Former employees of Petrofac, who were part of the November 19 layoffs, have received their salaries for the 19 days worked in November. While this partial payment has provided short-term relief, many are still awaiting clarity on their full-and-final settlement, including notice-period salaries and end-of-service benefits. Employees expressed concerns over how they will manage upcoming expenses such as rent, school fees, and household bills without the expected three-month notice-period payout. According to UAE labor rules, terminated staff are entitled to a three-month notice-period salary, but Petrofac has only paid for the 19 days worked in November. Employees were informed that the full settlement process would take up to 14 days from the date of termination, with a detailed statement of account expected by December 3. This statement will cover all dues, including airfares, leave balances, and any remaining payments. Until then, employees remain in a state of uncertainty, unable to plan their next steps. Petrofac has been facing operational and financial challenges in recent months, leading to multiple rounds of restructuring. The company has not issued an official statement regarding the concerns raised by former employees. Khaleej Times attempted to reach Petrofac for comment, but multiple calls went unanswered. The lack of clarity on gratuity payouts, leave encashments, and notice-period salaries has added to the financial stress for families with long-term commitments in the UAE.

分类: business

-

ADX launches new ETF aimed at access to global heavyweights powering the growth of AI

The Abu Dhabi Securities Exchange (ADX) has unveiled a groundbreaking exchange-traded fund (ETF) designed to provide investors with access to the global companies driving the rapid expansion of artificial intelligence (AI). Launched in collaboration with Abu Dhabi-based investment management firm Lunate, the Boreas S&P AI Data, Power & Infrastructure UCITS ETF targets key sectors essential to AI development, including technology, industrials, utilities, and real estate. The ETF invests in companies that are building and managing critical infrastructure, power systems, and energy grids necessary for the AI-driven economy. Among its portfolio are global giants such as Alphabet (Google’s parent company), Amazon, Oracle, ABB, and Broadcom. The ETF tracks an AI-related data center and power supply infrastructure index, which has historically delivered an annual return of 15.7%, based on back-tested data. As AI continues to grow, the demand for data, computational power, and energy infrastructure is surging, creating significant investment opportunities. Abdulla Salem Alnuaimi, Group CEO of ADX, emphasized the exchange’s commitment to offering innovative investment products that align with global trends, noting that thematic ETFs worldwide have surpassed $300 billion in assets. Sherif Salem, Partner & Head of Public Markets at Lunate, highlighted the ETF’s role in strengthening Abu Dhabi’s position as a global financial hub. ADX, already the region’s leader in ETF listings and trading, continues to expand its offerings to meet the evolving needs of investors.

-

Bolivia’s new president plans to scrap taxes and borrow money to confront economic crisis

In a decisive move to address Bolivia’s deepening economic crisis, President Rodrigo Paz announced sweeping reforms just two weeks into his tenure. The nation’s first conservative leader in nearly two decades, Paz revealed plans to eliminate a series of taxes and slash federal spending by 30% in the 2026 budget. These measures aim to reverse years of populist economic policies enacted under the Movement Toward Socialism (MAS) party, which had long dominated Bolivian politics. Among the taxes targeted for repeal are the national wealth tax and a 0.3% levy on financial transactions, both of which Paz argued have stifled growth and discouraged investment. Business leaders have welcomed the changes, with Klaus Freking of the agricultural chamber hailing the end of ‘persecution of the private sector.’ However, Paz has opted to retain key elements of the MAS economic model, including fuel subsidies and a fixed exchange rate, despite their distortions. Economic analyst Gonzalo Chávez noted that while Paz’s initial steps are promising, they fail to address core structural issues. The government has also secured a $3.1 billion loan from the Andean Development Corporation, with plans to borrow up to $9 billion over the next three years. Additionally, Paz has worked to mend relations with the United States, culminating in agreements on nuclear cooperation and security assistance. The administration has also approved Elon Musk’s Starlink to operate in Bolivia, a move previously blocked by the former government. Early signs of progress include a reduction in fuel shortages and a modest recovery in Bolivia’s sovereign bonds and currency value.

