Global currency markets experienced significant volatility on Thursday as traders digested key policy decisions from major central banks. The U.S. dollar initially plummeted following the Federal Reserve’s cautious stance on future interest rate cuts but later rebounded, reflecting mixed signals from policymakers. Meanwhile, the British pound remained steady after the Bank of England (BoE) opted to maintain interest rates and slow the pace of its quantitative tightening (QT) program. The BoE reduced its annual gilt sales from £100 billion to £70 billion, aligning closely with market expectations. Marion Amiot, chief UK economist at S&P Global Ratings, noted that the BoE is unlikely to ease monetary policy further this year. The euro saw modest gains, rising 0.1% against the pound, while gilt yields dipped slightly. In Norway, the Norges Bank cut interest rates by 25 basis points, as anticipated, signaling potential further reductions. The Norwegian crown remained stable despite the rate cut. In Japan, the yen weakened ahead of the Bank of Japan’s (BOJ) policy decision on Friday, with markets expecting no immediate rate hikes but pricing in a possible increase by March 2024. Elsewhere, the New Zealand dollar fell to its lowest level since September 8 after data revealed a 0.9% contraction in GDP for the second quarter, fueling speculation of policy easing by the Reserve Bank of New Zealand. Analysts remain divided on the implications of the Fed’s actions, with some viewing the rate cut as the first in a series, while others interpret Chair Jerome Powell’s comments as less dovish. The dollar index, which measures the greenback against a basket of major currencies, initially dropped to its lowest since February 2022 but later recovered, ending the day steady at 96.96. The currency markets’ turbulence underscores the ongoing uncertainty surrounding global economic conditions and central bank policies.

分类: business

-

Nestle’s new chairman Isla brings Zara magic to Nescafe maker’s turnaround

Nestle, the Swiss multinational food and beverage giant, has appointed Pablo Isla as its new chairman, effective October 1, 2023. Isla, renowned for his transformative leadership at Inditex, the parent company of Zara, brings a wealth of expertise in logistics, e-commerce, and consumer trends to Nestle. His appointment comes at a critical juncture for the company, which has seen its shares underperform, losing 33% of their value over the past three years, while competitors like Unilever and Danone have thrived. Isla’s track record of driving rapid global expansion and integrating digital and physical retail channels at Inditex positions him as a catalyst for Nestle’s much-needed revitalization. Nestle’s recent struggles include declining sales and profits, compounded by the abrupt dismissal of former CEO Laurent Freixe. Investors are optimistic that Isla, alongside newly appointed CEO Philipp Navratil, will spearhead a digital transformation, leveraging artificial intelligence to optimize supply chains and enhance sales. Isla’s leadership style, described as hands-on and collaborative, is expected to foster innovation and rapid change within the company. His experience in mentoring and guiding executives will also be invaluable in supporting Navratil’s transition into the CEO role. With Nestle’s e-commerce sales already accounting for 20.2% of total revenue, Isla’s appointment signals a renewed focus on digital growth and operational efficiency, aiming to reclaim the company’s competitive edge in the global market.

-

Trump trade war fallout hits Argentine soy crushers despite export boom

The U.S.-China trade war has had unexpected repercussions in Argentina, where the country’s soy crushing industry is facing significant challenges despite record-high soybean exports. According to recent reports, Argentina’s soybean sales to China have surged to a six-year high, driven by Beijing’s search for alternatives to U.S. soybeans. However, this export boom has led to a shortage of raw beans for local processors, causing idle capacity in crushing facilities to rise to 31% in July, with further increases since then. Gustavo Idigoras, president of the CIARA-CEC grain exporters and processors chamber, expressed concern over the situation, stating that the trade war has harmed Argentina by reducing jobs and export value. He also noted that the surplus of soybeans in the U.S. has intensified competition for Argentine soymeal in Southeast Asia. While exports of unprocessed soybeans from the 2024/25 harvest have reached 8.81 million metric tons, nearly double the previous season, the future of Argentina’s soybean exports remains uncertain, hinging on the outcome of U.S.-China trade negotiations. All eyes are on November, when the current trade waiver between the two nations expires.

