In a shocking development, Spanish National Police have apprehended 19 individuals linked to a harrowing migrant boat incident that resulted in multiple deaths and acts of torture. The vessel, which departed from Senegal en route to the Canary Islands, was carrying over 300 passengers, including individuals from Senegal, Guinea, Mali, Gambia, Sierra Leone, and Guinea-Bissau. However, only 248 survivors were rescued on August 24, with dozens reported missing. Authorities suspect that some victims were accused of witchcraft following a series of misfortunes during the journey, such as engine failure, severe weather, and food shortages. Survivors recounted horrific tales of fellow passengers attacking and abusing others, with some being thrown overboard alive. One male passenger succumbed to severe illness after being hospitalized. The suspects, now in pretrial detention, face charges including homicide, assault, torture, and facilitating irregular immigration. This incident underscores the perilous nature of irregular migration routes into Europe, with Spain being a primary entry point. While nearly 47,000 migrants reached the Canary Islands in 2024, marking a record high, this year has seen a significant decline in numbers, according to the Spanish Interior Ministry.

博客

-

Japan’s Kansai Electric to resume surveys for nuclear reactor replacement at Mihama halted by Fukushima disaster

Kansai Electric Power Co Inc (9503.T) is set to resume feasibility surveys at its Mihama nuclear power station in western Japan this November, marking Japan’s first significant move towards constructing a new reactor since the Fukushima disaster. The surveys, initially announced in July, will assess the viability of building a successor unit at the Mihama site, which was previously halted following the 2011 catastrophe. The comprehensive studies, expected to continue until around 2030, will include geological investigations both inside and outside the plant premises to identify suitable locations, followed by detailed assessments of topography and ground conditions. Kansai Electric emphasized that the findings will be evaluated alongside advancements in light-water reactor technology, regulatory policies, and the overall business environment before making a final decision on the new unit. The initial surveys for a replacement reactor at Mihama began in late 2010 but were suspended after the Fukushima incident. The renewed efforts will adhere to stricter safety regulations implemented post-disaster. Currently, only the No. 3 unit at Mihama remains operational, as the No. 1 and No. 2 units are being decommissioned. Since 2022, Kansai Electric has been collaborating with Mitsubishi Heavy Industries (7011.T) and other utilities, including Kyushu Electric Power (9508.T), Shikoku Electric Power (9507.T), and Hokkaido Electric Power (9509.T), to develop a next-generation 1.2-gigawatt advanced light-water reactor, known as ‘SRZ-1200.’ This consortium aims to enhance nuclear technology while ensuring compliance with modern safety standards.

-

African manufacturers in last-ditch bid to extend US trade programme

African manufacturers are intensifying efforts to secure a temporary extension of the African Growth and Opportunity Act (AGOA), a pivotal trade initiative set to expire at the end of September. Pankaj Bedi, chairman of United Aryan, a Kenyan apparel company supplying major U.S. retailers like Target and Walmart, revealed that delegations from Kenya and four other AGOA beneficiary nations recently visited Washington to lobby for a one- to two-year extension. The program, established in 2000 under President Bill Clinton, grants duty-free access to the U.S. market for thousands of African products, fostering economic development and job creation across sectors such as textiles, automotive, and mining. However, the aggressive tariff policies of former President Donald Trump have cast uncertainty over its renewal. Despite bipartisan support, last year’s attempt to extend AGOA for 16 years failed to reach a Congressional vote. Bedi emphasized that without an extension, manufacturers face steep tariff hikes, potentially leading to mass layoffs and a shift in U.S. reliance back to Asian manufacturers, particularly China. The White House has yet to publicly endorse an extension, leaving the future of AGOA in limbo.

