Emirates Airline has announced a groundbreaking initiative to provide free Starlink WiFi across its entire fleet, marking a significant leap in inflight connectivity. The rollout will begin in November 2025 with Boeing 777 aircraft and is expected to be completed by mid-2027. The service will be available to all passengers, regardless of cabin class, with no additional fees or Skywards membership required. The first aircraft equipped with Starlink, a Boeing 777-300ER (A6-EPF), is currently on display at the Dubai Airshow, where visitors can experience the high-speed internet firsthand. The first commercial flight featuring Starlink will depart immediately after the Airshow. Emirates plans to install the technology on approximately 14 aircraft per month, with the Airbus A380 fleet scheduled for upgrades starting in February 2026. This initiative underscores Emirates’ commitment to delivering industry-leading inflight experiences, allowing passengers to stream, game, work, and stay connected seamlessly at cruising altitude. The airline’s partnership with SpaceX’s Starlink aligns with its broader fleet refurbishment program, which includes new Premium Economy cabins, enhanced Business Class, and upgraded entertainment systems. Emirates President Sir Tim Clark emphasized that this move reflects the airline’s dedication to redefining air travel. Other regional carriers, such as Qatar Airways and Saudi airlines, have also adopted Starlink, further solidifying its position as a game-changer in aviation connectivity.

分类: business

-

Silver’s 2025 ascent: Why there’s so much more to the metal

Silver, often dubbed ‘poor man’s gold,’ has proven to be a lucrative investment in 2025, surging over 70% in the past year. Trading at approximately $51 per ounce in the London spot market, it remains a key player in both jewelry and industrial sectors, particularly in the production of electric vehicles, electronics, solar panels, and medical devices. The metal’s ascent has been fueled by increased ETF flows, though it remains vulnerable to price corrections. Analysts predict a robust upward trajectory, with prices potentially averaging $57 per ounce by the fourth quarter of 2026. The U.S. government’s recent classification of silver as a critical mineral has sparked speculation about tariffs, though the market remains resilient. Despite a projected 11% decline in demand next year, Bank of America forecasts silver could reach $65 per ounce by 2026. The metal’s value has also been bolstered by a weak U.S. dollar and ongoing supply deficits. Experts anticipate continued volatility, driven by industrial demand and investor behavior.

-

UAE: Gold prices fall from record highs, but analysts predict another surge

Gold prices, which recently soared to an unprecedented $4,500 per ounce, have experienced a slight decline, closing at $4,080.78 over the weekend. This 2.62% drop is attributed to profit-taking by investors. In the UAE, 24K and 22K gold were trading at Dh492.25 and Dh455.5 per gram, respectively. Despite the current dip, market analysts predict a potential resurgence, with prices potentially revisiting the $4,500 mark in the near future. Amir Boucetta, a marketing team leader at CPT, anticipates a temporary decline to $3,700-$3,800 before a bullish recovery. He emphasizes that this correction is healthy and advises investors to focus on fundamentals rather than panic selling. Komalpreet Kaur of XtremeMarkets highlights a gradual recovery, projecting gold could reach $5,000 by 2026-27, driven by factors such as US tariffs, China’s gold reserves buildup, and the US economy. Alex Kuptsikevich, chief market analyst at FxPro, notes that the US dollar’s weakness and Federal Reserve’s monetary policies have historically favored gold. However, he warns of potential volatility, as recent market trends suggest a shift in sentiment. Despite short-term fluctuations, the long-term outlook for gold remains optimistic, supported by global economic uncertainties and central bank activities.

