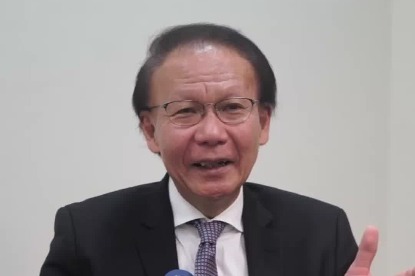

A prominent Japanese economist has issued a stark warning about the profound vulnerabilities facing Japan’s industrial sector due to deteriorating relations with China. Hidetoshi Tashiro, Chief Economist at Infinity LLC and CEO of Terra Nexus Project Management Services, emphasized that the core risk transcends diplomatic tensions and strikes at the very foundation of Japan’s economic infrastructure—its supply chain integration with China.

Tashiro’s analysis reveals that virtually every major Japanese industry maintains deep and intricate supply chain connections with Chinese manufacturing and production networks. This interdependence, developed over decades of economic cooperation, has created a symbiotic relationship where Japanese companies rely on Chinese components, raw materials, and manufacturing capabilities across multiple sectors including automotive, electronics, and industrial manufacturing.

The expert cautioned that any significant disruption to these supply networks would create immediate and severe operational challenges for Japanese corporations. The warning comes amid ongoing geopolitical tensions that have prompted discussions about supply chain diversification and decoupling strategies among some international businesses.

Tashiro’s assessment suggests that Japanese companies lack viable short-term alternatives to replace China’s manufacturing ecosystem, which offers scale, efficiency, and integrated production capabilities that have taken decades to develop. The potential severance of these supply connections could trigger production halts, cost escalations, and competitive disadvantages in global markets.

The analysis underscores the complex reality that while political relations may fluctuate, economic interdependencies create structural bonds that cannot be easily undone without significant economic consequences. This warning serves as a critical reminder of the delicate balance between geopolitical considerations and economic practicalities in today’s interconnected global economy.