An Eritrean man has been deported from the UK to France under the government’s ‘one in, one out’ migration agreement, marking the second such removal since the policy was introduced. The man, whose identity remains undisclosed, was escorted by Home Office officials on an Air France flight from Heathrow to Paris. This action follows a failed last-minute court appeal to delay his departure, with the presiding judge ruling there was no legal justification to halt the process. The ‘one in, one out’ scheme, a year-long pilot agreement between the UK and France, aims to deter illegal small boat crossings by returning migrants to France while allowing asylum seekers with strong cases to enter the UK in exchange. The first deportation under this policy involved an Indian national, who was returned to France earlier this month. The Eritrean man, who arrived in the UK via a small boat in August, had claimed to be a victim of human trafficking. However, the judge noted inconsistencies in his account, leading to the decision to proceed with his removal. The Home Office has confirmed that more flights are planned, though ongoing legal challenges may affect their execution. Since the scheme began in August, approximately 5,590 migrants have reached the UK, with around 100 currently detained in immigration removal centers near Heathrow.

博客

-

Foreign holdings of US Treasuries surge to all-time high in July, China’s sink

Foreign holdings of U.S. Treasuries reached an unprecedented high in July, according to the latest data from the U.S. Treasury Department. The total value of foreign-owned U.S. Treasuries climbed to $9.159 trillion, marking a third consecutive month of record-breaking figures. This surge was primarily driven by increased investments from Japan and the United Kingdom, which solidified their positions as the top non-U.S. holders of American government debt. Japan’s holdings rose to $1.151 trillion, the highest since March 2024, while the UK’s holdings grew by approximately 5% to nearly $900 billion. In contrast, China continued to reduce its exposure to U.S. Treasuries, with holdings dropping to $730.7 billion, the lowest level since December 2008. This decline reflects China’s long-term strategy to diversify its reserves and reduce reliance on the U.S. dollar, amid economic challenges and trade tensions. On a transactional basis, the U.S. saw $58.2 billion in foreign inflows of Treasuries in July, rebounding from outflows in June. However, foreign investors sold $16.3 billion in U.S. equities during the same period, signaling a shift in global investment preferences. The net capital inflow into the U.S. also fell sharply to $2.1 billion in July, down from $92 billion in June, highlighting the volatile nature of international capital movements.

-

Cyber attacks cost German economy 300 bln euros in past year, survey finds

The German economy suffered staggering losses of nearly €300 billion ($354.99 billion) over the past year due to a surge in cyberattacks, according to a recent survey by industry group Bitkom. The report, unveiled on September 18, 2025, in Berlin, highlights that foreign intelligence agencies, particularly from Russia and China, are increasingly behind these attacks, overshadowing traditional cybercriminals. Ralf Wintergerst, President of Bitkom, emphasized during a press conference that nearly half of the companies able to trace the origins of attacks identified Russia and China as the primary sources, while a quarter pointed to other EU countries or the United States. The survey, which polled 1,002 companies, revealed that ransomware attacks, which lock data until a ransom is paid, were the most prevalent, affecting 34% of businesses—a significant jump from 12% in 2022. One in seven companies admitted to paying ransoms. While large corporations were generally well-prepared for the escalating cyber threats, small and medium-sized enterprises, which form the backbone of Germany’s economy, were found to be more vulnerable. The €289.2 billion in damages primarily stemmed from production losses, theft, and substantial legal and remediation costs. Sinan Selen, Deputy Head of Germany’s domestic security service BfV, noted that the lines between cybercrime and cyberespionage are increasingly blurred, with state actors often purchasing credentials from criminals on the dark web. He also identified Iran and North Korea as significant sources of cyberattacks. The findings underscore the growing complexity of cybersecurity in an era of heightened geopolitical tensions, particularly since Russia’s invasion of Ukraine in 2022.