-

Middle East construction embraces digitalisation to drive sustainability goals

The Middle East’s construction industry is undergoing a profound transformation, driven by the dual imperatives of sustainability and digitalization. Companies across the region are increasingly adopting low-carbon design principles, energy-efficient building practices, and advanced technologies to optimize resource use and minimize environmental impact. Key innovations such as Building Information Modeling (BIM), digital twins, AI-based simulations, and lifecycle analysis are enabling construction teams to model environmental outcomes, reduce waste, and align with global and regional sustainability standards. This shift is further bolstered by robust regulatory frameworks and ambitious national agendas, including the UAE Net Zero 2050 and Saudi Vision 2030, which emphasize decarbonization and data-driven decision-making. At the recent Big 5 Global 2025 event, Nemetschek Arabia showcased its cutting-edge solutions, including AI-driven design optimization, BIM collaboration, and smart building operations, highlighting the potential of open and intelligent digital workflows to enhance productivity and sustainability. The GCC construction market, valued at $147.1 billion in 2024, is projected to grow to $226.2 billion by 2033, driven by mega-projects such as Saudi Arabia’s giga developments and UAE landmarks like the Saadiyat Cultural District. Nemetschek Arabia aims to deepen its role as a digital transformation partner, focusing on localized solutions, ecosystem collaboration, and AI-driven innovation to support the region’s net-zero goals and the creation of resilient, sustainable cities.

-

NADZ Healthcare crowned “Best Home Healthcare” at Health Magazine Awards 2025

In a landmark achievement for the regional healthcare sector, NADZ Healthcare has been honored with the coveted “Best Home Healthcare” award at the Health Magazine Annual Health Awards 2025. The prestigious recognition was presented by Sheikh Nahyan bin Mubarak Al Nahyan during a ceremony that celebrated excellence in medical services across the UAE.

The award specifically acknowledges NADZ Healthcare’s innovative fusion of clinical precision and concierge-style service delivery, establishing new benchmarks for in-home medical care catering to Dubai’s affluent and privacy-conscious residents. This patient-centric model was fundamentally shaped by the philosophical approach of its founder, Dr. Nadia Choudhry, who has led the organization for 15 years.

Judging panel representatives highlighted three distinctive strengths that positioned NADZ Healthcare above competitors:

1. **Advanced Mobile Medical Capabilities**: The organization maintains hospital-grade clinical standards through DHA-licensed medical teams equipped with sophisticated portable diagnostics technology. Their arsenal includes point-of-care blood testing equipment, mobile ECG and ultrasound devices, and remote patient monitoring systems, enabling accurate medical assessments in diverse environments including private residences, luxury hotels, and yachts.

2. **Discretion-Forward Service Model**: Catering specifically to high-net-worth individuals and privacy-sensitive clients, NADZ operates unbranded clinical vehicles and conducts low-profile visits to ensure complete confidentiality. Simultaneously, the provider offers premium wellness services in unconventional settings, including physiotherapy sessions aboard private yachts and comprehensive health evaluations on golf courses.

3. **Empathy-Driven Patient Care**: Beyond technical excellence, the organization has earned consistent praise for its human-centered approach to medicine. Dr. Choudhry’s philosophy of serving as both medical professional and attentive listener has permeated the entire clinical team, creating an environment where patients feel genuinely heard, safe, and comprehensively supported.

The award committee noted NADZ’s exceptional performance across multiple service domains, including emergency stabilization, post-operative care, preventive wellness programs, and VIP event medical coverage. This recognition reflects broader regional trends toward personalized, mobile healthcare solutions that prioritize patient experience, particularly among corporate clients, private families, and ultra-high-net-worth individuals.

Dr. Choudhry emphasized the organization’s commitment to patient choice, noting: “We architected NADZ to provide genuine alternatives in healthcare delivery. Whether clients require absolute anonymity or prefer to share their healthcare journey publicly, we deliver identical clinical excellence and respect to both preferences.”

With growing demand for premium home healthcare services, NADZ plans strategic expansion of its specialist teams, mobile diagnostic capabilities, and rapid-response coverage throughout Dubai and wider UAE regions.

-

Women chair 15.8% of board positions in 73 listed financial companies in the UAE

A groundbreaking report titled ‘Discovery Series 2025: Women transforming financial services,’ jointly published by Heriot-Watt University and Grant Thornton, has shed light on the representation of women in senior leadership roles within the UAE’s financial services sector. The report, which serves as an evidence-based benchmark, highlights that women currently chair 15.8% of board positions across 73 listed financial companies in the UAE. This figure surpasses the UAE-wide average of 14.8% across all sectors, as per the 2025 GCC Board Gender Index, indicating that the financial sector is slightly ahead in advancing women’s representation at the board level.

The report underscores the critical contributions of women in key roles such as board directors, Chief Risk Officers (CROs), and Heads of Internal Audit (HIAs) across banks, investment firms, insurance companies, and fintech enterprises. These roles are pivotal in safeguarding the integrity of the financial sector and enabling sustainable growth, particularly as the UAE continues to diversify its economy and reduce its reliance on oil. In 2024, the UAE’s economy grew by 4% to Dh1.77 trillion, with the non-oil sector accounting for over three-quarters of the GDP. The financial industry alone contributed approximately 13.2% to the economy.