-

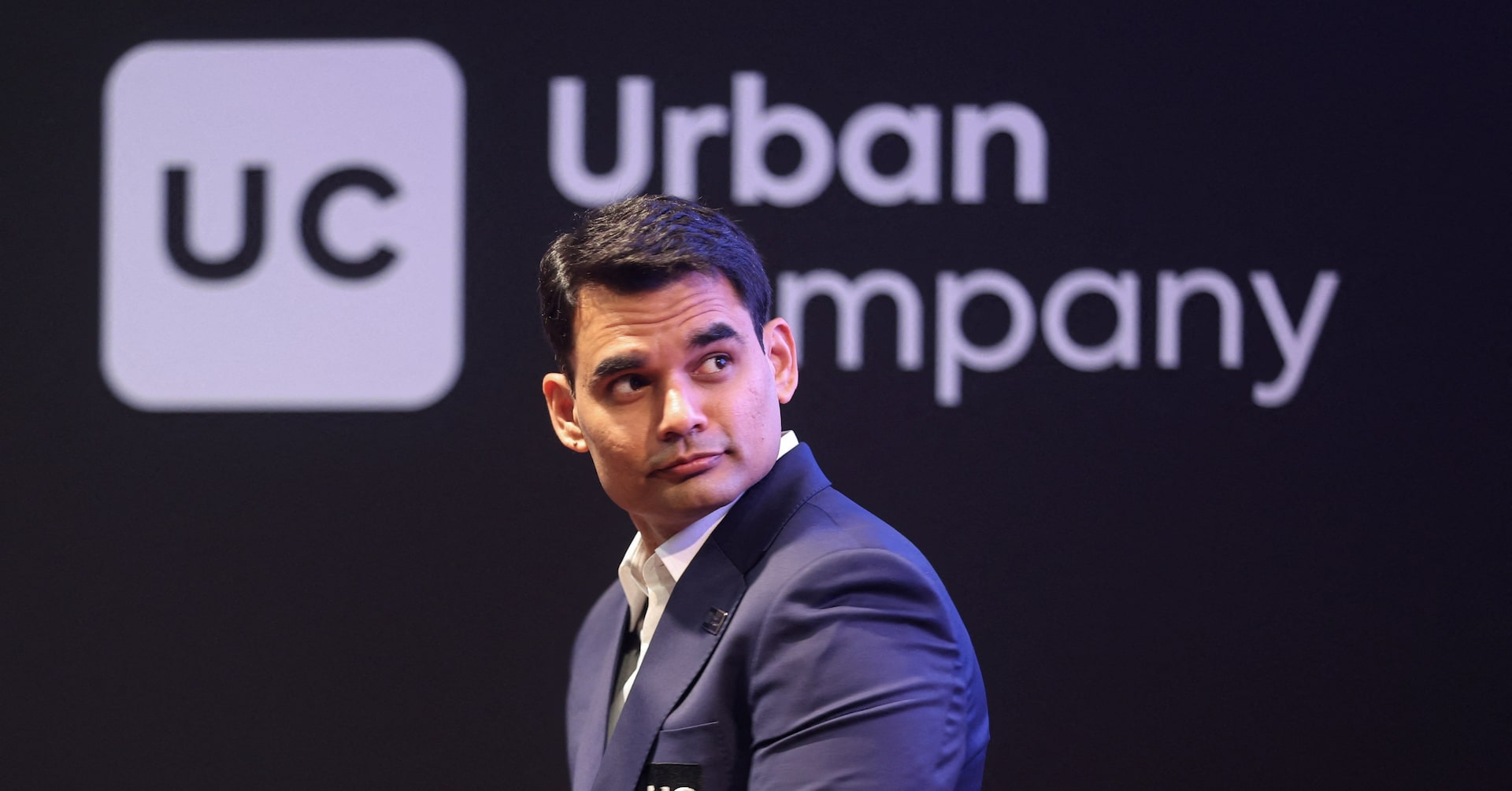

India’s Urban Company soars 74% in trading debut, hits about $3 billion valuation

Urban Company Limited, a leading player in India’s home-services sector, made a spectacular debut on the National Stock Exchange (NSE) on September 17, 2025. The company’s shares surged by 74%, catapulting its valuation to nearly $3 billion. This marked one of the most successful initial public offerings (IPOs) of 2025, with the issue being oversubscribed by a staggering 103.65 times, attracting bids worth approximately $13 billion. Urban Company’s stock opened at a 57.5% premium to its issue price, far exceeding analysts’ predictions of a 40%-51% upside. The shares hit a high of 179 rupees during the trading session and closed at 166.8 rupees, up 62% from the issue price. The IPO’s success underscores investor confidence in Urban Company’s dominance of India’s largely unorganized home-services market, which is projected to grow at a compound annual growth rate of 22.4% from 2023 to 2030, according to Grand View Research. Aishvarya Dadheech, founder of Fident Asset Management, noted that the enthusiasm reflects Urban Company’s position as a long-term play on digital adoption and rising demand for home services. The listing also coincided with a broader uptick in Indian equities, buoyed by optimism surrounding U.S.-India trade talks. The blue-chip Nifty 50 index has risen 7% in 2025 but remains 4% below its record levels from a year ago. Urban Company’s debut is a testament to the resilience and growth potential of India’s IPO market, which has rebounded after a slow start to the year and is on track to set new fundraising records.

