Anna Daroy, a former director general of the Institute of Directors (IoD), has been disqualified from holding company directorships for 11 years after exploiting the UK government’s Bounce Back Loan Scheme during the COVID-19 pandemic. The 61-year-old, who was once shortlisted for the ‘Businesswoman of the Year’ award, secured two £50,000 loans for her management consultancy, Globepoint Associates Ltd, in 2020, despite the scheme’s rule limiting companies to a single loan. The Insolvency Service, which announced the ban on Thursday, stated that Daroy should have repaid one of the loans, which were obtained from separate banks within five days. Globepoint Associates Ltd went into liquidation in March 2023 with both loans unpaid. Kevin Read, chief investigator at the Insolvency Service, criticized Daroy’s actions, emphasizing that the loans were intended to support struggling businesses, not to be misused. Daroy, who served as interim chief operating officer and interim director general of the IoD from October 2018 to November 2019, has not publicly commented on the matter. The Insolvency Service has disqualified over 2,400 directors for similar abuses of COVID financial support schemes. The IoD reiterated its commitment to high standards of conduct and stated that any member disqualified as a director would have their membership terminated.

博客

-

US holiday shopping growth to cool this year, Mastercard forecasts

The U.S. holiday shopping season is anticipated to experience a moderated growth in sales this year, according to a recent forecast by Mastercard. The Mastercard Economics Institute projects a 3.6% increase in retail sales from November 1 to December 24, a decline from the 4.1% growth recorded during the same period last year. This slowdown is attributed to consumers prioritizing discounts and promotions in response to persistent inflation and broader macroeconomic uncertainties. The report highlights that the Trump administration’s fluctuating trade policies have escalated the costs of goods, further dampening consumer demand. Additionally, the shortened interval between Thanksgiving and Christmas this year, coupled with the early rollout of promotions, is expected to bolster online sales at the onset of December. Michelle Meyer, Chief Economist at Mastercard Economics Institute, emphasized that while the total spending may not differ significantly from last year, the composition of spending will shift, with pricing becoming a more critical factor due to the impact of tariffs. Online sales are forecasted to rise by 7.9%, a slight decrease from the 8.6% growth observed last year, while in-store sales are projected to grow by 2.3%, down from 2.8% in the 2024 holiday season. Mastercard’s forecast, derived from SpendingPulse insights, which track in-store and online retail sales across all payment methods excluding automotive sales, aligns with recent subdued projections from Salesforce and mixed forecasts from major retailers. Target and Best Buy have maintained their annual forecasts, whereas Walmart and Macy’s have raised theirs. Conversely, toymaker Mattel has reduced its forecast. As retailers navigate these challenges, the holiday shopping season remains a pivotal driver of annual sales, albeit under more constrained economic conditions.

-

China’s DeepSeek says its hit AI model cost just $294,000 to train

In a groundbreaking revelation, Chinese AI developer DeepSeek disclosed that it spent a mere $294,000 to train its R1 model, a figure significantly lower than the costs reported by its U.S. counterparts. This disclosure, published in a peer-reviewed article in the journal Nature on September 18, 2025, is poised to reignite discussions about China’s role in the global AI race. The Hangzhou-based company, which has largely remained out of the public eye since its January 2025 announcement of lower-cost AI systems, detailed that the R1 model was trained using 512 Nvidia H800 chips over 80 hours. The article, co-authored by DeepSeek founder Liang Wenfeng, also revealed that the company utilized Nvidia A100 GPUs in the preparatory stages of development, a fact that had not been previously disclosed. This revelation comes amidst ongoing scrutiny from U.S. companies and officials regarding DeepSeek’s access to advanced AI chips, particularly after the U.S. imposed export controls on high-performance chips to China in October 2022. Despite these challenges, DeepSeek has managed to attract top talent in China, partly due to its operation of an A100 supercomputing cluster, a rarity among domestic firms. The company’s cost-effective approach to AI development has already had a significant impact on global markets, prompting investors to reevaluate the dominance of established AI leaders like Nvidia.

