In a significant move to strengthen bilateral ties, the European Commission has outlined ambitious plans to deepen cooperation with India across multiple sectors, including defense, technology, and trade. This initiative comes despite ongoing tensions over India’s close relationship with Russia, particularly in light of increased Russian oil purchases by New Delhi following the 2022 invasion of Ukraine. The European Union and India are now in the final stages of negotiating a free trade agreement, with both parties aiming to conclude the deal by the end of 2025. The negotiations, which were relaunched in 2022, have gained momentum following the re-election of U.S. President Donald Trump, whose tariff policies have prompted both the EU and India to seek new alliances. EU Foreign Policy Chief Kaja Kallas acknowledged the existence of ‘clear areas of disagreement’ but emphasized the bloc’s commitment to avoiding pushing India further into Russia’s sphere of influence. The EU’s vision document released on September 17 highlights plans for collaboration on investment protection, air transport, supply chain security, green hydrogen, decarbonization of heavy industry, and research and innovation. Additionally, the EU envisions a defense and security partnership with India, similar to those already established with Japan and South Korea, and joint projects in third countries, particularly in Africa and South Asia. Despite geopolitical complexities, the EU views India as a key partner in upholding the rules-based multilateral order and anticipates benefiting from India’s projected rise to become the world’s third-largest economy by 2030.

标签: Asia

亚洲

-

Exclusive: Adani-led Sri Lanka container terminal to double capacity ahead of deadline

The Adani Group, in collaboration with its partners, is advancing the expansion of the $840 million Colombo West International Terminal in Sri Lanka, aiming to double its capacity by late 2026, ahead of the original schedule. This development comes despite the group’s decision to withdraw a $553 million funding request from the U.S. International Development Finance Corp, opting instead to finance the project through internal resources. The terminal, strategically located next to a facility operated by China Merchants Port Holdings, highlights Sri Lanka’s pivotal role in the geopolitical competition for influence in the Indian Ocean between India and China. The first phase of the fully automated terminal became operational in April, with the second phase now underway. Zafir Hashim, head of transportation at John Keells Holdings, a key partner, revealed that the project is progressing three to four months ahead of the February 2027 deadline. Upon completion, the terminal will handle 3.2 million containers annually, significantly boosting Colombo’s port throughput. The majority of the terminal’s business originates from India. Despite controversies, including allegations of bribery against Adani Group Chairman Gautam Adani—which the group has denied—Hashim expressed confidence in the partnership, stating that Adani has been a reliable collaborator. Adani Ports and Special Economic Zone holds a 51% stake in the terminal, with John Keells owning 34% and the Sri Lanka Ports Authority holding the remainder. Sri Lanka is also exploring further renewable energy investments with Adani, despite earlier disagreements over wind power projects. In February, Adani withdrew from two proposed $1 billion wind projects after the Sri Lankan government sought to renegotiate power purchase rates. However, the group later showed renewed interest by purchasing bid documents for smaller wind projects, signaling potential future collaborations.

-

Fury over corruption and ‘nepo babies’ as floods paralyse Philippines

In the Philippines, chronic flooding has become a grim reality for millions, exacerbated by allegations of widespread corruption in flood control projects. Crissa Tolentino, a 36-year-old public school teacher, navigates her daily life in Apalit, a low-lying town near Manila, by paddling through inundated streets. For her, this is not just a commute but a lifeline to her workplace and the clinic where she receives cancer treatment. However, this year, her frustration has reached a boiling point due to an unusually fierce monsoon that has disrupted lives and exposed deep-seated corruption.

Ms. Tolentino’s anger is echoed across the nation, where citizens are questioning the government’s inability to manage floods despite billions of pesos allocated for infrastructure. Allegations of ‘ghost projects’—construction contracts awarded for non-existent initiatives—have fueled public outrage. President Ferdinand ‘Bongbong’ Marcos Jr. has acknowledged the issue, even discovering a flood control dam that was supposed to exist but didn’t. The economic planning minister revealed that 70% of public funds for flood control had been siphoned off by corruption.

The scandal has led to high-profile resignations, including the House Speaker and the Senate leader, both implicated in corruption allegations. Social media has become a battleground for public anger, with Filipinos using AI-generated videos and hashtags like ‘nepo babies’ to criticize the extravagant lifestyles of politicians’ children. A planned anti-corruption protest on September 21, coinciding with the anniversary of martial law, underscores the depth of public discontent.

President Marcos Jr. has announced an inquiry to ‘unmask the swindlers,’ but skepticism remains. The focus has shifted to a family-owned construction firm, the Discayas, whose lavish lifestyle has drawn widespread condemnation. Their admission of paying kickbacks to lawmakers has further inflamed tensions. Meanwhile, Filipinos like Rhens Rafael Galang, who has turned his flood-related struggles into a thriving business, cling to hope for honest, long-term flood control solutions.

