Global currency markets experienced significant volatility on Thursday as traders digested key policy decisions from major central banks. The U.S. dollar initially plummeted following the Federal Reserve’s cautious stance on future interest rate cuts but later rebounded, reflecting mixed signals from policymakers. Meanwhile, the British pound remained steady after the Bank of England (BoE) opted to maintain interest rates and slow the pace of its quantitative tightening (QT) program. The BoE reduced its annual gilt sales from £100 billion to £70 billion, aligning closely with market expectations. Marion Amiot, chief UK economist at S&P Global Ratings, noted that the BoE is unlikely to ease monetary policy further this year. The euro saw modest gains, rising 0.1% against the pound, while gilt yields dipped slightly. In Norway, the Norges Bank cut interest rates by 25 basis points, as anticipated, signaling potential further reductions. The Norwegian crown remained stable despite the rate cut. In Japan, the yen weakened ahead of the Bank of Japan’s (BOJ) policy decision on Friday, with markets expecting no immediate rate hikes but pricing in a possible increase by March 2024. Elsewhere, the New Zealand dollar fell to its lowest level since September 8 after data revealed a 0.9% contraction in GDP for the second quarter, fueling speculation of policy easing by the Reserve Bank of New Zealand. Analysts remain divided on the implications of the Fed’s actions, with some viewing the rate cut as the first in a series, while others interpret Chair Jerome Powell’s comments as less dovish. The dollar index, which measures the greenback against a basket of major currencies, initially dropped to its lowest since February 2022 but later recovered, ending the day steady at 96.96. The currency markets’ turbulence underscores the ongoing uncertainty surrounding global economic conditions and central bank policies.

博客

-

Nestle’s new chairman Isla brings Zara magic to Nescafe maker’s turnaround

Nestle, the Swiss multinational food and beverage giant, has appointed Pablo Isla as its new chairman, effective October 1, 2023. Isla, renowned for his transformative leadership at Inditex, the parent company of Zara, brings a wealth of expertise in logistics, e-commerce, and consumer trends to Nestle. His appointment comes at a critical juncture for the company, which has seen its shares underperform, losing 33% of their value over the past three years, while competitors like Unilever and Danone have thrived. Isla’s track record of driving rapid global expansion and integrating digital and physical retail channels at Inditex positions him as a catalyst for Nestle’s much-needed revitalization. Nestle’s recent struggles include declining sales and profits, compounded by the abrupt dismissal of former CEO Laurent Freixe. Investors are optimistic that Isla, alongside newly appointed CEO Philipp Navratil, will spearhead a digital transformation, leveraging artificial intelligence to optimize supply chains and enhance sales. Isla’s leadership style, described as hands-on and collaborative, is expected to foster innovation and rapid change within the company. His experience in mentoring and guiding executives will also be invaluable in supporting Navratil’s transition into the CEO role. With Nestle’s e-commerce sales already accounting for 20.2% of total revenue, Isla’s appointment signals a renewed focus on digital growth and operational efficiency, aiming to reclaim the company’s competitive edge in the global market.

-

US embassy in India says it revoked, denied visas over fentanyl links

The U.S. Embassy in New Delhi has taken decisive action against certain Indian business executives and corporate leaders by revoking or denying their visas. This move comes in response to their alleged involvement in trafficking fentanyl precursors, as confirmed by the embassy in an official statement released on Thursday. Fentanyl precursors are the essential chemicals used in the production of fentanyl, a potent synthetic opioid responsible for a significant public health crisis in the United States. The embassy did not disclose the identities of the individuals affected by this visa action, maintaining confidentiality in line with its protocols. This development underscores the U.S. government’s intensified efforts to combat the global fentanyl trade and its supply chain. The decision also highlights the growing scrutiny of international business leaders linked to activities that contribute to the opioid epidemic. The embassy’s statement serves as a stern reminder of the legal and diplomatic consequences for those involved in such illicit activities.

-

Trump trade war fallout hits Argentine soy crushers despite export boom

The U.S.-China trade war has had unexpected repercussions in Argentina, where the country’s soy crushing industry is facing significant challenges despite record-high soybean exports. According to recent reports, Argentina’s soybean sales to China have surged to a six-year high, driven by Beijing’s search for alternatives to U.S. soybeans. However, this export boom has led to a shortage of raw beans for local processors, causing idle capacity in crushing facilities to rise to 31% in July, with further increases since then. Gustavo Idigoras, president of the CIARA-CEC grain exporters and processors chamber, expressed concern over the situation, stating that the trade war has harmed Argentina by reducing jobs and export value. He also noted that the surplus of soybeans in the U.S. has intensified competition for Argentine soymeal in Southeast Asia. While exports of unprocessed soybeans from the 2024/25 harvest have reached 8.81 million metric tons, nearly double the previous season, the future of Argentina’s soybean exports remains uncertain, hinging on the outcome of U.S.-China trade negotiations. All eyes are on November, when the current trade waiver between the two nations expires.

