Saudi Arabia’s visionary $1 trillion Neom megaproject is undergoing substantial downsizing and redesign following years of implementation delays and financial constraints. According to a Financial Times report citing informed sources, Neom’s leadership now envisions a significantly scaled-down version of the originally proposed development.

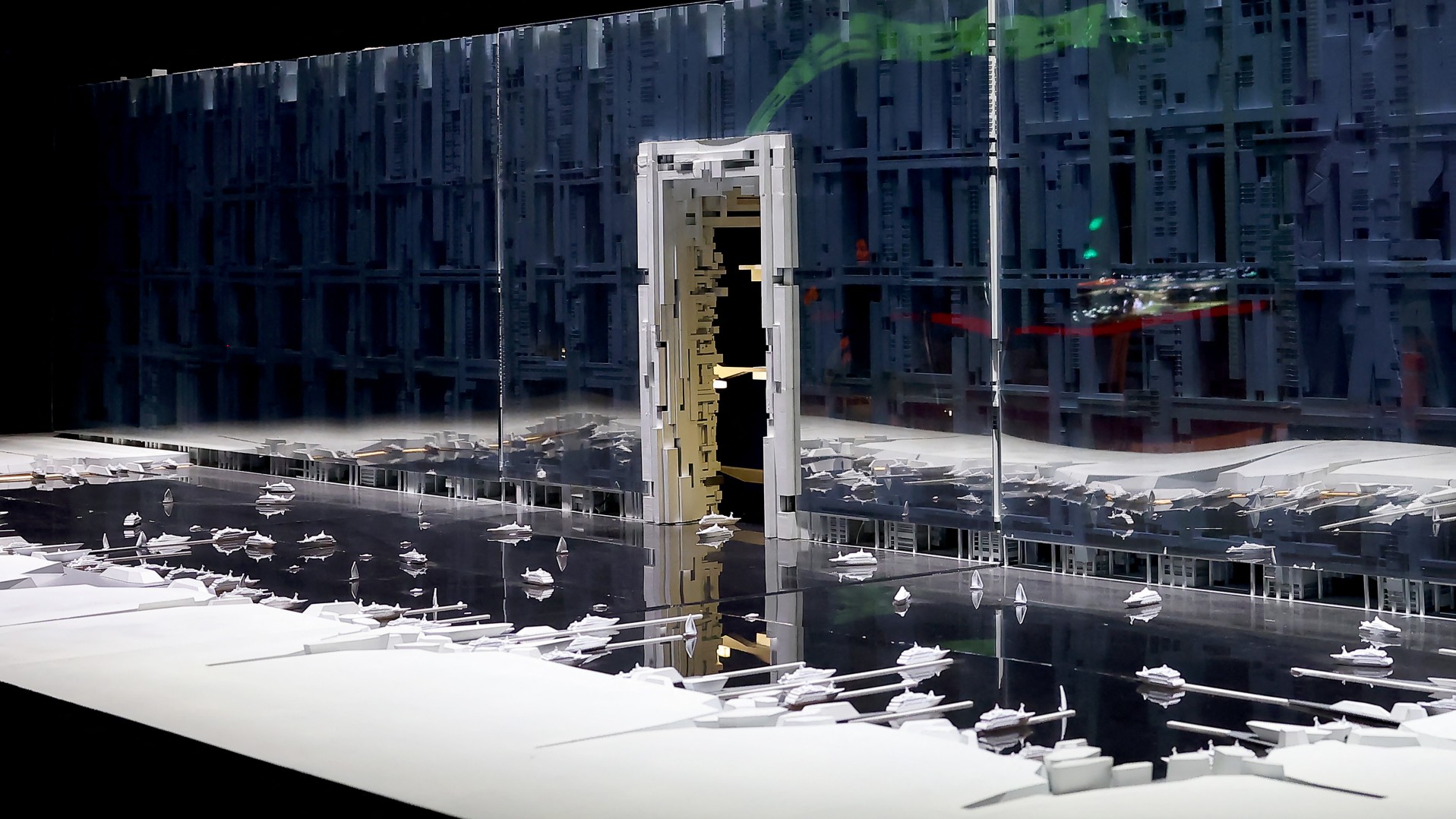

The project’s centerpiece, ‘The Line’—initially conceptualized as a revolutionary 170-kilometer linear city—has been radically reconfigured into a more modest undertaking. Sources indicate the redesigned concept will utilize existing infrastructure differently than originally planned, marking a fundamental shift in approach.

Additional components of the Neom blueprint have also faced reduction. The planned eight-sided floating city ‘Oxagon’ and the ‘Trojena’ ski resort—originally slated to host the 2029 Asian Winter Games—have been downsized, with Riyadh announcing the withdrawal from hosting the winter sports event.

The strategic repositioning emphasizes industrial sectors, particularly positioning Neom as a hub for data centers. This aligns with Crown Prince Mohammed bin Salman’s ambition to establish Saudi Arabia as a major artificial intelligence player. The coastal location provides strategic advantages for seawater cooling systems essential for data center operations.

Financial pressures stemming from stagnating oil prices have prompted this recalibration. Saudi authorities are simultaneously prioritizing resources toward fixed-deadline events including the 2030 Expo international trade fair and the 2034 World Cup.

The project has faced persistent criticism regarding its feasibility and human rights implications. Allegations include forced displacement of the indigenous Howeitat tribe from their ancestral lands in northwest Saudi Arabia. Reports document arrests and detentions of tribe members resisting eviction, including the 2020 shooting death of an activist protesting land clearance.

A comprehensive year-long review examining Neom’s implementation is scheduled for completion by first quarter 2026. Neom’s management stated they ‘continuously evaluate phasing and prioritization to align with national objectives and create long-term value,’ emphasizing advancement ‘in line with strategic priorities, market readiness and sustainable economic impact.’

As part of the Public Investment Fund’s portfolio, Neom’s restructuring reflects broader potential reviews of Saudi Arabia’s sovereign wealth fund projects amidst evolving economic realities.