In a significant move aimed at reducing healthcare costs, the Trump administration has finalized a groundbreaking agreement with pharmaceutical giant Pfizer. The deal, announced during a White House press conference on Tuesday, will enable patients to purchase prescription drugs at heavily discounted rates through a new federal government-operated website, TrumpRx. Under the terms of the agreement, prices for certain medications will be reduced by up to 85% on the platform. Additionally, Pfizer has committed to lowering drug prices for Medicaid, the government’s health insurance program for low-income Americans, in exchange for exemption from tariffs. This development follows President Trump’s recent announcement of a 100% tariff on imported branded or patented drugs, effective October 1. Pfizer is the first pharmaceutical company to reach such an agreement after Trump issued ultimatums to 17 drug manufacturers earlier this summer, demanding price reductions within 60 days. During the press conference, Trump emphasized his policy of aligning U.S. drug prices with lower international rates, stating that Pfizer’s commitment to offering Medicaid medications at ‘most-favored nations’ prices would significantly reduce program costs. Pfizer confirmed that the majority of its primary care drugs would be available on TrumpRx, though specific medications were not disclosed. The company also pledged an additional $70 billion investment in U.S. manufacturing, research, and development. Pfizer’s CEO, Albert Bourla, highlighted the stability the deal provides regarding tariffs and pricing. Following the announcement, Pfizer’s shares surged nearly 7%. However, Trump acknowledged that his efforts to lower U.S. drug prices might lead to price increases abroad, as seen with Eli Lilly’s decision to raise prices in Europe to offset reductions in the U.S. The effectiveness of TrumpRx, set to launch in early 2026, remains uncertain, as insurance companies and intermediaries continue to influence drug costs.

分类: business

-

Start-up founder Charlie Javice sentenced for defrauding JPMorgan

Charlie Javice, the founder of student loan start-up Frank, has been sentenced to 85 months in prison for defrauding JPMorgan Chase during the bank’s $175 million acquisition of her company. The sentencing, delivered on Monday in Manhattan federal court, follows her conviction earlier this year on charges of bank, wire, and securities fraud, as well as conspiracy to commit fraud. Javice was found guilty of fabricating customer data to inflate Frank’s user base, misleading JPMorgan into believing the platform had 4 million users when the actual number was closer to 300,000. Federal prosecutors had sought a 12-year sentence, while Javice’s defense team argued for 18 months. In addition to the prison term, U.S. District Judge Alvin Hellerstein ordered Javice to forfeit over $22 million and pay $287 million in restitution to JPMorgan, jointly with her co-defendant Olivier Amar, Frank’s chief growth and acquisition officer. Javice, 33, gained prominence in the financial sector after launching Frank in 2017, which aimed to simplify the college financial aid process. Her success earned her a spot on Forbes’ ’30 Under 30′ list in 2019. However, JPMorgan’s acquisition of Frank in 2021 quickly unraveled as the bank discovered the fraudulent user data. JPMorgan CEO Jamie Dimon has since labeled the deal a ‘huge mistake.’ In a recent letter to Judge Hellerstein, Javice expressed remorse, stating, ‘I accept the jury’s verdict and take full responsibility for my actions. There are no excuses, only regret.’

-

Thousands of jobs at risk in Africa as US trade deal expires

The expiration of the African Growth and Opportunity Act (AGOA), a pivotal U.S. trade agreement that has provided African exporters with duty-free access to American markets since 2000, is set to take effect this Tuesday. This development has left businesses across the continent grappling with heightened competitive pressures and the looming imposition of new tariffs. AGOA has been instrumental in bolstering industries such as Kenya’s textile and apparel sector, enabling it to compete effectively with Asian counterparts like Bangladesh and Vietnam. However, with the agreement’s termination, Kenyan manufacturers, including United Aryan, a Nairobi-based apparel exporter, fear they will lose their competitive edge. ‘Without AGOA, we stand no chance against Asian competitors,’ lamented Pankaj Bedi, owner of United Aryan, which exports Levi’s and Wrangler jeans to the U.S. Kenyan President William Ruto has urged the U.S. to consider renewing and extending AGOA for at least five years, emphasizing its role as a vital link between Africa and the U.S. The end of AGOA coincides with the introduction of new U.S. tariffs, announced in April, which could further exacerbate challenges for African exporters. Kenya, for instance, already faces a 10% tariff on non-AGOA exports, and its manufacturers are hindered by high energy costs, imported raw materials, and limited domestic supply chains. African leaders, including Ruto, are pushing for last-minute renegotiations and bilateral agreements with the U.S., but uncertainty remains. The termination of AGOA threatens to disrupt industries that employ millions, particularly in countries like Kenya, where over 66,000 workers in the textile sector are at risk of job losses. The broader economic implications include reduced foreign investment, weakened supply chains, and rising poverty, according to researchers at the German Institute of Development and Sustainability. For workers like Julia Shigadi, a machinist at United Aryan, the end of AGOA is not just a professional setback but a personal crisis. ‘This job is my lifeline,’ she said. ‘If it’s gone, my life is over.’

