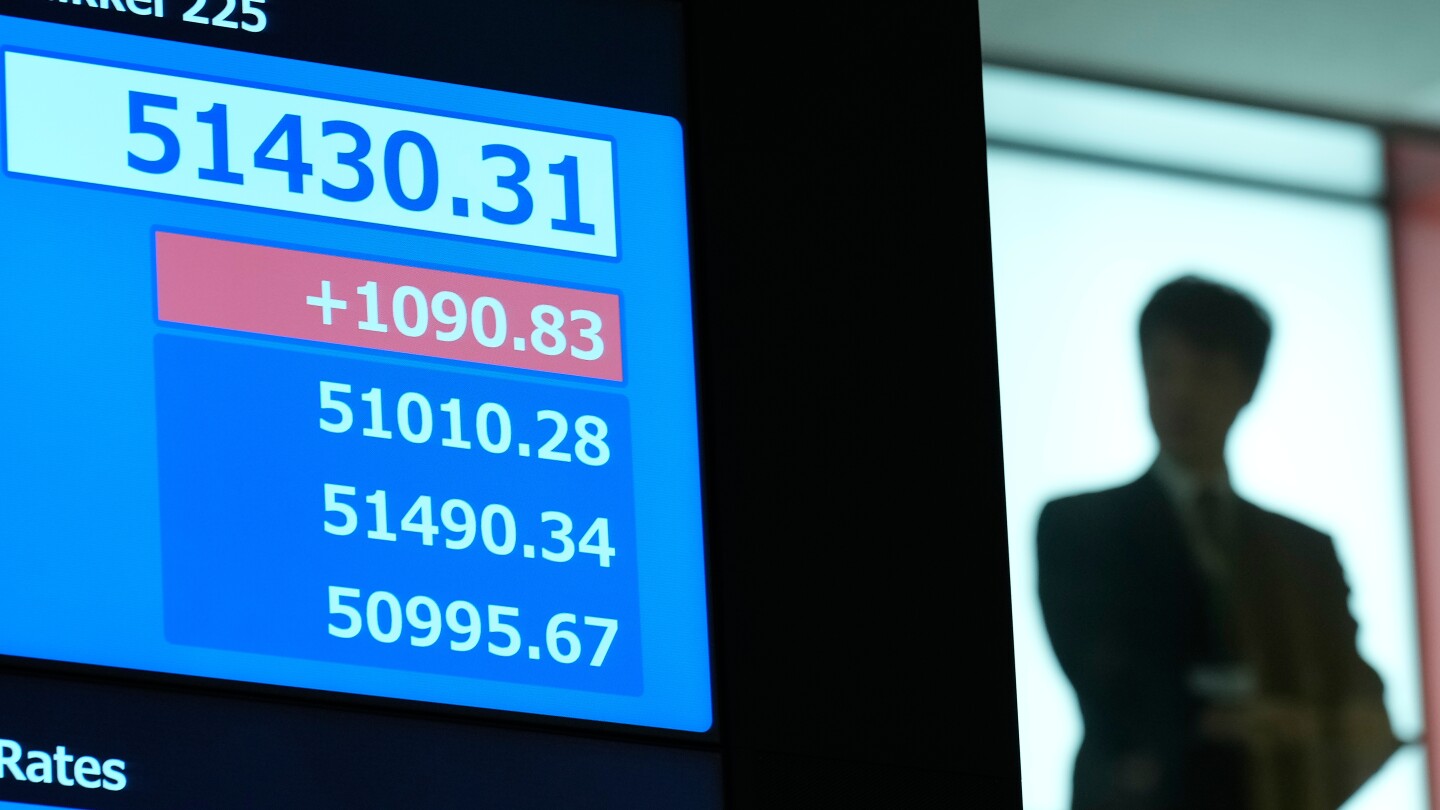

Asian equity markets experienced substantial gains on Tuesday, with multiple benchmarks reaching historic levels in the wake of a powerful Wall Street rally and significant geopolitical developments involving Venezuela. Tokyo’s Nikkei 225 shattered previous records by climbing 1.3% to close at 52,518.08, propelled by robust buying in technology-related shares including precision tools manufacturer Disco Corp., which surged 6.1%. South Korea’s Kospi advanced 1.5% to 4,525.98, establishing new record territory supported by automotive and electronics manufacturers. Hong Kong’s Hang Seng index jumped 1.5% to 26,748.80, while mainland China’s Shanghai Composite rose 1.5% to 4,082.36, marking its highest position in four years. Taiwan’s Taiex climbed 1.6%, though Australia’s S&P/ASX 200 retreated 0.5% and India’s Sensex declined 0.5%. The broad Asian rally followed Monday’s substantial gains on Wall Street where energy corporations and financial institutions led advances. The S&P 500 increased 0.6%, approaching its December record, while the Dow Jones Industrial Average achieved a new historic high by adding 1.2% to 48,977.18. The technology-focused Nasdaq composite rose 0.7%, and small-cap stocks demonstrated particular strength with the Russell 2000 jumping 1.6%, indicating widespread investor confidence. Energy markets remained volatile following the capture of Venezuelan President Nicolás Maduro by U.S. forces. While crude prices surged Monday with U.S. crude reaching $58.32 per barrel and Brent crude climbing to $61.76, both benchmarks retreated slightly in early Tuesday trading. Major oil companies including Chevron (up 5.1%), Exxon Mobil (up 2.2%), and Halliburton (surging 7.8%) recorded substantial gains after former President Trump proposed involving U.S. energy firms in rebuilding Venezuela’s decimated petroleum industry. Market participants are anticipating several key economic indicators this week, including Wednesday’s services sector report from the Institute for Supply Management and upcoming employment data. The Federal Reserve continues monitoring labor market conditions against inflation concerns as it deliberates interest rate policy. Meanwhile, technology shares remained in focus as the CES trade show commenced in Las Vegas, with artificial intelligence investments continuing to drive market optimism despite valuation concerns. Precious metals maintained their upward trajectory with gold adding 0.5% and silver advancing 2.9% following Monday’s significant gains, reflecting ongoing safe-haven demand amid geopolitical uncertainties. Bitcoin retreated 1.3% to approximately $93,700 after recently reaching its highest level since mid-November.

Asian shares and US futures advance, as Tokyo’s Nikkei 225 hits a record high