-

US scraps tariffs on some foods over inflation woes

In a significant policy shift, the US administration has announced the removal of tariffs on over 200 food products, including essential items like coffee, beef, bananas, and orange juice. This decision comes as American consumers grapple with escalating grocery prices, which have fueled widespread discontent. The move represents a notable departure from President Donald Trump’s earlier stance, where he maintained that the tariffs imposed earlier this year were not contributing to inflation. The executive order, released on Friday, modifies the scope of reciprocal tariffs initially announced on April 2 and took immediate effect. Duties already collected will be refunded. Trump, speaking aboard Air Force One, acknowledged that tariffs might ‘in some cases’ raise prices but reiterated his belief that the US has ‘virtually no inflation.’ He also revealed plans to distribute a $2,000 payment to lower- and middle-income citizens next year, funded by tariff revenues. The list of exempted products includes everyday staples that have seen double-digit price increases, such as oranges, cocoa, and fertilizers. Critics, including US Representative Don Beyer, argue that the administration is finally acknowledging the inflationary impact of its trade policies. Despite the tariff rollback, consumers remain frustrated by high grocery prices, which economists attribute partly to import duties. Richard Neal, the top Democrat on the House Ways and Means Committee, criticized the move as ‘putting out a fire that they started.’ The US Consumer Price Index for September 2025 showed a 3% year-over-year increase, with beef and coffee prices surging by 14.7% and 18.9%, respectively. While some industry groups have praised the exemptions, the broader economic implications of the tariff reversal remain a contentious issue.

-

National platforms launched to boost recycling efforts

In a significant move toward establishing a unified resource recovery and reuse system, China has launched two national-level recycling platforms in Tianjin. Developed by China Resources Recycling Group Co (CRRG), the National Recycled Steel Trading Service Platform and the China Equipment Asset Recycling Platform aim to address industry challenges such as regional fragmentation and lack of transparency. Leveraging advanced technologies like artificial intelligence, these digital platforms integrate information, logistics, and capital to transform waste into valuable resources. CRRG’s deputy Party secretary and general manager, Zhu Jianchun, emphasized that these platforms will shift the recycling industry from isolated regional operations to a coordinated national effort, enhancing data transparency, industry oversight, and market activity. The recycled steel trading platform, now open to individual sellers, simplifies scrap metal recycling and boosts the supply of green raw materials. Additionally, CRRG has launched a nationwide green supply chain for secure mobile phone recycling in 32 major cities, ensuring personal data is securely erased to encourage public participation. The company also achieves high recovery rates for critical battery materials, with nickel, cobalt, and manganese recovery rates reaching 99.6% and lithium recovery at 91%. CRRG’s innovative projects, including the world’s first production line for repurposing retired solar panels, set new standards for solid waste reuse. The company is also developing refined recycling systems for end-of-life vehicles, ensuring nearly every component is reused or recycled. CRRG’s initiatives align with China’s 14th and upcoming 15th Five-Year Plans, positioning the company as a key driver of the circular economy.

-

Asian shares are mostly lower after US stocks stumble

Asian markets experienced a mostly downward trend on Monday, with U.S. futures showing modest gains following a lackluster performance on Wall Street last week. Tokyo’s Nikkei 225 index dropped 0.3% to 50,226.67, reflecting concerns over Japan’s economic contraction, which saw a 1.8% annual decline in the July-September quarter. The dollar strengthened against the yen, rising to 154.65 yen from 154.58 yen. Chinese markets also saw declines, with Hong Kong’s Hang Seng index falling 0.8% to 26,359.22 and the Shanghai Composite index slipping 0.4% to 3,973.31. Geopolitical tensions between China and Japan further dampened market sentiment, particularly following Japanese Prime Minister Sanae Takaichi’s remarks suggesting a potential military response to Chinese actions against Taiwan. China, which views Taiwan as part of its territory, has warned its citizens against traveling to or studying in Japan. In South Korea, the Kospi index rose 1.7% to 4,078.39, driven by gains in tech-related shares, particularly computer chip makers collaborating with Nvidia on artificial intelligence projects. Australia’s S&P/ASX 200 edged down less than 0.1% to 8,628.60, while Taiwan’s Taiex and India’s Sensex posted modest gains. U.S. futures indicated a positive outlook, with the S&P 500 up 0.5% and the Dow Jones Industrial Average slightly higher. Despite recent volatility, the S&P 500 remains close to its record high, with investors closely watching Nvidia’s upcoming earnings report for signs of sustained growth. Meanwhile, questions linger over the Federal Reserve’s potential interest rate cuts, as inflation remains above the 2% target. Bitcoin saw a slight increase, while oil prices dipped in early trading.