-

Exclusive: Japan’s JERA in advanced talks to buy $1.7 billion of US shale gas assets, sources say

Japan’s leading power generator, JERA Co., Inc., is in advanced negotiations to acquire natural gas production assets in the United States for approximately $1.7 billion, according to sources familiar with the matter. This move underscores Japan’s strategic efforts to secure energy resources amid global market volatility and rising demand. The assets in question are owned by GEP Haynesville II, a joint venture between Blackstone-backed GeoSouthern Energy and pipeline operator Williams Companies. JERA has emerged as the top bidder, outpacing several U.S.-based energy firms, though the deal remains subject to finalization. This acquisition would mark JERA’s first venture into shale gas production, granting the world’s largest liquefied natural gas (LNG) buyer greater control over its supply chain. The deal aligns with Japan’s broader strategy to diversify energy sources, particularly in light of Russia’s invasion of Ukraine, which disrupted global energy markets. Additionally, the U.S.-Japan trade agreement, finalized earlier this month, commits Japan to $7 billion in annual energy purchases from the U.S., further bolstering bilateral energy ties. GEP Haynesville II, a major producer in the Haynesville shale basin spanning Texas and Louisiana, is expected to nearly double its output by 2028, according to Rystad Energy. The Haynesville basin’s proximity to LNG export facilities on the U.S. Gulf Coast has made it a highly sought-after asset. While JERA declined to comment, the potential acquisition highlights Japan’s growing reliance on U.S. energy resources to meet its domestic needs and support its technological advancements, including the AI-driven surge in data center power demand.

-

Uganda to cut public spending, domestic borrowing in 2026/27 FY

Uganda has unveiled plans to reduce its overall spending by 4.1% in the 2026/27 financial year, according to a Ministry of Finance document released on Wednesday. The East African nation projects its public expenditure for the 12 months starting July 2026 at 69.4 trillion Ugandan shillings ($19.9 billion), a decrease from 72.4 trillion shillings in the previous fiscal year. The government also aims to cut domestic debt issuance by 21.1%, lowering it to 9 trillion shillings, to manage interest payments and maintain sustainable debt levels. Key priorities for the upcoming fiscal year include completing the East African Crude Oil Pipeline (EACOP) to initiate crude oil production, advancing mineral quantification for iron ore, gold, and copper deposits, and continuing the development of a refinery and the standard gauge railway project. These measures reflect Uganda’s strategic focus on infrastructure development while ensuring fiscal discipline.

-

South African inflation surprise makes Thursday’s rate decision a close call

In a surprising turn of events, South Africa’s inflation rate for August 2024 fell to 3.3%, undershooting the 3.6% forecast by economists. This decline, attributed to softer fuel and food prices, has sparked speculation that the South African Reserve Bank (SARB) might implement another interest rate cut during its upcoming policy meeting on Thursday. The SARB has already reduced rates three times this year, with the latest cut in July, when it set a new inflation target of 3%. Prior to the release of the inflation data, the consensus was that the central bank would maintain the repo rate at 7%. However, the unexpected drop in inflation, coupled with falling bond yields and a stronger rand, has led some analysts to predict a 25 basis point cut. Razia Khan, chief economist for Africa and the Middle East at Standard Chartered, described the inflation release as a ‘game changer,’ suggesting that the September meeting could be pivotal. While some analysts remain cautious, citing potential price shocks from recent tariffs imposed by the U.S. on South African exports, others argue that a flagging economy provides additional justification for easing monetary policy. The SARB has acknowledged that the impact of these tariffs on growth and inflation could be modest, but this has yet to be reflected in official data. The central bank’s decision will be closely watched as it seeks to balance inflation control with economic stimulation.

-

Former CDC head says she was fired for refusing Kennedy’s vaccine changes

Dr. Susan Monarez, the recently ousted head of the US Centers for Disease Control and Prevention (CDC), has revealed that her dismissal stemmed from her refusal to endorse vaccine policy changes unsupported by scientific evidence. In a Senate committee hearing on Wednesday, Monarez disclosed that Health Secretary Robert F. Kennedy Jr. demanded she approve all recommendations from the Advisory Committee on Immunization Practices (ACIP) and terminate key vaccine policy officials without cause. When she declined, Kennedy allegedly threatened her removal, citing frequent communication with President Donald Trump on vaccine policy revisions. Monarez, who served less than a month as CDC director, also accused Kennedy of disparaging CDC staff as ‘horrible people’ and labeling the agency as ‘corrupt.’ Her firing followed a high-profile incident where a man shot 180 rounds at CDC headquarters, killing a police officer in protest of COVID-19 vaccines. Monarez’s departure triggered a wave of resignations, including that of Chief Medical Officer Dr. Debra Houry, who testified that CDC leaders were reduced to ‘rubber stamps’ under Kennedy’s leadership. Kennedy, a prominent vaccine skeptic, defended his actions, claiming Monarez was untrustworthy. The controversy has intensified the national debate over vaccine policies, with several states adopting independent immunization standards and Florida moving to eliminate vaccine mandates. Republicans on the committee largely supported Kennedy’s decision, accusing Monarez and Houry of resisting changes and obstructing the Trump administration’s agenda. Both former officials denied these allegations, portraying Kennedy as prioritizing politics over science.

