The global digital infrastructure faces a monumental shift as Saudi Arabia emerges as a formidable challenger to Egypt’s long-standing dominance in intercontinental internet connectivity. For decades, Egypt has controlled what experts describe as the ‘digital Suez Canal’—a critical bottleneck where an estimated 17-30% of worldwide internet traffic traverses through the Red Sea corridor linking Europe to Asia.

This strategic advantage enabled state-owned Telecom Egypt to maintain what industry analysts characterize as a monopolistic pricing structure, charging operators equivalent fees for transiting Egyptian territory as other providers charge for the substantially longer Singapore-Mediterranean route. Paul Brodsky, senior analyst at TeleGeography, notes that Egypt has represented ‘a single point of failure for cables running between Europe and Asia, the Middle East and East Africa’—the ‘white whale of the subsea cable business’ that operators have long sought to circumvent.

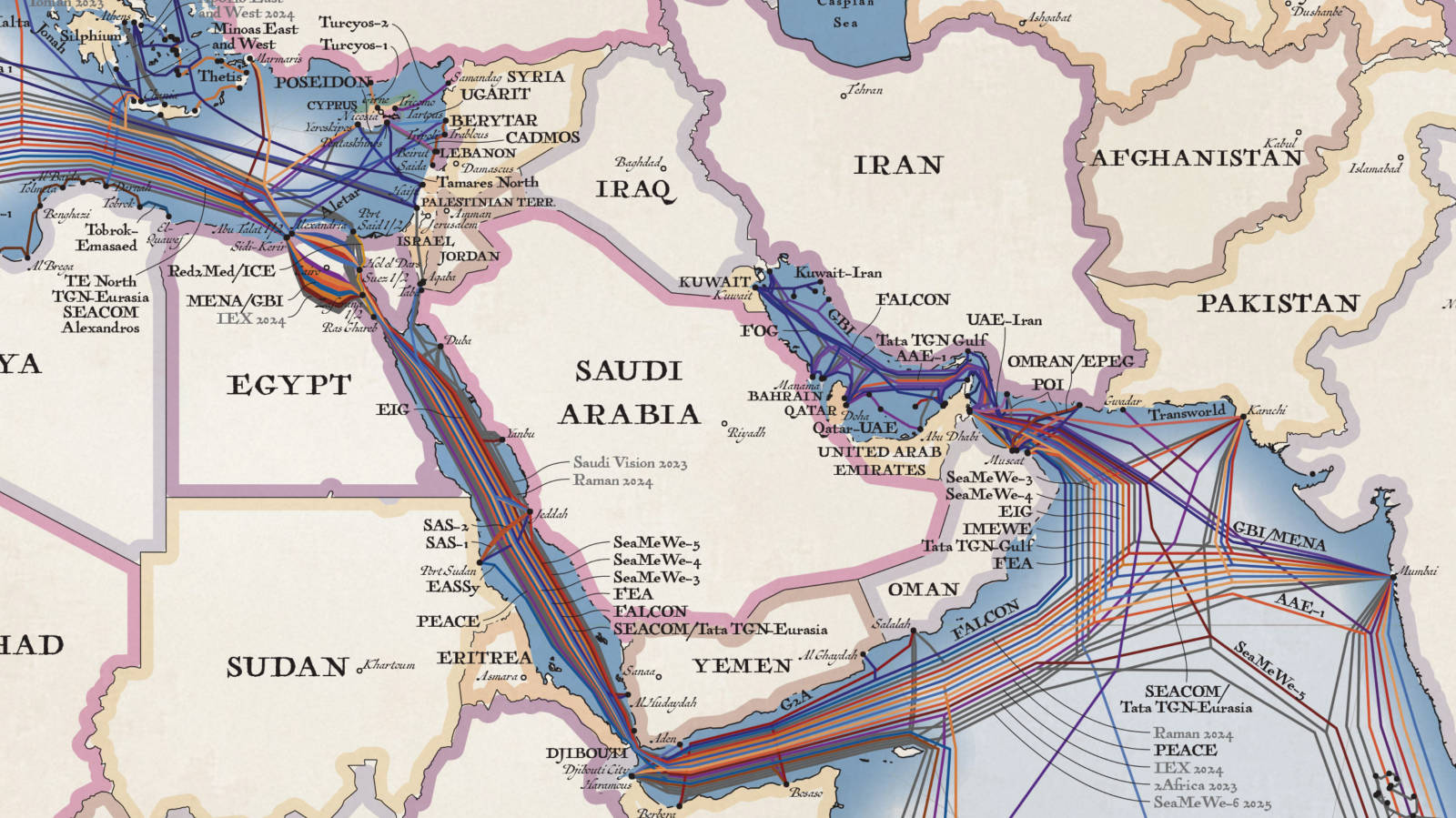

The geopolitical landscape began shifting dramatically with the 2020 Abraham Accords, which normalized relations between Israel, UAE, and Bahrain. This diplomatic breakthrough catalyzed ambitious infrastructure projects designed to bypass Egyptian territory. Google’s $400 million Blue-Raman project exemplifies this trend, utilizing a segmented cable system connecting Europe to Israel, then crossing terrestrially to Jordan before linking to Saudi Arabia. The Raman component will land at Duba, Saudi Arabia—just 25km from the $500 billion Neom megaproject—before extending to Aqaba, Jordan.

Saudi Arabia’s Vision 2030 economic diversification strategy aggressively pursues regional digital hub status. The state-owned Saudi Telecom Company has committed $1 billion to develop the MENA Hub, while simultaneously advancing the Saudi Vision Cable along the kingdom’s western coastline. According to TeleGeography data, six new cables will land in Saudi Arabia within three years, including Meta’s massive 45,000-km 2Africa cable connecting Jeddah, Yanbu, and Duba.

The most revolutionary development comes from privately-developed Trans Europe Asia System (TEAS), which proposes a predominantly terrestrial route across Saudi Arabia. This unprecedented approach would completely avoid the Red Sea, though industry experts note significant technical challenges regarding desert installation and maintenance requirements. Julian Rawle, a submarine fiber-optic consultant, observes that while the route through sparsely populated desert along GCC Interconnection Authority rights-of-way reduces risks, the project faces substantial implementation hurdles.

Market analysts suggest that Saudi Arabia must avoid Egypt’s pitfalls by maintaining competitive pricing and investing in hub infrastructure rather than merely functioning as a conduit. The emerging competition between UAE and Saudi Arabia for regional digital supremacy may ultimately benefit operators through market-driven pricing and enhanced network resilience across East-West connections.