-

Japan’s economy contracts as exports get hit by US tariffs

Japan’s economy experienced a notable downturn in the July-September quarter, contracting at an annualized rate of 1.8%, according to government data released on Monday. This marks the first economic contraction in six quarters, with the nation’s gross domestic product (GDP) declining by 0.4% on a quarterly basis. The downturn was primarily driven by a sharp decline in exports, which fell by 1.2% from the previous quarter and by 4.5% on an annualized basis. The slump in exports is largely attributed to the impact of U.S. tariffs, which have posed significant challenges for Japan’s export-reliant economy, particularly for major automakers like Toyota Motor Corp. Despite the contraction, the decline was less severe than the 0.6% drop anticipated by market analysts. Imports for the quarter saw a marginal decrease of 0.1%, while private consumption edged up by 0.1%. The U.S. currently imposes a 15% tariff on nearly all Japanese imports, a reduction from the earlier 25% rate. Japan’s recent political landscape also saw a shift with Sanae Takaichi assuming the role of prime minister in October, adding another layer of complexity to the nation’s economic outlook.

-

Sharjah’s green realty boom accelerates as Beeah’s Khalid bin Sultan City Phase 1 sells out

Sharjah’s real estate market has reached a significant milestone with the complete sell-out of Phase 1 of Khalid Bin Sultan City, a flagship mixed-use development by Beeah. This project, designed by the globally acclaimed Zaha Hadid Architects, represents the UAE’s first fully master-planned residential initiative by the firm. The strong buyer response, including the immediate sale of an entire residential cluster during the launch event, underscores Sharjah’s growing reputation as a hub for sustainable, master-planned living.

-

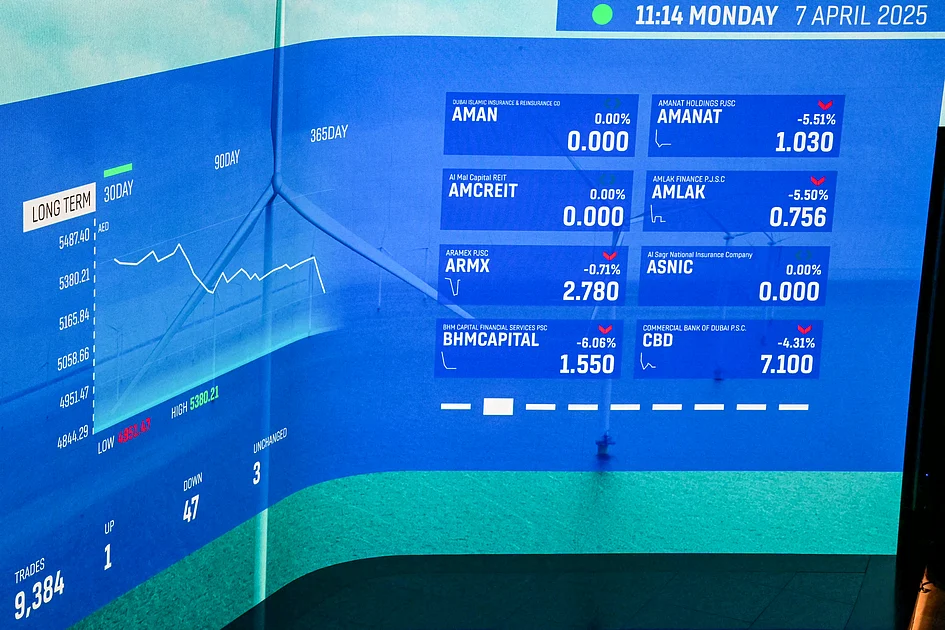

UAE markets face technical weakness amid global headwinds

The equity markets in Dubai and Abu Dhabi experienced a downturn last week, influenced by broader global economic challenges. The Dubai Financial Market (DFM) General Index fell by 1.25%, closing at 5,949, while the Abu Dhabi Securities Exchange (ADX) General Index dropped by 1.56% to 9,917.90, slipping below the significant 10,000 mark. This decline was primarily driven by significant losses in key sectors such as technology, financials, and healthcare, despite some gains in materials and real estate sectors. Analysts attribute this trend to the ongoing global risk-off sentiment, which has overshadowed the strong corporate earnings reported by major companies like Dewa and Salik. Vijay Valecha, Chief Investment Officer at Century Financial, highlighted the cautious outlook, suggesting that the markets may continue to face volatility and limited upside potential in the near term. The technical indicators also support this view, with both indices breaching their 50- and 100-day moving averages and the Relative Strength Index (RSI) indicating weakening momentum. Looking ahead, the market is expected to remain range-bound, with potential short-term rallies likely to encounter resistance unless there is a significant improvement in global risk appetite.