-

Trump’s dream of retaking Bagram might end up looking like an Afghan re-invasion, sources say

Former U.S. President Donald Trump’s ambition to reoccupy Bagram Air Base in Afghanistan has sparked significant debate among current and former U.S. officials, who argue that such a move could resemble a full-scale re-invasion of the country. Speaking to reporters during a trip to London, Trump emphasized the base’s strategic proximity to China, stating, ‘It’s an hour away from where China makes its nuclear weapons.’ However, experts and officials have expressed skepticism about the feasibility and practicality of this plan.

-

oneworld Alliance considers Indian partner as market expands

The oneworld Alliance, a prominent global airline consortium comprising 15 members including American Airlines and Qantas Airways, is actively exploring the possibility of adding an Indian airline partner. This strategic move comes as India’s aviation market continues to experience rapid expansion. Nat Pieper, the alliance’s CEO, revealed this development during the Wings Club gathering in New York, a forum for aviation executives and analysts. Pieper emphasized the complexity of integrating a new member, noting that the decision must align with the interests of both the alliance as a whole and its individual members. With ten of its current members already operating in India, the alliance is also considering collaborative initiatives such as loyalty programs and shared lounge facilities to enhance their collective presence in the region. The anticipated addition of Hawaiian Airlines in 2026, following its acquisition by Alaska Air in 2024, further underscores the alliance’s commitment to growth and diversification.

-

CFPB considers worker furloughs as funding crunch deepens, sources say

The U.S. Consumer Financial Protection Bureau (CFPB) is grappling with a severe financial crisis that may force the agency to furlough employees, according to insider sources. The funding crunch stems from a series of budgetary constraints imposed by Congress and exacerbated by the Trump administration’s refusal to allocate fresh funds since taking control of the agency in February. The administration had initially aimed to reduce the CFPB’s workforce by 90%, but these plans have been stalled due to ongoing legal challenges from employee unions and consumer advocacy groups. As a result, the agency continues to bear the financial burden of paying most employees despite its dwindling resources. Last week, CFPB leadership informed staff of potential workforce reductions to comply with additional funding limits set by Congress. On Thursday, sources revealed that senior officials are now considering furloughs—temporary suspensions without pay—though the scope and timeline of such measures remain unclear. The agency’s financial woes are further compounded by Congress’s decision to slash the CFPB’s maximum draw from the Federal Reserve from 12% to 6.5% of the Fed’s expenses, effectively cutting hundreds of millions of dollars from its budget. In a bid to conserve cash, the CFPB has directed contracting officers to minimize payouts for goods and services, prioritizing payroll and operational costs. With the next fiscal year set to begin in less than two weeks, concerns are mounting that the agency may lack sufficient funds to cover payroll and severance expenses. CFPB representatives have yet to comment on the matter.

-

India regulator rejects US firm’s fraud claims against Adani Group

India’s Securities and Exchange Board (Sebi) has officially dismissed allegations of stock manipulation and financial fraud against billionaire Gautam Adani and his conglomerate, which were initially raised by US short-seller Hindenburg Research. The investigation, launched in 2023 following Hindenburg’s explosive report, concluded that Adani’s companies did not violate regulatory norms. Sebi’s findings revealed no evidence of undisclosed transactions between Adani’s firms and related parties, nor any signs of market manipulation, money siphoning, or investor losses. Adani, one of Asia’s wealthiest individuals, celebrated the decision on social media, stating that Sebi’s ruling reaffirmed the baseless nature of Hindenburg’s claims. The allegations had previously caused Adani’s group to lose over $100 billion in market value within days. The controversy also fueled political tensions in India, with the opposition Congress party accusing Prime Minister Narendra Modi’s BJP of inaction. Hindenburg’s founder, Nate Anderson, recently announced the dissolution of the firm, citing personal reasons. The case underscores the complexities of financial scrutiny and the impact of short-selling on global markets.