-

Starmer, Trump to discuss foreign affairs, investment after pomp-filled royal welcome

U.S. President Donald Trump and British Prime Minister Keir Starmer convened at Chequers, the Prime Minister’s country residence, on September 18, 2025, to solidify a landmark £150 billion ($205 billion) U.S. investment package in the UK. The deal, spanning technology, energy, and life sciences, aims to rejuvenate the historic ‘special relationship’ between the two nations. This meeting, part of Trump’s second state visit to the UK, shifted focus from domestic political challenges to global affairs, following a day of ceremonial events with King Charles III. Despite the celebratory tone, underlying tensions over Ukraine, Israel, and sensitive domestic issues loomed. Starmer, facing domestic pressures, sought to leverage the visit to bolster his international standing. Trump, meanwhile, emphasized the value of U.S.-UK ties, praising Britain’s historical contributions to global values. The leaders also addressed contentious topics, including Russia’s invasion of Ukraine and Israel’s actions in Gaza, which could strain discussions. While Starmer secured significant U.S. investments, hopes for reduced steel and aluminium tariffs were dashed. The visit underscored both cooperation and friction in the U.S.-UK alliance.

-

U.S. may ease India tariffs, India’s chief economic adviser says

In a significant development for U.S.-India trade relations, India’s Chief Economic Adviser V. Anantha Nageswaran has expressed optimism that the U.S. may soon eliminate the punitive 25% import tariff on Indian goods and reduce reciprocal tariffs to 10-15%. Speaking at an event in Kolkata on Thursday, Nageswaran stated, ‘My personal confidence is that in the next couple of months, if not earlier, we will see a resolution to at least the extra penal tariff of 25%.’ He further suggested that the reciprocal tariff of 25% could also be lowered to levels previously anticipated between 10% and 15%. This announcement follows ‘positive’ and ‘forward-looking’ trade discussions between the two nations earlier this week. The talks aimed to address tensions that escalated after former U.S. President Donald Trump imposed punitive tariffs on India for purchasing Russian oil, doubling overall tariffs to 50% in August. Trump and Indian Prime Minister Narendra Modi recently held a phone conversation, during which Trump thanked Modi for his efforts in resolving the Russia-Ukraine conflict. While no specific agreements were disclosed, the call signaled a potential thaw in bilateral relations, which had been strained in recent months. Indian stock markets responded positively to Nageswaran’s comments, with the benchmark Nifty 50 index reaching one-week highs and its highest close since July 9.