-

Thousands of workers in limbo as US-Africa trade deal set to expire

At Shona EPZ, a bustling garment factory in Nairobi, Kenya, the hum of sewing machines and the chatter of workers typically create a reassuring rhythm. However, today’s atmosphere is tinged with anxiety as the factory’s future hangs in the balance due to the impending expiration of the African Growth and Opportunity Act (Agoa). This landmark US trade policy, which has granted duty-free access to the US market for African goods for 25 years, is set to expire on Tuesday, leaving thousands of workers like Joan Wambui uncertain about their livelihoods. Joan, a 29-year-old mother, has been employed at Shona EPZ for six months, sewing sportswear exclusively for the American market. Her salary supports her four-year-old daughter, two college-going sisters, and her mother. Losing her job would not only disrupt her family’s stability but also strip her of the dignity and hope that come with a steady income. Shona EPZ, which employs 700 people, has already seen a significant drop in output due to buyer hesitancy amid the uncertainty. Factory director Isaac Maluki warns that without an Agoa extension, layoffs and even shutdowns may be inevitable. The stakes are high not just for Kenya but for over 30 African countries that rely on Agoa to export over 6,000 products to the US. Kenyan Trade Minister Lee Kinyanjui is pushing for at least a short-term extension to allow for transition mechanisms, while President William Ruto seeks a bilateral trade deal with the US. Meanwhile, trade experts like Teniola Tayo urge African nations to diversify their markets and leverage the African Continental Free Trade Area to reduce overreliance on the US. For workers like Joan, the urgency of feeding their families overshadows the slow pace of diplomatic negotiations. Her plea to governments is simple: provide young people with opportunities to showcase their potential.

-

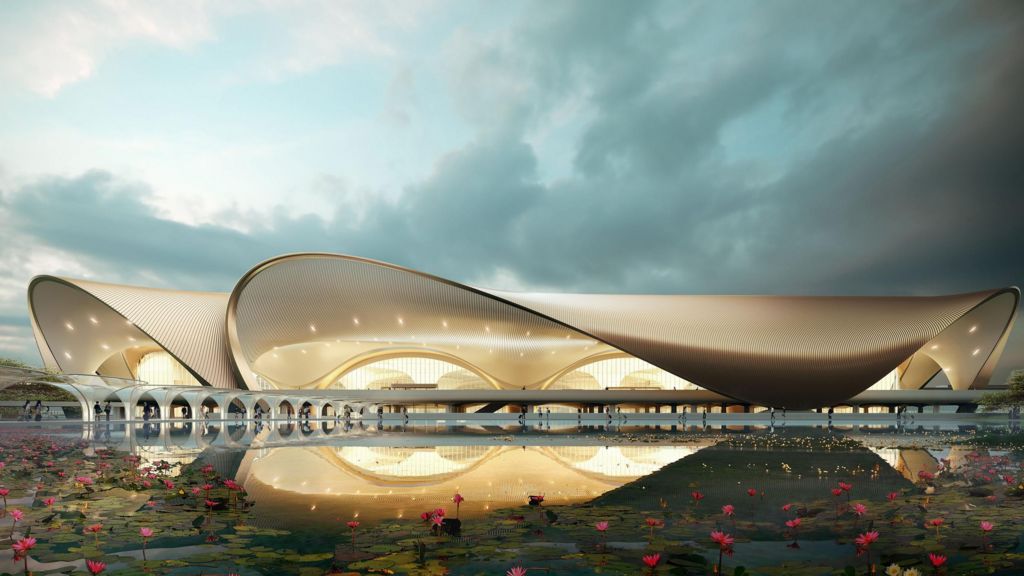

Mumbai’s new airport faces traffic woes as it takes on Singapore and Dubai

The Navi Mumbai International Airport (NMIA), a sprawling 1,100-hectare facility, is poised to transform India’s aviation landscape. Located 40 kilometers from Mumbai’s commercial center, the airport will feature four terminals and handle up to 90 million passengers annually upon full expansion. This development comes as a much-needed relief for Mumbai’s overburdened Chhatrapati Shivaji Maharaj International Airport, which has reached its capacity of 55 million passengers per year. Arun Bansal, CEO of Adani Airport Holdings Limited, emphasized that NMIA will significantly ease congestion and meet the growing demand for air travel in India’s financial capital. The airport, connected to Mumbai by India’s longest sea bridge, will operate two parallel runways and is designed to be India’s first fully digital hub, leveraging advanced technology to streamline check-in, security, and boarding processes. However, challenges remain, including connectivity issues and regulatory hurdles that could impede its ambition to become a global aviation hub on par with Singapore or Dubai. Despite these obstacles, NMIA represents a critical step in India’s aviation ambitions, joining cities like New York and London in operating multiple airports.

