a support program for U.S. farmers, according to a Financial Times report published on Thursday. Agriculture Secretary Brooke Rollins revealed in an interview that the administration is actively considering this approach, stating, ‘There may be circumstances under which we will be very seriously looking to and announcing a package soon.’ Rollins emphasized that using ‘tariff income that is now coming into America’ is ‘absolutely a potential’ funding source. The White House has yet to comment on the matter. This development comes amid mounting pressure from agricultural groups, exacerbated by China’s halt in soybean purchases from the U.S. due to the ongoing trade dispute. Additionally, tariffs have increased costs for essential farming inputs such as fertilizer and machinery. Agriculture has become a focal point in the escalating trade tensions between the two superpowers, initiated by President Donald Trump’s tariff policies. The situation underscores the broader economic challenges faced by U.S. farmers in the current geopolitical climate.

-

Facebook owner unveils new AI-powered smart glasses

At the annual Meta Connect conference held in Silicon Valley, Meta CEO Mark Zuckerberg introduced a groundbreaking lineup of smart glasses and AI-powered wearable devices, signaling the company’s ambitious push into the future of wearable technology. The event, attended by hundreds of tech enthusiasts and industry leaders, showcased Meta’s latest innovations, including the Meta Ray-Ban Display glasses and the Oakley Meta Vanguard, both designed to integrate seamlessly with the company’s AI ecosystem. The Meta Ray-Ban Display features a high-resolution, full-color screen embedded in one lens, enabling users to conduct video calls, view messages, and capture photos with a 12-megapixel camera. Additionally, Meta unveiled a neural wristband that pairs with the glasses, allowing users to perform tasks like sending messages through subtle hand gestures. Despite a minor hiccup during the live demonstration—a WhatsApp call failed to connect—Zuckerberg emphasized the transformative potential of these devices, calling the technology a ‘huge scientific breakthrough.’ Analysts predict that smart glasses, with their everyday practicality, could outperform Meta’s Metaverse project in terms of market adoption. However, challenges remain in convincing consumers of their value, particularly given the $799 price tag for the Meta Ray-Ban Display. Zuckerberg also highlighted Meta’s massive investments in AI infrastructure, including plans to build sprawling data centers across the U.S., as part of its mission to develop ‘superintelligence.’ The event was not without controversy, as activists protested outside Meta’s New York headquarters, demanding stronger safeguards for children on social media platforms. These concerns were amplified by recent Senate testimonies from former Meta researchers alleging the company downplayed potential harms of its VR products. Meta has denied these claims, labeling them as ‘nonsense.’

-

NYT chief executive warns Trump is deploying ‘anti-press playbook’, FT says

On September 17, 2025, Meredith Kopit Levien, CEO of The New York Times, publicly addressed the $15-billion lawsuit filed by U.S. President Donald Trump against the newspaper. Speaking at a Financial Times conference, Levien dismissed the lawsuit as ‘legally baseless’ and lacking any legitimate claims. She asserted that the suit was a strategic move to intimidate and suppress independent journalism, particularly the fact-based reporting that The New York Times is renowned for. ‘The New York Times will not be cowed by this,’ Levien declared, emphasizing the paper’s commitment to upholding journalistic integrity. This lawsuit is part of a broader pattern of legal actions Trump has taken against media outlets during his second term, including a $10-billion defamation case against The Wall Street Journal in July. The White House has yet to comment on the matter. The New York Times, in response to Reuters, reiterated that the lawsuit was an attempt to stifle independent reporting and lacked any substantive legal foundation. The case underscores the ongoing tension between the Trump administration and the press, raising concerns about press freedom and the role of media in holding power to account.

-

Markets sleeping on US-China trade breakthrough

Despite the optimistic developments in US-China trade negotiations, global investors have largely failed to recognize the potential upside. The world’s two largest economies are steadily moving toward a trade settlement that could yield significant benefits for both nations. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer have been engaged in ongoing discussions with Beijing, with the latest round of talks set to take place in Spain. A reciprocal-tariff truce has been extended to November, and sensitive issues such as technology transfers, industrial overcapacity, and data rules are now being addressed in detail. The US trade deficit with China, which stood at $300 billion last year, has narrowed to $128 billion through July, with officials forecasting a 30% decline by 2025. However, investors remain cautious, holding cash and safe-haven assets as if confrontation is inevitable. This overlooks the mutual incentives driving Washington and Beijing toward accommodation. For the US, easing tariff threats helps contain inflation and provides clarity for American companies. For China, securing reliable access to the US market stabilizes employment and supports tax revenues. A credible trade agreement would offer tangible economic wins for both nations, yet markets have yet to price in the potential benefits. Reduced tariff risks could lower global shipping costs, ease inflationary pressures, and encourage capital spending. Industries such as advanced manufacturing, semiconductors, and rare-earth mining could see positive re-ratings, while Asian economies integrated into China-plus-one supply chains would benefit from increased investment. The cautious response from investors reflects years of confrontation rather than current realities. Evidence on the ground suggests a shift, with rising US core capital goods orders and multinationals planning for a more stable trade environment. ASEAN nations are attracting record foreign investment as production diversifies but remains linked to China. The political symbolism of a deal is also significant, demonstrating pragmatic leadership and competence for both governments. While verification and enforcement of any agreement will be critical, waiting for perfection before reallocating capital is a speculative bet. The next phase of global growth could be built on a pragmatic bargain between Washington and Beijing, offering mutual gains for the world’s two largest economies.