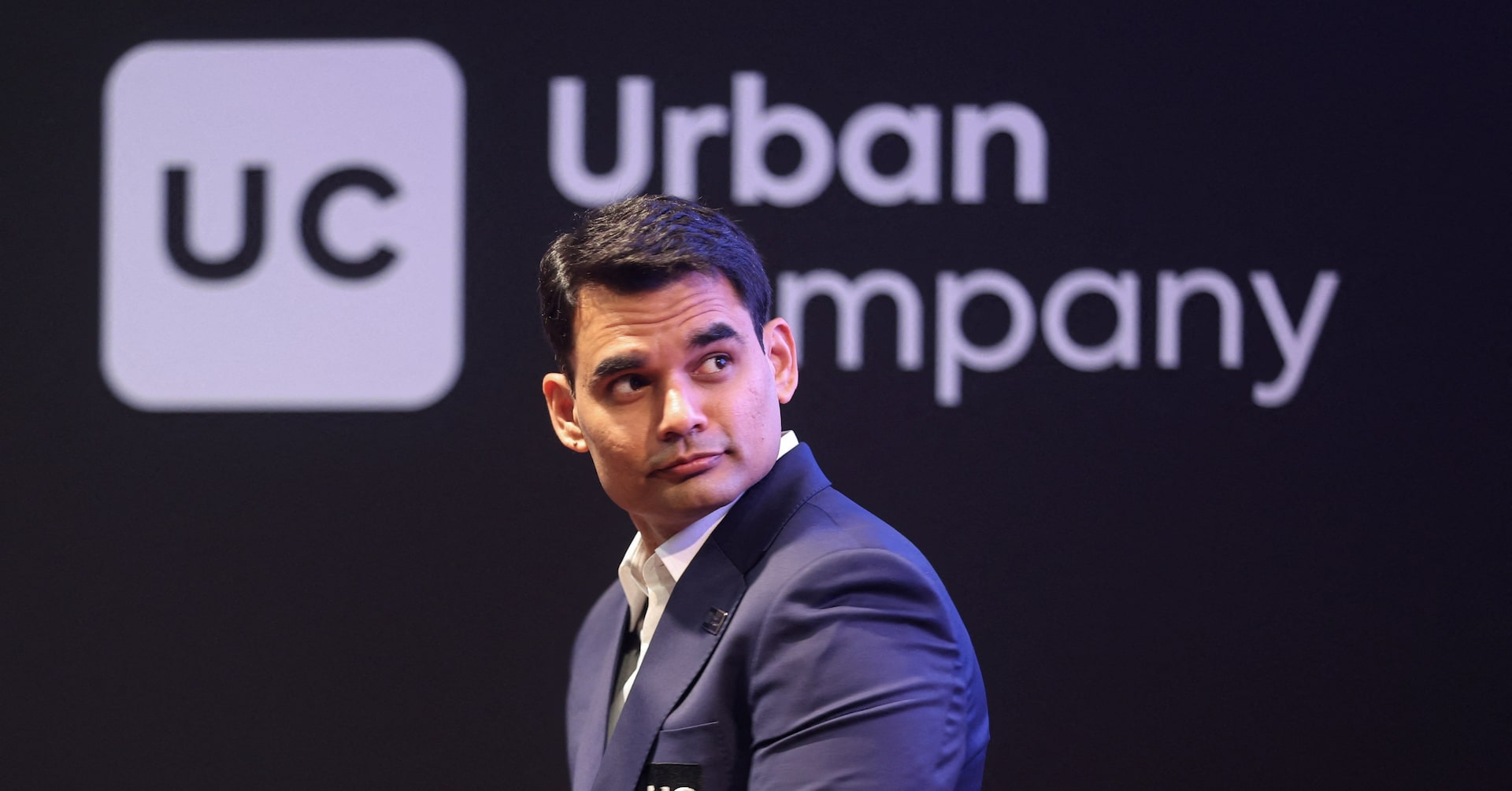

Urban Company Limited, a leading player in India’s home-services sector, made a spectacular debut on the National Stock Exchange (NSE) on September 17, 2025. The company’s shares surged by 74%, catapulting its valuation to nearly $3 billion. This marked one of the most successful initial public offerings (IPOs) of 2025, with the issue being oversubscribed by a staggering 103.65 times, attracting bids worth approximately $13 billion. Urban Company’s stock opened at a 57.5% premium to its issue price, far exceeding analysts’ predictions of a 40%-51% upside. The shares hit a high of 179 rupees during the trading session and closed at 166.8 rupees, up 62% from the issue price. The IPO’s success underscores investor confidence in Urban Company’s dominance of India’s largely unorganized home-services market, which is projected to grow at a compound annual growth rate of 22.4% from 2023 to 2030, according to Grand View Research. Aishvarya Dadheech, founder of Fident Asset Management, noted that the enthusiasm reflects Urban Company’s position as a long-term play on digital adoption and rising demand for home services. The listing also coincided with a broader uptick in Indian equities, buoyed by optimism surrounding U.S.-India trade talks. The blue-chip Nifty 50 index has risen 7% in 2025 but remains 4% below its record levels from a year ago. Urban Company’s debut is a testament to the resilience and growth potential of India’s IPO market, which has rebounded after a slow start to the year and is on track to set new fundraising records.

India’s Urban Company soars 74% in trading debut, hits about $3 billion valuation