-

U.S. may ease India tariffs, India’s chief economic adviser says

In a significant development for U.S.-India trade relations, India’s Chief Economic Adviser V. Anantha Nageswaran has expressed optimism that the U.S. may soon eliminate the punitive 25% import tariff on Indian goods and reduce reciprocal tariffs to 10-15%. Speaking at an event in Kolkata on Thursday, Nageswaran stated, ‘My personal confidence is that in the next couple of months, if not earlier, we will see a resolution to at least the extra penal tariff of 25%.’ He further suggested that the reciprocal tariff of 25% could also be lowered to levels previously anticipated between 10% and 15%. This announcement follows ‘positive’ and ‘forward-looking’ trade discussions between the two nations earlier this week. The talks aimed to address tensions that escalated after former U.S. President Donald Trump imposed punitive tariffs on India for purchasing Russian oil, doubling overall tariffs to 50% in August. Trump and Indian Prime Minister Narendra Modi recently held a phone conversation, during which Trump thanked Modi for his efforts in resolving the Russia-Ukraine conflict. While no specific agreements were disclosed, the call signaled a potential thaw in bilateral relations, which had been strained in recent months. Indian stock markets responded positively to Nageswaran’s comments, with the benchmark Nifty 50 index reaching one-week highs and its highest close since July 9.