As the nation grapples with the dual crises of extreme weather and corruption, the question remains: will the government’s promises translate into tangible change, or will public fury continue to grow?

-

Hong Kong leader pledges to boost economy, livelihoods

In a comprehensive policy address delivered on September 17, 2025, Hong Kong Chief Executive John Lee outlined a series of measures aimed at revitalizing the city’s economy, enhancing public welfare, and reinforcing its status as a global hub. Speaking at the Legislative Council, Lee emphasized the government’s commitment to accelerating the development of the Northern Metropolis, a strategic area adjacent to Shenzhen, which is poised to become a new business and residential district accommodating approximately 2.5 million people. This initiative aligns with the broader Greater Bay Area project, which seeks to integrate Hong Kong, Macau, and nine Guangdong cities into a cohesive economic powerhouse. Lee also highlighted plans to establish an international gold trading market, expand the fintech sector, and promote green and sustainable finance. Additionally, the government aims to bolster the aviation industry by developing a sustainable fuel supply chain and attracting pharmaceutical companies to conduct clinical trials and advanced medical treatments in Hong Kong. On the social front, Lee pledged to improve housing conditions, increase worker incomes, enhance elderly care, and provide greater opportunities for young people. He also introduced measures to support pet-friendly businesses and incentivize childbirth through tax allowances. Despite the challenges posed by China’s economic slowdown and ongoing trade tensions with the U.S., Lee reaffirmed Hong Kong’s economic growth forecast of 2% to 3% for 2025, underscoring the city’s resilience and potential as a gateway for mainland enterprises seeking global expansion.

-

Nissan seeks to learn from Chinese supplier strategies as part of cost-cutting drive

Nissan Motor Co Ltd is intensifying its efforts to enhance cost efficiency by studying the practices of Chinese suppliers and integrating their methods into its global operations. The Japanese automaker aims to reduce variable costs by 250 billion yen ($1.71 billion) as part of a broader efficiency initiative, according to Tatsuzo Tomita, Nissan’s chief of total delivered cost transformation. Tomita highlighted the effectiveness of Chinese suppliers in utilizing standardized parts and fostering close collaboration with designers, practices that Nissan is now exploring for its current and future vehicle parts. This strategic move is part of Nissan’s ongoing turnaround plan, which includes cutting approximately 20,000 jobs and consolidating seven plants. The company has set an ambitious target of achieving 500 billion yen in cost reductions by March 2027, with half expected to come from fixed costs and the remainder from variable costs. The initiative aims to secure operating profit and positive free cash flow in Nissan’s automotive business by the same deadline. Following the announcement, Nissan’s shares rose by 1.6%, reaching their highest level since late May. Tomita emphasized that the company is not reducing its supplier base but rather strengthening collaboration. He noted that Chinese suppliers are expanding globally, with operations in Hungary, Morocco, and Turkey, and are being considered as potential partners in Nissan’s international strategy. While acknowledging the significant challenge of the 250 billion yen variable cost reduction target, Tomita expressed confidence in achieving it by maintaining the current momentum and sourcing innovative ideas from employees. The impact of these cost-saving measures is expected to become more apparent by the end of this year or next year, varying across different vehicle models.

-

Taiwan shows off first missile to be jointly manufactured with US arms maker

Taiwan has taken a significant step in strengthening its defense capabilities by unveiling its first missile jointly developed with a U.S. company. The Barracuda-500, an autonomous, low-cost cruise missile designed by U.S. defense technology startup Anduril Industries, was showcased at the Taipei Aerospace and Defence Technology Exhibition. This marks a pivotal moment in the growing defense collaboration between Taiwan and the United States, aimed at countering China’s escalating military threats. Taiwan, which China claims as its own territory, has been under increasing pressure from Beijing, including frequent military drills and incursions into its airspace and waters. President Lai Ching-te emphasized the importance of deepening security ties with the U.S., Taiwan’s primary international supporter and arms supplier. The National Chung-Shan Institute of Science and Technology (NCSIST), which displayed the missile, plans to mass-produce it locally through technology transfer. The missile is designed for group attacks on warships, akin to exploding drones. NCSIST President Li Shih-chiang highlighted the goal of building a self-reliant defense system, with production costs kept below T$6.5 million per missile. Li also stressed Taiwan’s unique vulnerability, noting that unlike Ukraine, Taiwan cannot rely on neighboring countries for reinforcements in case of conflict. During the three-day trade show, NCSIST will sign two contracts and six Memorandums of Understanding with U.S. and Canadian companies. Taiwan aims to increase its defense spending to 5% of GDP by 2030, up from 3.3% next year, and seeks broader international support beyond the United States.