Despite these advancements, the report reveals significant gaps in gender representation. Eight of the 73 companies studied have no women on their boards, and only three out of 49 companies have a female CRO. Similarly, just six out of 60 companies have a female HIA, highlighting the need for proactive measures to enhance gender balance in leadership roles.

Hisham Farouk, CEO of Grant Thornton UAE, emphasized the importance of intentional progress in building a world-class, innovation-led economy. He noted that the Discovery Series serves as a benchmark to help industry, regulators, and boards track progress and actively close the leadership representation gap. Emma Smalls, UAE Head of Business Risk Private Bank at HSBC Middle East, echoed this sentiment, calling for continued focus on inclusive leadership to accelerate the journey toward diverse and resilient governance.

Professor Dame Heather McGregor, Provost and Vice-Principal of Heriot-Watt University Dubai, stated that the report aims to provide a clear, evidence-based picture of gender representation at senior levels in the UAE financial sector. She emphasized the financial industry’s responsibility to champion gender equity, given its progressive nature and significant role in the UAE’s economic transformation.

The 2025 Discovery Series, which can be accessed online, combines quantitative data and qualitative narratives to offer sector-specific insights into how women are shaping governance, risk, and reform from within. Through this initiative, Grant Thornton and Heriot-Watt University hope to inspire further action and accelerate the journey toward truly diverse and resilient governance in the UAE’s financial services sector.

-

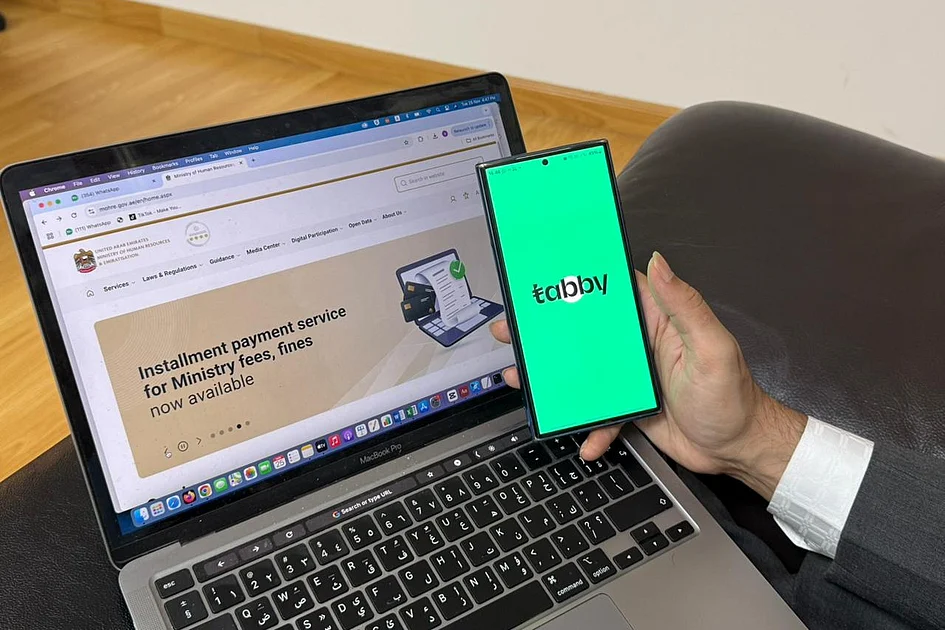

UAE: Residents can now pay fines, fees in monthly instalments with Tabby

The UAE Ministry of Finance (MoF) has unveiled a groundbreaking initiative allowing residents to pay federal government fees and fines in monthly instalments through the Tabby app. Announced on Tuesday, this move leverages the ‘Buy Now, Pay Later’ model, offering customers flexibility in managing their financial obligations. Under this arrangement, Tabby will settle the full amount with the relevant government entity upfront, while customers repay the sum in pre-agreed instalments. This service is optional, with the associated commission borne solely by the user. The partnership with Tabby aligns with the MoF’s broader strategy to enhance digital payment solutions, foster financial inclusion, and support the UAE’s digital transformation. Saeed Rashid Al Yateem, MoF’s Assistant Undersecretary for Government Budget and Revenue Sector, emphasized the ministry’s commitment to adopting cutting-edge financial technologies to improve customer satisfaction and provide secure, flexible payment options. Hosam Arab, co-founder and CEO of Tabby, expressed pride in supporting the MoF’s mission to make federal services more accessible across the UAE. This initiative underscores the UAE’s progressive approach to integrating modern financial tools into public services, ensuring convenience and efficiency for residents.

-

Ageing populations a ‘ticking time bomb’ for GDP growth, says EBRD

The European Bank for Reconstruction and Development (EBRD) has issued a stark warning about the economic repercussions of ageing populations, describing the trend as a ‘ticking time bomb’ for GDP growth. In its annual report released on Tuesday, the EBRD highlighted that declining birth rates and an increasing share of elderly citizens are already undermining economic progress in several nations. Emerging Europe, in particular, is projected to see a reduction in annual per capita GDP growth by nearly 0.4 percentage points between 2024 and 2050 due to a shrinking working-age population.