-

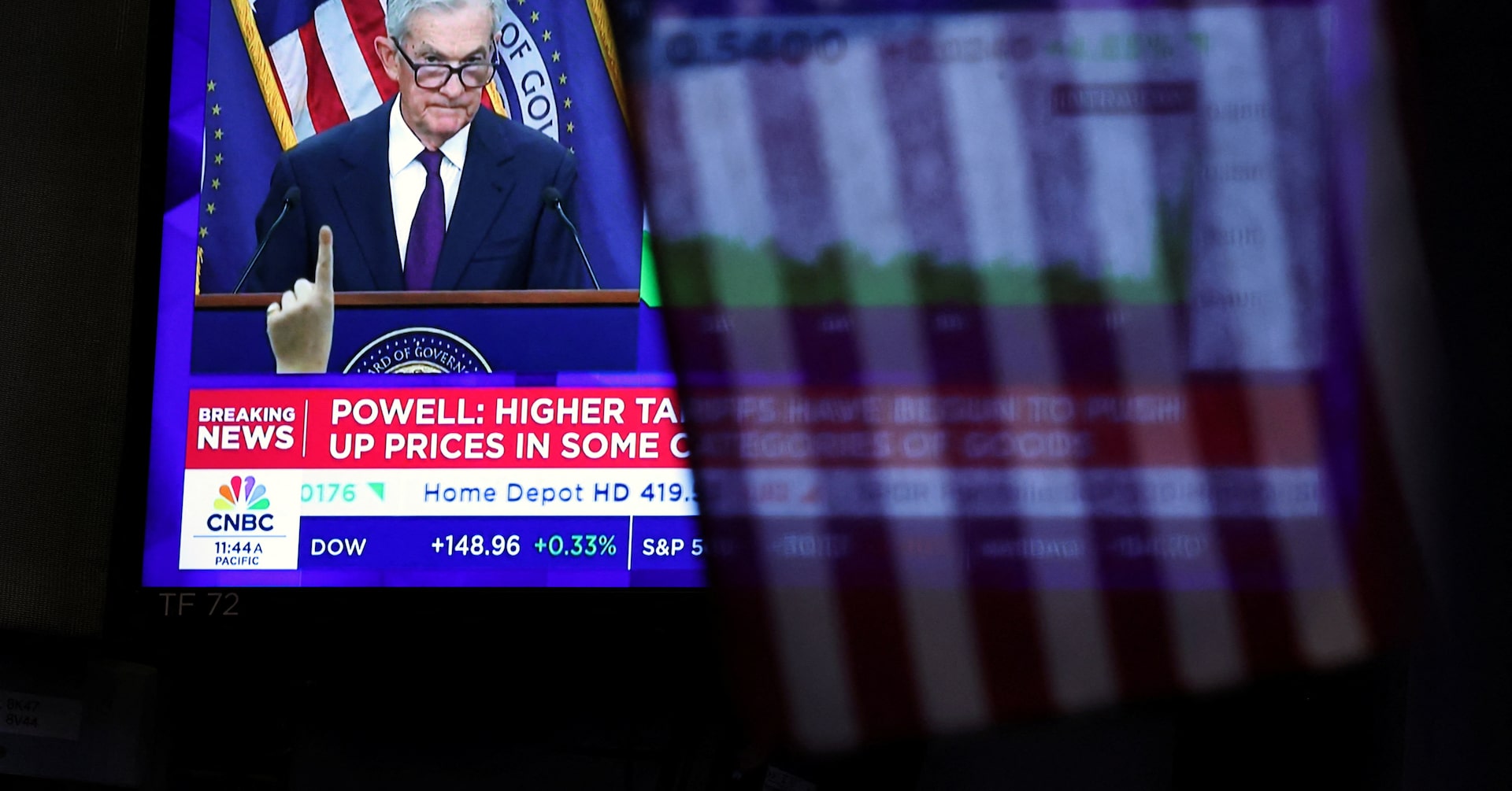

Morning Bid: Wall St rallies after post-Fed hesitation

The U.S. Federal Reserve’s decision to implement its first interest rate cut of 2025 sent ripples through global markets, sparking a mix of reactions across financial sectors. While the initial announcement led to a stumble in U.S. markets, stock futures rebounded sharply ahead of Thursday’s trading session as Fed Chair Jerome Powell signaled a cautious approach to further easing. The dollar and Treasury yields experienced significant fluctuations, with the greenback hitting a multi-year low before recovering. Powell emphasized a risk-management strategy, noting that while the median projection among Fed policymakers suggests two additional cuts this year and one in 2026, a third of officials oppose further easing in 2025, and nearly half anticipate only one more cut or none at all. This divergence has left markets uncertain, with Fed futures pricing in an 85% chance of a 25-basis-point cut in October and only 44 basis points of easing for the remainder of the year. The Nasdaq and S&P 500 both dipped on Wednesday, partly due to Nvidia’s 3% decline following reports of Chinese regulators urging domestic tech firms to halt purchases of Nvidia’s AI chips. However, optimism returned as Chinese officials expressed willingness to engage in dialogue, and tech stocks like Oracle and Lyft surged on positive news. Meanwhile, global central banks are also in focus, with the Bank of Canada cutting rates as expected and the Bank of England’s decision on quantitative tightening drawing attention. The Bank of Japan is expected to hold rates but hint at future hikes, adding to the complexity of global monetary policy. As markets brace for further volatility, the Fed’s rate-cutting cycle stands in contrast to other central banks winding down their easing measures, signaling potential turbulence ahead.

-

Taiwan central bank raises growth forecast, warns of tariff risks

In a significant move, Taiwan’s central bank has decided to maintain its benchmark discount rate at 2% during its quarterly meeting, aligning with market expectations. The decision, made unanimously, reflects the bank’s cautious optimism about the island’s economic trajectory. Governor Yang Chin-long highlighted the unique nature of this year’s economic growth, driven largely by booming exports, particularly in the semiconductor sector, which has been pivotal in powering the global AI boom. Companies like Nvidia have benefited immensely from Taiwan’s advanced chip production, bolstering the local economy. However, Yang expressed concerns over the potential adverse effects of U.S. tariffs, which could necessitate adjustments in monetary policy. The central bank has revised its 2025 economic growth forecast upward to 4.55%, up from 3.05% in June, but anticipates a slowdown to 2.68% in the following year. Additionally, the bank has trimmed its consumer price index forecast for this year to 1.75%, with inflation expected to ease further to 1.66% next year. The bank remains vigilant, closely monitoring developments in U.S. tariffs and geopolitical risks, which could significantly impact Taiwan’s competitive edge. This rate decision follows the U.S. Federal Reserve’s recent rate cut, the first since December, amid concerns over rising unemployment.

-

Gold gains on softer dollar after Fed delivers rate cut

Gold prices experienced a notable uptick on Thursday, driven by a weakening dollar and the U.S. Federal Reserve’s decision to cut interest rates by 25 basis points. The Fed’s move, coupled with its indication of a gradual easing path for the remainder of the year, has significantly bolstered the appeal of the precious metal. Spot gold rose by 0.2% to $3,668.34 per ounce, following a record high of $3,707.40 on Wednesday. U.S. gold futures for December delivery, however, saw a slight decline of 0.4% to $3,703. The dollar, which had recently gained strength, retreated to near a two-month low, making gold more affordable for holders of other currencies. Concurrently, benchmark 10-year Treasury yields also decreased. Market analysts attribute the rise in gold prices to the dollar’s resumed weakness and the Fed’s dovish stance, which suggests two additional rate cuts this year. Fed Chair Jerome Powell described the rate cut as a ‘risk-management measure’ in response to a softening labor market, emphasizing a ‘meeting-by-meeting’ approach to future rate decisions. Gold, a non-yielding asset, is traditionally seen as a safe haven during periods of geopolitical and economic uncertainty, and it tends to thrive in low-interest-rate environments. Analysts, including Ross Norman, an independent market expert, believe that gold’s bull run remains robust, with record highs likely to persist. Traders are currently anticipating a 90% chance of another 25-basis point cut at the Fed’s October meeting, according to the CME Group’s FedWatch tool. ANZ Bank also predicts that gold will outperform early in the easing cycle, citing increased demand for haven assets amid a challenging geopolitical landscape. Meanwhile, other precious metals showed mixed performance, with spot silver rising 0.4% to $41.84 per ounce, platinum gaining 1.5% to $1,383.60, and palladium declining 0.7% to $1,146.55 per ounce.