-

US weekly jobless claims fall, but labor market softening

The U.S. labor market is showing signs of softening as both the demand for and supply of workers have diminished, according to recent data. Initial claims for state unemployment benefits dropped by 33,000 to a seasonally adjusted 231,000 for the week ending September 13, partially reversing a surge from the previous week. However, the hiring side of the market has nearly stalled, with payrolls increasing by only 22,000 jobs in August and averaging 29,000 positions per month over the last three months. The unemployment rate is nearing a four-year high of 4.3%, and the average duration of joblessness has risen to 24.5 weeks, the longest since April 2022. Economists attribute the slowdown in hiring to uncertainty caused by import tariffs and a reduction in labor supply due to stricter immigration policies. Federal Reserve Chair Jerome Powell described the situation as a ‘curious balance,’ where both supply and demand have sharply declined. In response, the Fed cut its benchmark interest rate by a quarter-percentage-point to a 4.00%-4.25% range and projected further reductions for the rest of 2025 to support the labor market. Despite low layoffs, those who lose their jobs are facing prolonged unemployment due to the sluggish pace of hiring.

-

Russia says it will answer Japan’s new sanctions

MOSCOW, Sept 18 (Reuters) – Russia has strongly criticized Japan’s latest round of sanctions, labeling them as ‘unfriendly’ and warning that they will not go unanswered. The sanctions, announced last week, are part of Japan’s response to Russia’s ongoing invasion of Ukraine. They target additional individuals and entities while also lowering the price cap on Russian oil exports. Maria Zakharova, the spokeswoman for Russia’s Foreign Ministry, addressed the media on Thursday, emphasizing that Russia’s response would be carefully considered and aligned with its national interests. ‘Japan’s latest unfriendly actions will not go unanswered,’ Zakharova stated. ‘Our response will be well thought out and based on national interests. We will continue to take appropriate countermeasures, including those of an asymmetric nature.’ The escalating tensions between the two nations come amidst a broader geopolitical struggle, as Japan aligns itself with Western nations in imposing economic measures against Russia. The situation underscores the deepening rift between Russia and countries supporting Ukraine, with economic sanctions becoming a key tool in this conflict.

-

US Fed starts easing path, other major central banks on hold

In a significant shift in monetary policy, the U.S. Federal Reserve has announced its first interest rate cut since December, marking a divergence from other major central banks that have opted to maintain their current rates. The decision comes amid a softening job market and signals potential further cuts in October and December. Fed Chair Jerome Powell emphasized that the job market’s condition is now a critical factor for policymakers. Meanwhile, U.S. President Donald Trump has initiated the dismissal of Federal Reserve Governor Lisa Cook over alleged improprieties in mortgage loan acquisitions. Newly sworn-in Fed Governor Stephen Miran cast the sole dissenting vote, advocating for a more aggressive 50 basis points cut. In contrast, the Bank of England kept its rates unchanged, with policymakers voting to slow the pace of unloading gilts purchased between 2009 and 2021. The Bank of Canada also reduced its key rate to a three-year low of 2.5%, citing a weak jobs market and reduced concerns about underlying price pressures. The Swiss National Bank, however, has maintained its key rate at 0%, with Chairman Martin Schlegel stating that the bar is high for a return to negative rates. The Reserve Bank of New Zealand is expected to cut rates further, with a Reuters poll indicating potential reductions by year-end. The European Central Bank has kept its key rate steady at 2%, with ECB chief Christine Lagarde noting that the bank remains in a ‘good place’ despite balanced economic risks. The Bank of Japan is anticipated to hold rates steady amid political uncertainty following Prime Minister Shigeru Ishiba’s resignation. These varied approaches reflect the complex global economic landscape, with central banks navigating inflation, growth, and employment challenges.

