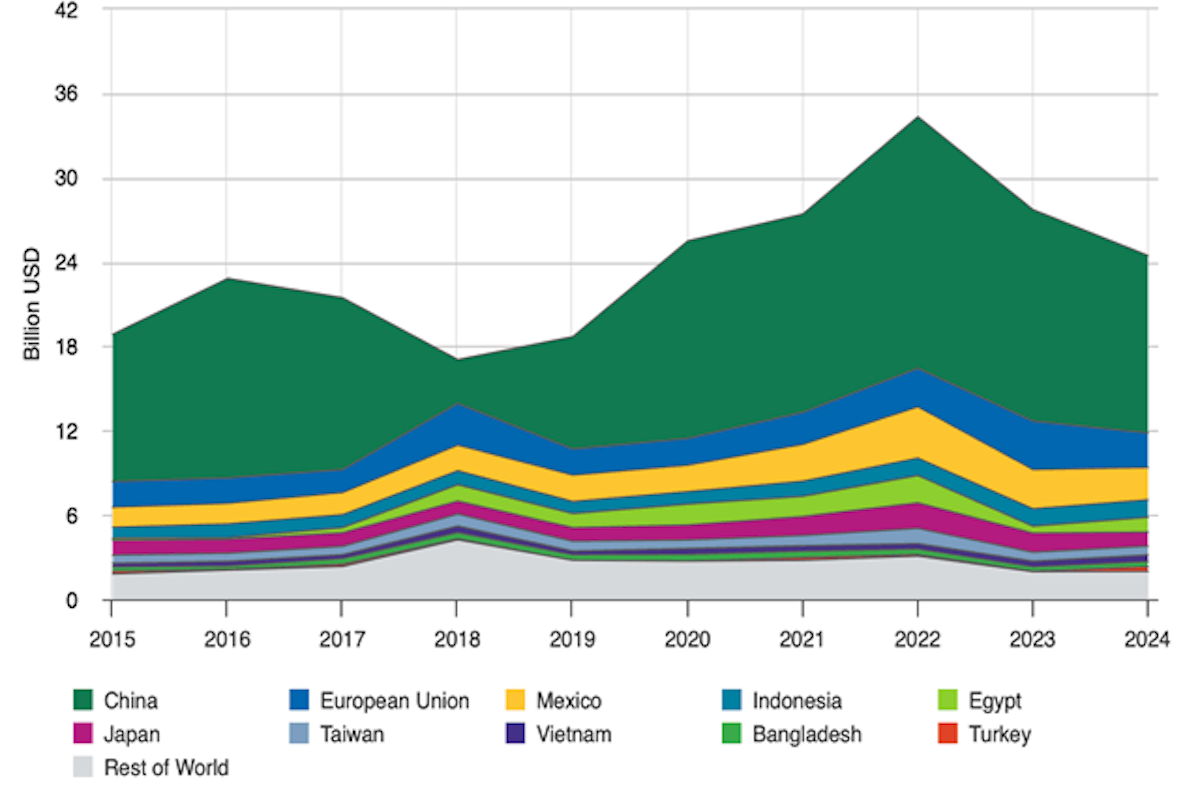

In 2003, during my early days at DTN/The Progressive Farmer, I was invited to speak about China at a farmers’ meeting in Iowa. Though not an expert on Chinese agriculture, my 17 years living and working in Tokyo and Hong Kong allowed me to witness China’s extraordinary economic growth. I confidently declared, ‘China is the difference between $5 soybeans and $10 soybeans.’ This prediction proved accurate, as US soybean exports to China doubled in the following years, with prices soaring to $9–$15 per bushel. For decades, China has been the largest overseas buyer of US soybeans, accounting for over half of American exports in 2024, far surpassing the European Union’s 10% share. However, the trade war initiated by President Donald Trump in 2018 disrupted this relationship, prompting China to increasingly turn to Brazil as its primary supplier. Despite this shift, China continued to purchase significant quantities of US soybeans—until 2024. This year, China has drastically reduced its imports, buying only 200 million bushels in the first eight months, compared to 1 billion during the same period in 2023. In recent months, imports have dropped to zero. The American Soybean Association’s president, Caleb Ragland, expressed concern, stating, ‘The farm economy is suffering while our competitors supplant the United States in the biggest soybean import market in the world.’ While some analysts predict a potential rebound in Chinese purchases, the ongoing trade tensions, including Trump’s imposition of 100% tariffs on Chinese goods, cast doubt on this possibility. The situation underscores the urgent need for US farmers to diversify their markets and reduce reliance on China. Meanwhile, China is actively expanding its domestic soybean production and investing in alternative suppliers like Brazil and Russia. For US farmers, the loss of China as a major buyer is a stark reminder of the risks of overdependence on a single market. Developing new domestic and international markets is essential to ensure long-term stability and growth in the soybean industry.