-

India’s stock benchmarks hit 10-week highs on Fed rate cut, optimism over US trade talks

India’s stock market surged to a 10-week high on Thursday, driven by gains in IT and pharmaceutical sectors. The rally followed the U.S. Federal Reserve’s decision to implement a quarter-point rate cut and indications of easing trade tensions. The Nifty 50 index climbed 0.37% to 25,423.60, while the BSE Sensex rose 0.39% to 83,013.96. IT and pharmaceutical stocks, which derive significant revenue from the U.S., saw notable increases of 0.8% and 1.5%, respectively. Biocon and Natco Pharma further boosted the pharma index with gains of 4% and 3.3%, supported by favorable regulatory developments in the U.S. Twelve out of 16 major sectors recorded gains, with small-cap and mid-cap indices adding 0.3% and 0.4%, respectively. The Fed’s rate cut, its first this year, has sparked optimism among investors, though uncertainty remains about the pace of future monetary easing. Market analyst Om Ghawalkar noted that the decision could attract foreign institutional investments and bolster investor confidence. Additionally, chief economic advisor V. Anantha Nageswaran hinted at potential reductions in U.S. tariffs on certain Indian imports, further supporting market sentiment. The Nifty 50 has closed in positive territory in 11 of the last 12 sessions, now trading just 3.25% below its September 2024 peak. However, Cohance Lifesciences saw a 5.6% decline after a block deal involving an 8.9% stake at a discounted price.

-

Oil India sees restart of Mozambique LNG project by year’s end

India’s state-run Oil India Ltd (OILI.NS) has announced that the $20-billion Mozambique liquefied natural gas (LNG) project, operated by French energy giant TotalEnergies (TTEF.PA), is expected to restart development by the end of 2025. The project, in which Oil India holds a stake, was halted in 2021 due to a deadly attack by Islamic State-linked insurgents, prompting TotalEnergies to declare force majeure. Speaking at the company’s annual shareholder meeting, Oil India Chairman Ranjit Rath expressed optimism about the project’s revival, citing improved security conditions and its strategic importance in meeting India’s growing gas demand. TotalEnergies CEO Patrick Pouyanne had previously indicated in June that development could resume ‘this summer.’ The project is a multinational venture, with TotalEnergies holding a 26.5% stake, Mitsui & Co (8031.T) owning 20%, Mozambique’s state-owned ENH at 15%, and Indian state firms ONGC Videsh, Bharat PetroResources, and Oil India collectively holding 30%. Thailand’s PTTEP (PTTEP.BK) owns the remaining share. Separately, Oil India reported significant dividends from its investments in Russian projects, including Vankorneft and Taas-Yuryakh, with $942 million received, representing 91% of its original investment. Full recovery of the investment is anticipated in the coming year.

-

Exclusive: Turkey’s surprise Air Europa deal came down to one key thing: control

In a surprising move, Turkish Airlines has successfully acquired a significant stake in Spanish carrier Air Europa, outmaneuvering European rivals Lufthansa and Air France-KLM. The deal, valued at 300 million euros for a 25-27% stake, was finalized due to Turkish Airlines’ willingness to share control with Air Europa’s Hidalgo family owners, according to sources familiar with the negotiations. This marks a rare instance of a non-European airline investing in a European carrier, particularly given EU regulations that restrict majority ownership by non-EU entities. The agreement underscores Turkish Airlines’ strategic focus on expanding its presence in Iberia and Latin America, leveraging Air Europa’s established routes. While Lufthansa and Air France-KLM sought a path to majority control, their demands were incompatible with the Hidalgo family’s preference for maintaining influence. Analysts note that the deal is less about financial gain and more about geopolitical and connectivity advantages, positioning Turkish Airlines to strengthen its hub-and-spoke network. The Turkish government’s support further bolsters the airline’s strategic ambitions, with Transport Minister Abdulkadir Uraloglu highlighting the alignment with Turkey’s broader global connectivity strategy. Despite the complexities of minority stakes, Turkish Airlines’ financial stability and political backing mitigate potential risks, ensuring the deal’s viability.