-

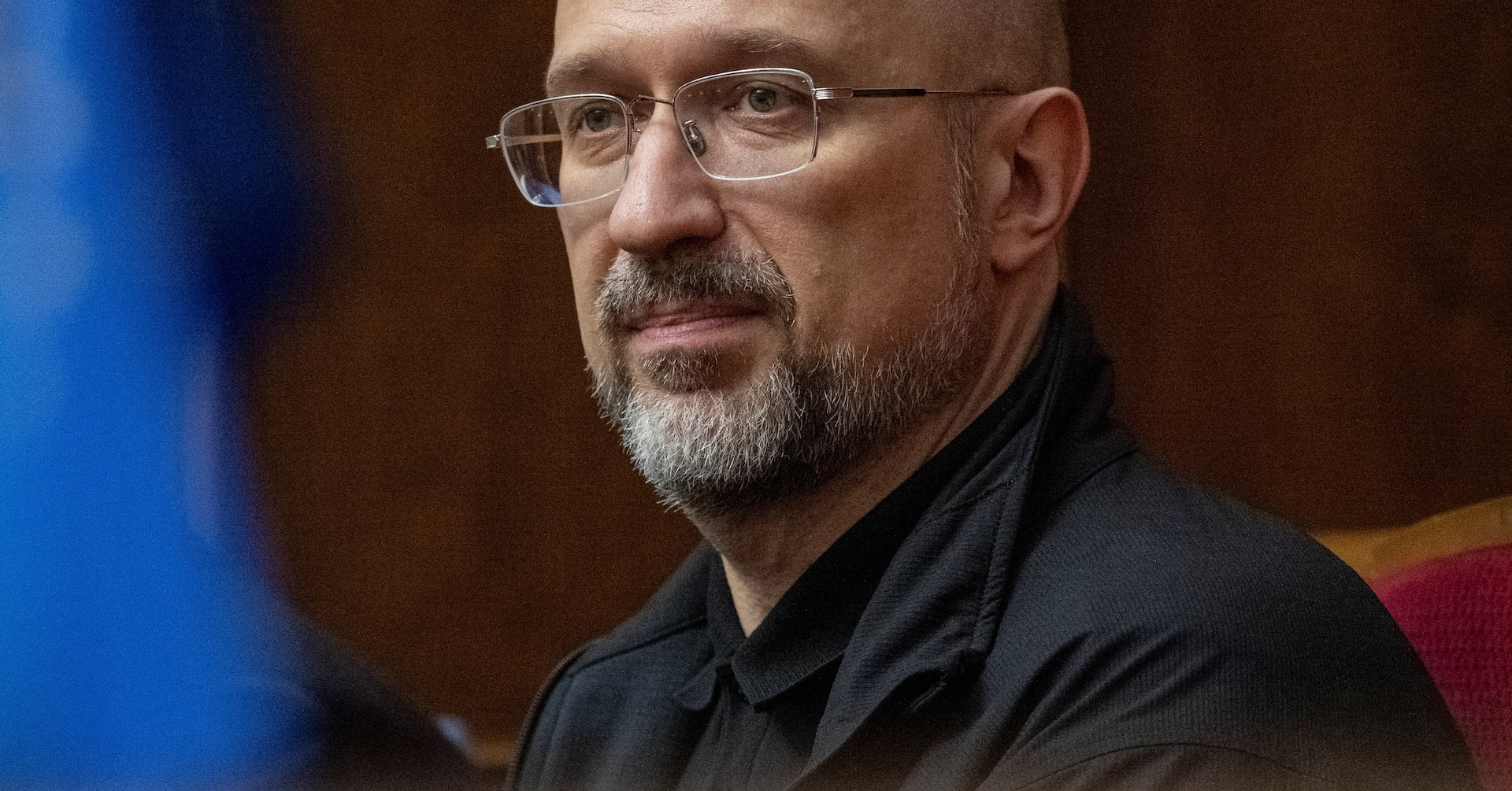

Ukraine to give Polish forces drone defence training after incursion

In a significant move to bolster regional security, Ukraine and Poland have announced a joint initiative to counter drone threats, following a recent incursion of Russian drones into Polish airspace. Ukrainian Defence Minister Denys Shmyhal revealed the collaboration during a press conference in Kyiv on Thursday, alongside his Polish counterpart, Wladyslaw Kosiniak-Kamysz. The partnership will focus on training Polish troops and engineers in advanced drone interception techniques, leveraging Ukraine’s expertise in combating massed Russian drone attacks. Shmyhal emphasized that the training would encompass the entire ‘ecosystem’ of drone defense, from electronic jamming to deploying interceptor drones. Ukraine will also share its systems for tracking Russian aerial targets with Poland, enhancing early detection capabilities. The joint exercises will take place at a training ground in Lipa, southern Poland. This initiative comes after more than 20 Russian drones entered Polish airspace on September 9-10, prompting NATO jets to intercept them. While Russia claimed the drones were targeting Ukraine, the incident has heightened concerns in Warsaw about Moscow’s intentions. Ukraine’s layered defense system, which includes interceptor drones, heavy machine guns, and electronic warfare, has proven effective against Russian drone swarms, offering a cost-efficient solution compared to traditional missile interceptions.

-

GE Healthcare exploring stake sale in China unit, Bloomberg News reports

GE Healthcare, a leading medical device manufacturer, is reportedly considering the sale of a stake in its China unit, according to a Bloomberg News report on September 18, 2025. The potential transaction could value the assets at several billion dollars, though discussions remain in preliminary stages, and no definitive decisions have been reached. A company spokesperson declined to comment on market rumors but reiterated GE Healthcare’s commitment to serving patients in China, one of the world’s largest healthcare markets. The move comes amid growing challenges for U.S. companies in China, including political tensions, intense domestic competition, and slowing economic growth. A recent survey by the American Chamber of Commerce in Shanghai revealed that U.S. companies’ five-year business outlook in China has plummeted to a record low of 41%. GE Healthcare has faced significant hurdles in the region, with a 15% decline in revenue in 2024 attributed to weakened sales and tariff impacts. In July 2025, the company’s CFO indicated plans to shift production capacity to more tariff-friendly locations. Despite these challenges, GE Healthcare’s shares rose 1.4% in premarket trading following the news.

-