EBRD Chief Economist Beata Javorcik emphasized that post-communist countries are ‘getting old before getting rich,’ with a median age of 37 and an average GDP per capita of $10,000—far below the levels seen in advanced economies during similar demographic stages. The report identified multiple factors contributing to declining birth rates, including shifting social norms and the impact of motherhood on women’s career earnings. While many EBRD member states have implemented incentives to encourage higher birth rates, these measures have failed to produce significant or lasting results.

Migration, often suggested as a solution, remains politically unpopular in most regions. Additionally, public sentiment toward leveraging artificial intelligence (AI) to boost productivity is mixed. Javorcik argued that extending working lives through retraining and pension reforms could be the most effective strategy, though it requires candid discussions with voters about the implications of demographic shifts.

The report also noted that ageing leaders, who tend to prioritize pension protection and restrict migration, further complicate efforts to address the issue. Globally, the average age of leaders is now 60, significantly older than the median adult. In autocracies, this gap has widened to 26 years in 2023, up from 19 years in 1960.

For newer EBRD member nations like Nigeria, the focus should be on job creation and private sector expansion to capitalize on their current demographic dividend. However, Javorcik cautioned that this window of opportunity is fleeting, as birth rates in other parts of Africa are also declining. ‘These countries must act now to secure their economic future,’ she said.

-

UAE real estate booms as country emerges as a magnet for global wealthy

The United Arab Emirates (UAE) has solidified its position as a premier destination for the world’s affluent, with over 9,800 millionaires relocating to the country in 2025 alone, according to Henley & Partners. This migration is driven by the UAE’s investor-friendly policies, tax efficiency, and cutting-edge infrastructure, which have transformed Dubai into a global hub for luxury real estate. The city now rivals established markets like New York and London, attracting unprecedented demand for ultra-luxury properties. Amid this boom, Sunteck Realty Ltd, a leading Indian luxury developer, has announced its entry into the UAE market with the establishment of Sunteck International in Dubai. The company has unveiled an ambitious plan to invest Dh15 billion in UAE real estate projects over the next three years, signaling its long-term commitment to the region. Sunteck’s inaugural project, a prime land parcel in Downtown Dubai near the Burj Khalifa and The Dubai Mall, is set to redefine ultra-luxury living with contemporary design and branded residences in collaboration with global hospitality brands. Kamal Khetan, Chairman & Managing Director of Sunteck Realty Ltd, emphasized Dubai’s unique appeal, citing its unmatched growth potential and favorable pricing compared to other global cities. He highlighted the UAE’s attractiveness to high-net-worth individuals, noting that many are leaving Europe for the UAE. Khetan expressed confidence in Dubai’s real estate market, stating that it offers unparalleled volumes, pricing, and margins, making it the ideal location for Sunteck’s international debut.

-

UAE and Japanese financial institutions buy big stakes in Indian banks

In a significant shift in India’s financial landscape, global financial institutions from the United Arab Emirates (UAE) and Japan are making substantial investments in Indian banks, capitalizing on the government’s relaxed restrictions on foreign shareholdings. Emirates NBD, Dubai’s largest lender, is poised to acquire a 60% stake in RBL Bank, a private Indian bank, for $3 billion, marking the largest cross-border acquisition in India’s financial sector. Earlier, Japan’s Sumitomo Mitsui Financial Group (SMFG) purchased a 24.2% stake in Yes Bank for $1.7 billion, becoming its largest shareholder. Meanwhile, Mitsubishi UFJ Financial Group (MUFG), Japan’s largest lender by assets, is finalizing deals to invest $4 billion in Indian financial institutions, including a 20% stake in Shriram Finance, a major credit solutions provider. These developments align with Indian Finance Minister Nirmala Sitharaman’s vision to create more ‘big banks.’ Foreign investments in India’s financial sector surged to $8 billion in 2025, up from $2.3 billion in the previous year. Concurrently, India and Israel are advancing a free trade agreement (FTA) to bolster economic and technological cooperation, with Israeli Prime Minister Benjamin Netanyahu emphasizing the strategic partnership. The UAE’s investments in India are also set to reach $100 billion across sectors, including a controversial mega-mall project in Kashmir. However, these moves have drawn criticism from activists, who accuse India of human rights violations in the region. The UAE’s financial networks have also been implicated in supporting militias in Sudan, raising ethical concerns. As global financial giants pivot towards India, the Reserve Bank of India’s easing of restrictions has further incentivized foreign investments in medium-sized banks.