-

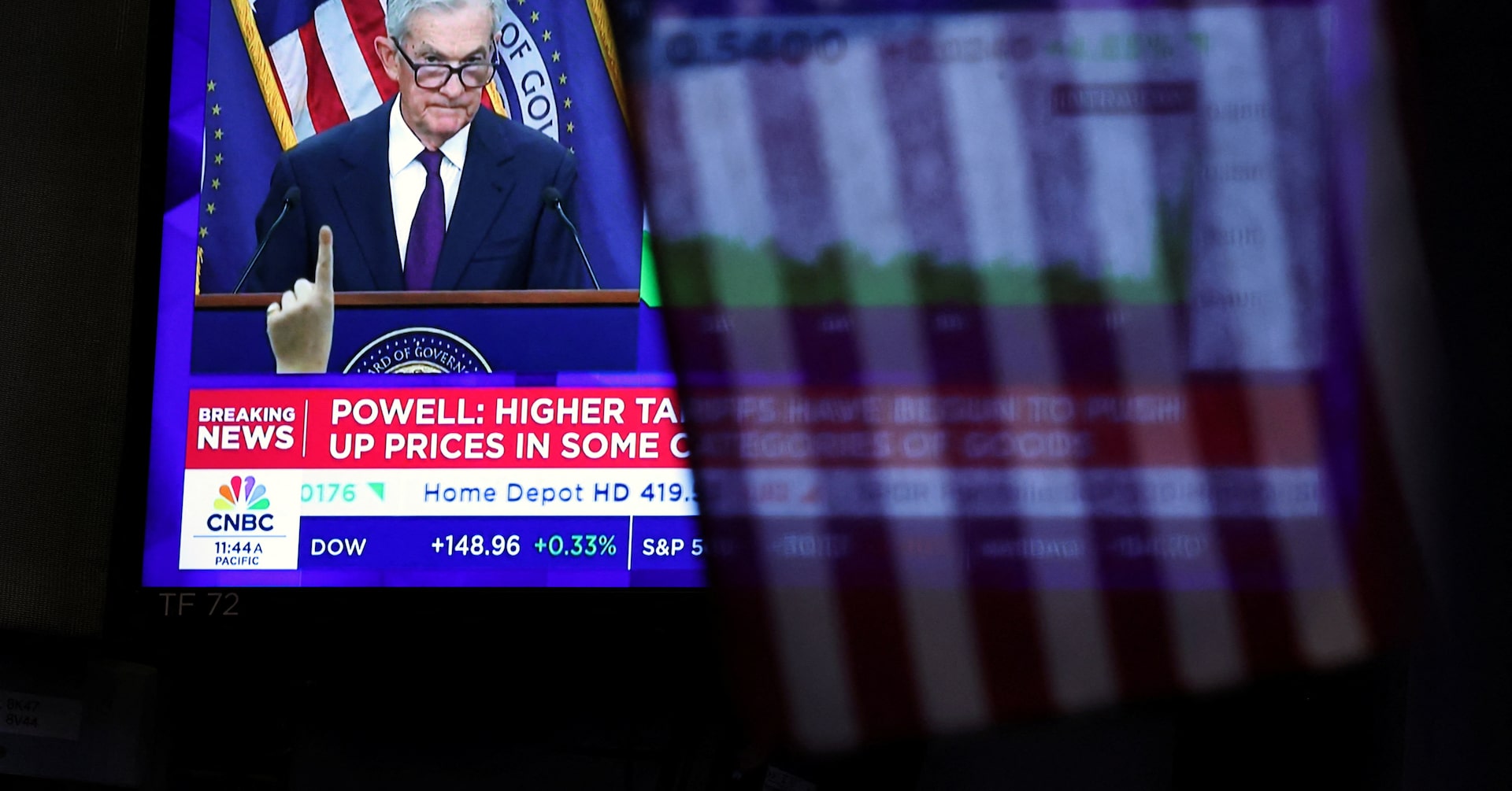

Morning Bid: Wall St rallies after post-Fed hesitation

The U.S. Federal Reserve’s decision to implement its first interest rate cut of 2025 sent ripples through global markets, sparking a mix of reactions across financial sectors. While the initial announcement led to a stumble in U.S. markets, stock futures rebounded sharply ahead of Thursday’s trading session as Fed Chair Jerome Powell signaled a cautious approach to further easing. The dollar and Treasury yields experienced significant fluctuations, with the greenback hitting a multi-year low before recovering. Powell emphasized a risk-management strategy, noting that while the median projection among Fed policymakers suggests two additional cuts this year and one in 2026, a third of officials oppose further easing in 2025, and nearly half anticipate only one more cut or none at all. This divergence has left markets uncertain, with Fed futures pricing in an 85% chance of a 25-basis-point cut in October and only 44 basis points of easing for the remainder of the year. The Nasdaq and S&P 500 both dipped on Wednesday, partly due to Nvidia’s 3% decline following reports of Chinese regulators urging domestic tech firms to halt purchases of Nvidia’s AI chips. However, optimism returned as Chinese officials expressed willingness to engage in dialogue, and tech stocks like Oracle and Lyft surged on positive news. Meanwhile, global central banks are also in focus, with the Bank of Canada cutting rates as expected and the Bank of England’s decision on quantitative tightening drawing attention. The Bank of Japan is expected to hold rates but hint at future hikes, adding to the complexity of global monetary policy. As markets brace for further volatility, the Fed’s rate-cutting cycle stands in contrast to other central banks winding down their easing measures, signaling potential turbulence ahead.