-

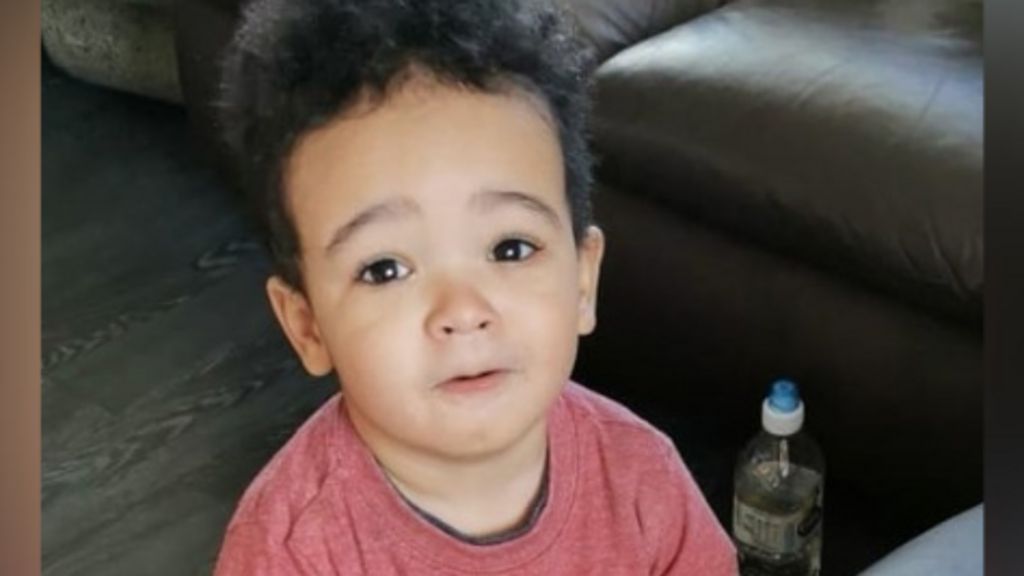

Irish police find skeletal remains in search for missing boy

Skeletal remains discovered during a police search in Donabate, County Dublin, are believed to belong to Daniel Aruebose, a young boy who has been missing for several years. Gardaí (Irish police) confirmed that the remains, found in an open area in the village north of Dublin, are likely those of the seven-year-old boy. Concerns about Daniel’s whereabouts were raised last month by Tusla, Ireland’s child welfare agency, prompting a weeks-long search. A ‘careful and sensitive exhumation’ will now take place, followed by DNA analysis to formally identify the remains. Daniel lived in The Gallery Apartments in Donabate, where an initial examination was conducted on August 31. Door-to-door inquiries at the complex are ongoing, but no arrests have been made. Ireland’s Minister for Children, Norma Foley, expressed deep sadness over the discovery, emphasizing the heartbreak of losing a child and extending her sympathy to those affected. She praised the diligent efforts of gardaí and other agencies involved in the search. Daniel’s disappearance is the second recent case in Ireland where a child went missing without triggering an immediate investigation. Kyran Durnin, reported missing in August 2024, is believed to have been killed over two years prior. These incidents have sparked public concern over child protection services. Foley acknowledged the shocking lack of intervention in Daniel’s case and pledged a rapid review by Tusla and the National Review Panel. Tusla last had contact with Daniel’s family five years ago, but no further checks were made after he turned two. The agency confirmed no new concerns were raised until August 29, 2025, when the matter was referred to gardaí. Tusla defended the closure of the case as ‘appropriate’ but announced plans to conduct wellbeing checks on 42,000 cases closed during the COVID-19 pandemic.

-

Sudanese network of volunteer aid groups wins Norwegian human rights award

In the midst of Sudan’s escalating humanitarian crisis, a network of community-driven initiatives known as the Emergency Response Rooms has been recognized for its extraordinary efforts to alleviate suffering. On September 17, 2024, the Norwegian Rafto Foundation awarded its annual prize to this grassroots organization, praising its commitment to preserving the fundamental right to life. The Emergency Response Rooms, which emerged during the civil war that erupted in 2023, have been instrumental in providing essential services such as food, water, and medical supplies to those displaced by the conflict. Comprising thousands of volunteers, the network operates in areas beyond the reach of international aid, often at great personal risk. The Rafto Foundation highlighted their innovative, community-driven approach as a beacon of hope in a country grappling with widespread famine and displacement. The Sudanese army’s ongoing conflict with the paramilitary Rapid Support Forces has exacerbated the crisis, leading the United Nations to label it the world’s worst humanitarian disaster. Despite these challenges, the Emergency Response Rooms continue to sustain basic services and uphold human dignity, offering a glimmer of hope for Sudan’s future. The Rafto Prize, which includes a diploma and $20,000 in prize money, has previously been awarded to notable figures who later received the Nobel Peace Prize, raising speculation about the network’s potential for further recognition.