Bank of England slows pace of bond rundown and keeps rates on hold

The Bank of England (BoE) announced a significant shift in its quantitative tightening (QT) strategy on Thursday, reducing the pace of its government bond sales to £70 billion from £100 billion over the next year. This marks the first slowdown since the central bank began unwinding its gilt holdings in 2022. The Monetary Policy Committee (MPC) voted 7-2 in favor of the adjustment, which aims to minimize disruptions in the volatile gilt market. The decision comes as long-dated gilt yields hit their highest levels since 1998 earlier this month, raising concerns about market stability. Governor Andrew Bailey emphasized that while inflation is expected to return to the 2% target by mid-2027, the UK is ‘not out of the woods’ yet. The BoE also maintained its benchmark interest rate at 4%, aligning with market expectations. Future gilt sales will be skewed toward short- and medium-dated bonds, with a 40:40:20 split, compared to the previous even distribution. Economists suggest this move could ease pressure on the UK bond market ahead of the upcoming budget announcement. Sterling weakened slightly against the dollar following the decision, while 30-year gilt yields edged lower. The BoE also revised its third-quarter growth forecast upward to 0.4%, signaling cautious optimism about the economy.

-

Instant view: Nvidia’s $5 billion bet on Intel

In a significant move within the semiconductor industry, Nvidia announced on Thursday a $5 billion investment in Intel, bolstering the struggling U.S. chip foundry. This decision comes weeks after the White House facilitated a deal for the U.S. government to acquire a substantial stake in Intel. The investment marks a pivotal moment for Intel, which has faced challenges in its turnaround efforts despite its storied history in the tech sector. Following the announcement, Intel’s shares surged by 30% in premarket trading. Analysts view Nvidia’s move as less about financial impact and more about strategic influence. Matt Britzman, Senior Equity Analyst at Hargreaves Lansdown, noted that the investment provides Intel with both financial and strategic support, though it falls short of a complete solution for Intel’s foundry business, which continues to struggle against competitors like TSMC. For Nvidia, the investment aligns with U.S. policy objectives, potentially easing restrictions on selling advanced chips to China and signaling a shift in industry dynamics. Art Hogan, Chief Market Strategist at B Riley Wealth, emphasized that while the deal must still pass regulatory approval, it represents a positive step for U.S. manufacturing. The partnership underscores the geopolitical undertones of the semiconductor industry, with both companies aiming to strengthen their positions in a highly competitive market.