-

Unification Church leader questioned in ex-South Korea first lady investigation

Han Hak-ja, the leader of the Unification Church, appeared before South Korean prosecutors on September 17, 2025, to face questioning over allegations of orchestrating bribery schemes involving the wife of ousted President Yoon Suk Yeol and a close political ally. The allegations, which Han has vehemently denied, claim she instructed the church to provide bribes to former First Lady Kim Keon Hee and lawmaker Kweon Seong-dong. Han arrived at the special prosecutor’s office in Seoul, where she underwent more than nine hours of interrogation before leaving in a wheelchair, surrounded by media. She firmly responded “No!” when asked if she had ordered the bribes. The Unification Church has also denied any involvement, calling the accusations “false information” and urging its members to pray for Han rather than hold public rallies. The case is part of a broader investigation into corruption during Yoon’s presidency, which has already led to the indictment of Kim Keon Hee and the detention of Kweon Seong-dong, who is accused of attempting to destroy evidence. Prosecutors have not yet considered issuing an arrest warrant for Han, citing her cooperation during questioning. The scandal has drawn significant attention, given the Unification Church’s controversial history and its global influence.

-

Japan’s Kansai Electric to resume surveys for nuclear reactor replacement at Mihama halted by Fukushima disaster

Kansai Electric Power Co Inc (9503.T) is set to resume feasibility surveys at its Mihama nuclear power station in western Japan this November, marking Japan’s first significant move towards constructing a new reactor since the Fukushima disaster. The surveys, initially announced in July, will assess the viability of building a successor unit at the Mihama site, which was previously halted following the 2011 catastrophe. The comprehensive studies, expected to continue until around 2030, will include geological investigations both inside and outside the plant premises to identify suitable locations, followed by detailed assessments of topography and ground conditions. Kansai Electric emphasized that the findings will be evaluated alongside advancements in light-water reactor technology, regulatory policies, and the overall business environment before making a final decision on the new unit. The initial surveys for a replacement reactor at Mihama began in late 2010 but were suspended after the Fukushima incident. The renewed efforts will adhere to stricter safety regulations implemented post-disaster. Currently, only the No. 3 unit at Mihama remains operational, as the No. 1 and No. 2 units are being decommissioned. Since 2022, Kansai Electric has been collaborating with Mitsubishi Heavy Industries (7011.T) and other utilities, including Kyushu Electric Power (9508.T), Shikoku Electric Power (9507.T), and Hokkaido Electric Power (9509.T), to develop a next-generation 1.2-gigawatt advanced light-water reactor, known as ‘SRZ-1200.’ This consortium aims to enhance nuclear technology while ensuring compliance with modern safety standards.