-

Fixed income gains ground among UAE investors amid market volatility

In the face of ongoing global market uncertainty and heightened geopolitical risks, fixed income investments are increasingly becoming a cornerstone in the portfolios of UAE investors. Kareena Moledina, Lead for Fixed Income Client Portfolio Management (EMEA) at Janus Henderson Investors, recently shared her insights with Khaleej Times on the growing relevance of bonds in the region’s investment strategy.

Moledina highlighted three primary benefits of fixed income investments: steady income, capital preservation, and diversification. With yields currently at attractive levels, investors can secure reliable, tax-free cash flows without assuming excessive risk. This is particularly advantageous in the UAE, where many investors depend on consistent income to meet their financial obligations.

Beyond income generation, bonds act as a defensive anchor in portfolios that are heavily weighted towards equities and real estate. ‘When markets become volatile, fixed income helps preserve capital,’ Moledina explained. ‘It serves as a stabilizing force, especially in economies like the UAE’s, where exposure to property and energy is significant.’

Moledina also emphasized how bonds complement traditional asset classes in the Gulf Cooperation Council (GCC), which are typically cyclical and sensitive to economic downturns. Unlike equities and real estate, which often decline together during slowdowns, bonds tend to rise when central banks cut interest rates. This inverse relationship helps smooth portfolio performance and reduce overall volatility.

Liquidity is another key advantage of fixed income investments. While real estate transactions can be slow and costly, and equities volatile, high-quality bonds offer quick access to cash. ‘Fixed income plays a key role in the liquidity waterfall of a portfolio,’ Moledina noted, referring to the hierarchy of assets investors can tap into when needed.

In a dollar-pegged economy like the UAE’s, the current ‘higher-for-longer’ interest rate environment presents both opportunities and challenges. On the upside, yields are significantly more attractive than during the ultra-low-rate era, allowing income-seeking investors to earn meaningful returns from high-quality bonds. However, Moledina cautioned that portfolio construction is now more critical than ever.

‘Investors should focus on shorter-duration, higher-quality assets to mitigate downside risks,’ she advised. Floating-rate securities, such as collateralised loan obligations (CLOs), are gaining popularity for their ability to adjust income streams in line with interest rate movements, offering a natural hedge against volatility.

Risk management remains central to fixed income investing. Moledina outlined key risks including interest rate fluctuations, inflation, credit stress, and geopolitical shocks. ‘Detailed bottom-up research is essential,’ she said, emphasizing the importance of analysing cash flows, leverage, and refinancing profiles to identify resilient issuers.

Diversification across issuers, sectors, and geographies also helps protect portfolios from systemic shocks. ‘Quality, liquidity, and diversification are the pillars of capital preservation,’ she added.

Securitised credit, once a niche segment, is now gaining traction among investors seeking stable income and attractive valuations. With spreads in traditional corporate bonds tightening, securitised assets offer a compelling alternative. ‘They provide a spread pick-up of 40 to 50 basis points over investment-grade corporates while maintaining higher credit quality,’ Moledina said.

Many of these instruments are floating-rate, making them well-suited to the current interest rate environment. Even if rates decline, securitised assets continue to deliver strong returns due to their underlying credit spreads.

Janus Henderson, a leading manager of securitised active ETFs, has played a pivotal role in enhancing liquidity and transparency in the fixed income space. ‘Our scale allows us to offer efficient execution and clear pricing visibility, especially in securitised credit,’ Moledina said.

As UAE investors seek to build resilient portfolios amid global uncertainty, fixed income is proving to be a powerful tool—offering stability, income, and flexibility in a rapidly changing financial landscape.