Facing persistent supply chain disruptions and geopolitical tensions, major automakers across the United States and Europe are intensifying efforts to develop alternative technologies that reduce or eliminate dependence on rare-earth metals. These materials, particularly neodymium, dysprosium and terbium, are crucial components in numerous automotive parts ranging from electric vehicle motors to windshield wiper mechanisms and adjustable seating systems.

China’s dominant position in rare-earth mining and processing—controlling approximately 80-90% of global supply—has created significant vulnerabilities for Western manufacturers. The situation escalated in 2025 when Beijing implemented export controls on these materials, widely interpreted as retaliation against Trump administration tariffs on Chinese goods. Although some restrictions were temporarily suspended through diplomatic agreements, industry executives remain concerned about future weaponization of these critical resources.

The pandemic-era semiconductor shortage served as a wake-up call, highlighting the dangers of over-reliance on single-source suppliers. This realization has spurred two parallel strategies: diversifying sourcing outside China and developing alternative technologies that bypass rare-earth requirements entirely.

General Motors exemplifies the diversification approach through its partnership with MP Materials, a domestic company mining rare earths in California and constructing a Texas-based refining facility. Meanwhile, BMW has pioneered technological innovation with rare-earth-free motors already deployed in models like the iX SUV. These electronically excited motors generate magnetic fields through electric currents rather than permanent magnets, though they historically faced challenges with weight, size and energy efficiency that BMW claims to have largely overcome.

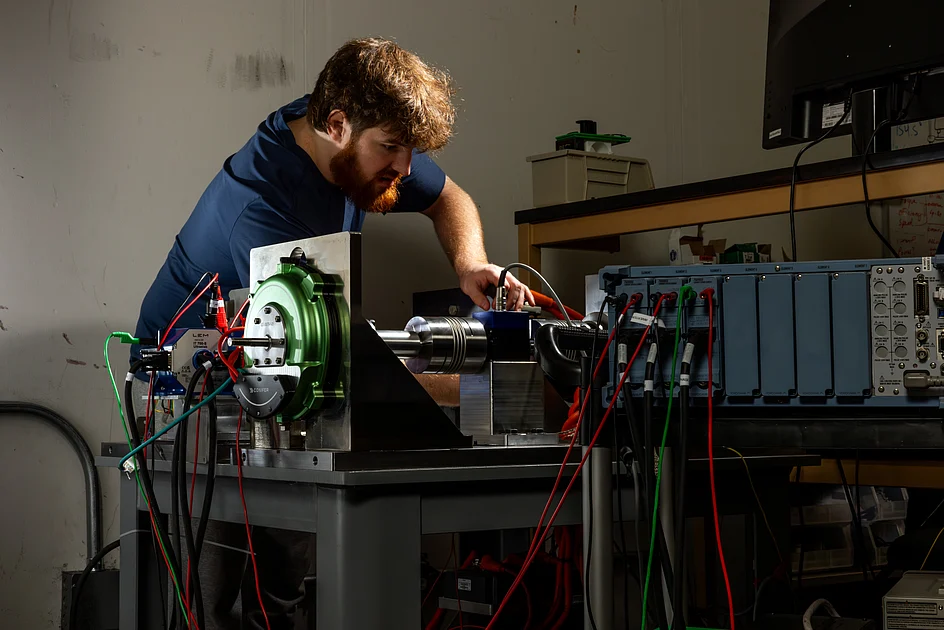

Research institutions including Northeastern University are exploring synthetic materials with magnetic properties found only in meteorites, while the Department of Energy offers grants up to $3 million for developing alternatives twice as powerful as existing rare-earth magnets—a target some experts consider unrealistic. Despite these efforts, most solutions remain years from commercialization, and current alternatives often come with cost or performance trade-offs.

Industry analysts note that while temporary détente has eased immediate shortages, the structural vulnerability persists. ‘This isn’t a challenge you can overcome in a year,’ observed Gracelin Baskaran of the Center for Strategic and International Studies, capturing the long-term nature of this supply chain transformation.