-

Kennedy’s hand-picked CDC committee to vote on hepatitis B and COVID shots

In a pivotal moment for U.S. public health policy, the Centers for Disease Control and Prevention (CDC) is poised to redefine its vaccination guidelines under the leadership of Health Secretary Robert F. Kennedy Jr. A newly appointed advisory committee, handpicked by Kennedy, is set to convene on September 18 and 19, 2025, to deliberate on critical vaccine recommendations, including those for hepatitis B, measles-mumps-rubella-varicella (MMRV), and COVID-19. This meeting follows Kennedy’s controversial decision earlier this year to dismiss all 17 members of the CDC’s Advisory Committee on Immunization Practices (ACIP) and replace them with a smaller, 12-member panel. The new committee, chaired by Martin Kulldorff, a biostatistician and epidemiologist known for his opposition to COVID-19 lockdowns, has already stirred debate. Among the key issues on the agenda is the potential delay of the hepatitis B vaccine for newborns, a move that has drawn criticism from medical experts who argue that the birth dose has been instrumental in reducing hepatitis B infections. The committee will also review the use of a combined MMRV vaccine, which has been linked to a higher risk of seizures in young children compared to separate MMR and varicella vaccines. The reshuffling of the CDC’s leadership and advisory panels has raised concerns among public health officials, with some accusing Kennedy of prioritizing ideology over science. The meeting comes amid broader turmoil at the CDC, including the resignation of several senior officials who cited fears that policy decisions were being predetermined without adequate scientific review. As the nation watches, the outcome of these deliberations could mark a significant shift in U.S. vaccination policy, with far-reaching implications for public health.

-

Taiwan central bank raises growth forecast, warns of tariff risks

In a significant move, Taiwan’s central bank has decided to maintain its benchmark discount rate at 2% during its quarterly meeting, aligning with market expectations. The decision, made unanimously, reflects the bank’s cautious optimism about the island’s economic trajectory. Governor Yang Chin-long highlighted the unique nature of this year’s economic growth, driven largely by booming exports, particularly in the semiconductor sector, which has been pivotal in powering the global AI boom. Companies like Nvidia have benefited immensely from Taiwan’s advanced chip production, bolstering the local economy. However, Yang expressed concerns over the potential adverse effects of U.S. tariffs, which could necessitate adjustments in monetary policy. The central bank has revised its 2025 economic growth forecast upward to 4.55%, up from 3.05% in June, but anticipates a slowdown to 2.68% in the following year. Additionally, the bank has trimmed its consumer price index forecast for this year to 1.75%, with inflation expected to ease further to 1.66% next year. The bank remains vigilant, closely monitoring developments in U.S. tariffs and geopolitical risks, which could significantly impact Taiwan’s competitive edge. This rate decision follows the U.S. Federal Reserve’s recent rate cut, the first since December, amid concerns over rising unemployment.

-

EU set to miss UN climate deadline amid internal divisions

In a significant development, European Union climate ministers are poised to confirm on Thursday that the bloc will fail to meet a global deadline for setting new emissions reduction targets. This delay stems from internal disagreements among EU governments, casting a shadow over the EU’s leadership in global climate action. The missed deadline could undermine the bloc’s credibility as it prepares to join other major powers at the United Nations General Assembly next week, where updated climate plans are expected to be presented ahead of the COP30 climate talks in November. While major emitters like China are anticipated to meet the deadline, and Australia has already announced its target, the EU’s internal discord highlights the challenges of aligning ambitious climate goals with economic and geopolitical realities. EU Climate Commissioner Wopke Hoekstra defended the bloc’s efforts, stating, “If you zoom out, you can find that we continue to be amongst the absolutely most ambitious on the global stage.” However, the EU’s inability to agree on new targets for 2035 and 2040 has sparked criticism. Germany, France, and Poland have called for further discussions on the 2040 goal at an October summit, delaying progress on both targets. As a temporary measure, EU ministers will attempt to draft a “statement of intent” outlining their climate ambitions. A draft of this statement, previously reported by Reuters, suggests the EU aims to reduce emissions by 66.3% to 72.5% by 2035. Despite the setback, the bloc remains committed to finalizing its 2035 target before COP30. Finnish Climate Minister Sari Multala emphasized, “It is hard for us to require the others, our international partners, to do the same if we don’t deliver ourselves.” The EU’s traditional role as a climate leader is under strain due to rising concerns over the costs of climate measures and competing priorities such as defense and industrial spending. Divisions among member states are further exacerbated by differing views on the European Commission’s proposal to cut net greenhouse gas emissions by 90% by 2040. While countries like Spain and Denmark advocate for stronger climate action, citing extreme weather events and energy security, others like the Czech Republic and Italy oppose the ambitious targets, citing potential harm to industries. This internal conflict underscores the complexities of balancing environmental goals with economic and political pressures in a rapidly changing world.