-

Nigeria banned shea butter exports to help women profit. But it backfired

In the heart of Nigeria’s shea butter industry, women like Hajaratu Isah are grappling with the harsh realities of a sudden government policy shift. The Nigerian government’s six-month ban on the export of raw shea nuts, announced in late August, has sent shockwaves through the industry, leaving thousands of women struggling to make ends meet.

-

Trump renews threat to impose 100% tariffs on non-US made movies

Former U.S. President Donald Trump has reiterated his controversial proposal to impose a 100% tariff on all films not produced within the United States, asserting that the American film industry has been ‘stolen’ by other nations. Speaking on his Truth Social platform, Trump emphasized that California, in particular, has suffered significantly due to the decline in domestic film production. He framed the tariff as a solution to what he described as a ‘long-time, never-ending problem.’

This announcement follows Trump’s broader tariff strategy, which recently included a 100% levy on branded or patented drug imports and 50% tariffs on kitchen and bathroom cabinets. Trump’s rhetoric has drawn criticism and skepticism, with many questioning the feasibility and economic impact of such a policy. Investment analyst Dan Coatsworth of AJ Bell highlighted the complexities of defining what constitutes an ‘American-made’ film, especially when productions involve foreign actors, directors, or funding.

Coatsworth also noted that filmmakers have increasingly relocated to countries offering more favorable tax incentives, leading to a decline in the prominence of the Los Angeles film industry. He warned that forcing productions back to the U.S. could drive up costs, which might ultimately be passed on to consumers, potentially harming demand for streaming services and cinema operators. Despite these concerns, investors have yet to treat the proposal as a serious threat, with stocks for companies like Netflix and Disney showing only brief dips before recovering.

The proposal’s implications for streaming platforms and international co-productions remain unclear. For instance, films like ‘Wicked,’ which was shot in the UK but produced by an American studio, could face ambiguous treatment under the proposed tariffs. Recent data from movie industry research firm ProdPro reveals that while the U.S. remains a major global production hub, spending has declined by 26% since 2022, with countries like Australia, New Zealand, Canada, and the UK attracting increased investment.

-

Japanese brewing giant Asahi hit by cyber-attack

Japanese brewing powerhouse Asahi Group Holdings has fallen victim to a significant cyber-attack, resulting in a widespread ‘systems failure’ that has disrupted its shipping and customer service operations in Japan. The company, renowned for its global beer brands such as Peroni, Pilsner Urquell, and Grolsch, confirmed that its European operations, including the UK, remain unaffected. However, the incident has forced the suspension of order and shipment activities domestically, as well as customer service functions. Asahi, which also owns Fullers in the UK—producer of London Pride and other beverages—has issued an apology to its customers and business partners, emphasizing that no personal data breaches have been detected. The company is actively investigating the cause and working to restore operations, though no timeline for recovery has been provided. This cyber-attack underscores the growing threat of digital crime to major corporations, with Asahi previously identifying such risks in its 2024 report. The incident comes amid a challenging domestic market in Japan, where declining alcohol consumption among younger generations has prompted Asahi to pivot toward zero or low-alcohol beverages, aiming to double their share of overall sales to 20%.

-

Nigerian government to meet oil workers’ union after strike halts nationwide supply

LAGOS, Nigeria — A critical meeting is scheduled between Nigerian government officials and representatives of the country’s oil workers union on Monday, following a nationwide strike triggered by the dismissal of 800 employees at Dangote Refinery, Africa’s largest refining facility. The strike, initiated by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), has disrupted operations across key oil and gas institutions, threatening to halt national supply chains.

-

Zimbabwe is tobacco country. But some want to switch to a healthier crop – blueberries

Zimbabwe, traditionally known as Africa’s largest tobacco producer, is now pivoting towards a new agricultural frontier: blueberries. A landmark trade agreement with China, the world’s leading importer of blueberries, has positioned Zimbabwe to potentially become Africa’s blueberry capital. While tobacco exports reached a record $1.3 billion last year, driven by rising demand in China, blueberry exports, though modest at $30 million, are seen as a promising alternative. Clarence Mwale, a horticulture specialist, emphasizes, ‘The future is food, not a bad habit.’