-

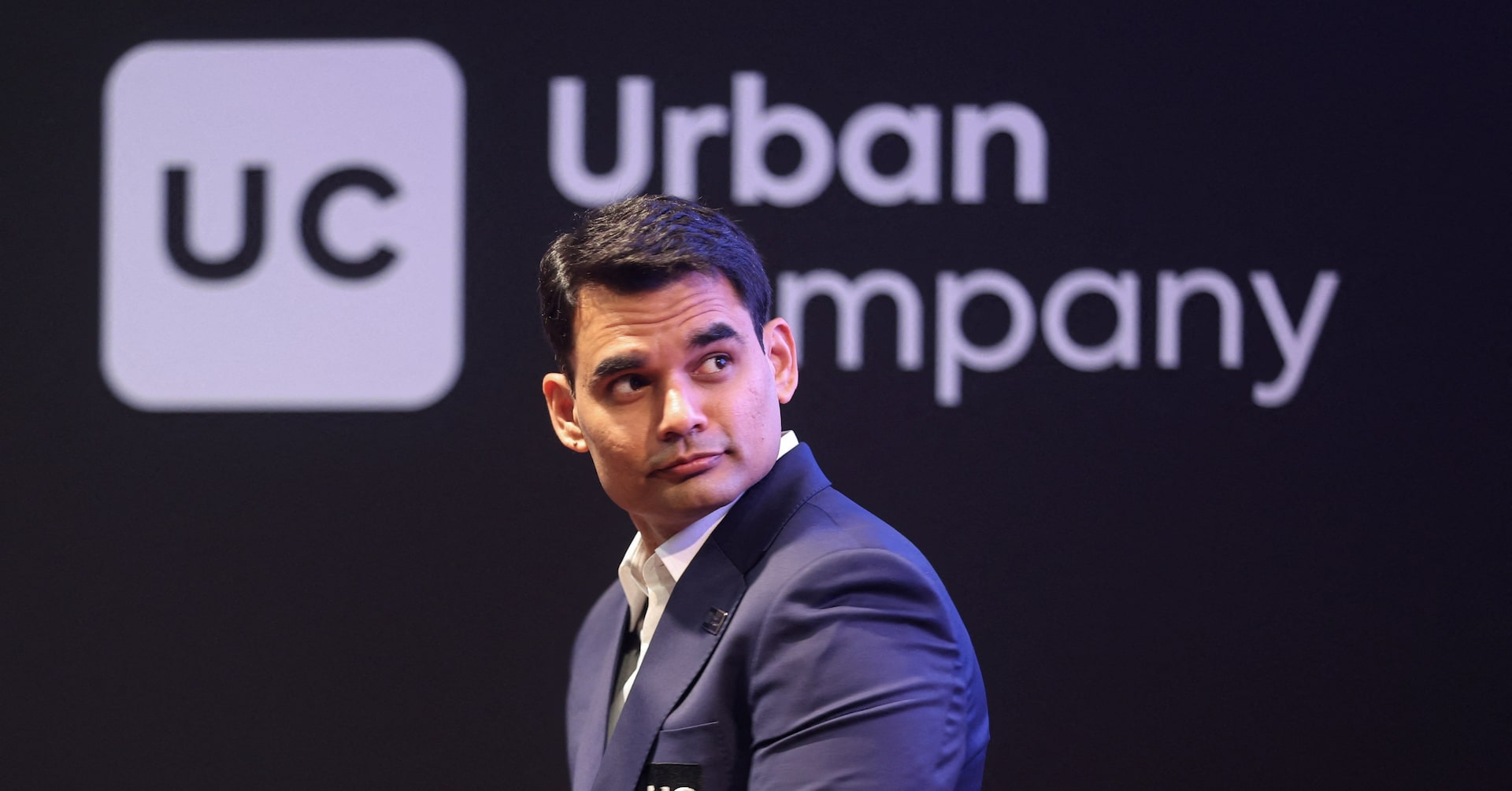

India’s Urban Company soars 74% in trading debut, hits about $3 billion valuation

Urban Company Limited, a leading player in India’s home-services sector, made a spectacular debut on the National Stock Exchange (NSE) on September 17, 2025. The company’s shares surged by 74%, catapulting its valuation to nearly $3 billion. This marked one of the most successful initial public offerings (IPOs) of 2025, with the issue being oversubscribed by a staggering 103.65 times, attracting bids worth approximately $13 billion. Urban Company’s stock opened at a 57.5% premium to its issue price, far exceeding analysts’ predictions of a 40%-51% upside. The shares hit a high of 179 rupees during the trading session and closed at 166.8 rupees, up 62% from the issue price. The IPO’s success underscores investor confidence in Urban Company’s dominance of India’s largely unorganized home-services market, which is projected to grow at a compound annual growth rate of 22.4% from 2023 to 2030, according to Grand View Research. Aishvarya Dadheech, founder of Fident Asset Management, noted that the enthusiasm reflects Urban Company’s position as a long-term play on digital adoption and rising demand for home services. The listing also coincided with a broader uptick in Indian equities, buoyed by optimism surrounding U.S.-India trade talks. The blue-chip Nifty 50 index has risen 7% in 2025 but remains 4% below its record levels from a year ago. Urban Company’s debut is a testament to the resilience and growth potential of India’s IPO market, which has rebounded after a slow start to the year and is on track to set new fundraising records.

-

Exclusive: Japan’s JERA in advanced talks to buy $1.7 billion of US shale gas assets, sources say

Japan’s leading power generator, JERA Co., Inc., is in advanced negotiations to acquire natural gas production assets in the United States for approximately $1.7 billion, according to sources familiar with the matter. This move underscores Japan’s strategic efforts to secure energy resources amid global market volatility and rising demand. The assets in question are owned by GEP Haynesville II, a joint venture between Blackstone-backed GeoSouthern Energy and pipeline operator Williams Companies. JERA has emerged as the top bidder, outpacing several U.S.-based energy firms, though the deal remains subject to finalization. This acquisition would mark JERA’s first venture into shale gas production, granting the world’s largest liquefied natural gas (LNG) buyer greater control over its supply chain. The deal aligns with Japan’s broader strategy to diversify energy sources, particularly in light of Russia’s invasion of Ukraine, which disrupted global energy markets. Additionally, the U.S.-Japan trade agreement, finalized earlier this month, commits Japan to $7 billion in annual energy purchases from the U.S., further bolstering bilateral energy ties. GEP Haynesville II, a major producer in the Haynesville shale basin spanning Texas and Louisiana, is expected to nearly double its output by 2028, according to Rystad Energy. The Haynesville basin’s proximity to LNG export facilities on the U.S. Gulf Coast has made it a highly sought-after asset. While JERA declined to comment, the potential acquisition highlights Japan’s growing reliance on U.S. energy resources to meet its domestic needs and support its technological advancements, including the AI-driven surge in data center power demand.