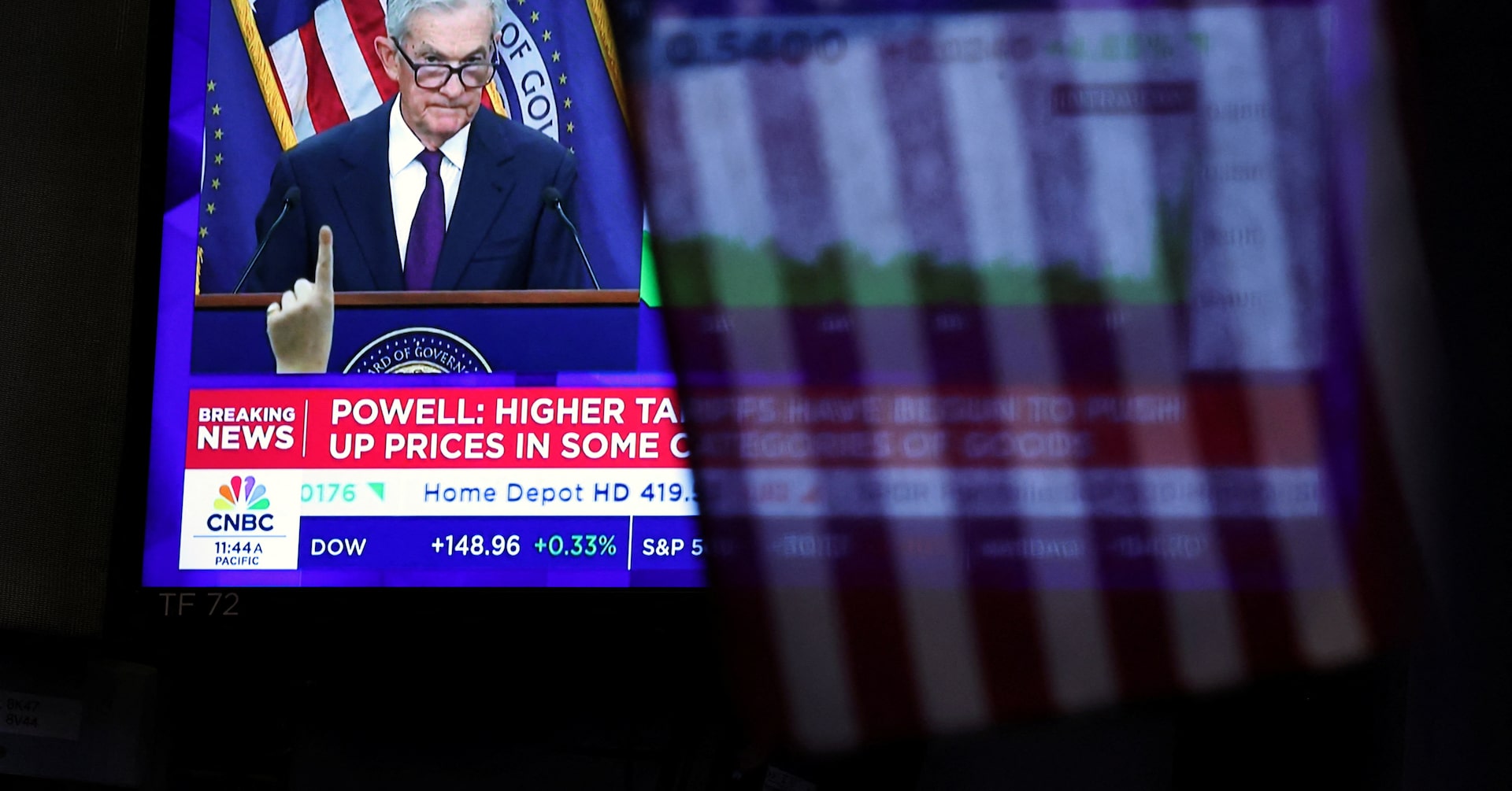

The U.S. Federal Reserve’s decision to implement its first interest rate cut of 2025 sent ripples through global markets, sparking a mix of reactions across financial sectors. While the initial announcement led to a stumble in U.S. markets, stock futures rebounded sharply ahead of Thursday’s trading session as Fed Chair Jerome Powell signaled a cautious approach to further easing. The dollar and Treasury yields experienced significant fluctuations, with the greenback hitting a multi-year low before recovering. Powell emphasized a risk-management strategy, noting that while the median projection among Fed policymakers suggests two additional cuts this year and one in 2026, a third of officials oppose further easing in 2025, and nearly half anticipate only one more cut or none at all. This divergence has left markets uncertain, with Fed futures pricing in an 85% chance of a 25-basis-point cut in October and only 44 basis points of easing for the remainder of the year. The Nasdaq and S&P 500 both dipped on Wednesday, partly due to Nvidia’s 3% decline following reports of Chinese regulators urging domestic tech firms to halt purchases of Nvidia’s AI chips. However, optimism returned as Chinese officials expressed willingness to engage in dialogue, and tech stocks like Oracle and Lyft surged on positive news. Meanwhile, global central banks are also in focus, with the Bank of Canada cutting rates as expected and the Bank of England’s decision on quantitative tightening drawing attention. The Bank of Japan is expected to hold rates but hint at future hikes, adding to the complexity of global monetary policy. As markets brace for further volatility, the Fed’s rate-cutting cycle stands in contrast to other central banks winding down their easing measures, signaling potential turbulence ahead.