-

US Senate votes to confirm top auto safety official

In a significant legislative move, the U.S. Senate on Thursday confirmed Jonathan Morrison as the head of the National Highway Traffic Safety Administration (NHTSA), along with 47 other nominees for critical roles in infrastructure and safety oversight. The vote, which passed with a narrow margin of 51-47, marks the first time in three years that the NHTSA will have a permanent leader. Morrison’s confirmation comes at a pivotal moment for the agency, which has been without a stable leadership since 2022. The Senate also approved nominees for key positions overseeing highways and pipelines, signaling a renewed focus on infrastructure safety and modernization. This decision is expected to have far-reaching implications for transportation safety standards and the implementation of major infrastructure projects across the nation. The confirmation process, though contentious, underscores the Senate’s commitment to addressing long-standing vacancies in critical federal agencies.

-

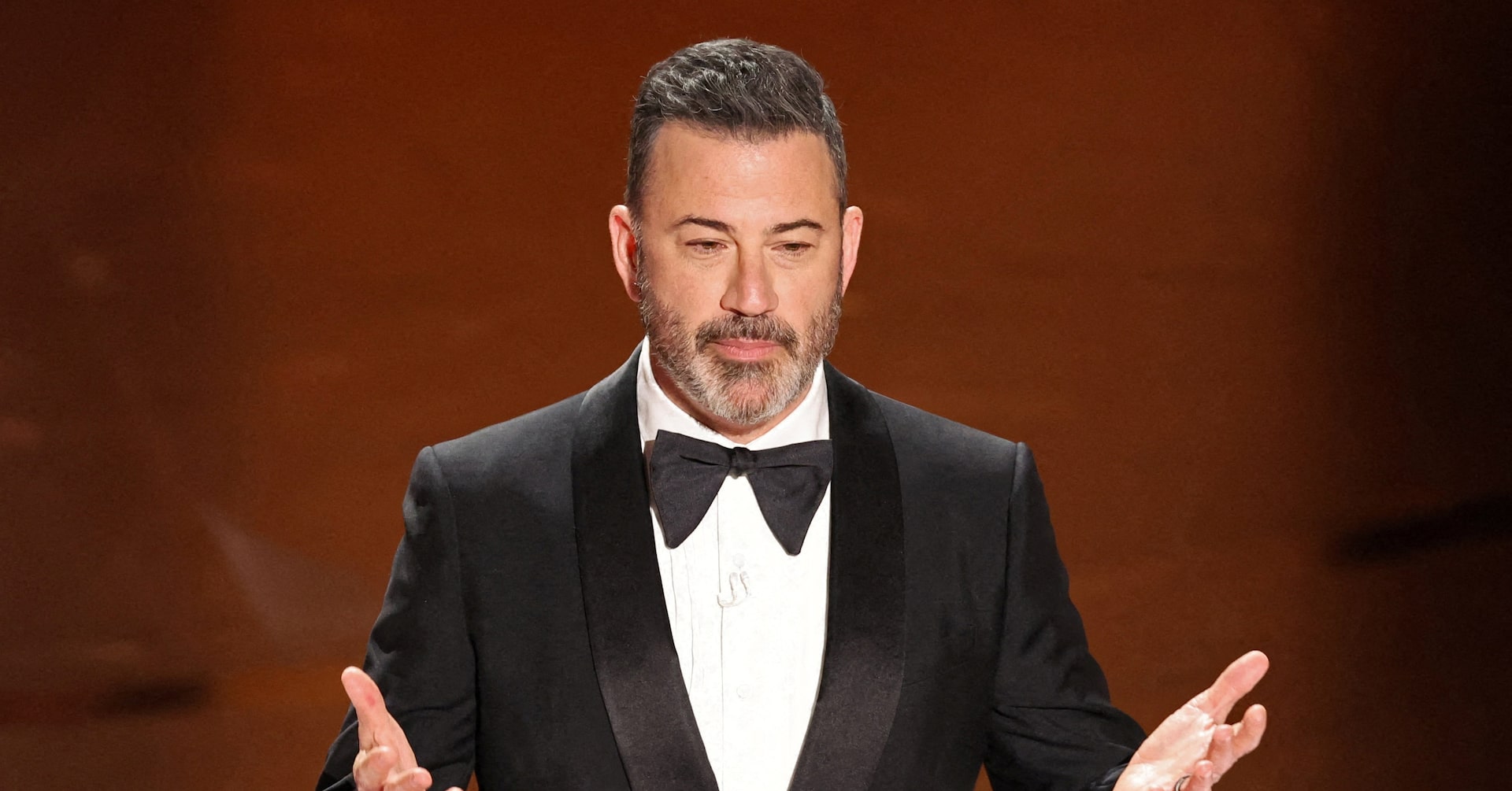

Explainer: Were Jimmy Kimmel’s free speech rights violated when ABC canceled his show?

Jimmy Kimmel, the renowned late-night talk show host, has found himself at the center of a heated controversy following his suspension by ABC. The decision came after Kimmel made contentious comments on his show, ‘Jimmy Kimmel Live!,’ regarding the assassination of conservative activist Charlie Kirk. Kimmel suggested that Kirk’s shooter was a supporter of former President Donald Trump and criticized the ‘MAGA gang’ for politicizing the tragedy. His remarks also included a jab at Trump for allegedly diverting attention to White House renovations when questioned about Kirk’s death. The fallout was swift, with Brendan Carr, head of the Federal Communications Commission (FCC), condemning Kimmel’s statements as misleading and hinting at potential regulatory actions. Carr’s comments, made on a conservative podcast, emphasized the need for broadcasters to uphold community interests. Shortly after, Nexstar Media Group announced it would cease airing Kimmel’s show on its ABC affiliates, citing the need to align with FCC standards. ABC followed suit, suspending Kimmel’s show indefinitely. While Kimmel could potentially sue the FCC or ABC for free speech violations or breach of contract, legal experts suggest that such cases would face significant hurdles. The First Amendment protects against government interference in speech, but proving coercion by the FCC would be challenging. Additionally, ABC retains the right to decide its programming, further complicating any legal recourse for Kimmel. The incident has sparked a broader debate about free speech, media regulation, and the boundaries of political commentary in entertainment.

-

Democratic-led US Senate resolution seeks recognition of Palestinian state

In a significant development, a group of U.S. senators has introduced the first-ever Senate resolution urging the recognition of a Palestinian state. This move, led by Democrat Jeff Merkley of Oregon, signals a notable shift in Washington’s stance toward Israel, nearly two years into its ongoing conflict with Hamas in the Gaza Strip. The resolution advocates for a demilitarized Palestinian state coexisting with a secure Israel, aiming to foster hope and enhance peace prospects for both sides. Despite the Democratic-led effort, the resolution faces slim chances of passing in the Republican-majority Senate, where President Donald Trump and his party have expressed opposition to recognizing Palestinian statehood. Concurrently, in the House of Representatives, Democrat Ro Khanna of California is circulating a letter to garner support for Palestinian statehood. These legislative actions reflect a growing inclination among U.S. lawmakers to pressure Israel to end the war and alleviate the humanitarian crisis in Gaza. The conflict, which began with Hamas’s October 7, 2023, attack, has resulted in over 65,000 Palestinian deaths, according to Gaza health authorities, and continues to devastate the region. The Israeli embassy in Washington has yet to comment on the Senate resolution. Meanwhile, international momentum for recognizing Palestine is building, with several U.S. allies preparing to do so as world leaders convene at the U.N. General Assembly in New York. A recent Reuters/Ipsos poll indicates that 58% of Americans support U.N. recognition of Palestine as a nation. The resolution’s co-sponsors include prominent Democrats and independent Senator Bernie Sanders, who recently described the situation in Gaza as a genocide, echoing findings by a U.N. Commission of Inquiry that Israel has rejected as biased. As the conflict approaches its second anniversary, the push for Palestinian statehood underscores the urgent need for a resolution to the protracted crisis.